We Need A Manhattan Project for Housing

These Housing Proposals Aren't Serious

Welcome to the Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Quick Economic Update

Deep Dive - We Need A Manhattan Project for Housing

My Skeptical Take.

Fuel for the Day: I’m “rawdoggin it” with no caffeine, no snacks, as the kids say these days (although that meant something very different when I was growing up). Just some sparking water to get the creative juices flowing. And so far so good! Really good. Montane Cucumber Lime, stuff is amazing (also with some booze :).

The Weekly 3: News, Data and Education to Keep You Informed

“Consumers don't produce inflation. Producers don't produce inflation. Inflation is produced only by too much government spending and too much government creation of money, and nothing else (Milton Friedman).”

One Rental At a Time Podcast - More on the Harris/Waltz Housing and Economic Proposals (Zuber).

Education Recommendation: Pillars of Wealth: How to Make, Save, and Invest Your Money to Achieve Financial Freedom. A personal finance book by real estate investor and educator David Greene. A nice review of how we should be thinking about money. I gift this often to young adults.

Today’s Interest Rate: 6.49%

(Flat, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate. Let’s get into it.

Quick Interest Rate Update

An uber-quick review of interest rates before we get to our main topic:

Rates are down markedly from just 30 days ago, ~.40%, following the bond market rally in 10-yr treasuries. Spreads have shrunken to

The Fed is on track for a September interest rate cut of .25%, starting a 1-2 year monetary policy easing cycle, which will catalyze lower mortgage rates to ~5%.

We will hear more from Fed Chair Jerome Powell on Friday at the annual Jackson Hole conference.

Ok, enough on interest rates. This week, we do a deep dive into the Harris/Waltz economic and housing policy proposals that are all over the press as the DNC gets underway in Chicago. There is a lot to get to!

America Needs a Manhattan Project for Housing

The Harris/Waltz campaign is out with more housing policy proposals, this on the heels of the then Biden/Harris proposals earlier this year. And just like most sequels, Part Deux is almost always worse than Part One. Except for Terminator 2, of course.

First and foremost. I absolutely love and give immense credit to a presidential candidate who attempts to tackle housing in America. Five+ housing proposals in as many months from the sitting Administration is noteworthy. Housing is not a crisis, it’s worse, it’s a chronic disease: a lingering condition that is getting worse over time. Peripheral treatments have been proposed and helpful therapies exist, but there is no cure in sight. We are short 4.4 million homes, and this number continues to grow.

However, these new housing proposals, and the several back in March and June, are just not serious efforts. Even if they work as intended, this is bantam-weight stuff, far below the gravitas of a US President. They are laden with price controls, lackluster developer incentives, incomplete/unknown means to cut regulation, are inflationary, will increase home prices and will not achieve the rhetorical goals to which they aspire.

It may be effective pandering/populist messaging for a campaign, but is not a serious policy effort.

The 1937 Federal Housing Act, the 1956 Federal Aid Highway Act, the 1968 Fair Housing Act…It has been a long time since we took serious action.

