Why Inflation?

Government Policies Caused Inflation. It's Time to Hit the Gym and Get Fit.

Welcome to the Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Why Inflation: How did we get here?

Why Home Prices: How did we get here?

My Skeptical Take.

Fuel for the Day: Cucumber soda water, zest of lemon, and a dash of Guarana plant caffeine extract. WoW. It’s like a Celsius but better and no crap in it (this stuff is powerful). Workout today is going to be intense! Like the circus. 😊

The Weekly 3: News, Data and Education to Keep You Informed

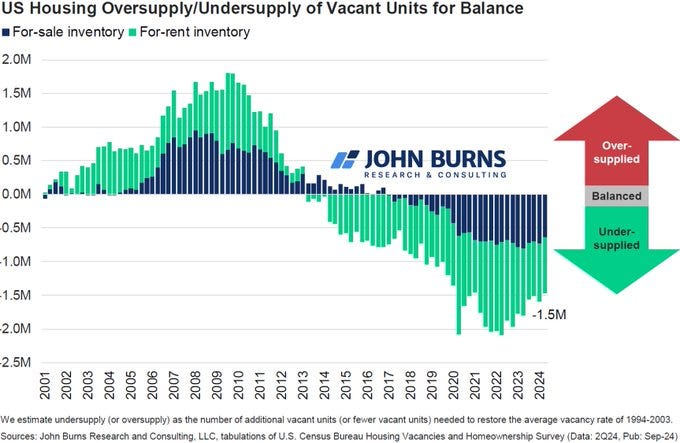

Housing is undersupplied by 1.5 million units (JBREC).

Nashville is a hot destination. 16.8 MILLION people visited Nashville in 2023. Breaking records for total visitors and visitor spending. But Inflation is taking its toll on tourism in 2024 (WPLN).

Book Recommendation: Bureaucracy: What Government Agencies Do And Why They Do It. This is one of the only books I’ve held on to from grad school. I revisit it every few years. Add this to your lifetime must-read list (J.Q. Wilson).

Today’s Interest Rate: 6.11%

(👇.29, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate, finance, inflation and government debt.

Everybody is focused on the next 2 days of Federal Reserve meetings and the interest rate cuts. I’ve written about this too many times, as is everyone else. So today, let’s get into something a little more, shall we say, interesting…

**Warning. I’m a little punchy and passionate today, time to let ‘em have it!**

Something a Little Different Today…

Let’s talk about government spending and inflation.

Stay with me.

I promise the below will blow your mind. And yes, this directly affects real estate. Everyone in the real estate space should understand this, plus I give a few important data points about the next few months that you won’t want to miss!

Why Inflation? Federal Over-Spending

The government spending is more ignorant and out of control than a drunk restaurant owner on an episode of Bar Rescue! (must-see TV).

This is Why Inflation.

Frankly, this is important. Very Important. Perhaps the most important single policy issue at hand for those under 65. If we don’t fix it, nothing we are talking about matters.

Case in point: There will be no such thing as a Starter Home if we continue down the path of inflation caused by out-of-control government spending.

The Road to Hell is Paved with….(well, you know the rest).

And this is not political. “Irrespective of the election outcome, the trend since the pandemic has been profligate fiscal policy,” as JP Morgan has put it. Both sides have completely abandoned fiscal restraint. Instead, its always Christmas.

And it’s not nefarious. It’s a cocktail of good intentions (do as much as I can for the people), mixed with a little bit of self-preservation (get reelected) that our leaders are drunk on. Well-meaning; yet, terribly misguided and economically ignorant.

Ok back to it…

Federal Spending has been at Catostrophicly High Levels

Here are 3 Absurd Stats:

U.S. Federal Debt is $35 Trillion.

U.S. Federal Debt is growing at $3 billion per day. Up double since 2020.

We spend $1 Trillion every 100 days.

Annual interest, just the interest, on this debt is $1.1 Trillion, up 30% from a year ago (US Treasury). This now eclipses our total Defense budget.

Federal Spending = Inflation.

A quick reminder. Only Government Creates Inflation.

Not the market.

Not business.

Not the grocery store.

There is no free money from the government printing press.

How We Got Here

Where did all the spending come from?

To review, the government's COVID response and Economic Stimulus policies 2020-today injected $10+ Trillion into the economy, and did not stop until far after the it had recovered. This is the culprit for our long term inflation problems.

This was foolish and a colossal overreaction.

To put it in perspective. Let’s review what we did during the 2008 Great Financial Crisis (GFC). The largest economic crisis in our lifetime.

Here is the chart showing money supply in the economy 2001-2012 (i.e. before, during and after the crisis).

This was a big big f’ing deal. Look at that chart, it’s a double. Lots of benjamins floating around.

