When will the Fed Stop Cutting Rates?

They are just getting started, but it begs the question, when/where will they stop?

Welcome to the Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Economic Update

Job Numbers

Housing Proposals, a Second Take

Hot Take: Too Much Supply Too Fast is Also Bad

My Skeptical Take.

Fuel for the Day:

Mellowing out with some Organic White Silver Needle Loose Leaf Tea. I love loose leaf tea (there are more options) and often tea bags are actually made with plastic. So I avoid them, hate the idea of dunking plastic into hot water and drinking it. Use a tea steeper like this stainless steel one.

The Weekly 3: News, Data and Education to Keep You Informed

Why Can’t We Build Stuff in America Anymore? Litigation and red tape. The average environmental impact statement takes 3 years, for energy related projects. Often much longer for other infrastructure projects. The average EIS report length is 1,214 pages (USU).

Flipping vs Long Distance Investing. A great podcast episode reviewing whether one should I flip in your local, but expensive, market or invest long-distance in a “better” market? David Greene.

Book Recommendation: On the Edge -- Nate Silver. I am fascinated by risk, human psychology, and why we take, and don’t take, the risks we do. Several folks recommended this book. As do I.

Today’s Interest Rate: 6.42%

(👇.07, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate. Let’s get into it.

“The cooling in labor market conditions is unmistakable. The time has come for policy to adjust. The direction of travel is clear.”

—Federal Reserve Chairman Jerome Powell

Well, you heard it from the man himself. After 2 1/2 years, the Fed will start cutting interest rates, circa September 17-18.

On the decision, Former Treasury Secretary Larry Summers, a favorite economist of mine, agreed, saying: “Inflation is coming down. The economy is slowing. On current facts, absolutely the next move should be towards monetary policy easing.”

Concluding with a hilarious (inadvertent) tip of the cap to Michael Scott fans:…

“That’s what he said, and I’m glad he said that” (referring to Powell).

Hahaha, good one Larry.

Summers also highlighted what wasn’t said in the speech, and with the rate-cutting cycle now starting, I would argue this is the most important for markets as we look toward the next 12 months.

The Future: When / Where do we Stop Cutting Rates?

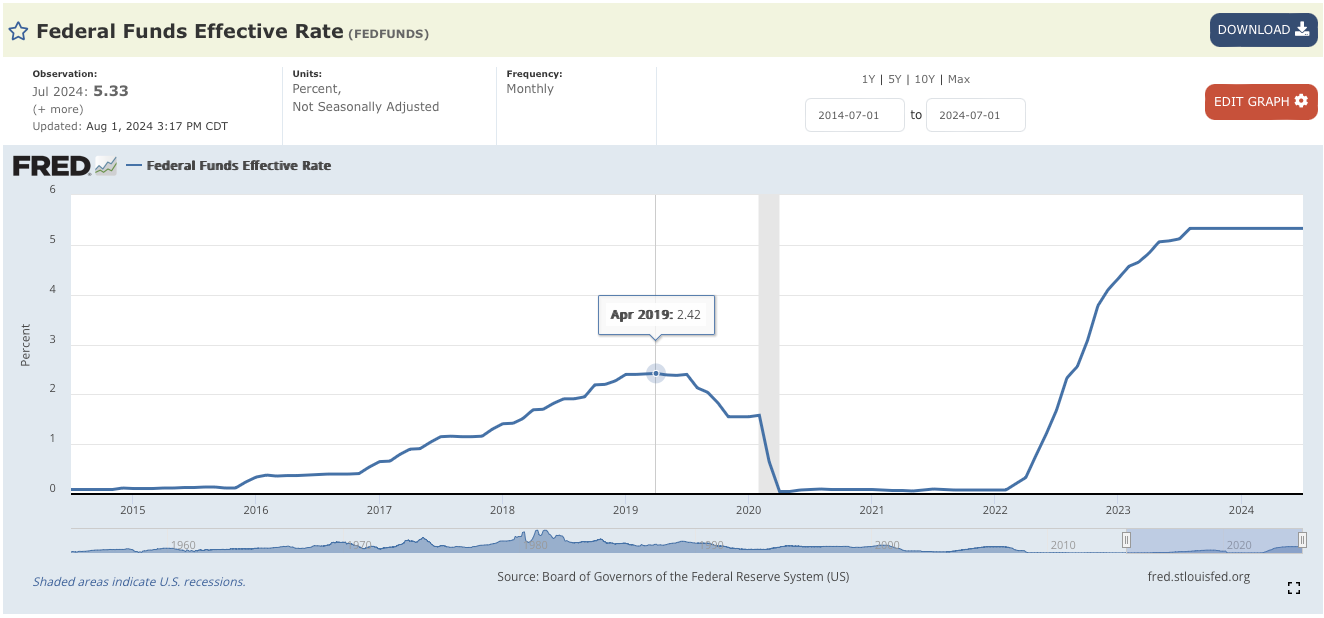

What Powell did not address is what the neutral interest rate should be, and at what % rate they will settle. The neutral rate, or r-star, represents the equilibrium rate that would theoretically maintain an economy at full employment with stable, low inflation, neither stimulating undue economic activity nor stifling it. This rate, is where the Fed will stop.

