The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, August 30th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: existing vs new homes, homebuilders, ‘Middle Housing’ and Ghostbusters!

New vs Existing Homes

Last week we touched on the closing price gap between existing and new homes. This quarter those ‘Proton Streams’ are dangerously close to crossing: New home prices are approaching the same price levels as existing homes (and vice versa).

According to the National Association of Realtors, the median new single family home price is now at $416k, after having cooled off significantly, -7% QoQ, and existing homes sales have recovered after bottoming in January, to $397k (*406.7k was also cited). If this trend continues they will cross next quarter.

A new home for less than an existing home? Watchout, ‘Stay-Puft Marshmallow Man.’

Or is that Dictator Kim Jong Un visiting a North Korean Factory? 😂

Ok, ok, enough Ghostbusters 80s references… I digress…

What is driving New Home Prices?

One of the culprits may likely be the crazy incentives new home builders are offering. Lennar, a large publicly traded homebuilder in 26 states, even has a website dedicated to finding the inventive they offer in your local market. I found that, when you use their in-house mortgage provider, you can get a 4.99% mortgage when you buy new!

Really? Let’s dive in….

Like what you are reading? Consider sharing this article with a friend!

I wanted to know more, so I hopped on with a live agent to talk about deals in Nashville, my home market. (shout out to “Katie” on Lennar live chat, wherever you are). Was this a 2-1 buy down, or the full 30 years? Do I have to live there? Were there crazy fees? I had so many questions!

Here is what I learned:

Rate - Its a FULL 30-year fixed rate of 4.99% (5.218 APR)

Price - There is no minimum home price, they offer it on all their homes.

DownP - They only require 10% down payment (but 20% avoids PMI costs )

You don’t get a better rate if you put more down. It appears to be a blanket incentive.

Closing costs / Fees. Most homes have an HOA (again these are likely planned communities) and there is small HOA joining fee. Other than that, normal closing cost related fees apply.

Investors - you can purchase these homes, and get this rate for an investment property. I was surprised by this. Rates for investor loans, anecdotally, are above 8% right now with a great credit score. Only restriction: since these homes are usually in planned communities, there is no AirBNB. Your tenant leases have to be 6-months or more (but perhaps medium term rentals to professionals would work well for cash flow boost if you are close to a hospital, college etc…)?

Real Estate Agents - Lennar welcomes you to bring your buyers. They are are happy to work with you as a real estate agent.

I know I missed a few questions, but hopefully this give a good summary

So why else are new homes flying off the shelf?

One answer could be because existing home inventory is LOW and “lousy.” There just ain’t that many existing homes on the market. Existing Home July inventory sat at a 3.3-months’ supply (less than half that of new homes). And of those homes, their quality/state may be in “fixer-upper” status. Case in point, the CEO of Toll Brothers (a luxury home builder, so consider the source) said on their earnings call that “What is sitting on the market is the old, tired inventory, which actually makes it even better for us…Because not only is the resale market really tight, but the quality of what's sitting on the resale market is lousy.”

Of note, Toll Brothers shot the lights out this quarter, and raised its future sales guidance. Home sales revenues were $2.7 billion, up 19% YoY.

Backing up these points, existing-home sales in July fell 2.2 %, according to the NAR. That’s a whopping 16.6% decline from one year ago.

Devil’s Advocate.

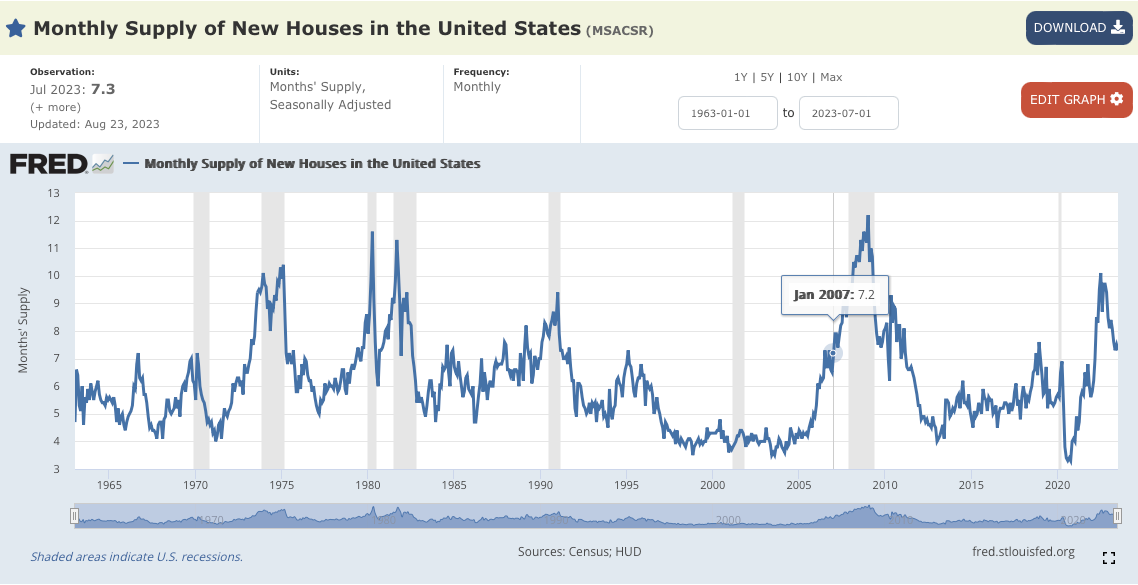

Is the supply of new homes getting too high? July came in at 7.3 months supply, and about half the time we hit a 7 months supply of new homes, we have a recession. Is there a bubble? My thoughts: no. We under-built for so long there is far too much pent up demand for wanting homeowners. But you never know; it’s a good data point to watch.