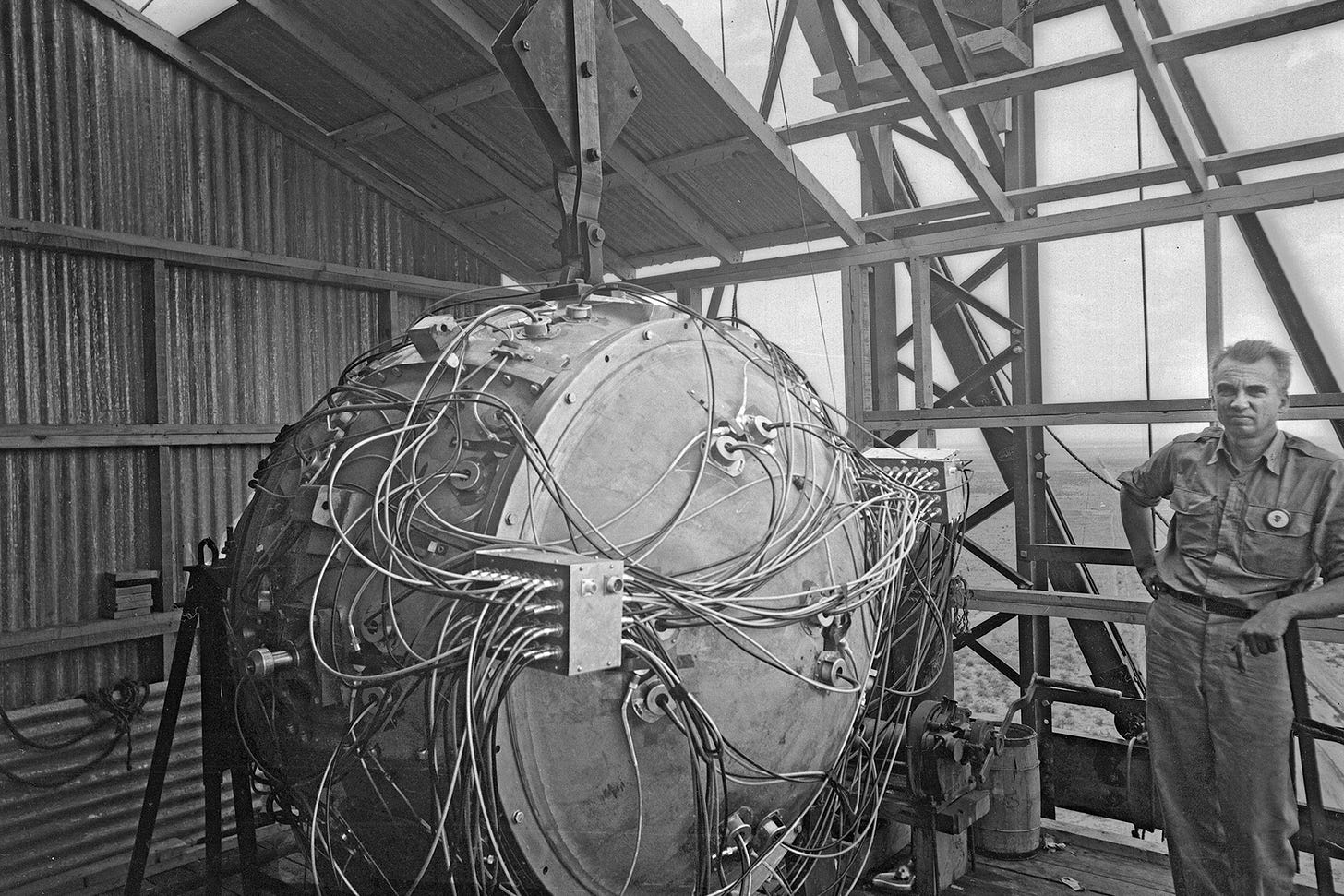

We need a Manhattan Project for housing. No more discussions; no more rhetoric or empty promises. It’s the very rare times like this that I wish I was back in a congressional office on Capitol Hill.

Here is what a couple of prominent folks are saying, from both sides of the aisle about these proposals:

“Rent control has been about as disgraced as any economic policy in the tool kit. The idea we’d be reviving and expanding it will ultimately make our housing supply problems worse, not better." -- Jason Furman, Obama’s Economic Advisor

“If you just put a lid on something and if you want to explore what really happens, just go back to the 1970s. We tried it. There was a whole movement for price controls across everything, because inflation was out of control and rampant, just like it is now. And so it's been tried. It does not work. What works is to flood the market with supply.” -- Dave Ramsay, Real Estate Investor and Personal Finance Author

“Housing affordability is crushed. Kamala Harris just unveiled a plan that would make it worse.” -- Lance Lambert, Housing Analyst

No, come on. Tell us what you really think….

And to recap, Biden/Harris had already proposed in March and then again in June:

To provide a $10,000 tax credit for first-time homebuyers.

Capping rent increases at 5%.

You can read my previous take on those policies here.

The New Harris/Waltz Housing Proposals:

Let’s get into it…Again the new proposals can be viewed here.

Calling for the construction of 3 million new housing units

Specifically, it states: “[We] will work in partnership with industry to build the housing we need, both to rent and to buy, and to take down barriers that stand in the way of building new housing, including at the state and local levels. This will make rents and mortgages cheaper.”

First off, GOOD!

We need this and 3 million homes is an admirable goal.

But….

It is unclear exactly what means will be used to achieve this lofty objective. The policy does mention a tax incentive for home builders, but only if the end buyer has never purchased a home before. Seems highly speculative / risky for the homebuilder and their investors to put up the capital if they only can sell it to the much smaller pool of first-time homebuyers to take advantage of this credit. And, the proposals makes no mention of reducing federal/local regulations that add an estimated 24% cost burden on single-family home construction and 41% on multifamily construction. Unfortunately, regulatory policy is a large part of the costs of building in America (NAHB).