What is that rate?

Well, traditionally is has been pegged around 2.5%, implying a real rate of 0.5% above the Fed’s 2% allowable inflation target. This is about where the Fed got to, eventually, after the great financial recession and before they cut rates again in reaction to COVID.

Will we get back to ~2.5 Fed funds rate? Summers doesn’t think so.

The Fed’s current internal - and now outdated - projections are saying somewhere in the mid 2s, which Summers described as “extremely unlikely,” saying, “I would be surprised if the Fed brings interest rates down by as much as the market is expecting over the next few years.”

I agree. I think low 3% may be a more realistic neutral rate.

Either way, the Fed must update its guidance soon. The concept of the neutral interest rate has been pivotal in shaping long-term rate expectations and borrowers who are highly interest rate sensitive need to know their plans.

This is particularly important in today’s environment given two important factors:

The immense borrowing that is happening at the Federal Government (we are now $35 Trillion in debt) and,

the epic capital expenditures happening in AI/data center/electricity needs.

What/where interest rates settle at is extremely important for these massive industries borrowing Trillions, not to mention us real estate investors and homebuyers.

We will want to keep a Skeptical Eye on the Fed’s long-term posture and when/where they will stop cutting rates. The long-term neutral rate will have massive downstream economic effects.

Back to the Present

In the short term, the FOMC committee will have to officially vote next month on their decision to cut, and at what level. All signs point to a reduction of .25% in the Fed Funds rate but the market is also pricing in a 36.5% chance of a .50% cut.

Back on July 3rd, we predicted a September rate cut, at .25% and I am still of that opinion. In his speech last Friday, Powell said, “timing and pace of rate cuts will depend on incoming data,” which is what he has to say. But I’ll go out on a limb here: I say we have no more than a .25% cut at a time and that they continue for the next 12 months, likely with one or two months where the Fed holds.

Bookmark this post. Hold my feet to the fire.

The Next 3 Weeks are an Important Market Signal

It will be interesting to see how the stock market reacts between now and the Fed’s Sept 17-18th meeting. That’s a lot of time to read the tea leaves and think about what the future will hold for the economy in the next 12 months. I expect the next 30 days to remain volatile, and I will be particularly on edge of how the economy and market participants react to the new easing cycle, including especially buyers of real estate. If the stock market dips into a correction (-10%) folks will feel less rich, investors and homebuyers will likely pull back and real estate activity will plummet. Watch out for this, it will be a rare buying opportunity for investors to snatch up deals.

Job Revisions Are Trending Negative

I didn’t want to go without mentioning a surprising trend in the job numbers that will have great effect on the preceding conversation. And that is revisions to job numbers.

We created 818,000 fewer jobs last year than we thought, according to the recently released revision numbers. This is a -28% decline, or -68,000 fewer per month, the most significant downward adjustment in job numbers since the Great Recession of 2009. This, following the revision of -306,000 jobs in the figures from last August.

Count me concerned. And prominent investors have had similar takes on this trend of downward revisions on weaker labor numbers.

Although, if you ask economist Ed Yardini (and I’m a fan), he had a different take:…

Showing this chart in a recent live stream:

Hey, it’s possible. Admittedly, I don’t have a good grasp of weather effects. But wow, 818k is a huge number to be off by.

The Concern - This is a Trend

The worry is what this means for the labor market. This revision hasn’t been a one off, its been a trend, with this revision being by far the biggest.

A trend of downward job revisions is unusual. Most often we get these revision numbers and it’s a few up, a few down, and it’s not often off/wrong by such a wide margin.

Is the labor market actually weaker than we/the market thinks? If so, again, we may see a correction in both the stock and real estate markets in 2024, to adjust. So far the market consensus is not. Which always worries me (I hate consensus since that usually means that outcome is baked into prices). Most on Wall Street think that the economy is strong, resilient and moving forward.

Time will tell, but my ears are now perked up. Looking for opportunity.

More on Presidential Housing Policy Proposals

In case you missed it, I went into great detail last week reviewing the Harris/Walz housing proposals. You can read those here, and also the then Biden/Harris housing proposals here, from earlier this year.

They are worth a read. Or ask one of the many AI to read it to you. 😃

Nobody of Substance likes these Housing Proposals

So, it’s been a week since our take on the candidates’ housing proposals and what a week it has been. Fortunately, our takes have aged well.

“Giving buyers extra money for houses right now would increase demand and translate quickly into higher prices” - Economist Mark Zandi

“Reading the plan's outline sent to reporters, you can feel the tension between the campaign’s policy team and political team – one fighting for progress, one fighting for applause lines” - Housing Anlayst Jay Parsons

“…if we're really going to talk about economics 101 this plan will ignite asset inflation and consumer inflation. I estimated that on the asset side, it would take home prices up 10 to 15% in 18 months.”