We spent ~$900 billion in an attempt to prevent a recession, a massive spending package, and the Fed started their Quantitative Easing policies to inject hundreds of billions more into the economy. We had massive companies failing, job layoffs and we were in deep deep systemic, financial trouble. You can see it in the chart. Money printing and loose monetary policy by the Federal Reserve spiked the money supply circulating in circulation.

But before we move on, first sit down.

You think that was massive?

You ain’t seen nothin’ sister.

Let’s zoom out, and see the difference between the $900 billion for the GFC recovery and what the government did in reaction to COVID….

Wait for it…..

Boom.

You can barely even see GFC spending on the chart.

This is what real inflationary policy looks like. This is why everything is more expensive today. And prices won’t deflate, they will only inflate at a slower pace (disinflation).

Let me dig into the details for you.

~$10 Trillion Government Spending / Policies Caused Inflation

The US government pumped trillions and trillions into the economy over the last 4 years. To start, they enacted 6 COVID-19 relief laws in 2020 and 2021 totaling $4.6 trillion. And we spent it. As of January 31, 2023, $90.5 billion, or 2% of the total amount of funding provided for COVID-19 relief, remained available for obligation.

More Spending: Infrastructure and Economic Stimulus

But we didn’t stop there. We also added $2+ Trillion more economic fiscal stimulus/spending in 2021, 2022 and 2023, which will take a decade to fully filter through the economy. The government enacted:

The Infrastructure Investment and Jobs Act - November 2021 - $500 Billion* (congress) to $1.2 Trillion* (Forbes)

The Inflation Reduction Act - 2022 - $433 Billion* (congress) to $1.2 Trillion* (Goldman Sachs) (*Bil proponents claim to offset spending with $400 billion in taxes and health care savings, but a recent analysis says it will actually cost 3x what was originally predicted by Congress). Important detail: the bill is really targeted at climate change and energy policy, not inflation reduction, as it is named.

The CHIPS Act - 2023 - $80 Billion (CBO) - $280 Billion. (McKinsey) Total costs is $280 Billion, with “new” direct appropriations of $80 Billion.

Important Note: We tried to pass another $3.5 Tillion in stimulus, right in the middle of infation alley! You may rememver the Administration’s “Build Back Better Act,” which Congress thankfully was unable to pass.

A Trillion is a LOT of money. A lot a lot. Again, remember that during the GFC, the stimulus injected was less than $1 Trillion in TOTAL (Economic Stimulus Act 2008: $152 Billion + American Recovery and Reinvestment Act: $840 Billion).

We were spending like Dax Shepard in Idiocracy! (also must see!)

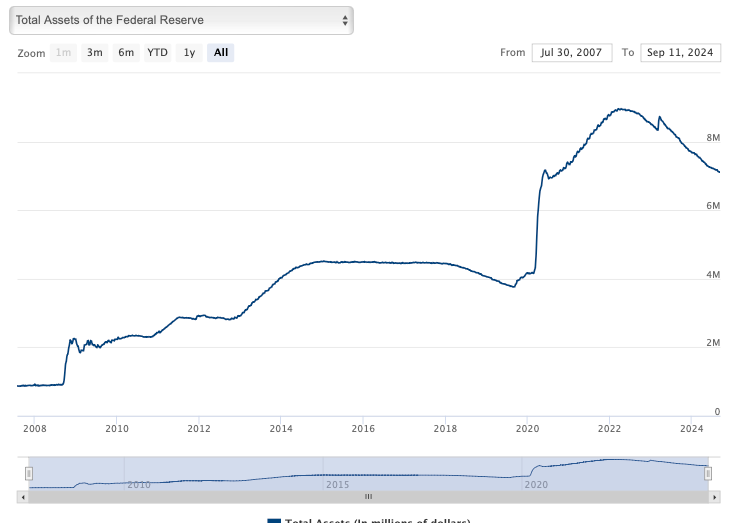

Federal Reserve Injected another $5 Trillion

Wait, Wait. There’s More. The Federal Reserve added its own enormous stimulus, Quantitative Easing, to the tune of $5 Trillion! (and that is on top of the $4 Trillion that was already on the Fed’s balance sheet)!

Scheiße!

Like shoveling coal into that locomotive’s boiler, $10+ Trillion in stimulus meant inflation sped away unchecked.

During this time the government, Both the US Treasury and the Federal Reserve said publically that the inflation we were experiencing was “transitory.”

And that lasted until the beginning of 2022, when they realized, uh oh…inflation was real and spiraling out of control.

So the Fed reversed, and fast. They spiked interest rates, and started Quantitive Tightening (see above chart, 2022 to today), in an effort to slow inflation and the economy.

They discovered this too late of course, which is how we got here to today. Prices that we all can agree….well…suck.

So it’s 2024, all that is over so we should be stopping the enormous deficit spending, right?