It also should be noted that there is a lot of demonizing of investors, hedge funds and landlords etc… who are the folks who actually finance homebuilding. I hope they don’t alienate them so they pull their $ from housing and invest in another market. As the home builders commented: “…on the heels of President Biden’s rent cap proposal, NAHB is concerned that efforts to target institutional investors…” will harm home building (NAHB). If you disincentivize development in rental housing supply via the 5% rent cap and demonize investors, you actually hurt renters, who then have fewer options, which puts upward pressure on rents. As a real estate investor, I am very put-off by the proposals’ inflammatory language.

Can we actually build 3M additional homes because of this policy?

It’s virtually impossible.

From housing analyst Lance Lambert: “Since January 2020, the U.S. has completed an average of 1.39 million housing units per year. To achieve 3 million additional housing units beyond the current trajectory, annual housing starts would need to increase by 750,000, reaching 2.14 million starts per year in 2025, 2026, 2027, and 2028….Such a significant increase in residential construction within a short timeframe, outside of a [very short term] post-recession recovery, is unprecedented.”

It’s just a road too far without more focus on building the supply of housing units. The proposals’ tax incentives are minor and focus on “affordable housing.” It just won’t cut it. The policies in the proposal just don’t support its stated goal of 3 million housing units.

A Little History and Track Record on Building in America

And If history is our guide, I am a bit dubious that the government can incentivize/help build 3 million anything, let alone homes.

For instance, Biden/Harris announced $18+ billion to expand rural broadband to thousands of Americans (which it still hasn’t deployed) while the technology solution already exists through SpaceX’s Starlink satellite broadband internet. Why spend $18+ billion to build infrastructure we don’t need? Might as well burn that money.

And $2.5 billion for 500,000 electric vehicle chargers, but to date has built 7. Yes, 7. Total. Meanwhile, Tesla built nearly 4000 in the 4th quarter of 2023 alone.

Details of how we will build 3M housing units in the proposals are not provided, it simply says they will provide incentives and cut red tape. Again, I hope they do! But I am dubious. This small-ball just won’t cut it. We need to think MUCH MUCH BIGGER, we need a Manhattan Project for Housing! (keep reading)

“A New Federal Fund To Spur Innovative Housing Construction.”

This is the part of the proposals, at least the idea of it, that I wholly support. Technology has not yet made its way into housing construction, and local governments are doing a horrible job of allowing new techniques and materials to penetrate the onerous building code/permit cabal. We still build homes like we did 100 years ago. Government incentives for businesses to improve building technology and the process for home building is a fantastic idea and a good use of our taxpayer dollars.

Here is a breakdown of all the construction-related costs for a single-family home. We need companies working on all of these parts of the home (or combining these into one, like with 3D printing walls and structural components).

Shouldn’t the future of home construction be a giant casting or printing machine that can “build” a home in a few days at 1/10 the price, then workers can go in to finish the internals? Shouldn’t this be something we can achieve?

I just saw SpaceX shoot 2 rockets into the atmosphere, drop off a satellite payload to deliver internet access to countries around the world, and then return and land themselves like synchronized swimmers. Holy sh!t. Badass.

So, why are we still building homes like cavemen?

Stop thinking small.

Of course, the devil is in the details and the rest of this section on innovation is devoted to talking about affordable housing, which is needed, but unrelated. Thus, I fear this $40 billion innovation fund will just become a slush fund/catch-all for developers to get a few free bucks to build crappy projects. These 2 sentences in the construction innovation section stick out to me:

“…empower developers and homebuilders to design and build rental and housing solutions that are affordable…” and “…empower local governments to fund local solutions to build housing.”

Incentivizing the discovery/creation of new building tech is not about “local solutions.” It’s about startups, capital investors and home builders developing and implementing new technology (with local code/zoning/permitting government agencies getting out of the way). Again, a tell that this is not a serious proposal to improve building technology. It’s nipping around the edges and while I hope it spurs some affordable hosuing projects, once again this small-ball policy pandering to emotions and good feelings.

“Lowering the Rent for Hardworking Americans by Taking on Corporate and Major Landlords.”

This section is highly problematic. Let’s take it step by step:

“Expand rental assistance.”

So far fine, just more Section 8 vouchers. Not a needlemover but not harmful at all.

“Boost housing supply for those without homes.”

No concrete (pardon the pun) details on how.

“Make sure corporate landlords can’t use taxpayer dollars to unfairly rip off renters.”

No idea what they are talking about here. If a landlord is doing something illegal or unethical the tenant has legal rights to take action.

“Stop Wall Street Investors from Buying Up and Marking Up Homes in Bulk.” While it is true that some tertiary cities have more institutional investment, institutional investors own less than 2% of the total housing stock. It is a myth that Wall Street owns a significant number of US homes. Saying they do is not being intellectually honest. Of the top 25 markets, Atlanta has the highest % of institutional investor ownership at ~4.33%. Most all landlords are mom and pops (like me), not large institutions. Chart 👇.