Regardless, the supply of new homes is ticking up, as homebuilders try to take advantage of historically elevated prices (despite still elevated material costs). For his two-cents, Toll Brothers says, “The market for new homes is solid, and we are well positioned with the right strategy in place to take advantage of it.” They attribute demand for new homes to the “well-publicized shortage of existing homes for sale,” and interest rates keeping folks from selling.

Not to be outdone, Zillow is testing a 1% down payment program to help homebuyers get into a home. One big problem I see here: low down payment means larger monthly payment, plus it’s at higher rates. I could see Zillow falling on their face here like they did with their failed automated iBuyer program. The risk from a potential housing bubble is from mortgage defaults, and with less down on the home there is a perverse incentive to just not pay the mortgage.

The program is only available in Arizona, for now. To be continued…

Home Prices and Demand

What are home prices going to do over the next 12 months and how should are real estate investors/financiers posturing themselves?

My thoughts: the market bottom was very likely in January and will average up from there. The nano-second that the FED announce/whispers/rumors/coughs/stutters that it is cutting interest rates, mortgage rates will plummet and home prices will skyrocket 10%. My opinion.

Prolific real estate investor/broker/Shark Barbara Corcoran agrees. Speaking to ABC’s Robin Roberts, she acknowledged that the housing market has been “surprisingly strong” in this high interest rate environment because “there are just not enough houses to go around…..but I can tell you this, house prices are not going to come down.” And “when mortgage rates come down [all hell will break loose]” Buyers waiting on the sidelines will jump into the market, “and houses are going to go up in price all over again,” she added. “I wouldn’t be surprised if they go up by as much as 10% or 15% when that happens.”

She also echoed my advice for potential home sellers, saying “… if it was my house, I would wait until next year when all the buyers come off the sidelines when interest rates come [down]. I’m going to get a lot more for my house than I would get right now.”

Goldman Sachs, which have been relatively conservative in their estimations, also just flipped, from negative to positive on 2023 home values. “…revising our home price forecasts higher, to 1.8% for full-year 2023 vs. -2.2% prior, and 3.5% in 2024 vs. 2.8% prior.

Middle Housing for the Middle Class!

I know I may be a biased, broken record at this point. But here it goes. If we need more homes let’s incentivize homeowners to get in the fight. How? Increase home density. We need incentives for homeowners to build ADUs (small apartments or even full sized homes built on an existing home’s lot). Some states/local governments are leading the charge, as I’ve highlighted before. And more that this can be done.

From WWII - 60’s we were building many many more small multifamily homes, let’s bring those back. It’s up to city, county, state officials to help. We need zoning that allows for small multifamily development, which can be restricted to long term rentals so they aren’t built only to rent in perpetuity, but to also own, as a condo/townhouse.

I see tons of large buildings going up, giant cranes towering over cities…. they’re all apartments, no condos, no opportunity for home ownership. We can start “small” and give incentives to developers to build small multi-family homes. And I aknowdelege that there aren’t enough developers that want to build this type of housing, there just isn’t enough meat on the bones for them to pay their project overhead. But there is plenty of room to profit for the small developers/mom-and-pop investors, like you and me! (Again, yes, I’m biased).

Shout out to Oregon, who is really leading the charge here.

Bottom Line

Home prices may be done dipping. We are nearly in month 9 of a steady upward move. New homes, with incentives and a lack of existing homes on the market, are extremely attractive right now, even for investors.

What I’m seeing? I want to echo/emphasize what I said last week. Existing homes that need work are sitting on the market. For those of you who are willing to get a little dirty, you can really do well as a buyer in this market. Just pickup some supplies, order pizza, watch some “YouTube University,” and you can turn a weekend with friends into a fully painted home, likely increasing its value tens of thousands of dollars. For example.

This is the silver lining for buyers in this market that I must reemphasize: while it’s still tough out there, buyers have negotiation leverage for existing homes. For example, in Nashville we are experiencing both record high sales prices but even higher Seller Sentiment: the gap between what sellers are trying to get for their property and what it ends up selling for is at an all time high.

For homeowners? Take Barbara’s sage advice. Don’t sell now. Wait for rates to come back to earth (around 5.5%, in my opinion), and for the flood of homebuyers to rush into the market.

And hey government folks, bring back middle housing for the middle class!

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at AndreasMueller@kw.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.