Wrong.

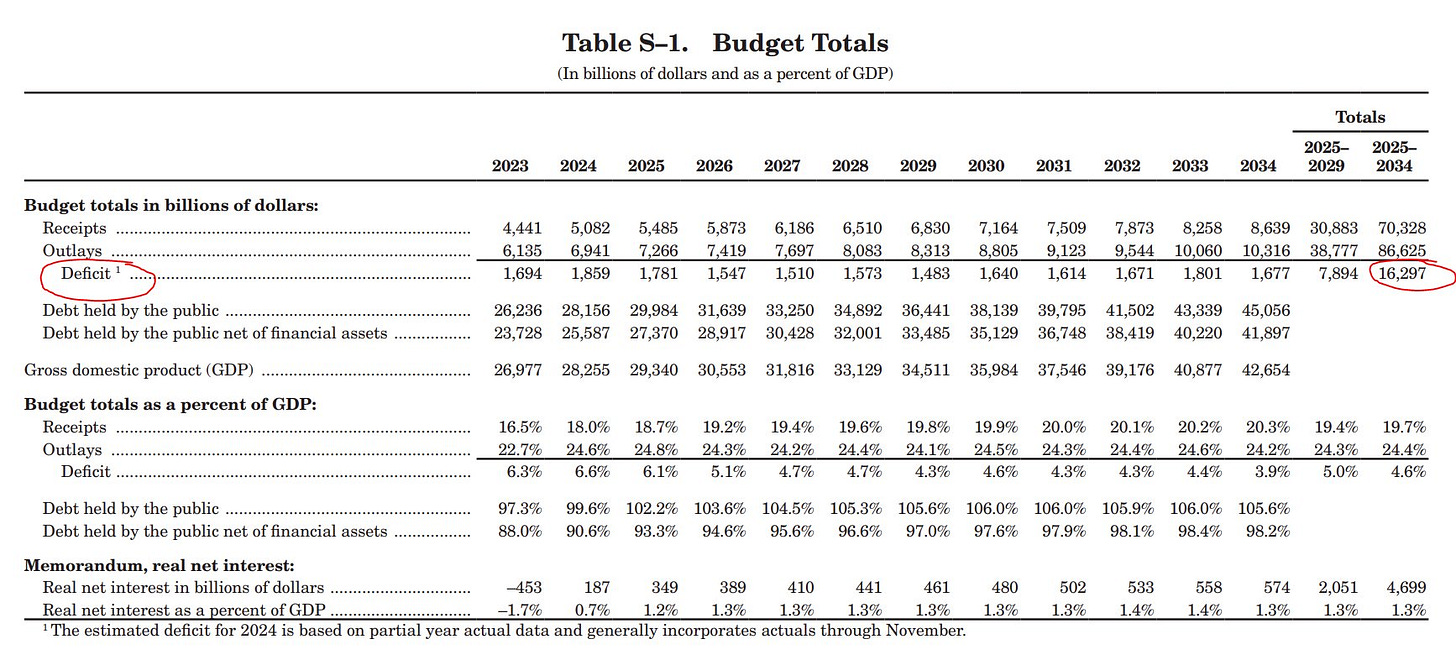

The current budget (which we always exceed) projects another $16 trillion in deficit spending (ie printing money) through 2035.

This is Why Inflation

And when DJ Pauly D is upset about inflation, you know it’s bad. That Gym, Tan, Laundry is out of control!

Oh, But it Gets Worse… Enormous Fraud and Waste.

Ahhh, how can this get any worse?!

Well. You would think all this borrowed cashola is being put to good use, well mostly at least. Right?

Well, think again.

The Government Accountability Office, the small watchdog office reviewing government finances and policies, estimates that the Federal Government Loses an Estimated $233 Billion to $521 Billion.

This is annually.

As in every year.

It is hard to comprehend this amount of wasted/stolen taxpayer money.

Every. Single. Year.

And just like the GFC, how/why nobody is prosecuted? Nobody held accountable? (pardon the pun)

What untold programs we could have accomplished with this money? Well, you could pretty much do anything at scale with this. Literally. How about:

Are you at the poverty level? Fresh, organic food is completely free for you. Hell, let’s make it free for everyone. Forever.

Housing? Starter homes/condos built. Done.

The most impressive highway, rail, and airliner system in the universe? Done.

Energy/electricity for all Americans forever? Done.

Or how about lowering taxes by 25%-50% for everyone? Return that money back to the people so they can decide how to best spend it. Yep that too!

The sheer magnitude of all of this incompetence is shameful for the most powerful, richest country in the known universe.

It’s just… well…sad…I’m not mad. I’m just deeply disappointed.

We can’t do better.

Government Spending → Inflation → Home Prices ☝️

So let’s tie this back to real estate.

Why have home prices gone bonkers in the last few years?