“Stop Rent-Setting Data Firms From Price Fixing To Raise Rents by Double Digits.”

Ok, let me get this straight, we are going to outlaw software? This is highly problematic and a slippery slope to larger censorship and price controls, in my opinion. Are we going to have some sort of Software Czar picking winners and losers?How would this even work? I would oppose giving power to an agency to inspect and outlaw software. If there is collusion, that is a different story, and is already illegal. This can be prosecuted today. Also, fun fact, all of Congress / Administration politicians benefit from the algorithms in the stock market and trade on non-public information to enrich themselves. Why don’t we outlaw that?

But I digress…

“Provide up to $25,000 in Down-Payment Support for First-Time Homeowners.”

Here we go…. now we are getting into the meat and potatoes of what is wrong with these proposals, they are laden with well-meaning, yet misplaced, intentions.

In short, giving folks $25k is a horrible idea, it’s pouring gasoline on the fire (demand), when you only have a few pieces of wood left (supply).

Simply giving folks money to spend is another form of economic stimulant and is inflationary. Even if it works to incentive home buying (it wont, keep reading), this will raise home prices by some multiple of $25k. More $ chasing fewer homes.

Even if the proposal is executed as foreseen, it will drive up prices

A housing unit/home, as we well know, takes time to build even if we are able to reduce red tape/permiting etc…. processes. But demand? That can spike rapidly, and giving $25k to folks will do that, especially if their plan goes as they intend it. So even if the plan to boost construction to some degree also works, it would take years to materialize, while housing demand is on fire from the $25k and $10k stimi-checks in these proposals. 2025-2027 would be the least affordable time in our history to buy a home, and it won’t even be close. Again, IF the policies work as intended, which they won’t (keep reading).

And if that is deficit spending, ie the government printing money, well add a larger multiple on that $25k increase to home prices. Currently, the gross national debt is $35 trillion. This equates to: $104,497 per person, $266,275 per household, and $483,889 per child. We can’t afford to continue to spend money we don’t have. The money printer is how we got into today’s inflationary mess.

Affordability: The Down Payment AND the Mortgage Matter

The core problem with our housing market is that it is expensive, the downpayment and the mortgage matter. Even if the government gifted all first-time homebuyers with 100% of the downpayment, not just $25k, could they also afford the monthly mortgage payment?

Most could not. Why?

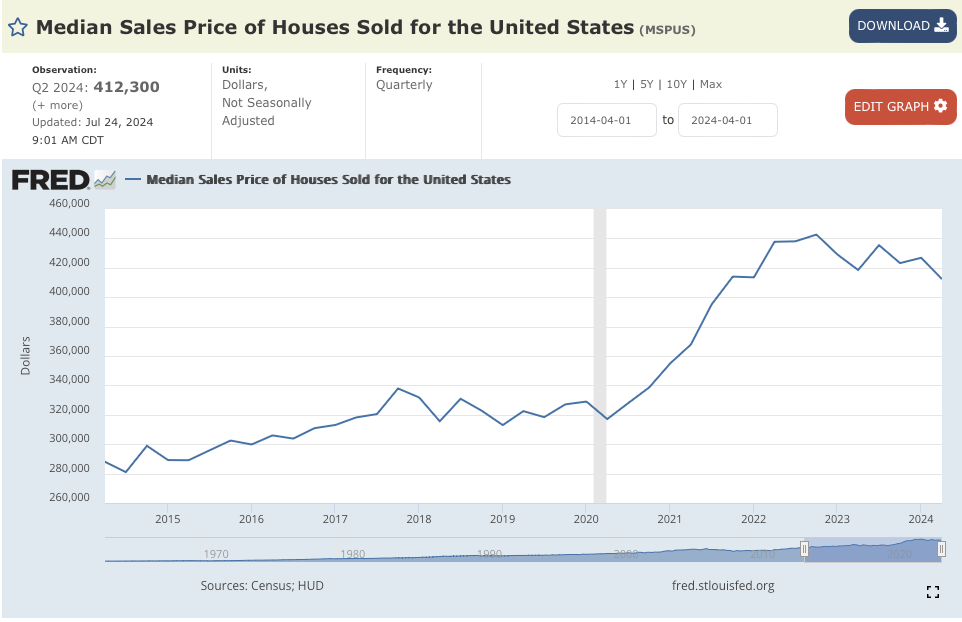

The median home price is ~$412k, meaning the mortgage at today’s rates and average insurance and property tax rates is ~ $2700.