—Michael Zuber, Housing Investor and Analyst

Ouch.

I too shared these concerns in my analysis.

Hot Take: Too Much Supply Too Fast is Also Bad

Any successful housing policy must focus on the supply of new housing units. But, an important nuance….

If we are to be successful in adding a supply of homes, we can also create an inflationary shock to the system if we attempt to add them too fast (I know, this may be counterintuitive to our previous arguments of supply supply supply).

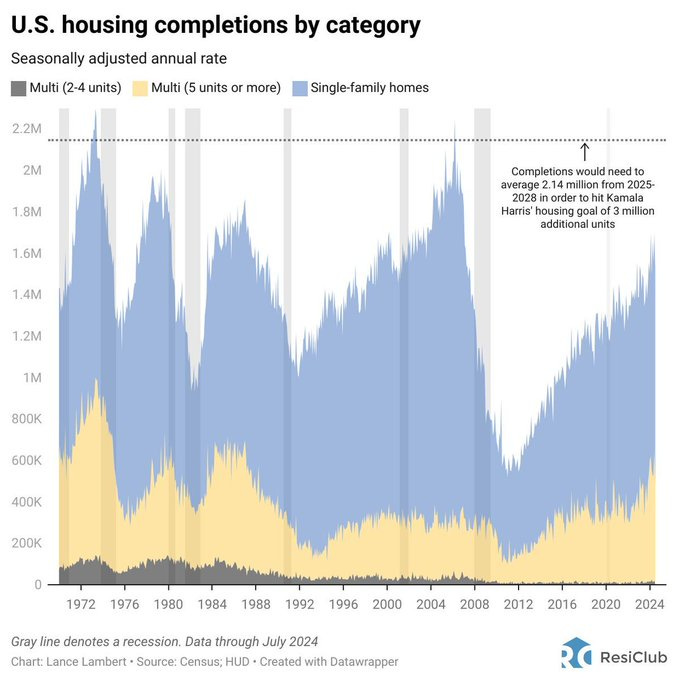

Remember that a home is simply a basket of stuff put together by humans. And as a result, the price of a home is highly dependent on these input costs. The Haris plan is to build 3 million homes in four years. But, from January 2020 onwards, the United States has averaged the completion of 1.39 million housing units annually. To add 3 million more units than this current pace by 2028, the annual rate of housing starts must increase by 750,000 units, which is 40-50% more homes each year . This would necessitate achieving an annual construction rate of 2.14 million housing starts each year from 2025 through 2028 (big props to housing analyst Lance Lambert for being on top of this. Read more here).

That is a massive increase and will stress our supply chains, lumber mills, and the availability of construction labor, which are all already near current capacity. So as it stands when we do add supply we need to slowly ramp it up over time, to avoid a supply-side shock.

This is why, again, I am calling, again, for a Manhattan Project for Housing.

We need to totally revamp the infrastructure it takes to build housing, invest in new technologies and techniques, and blast through bureaucratic limitations to building stuff and doing things.

We can do better.

My Skeptical Take:

Let me be clear, once again, it is admirable that housing policy is taking a front and center seat from the leading presidential candidate. I sincerely applauded it. Housing starts are at the 2019 COVID lows. We need to build more housing units ASAP.

But herein lies the problem. These proposals are misguided at best, and counterproductive at worst. They are poorly thought-out, filled with rhetoric and campaign-style promises. These are not serious policy proposals.

We may forget that President Barack Obama tried to do this. He brought the same message to the same Democratic National Convention stage, saying zoning and land use reforms were needed to “clear away some of the outdated laws and regulations that make it harder to build homes.”

And, staying A-political, his Administration was highly successful in getting major legislation through Congress: the historic Obamacare and Dodd-Frank finance/bank reforms, to name a few. But even in a deep housing recession, the worst in our lifetime, he was still unable to break through local red tape and limit litigious special interest groups spurning housing development.

I am dubious that the Harris/Walz team can do better.

Again, a major stumbling block is our feeble infrastructure building ability. The infrastructure to boost housing supply doesn’t exist today and the local/state/ federal bureaucratic red tape is suffocating to the industry.

Housing is not a crisis, it’s worse, it’s a chronic disease: a lingering condition that is getting worse over time. Peripheral treatments have been proposed and helpful therapies exist, but there is no cure in sight. We are short 4.4 million homes, and this number continues to grow.

We can do better.

The 1937 Federal Housing Act, the 1956 Federal Aid Highway Act, the 1968 Fair Housing Act…It has been a long time since we took serious action.

No more discussions; no more rhetoric or empty promises.

We need a Manhattan Project for housing.

LFG Government.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville, where we are seeing record tourism this year. 99 people per day move to Nashville and our city population is still under 700k. We have 3 professional sports teams, massive health care and entertainment industries, more than a dozen colleges, and no state income tax, to name a few.

Looking for a realtor in the Nashville area? We work with the best here who specialize in helping investors find great properties.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likley errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.