It’s Drugs!

Fiscal/economic stimulus drugs that is.

Hello, I’m From the Government and I’m Here to Help

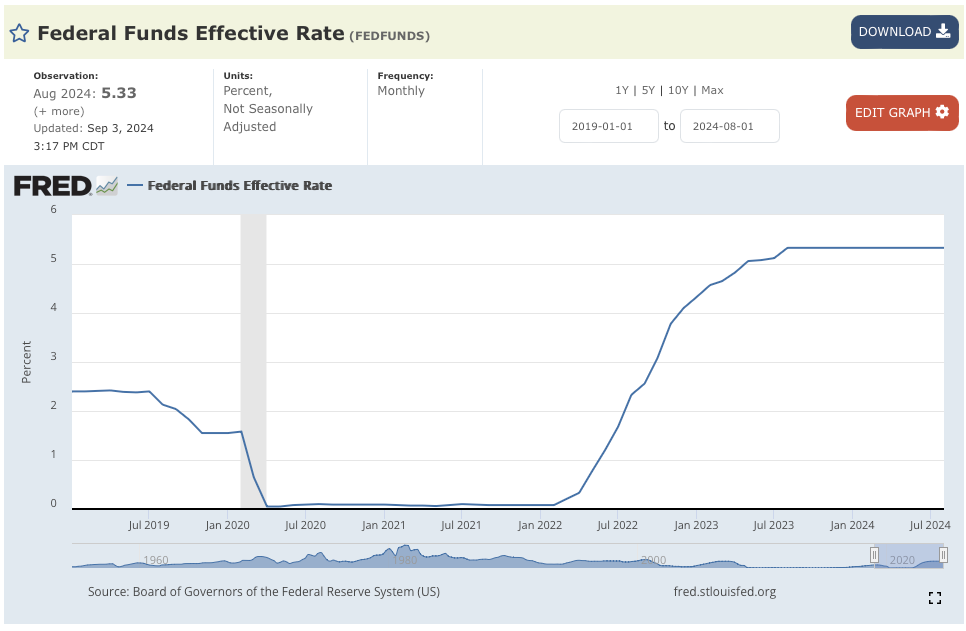

The Fed and Congress were a major contributor to both sides of our housing problem. Demand is low because interest rates were jacked up, fast, like really fast (below) to blunt inflation, which was caused by Congress and the Fed injecting $10+ trillion into the economy.

Supply is uber-low because few people - unless they have to or die, frankly - want to sell their home with a 2.8% mortgage only to trade it in for a 7% mortgage. That ultra-low - literally never again in a lifetime - loan % is a result of the Fed dropping the Fed Funds to 0% in 2020 and keeping it low for 2 years, while at the same time buying mortgage-backed securities, all while the market was booming.

They sprayed ether on a gasoline fire.

This yo-yo’ing back and forth of interest rates creates a real estate cycle that is extremely difficult for homebuyers and the market to absorb. Especially when it happens rapidly. It will take more than a decade to unwind the current one.

My Skeptical Take:

I am concerned that the relatively positive state of the current economy may be a lingering result of the stimulative drugs Uncle Sam slipped in our martini. Consumer spending is 2/3 of the economy and it’s hard to ignore the sheer volume of free dollars the federal government pumped, and is continuing to pump, into the economy. Folks will spend those dollars.

When the drugs stop, or at least abate, it will be time for the come-down. We may have a short recession when it does. And that is ok, it’s natural.

We have to STOP deficit spending at the current rate. The young generations are shouldering this inflation and it’s building.

The Congress and Administration need to get their fiscal house in order. It’s been too long since ideological opposites Bill Clinton and Newt Gingrich were able to strike a balanced budget deal.

Why can’t we do that again?

I say we can.

We can stop growing our debt faster than our GDP.

We can incentivize the SUPPLY of new homes. We do not need housing programs that give folks $ or provide incentives to BUY homes.

We can crack down on the building regulatory, permitting etc…process, which are ~40.6% of the cost of a home.

We can up-zone neighborhoods, allowing for more medium-density housing to be built, heck California, Denver and Oregon did it!

We can fight waste, fraud and abuse, $250-$500 billion is insane to have stolen from us each year!

We can find a diplomatic solution to dangerous and expensive forever wars (not political!).

America needs a Manhattan Project for Housing!

Ok, whew! I got that off my chest. I hope this was as cathartic for you too :)

Hit the gym government; it’s time for some belt-tightening.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville, where we are seeing record tourism this year. 90+ people per day move to Nashville and our city population is still under 700k. We have 3 professional sports teams, massive healthcare and entertainment industries, more than a dozen colleges, and no state income tax, to name a few.

Looking for a realtor in the Nashville area? We work with the best here who specialize in helping investors find great properties.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likley errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.