The median salary is $54,000, or $4500/mo before taxes.

A bank would not qualify the median salary worker for a median home, with these numbers.

Real Estate investor Grant Cardone made a similar point this week as well.

So how much will the $25k down payment even matter?

Hard to tell exactly. But it seems that it will be more of a benefit to upper-middle-class first-time homebuyers, not folks in the lower half of the income bracket, because again they can’t afford the monthly mortgage anyway.

This is why the proposal won’t work as intended.

The intense demand during 2020-2021, driven by zero % interest rates and work from home emptied the market of inventory, causing prices to overheat. Home prices are up roughly 50% since 2019. That price shock + the ensuing mortgage rate shock from 3% interest rates to 7% created the fastest-ever deterioration in housing affordability. But even with that shock, supply has not been able to keep up far from it. In fact, the Federal Reserve says “new construction would have had to increase by roughly 300% to absorb the pandemic-era surge in demand.”

Again, broken record here but, if we want prices to stabilize we need more supply, NOT demand.

A Plea to Politicians

I beg you, politicians please listen up! Stop announcing, creating, and proposing policies that stoke demand. We need more supply of homes. Focus on that and you may be able to blunt the growth of home prices. Price stabilization should be your north star. For their part, the major home builders agree, saying “A $10,000 tax credit for first-time buyers and $25,000 downpayment assistance are positive demand incentives but the plan must weigh more heavily on boosting supply because the nation faces a shortfall of roughly 1.5 million housing units.”

There is no Free in Government Spending

Just to be clear, and I think we all understand this, but I want to emphasize that, the government doesn’t “provide” anything. We, the rest of us, the taxpayer, are providing this via either our tax dollars or through deficit spending (aka printing money) which is inflationary. There is no free in government spending. Either way, it’s us who are paying for this. As a result, Home prices will increase by some multiple of $25,000 if we inject new money into the system.

An Aside: Grocery price Controls Making Headlines

Included in the Harris/Waltz proposals were several non-housing-related policy items. I purposely ignored this piece, and encourage you to read it for yourself here. I’ll simply point out that price fixing or colluding is already illegal and can be prosecuted under the law today. Perhaps the Washington Post said it best in their recent article:

“It’s hard to exaggerate how bad this policy is.” “When your opponent calls you ‘communist,’ maybe don’t propose price controls?” -- Catherine Rampeck

Investor and scientist David Friedberg also had a great explanation of why price controls don’t work and are harmful to the economy, which is worth a listen.

My Skeptical Take:

Let me be clear, it is admirable that housing policy is taking a front and center seat from the leading presidential candidate. I truly applauded it. Housing starts are at the 2019 COVID lows. We need to build more housing units ASAP.

But herein lies the problem. These proposals are misguided at best, and counterproductive at worst. They are poorly thought-out, filled with rhetoric and campaign-style promises. They are inflationary, make wild claims and have very little chance of achieving their stated goals - like 3 million homes built in 4 years - and even becoming law in the first place. Once again politicians choose to pander and focus on emotions and the vibe, not the core of the problem.

These are not serious policy proposals.

Every day 13,000+ Americans turn 35, the prime household formation age.

Will we build enough housing units?

So what should we do?

I am hopeful that we can chip away at the regulatory roadblocks / red tape that contribute to the cost, delay and heartburn of homebuilding. But so far, I don’t see an effort worthy of our admiration. From any candidate or leading politician.

What we need is a Manhattan Project for Housing in America.

As I have written before, we need an all-housing strategy to boost supply. Demolish local city process hurdles, allow more small multifamily, additions, ADUs, upzoning, and accelerate large development timelines so it doesn’t take 2-5+ years to get something built.

It took 13 months to build the Empire State Building in 1930.

Why have we become so feeble at building stuff? (not to mention bridges, trains, highways…)

One big idea: we can remove the limitations from Fannie and Freddie to provide construction lending, perhaps even in exchange for means-based rent restrictions. This would help build 250K-400K units/year. Guggenheim's Jim Millstein laid out this and several ideas recently, check out the podcast on Odd Lots for a more detailed explanation on this.

So yes, we can do it! The question is, will we take action?

Again, count me hopeful, but skeptical.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville, where we are seeing record tourism this year. 99 people per day move to Nashville and our city population is still under 700k. We have 3 professional sports teams, massive health care and entertainment industries, more than a dozen colleges, and no state income tax, to name a few.

Looking for a realtor in the Nashville area? We work with the best here who specialize in helping investors find great properties.

* I write this myself and get it out for you all in the same day. Apologize in advance for any typos / syntax errors. Don’t have a team of editors, yet :).

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.