Wait, Mortgage Rates are... Higher?

The Fed cuts rates but the market determines prices.

Welcome to the Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

The Fed Cuts!

But Mortgage Rates are….Higher?

Federal Debt and Spending will bring back Inflation.

My Skeptical Take.

Fuel for the Day: Trader Joe’s Bold Dark Roast Coffee. Not bad, and a great value.

The Weekly 3: News, Data and Education to Keep You Informed

Want to Increase Housing Supply and Lower Rents? Stop price controls. Argentina recently removed rent controls. What happened? Supply increased by >170%, rent growth eased to 3-year low, rentals now easier to find, and inflation cooled (@WSJ and Jay Parsons).

Presidential Candidate on Housing Policy: “Upon taking office, I will also sign an Executive Order directing the immediate termination of every single unnecessary rule that is impeding housing construction and driving up costs of housing” 👀 (Gov policies are 25% of the cost of a new single-family home, and 40% of multifamily homes.)

Book Recommendation: The Millionaire Real Estate Investor: Anyone Can Do it - Not Everyone Will (Keller). Operational, Practical advice for anyone looking to invest in real estate. A staple in my library.

Today’s Interest Rate: 6.19%

(☝️.08, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate. Let’s get into it.

The Fed Cuts!

What a week! The Fed (slightly) surprised investors, cutting its Federal Funds Rate by .5%, instead of a more widely held .25%. As you know, I was firmly in the .25% camp, but the bond market was pricing in a more than 50% chance of a .5% cut. Looks like Mr. Market, a la the late great Benjamin Graham, was right.

The Fed saw the economy slowing and decided to start stepping on the gas. Two inflation and labor reports (the two data categories they care about) were released since the last Fed meeting, showing weaker numbers in each. In fact, Powell called out the labor numbers specifically in the press conference as being “artificially high” as they were revised lower than they were originally reported. Last month, the Labor Department released jobs numbers, which covered April 2023 to March 2024, which showed a downward revision of 818,000 jobs to payroll figures for that period. That’s avery large negative revision to the number of jobs we thought were created last year.

You can watch Powell’s full press conference here.

A Strong Labor Market Continues

Later in the press conference, Powell reiterated that: “The labor market is growing at a strong pace,” but on an interesting note, called out immigration as the culprit for the softening in the numbers, saying: “If you’re having millions of people come into the labor force, then—and you’re creating 100,000 jobs, you’re going to see unemployment go up…We understand there’s been quite an influx across the borders, and that is actually been one of the things that has allowed unemployment rate to rise.” This point was made unprompted. It is of note because the Fed tries to avoid discussing hot-button political issues, meaning immigration’s effects were significant enough to warrant broaching. This should provide adequate fodder for the respective political machines this week, who jumped on it immediately.

Get your popcorn ready.

Regardless of the cause, unemployment has risen slightly (currently 4.2%) and labor market data have cooled in the last 30 days. The rate of price increases (aka inflation) is falling, but prices will remain elevated. The damage has been done. However the economy has proven to be quite resilient and unemployment is not high; in fact, it is “close to maximum employment;” and labor market “participation is at high levels,” said Powerll. The economy’s relative strength is enough for the Fed decided to “reduce the degree of policy restraint” and cut interest rates by .5%.

Good news for investors.

So What’s Next for Interest Rates?

“We are not on any preset course,” as Powell put it.

And I believe him.

From Powell’s Q&A it sounded like while there were consensus votes to cut rates at this meeting, it was not unanimous amongst the Federal Reserve members. I expect the Fed to be largely data driven moving forward. Fortunately, there will not be another Fed meeting / rate cut before the election so we don’t need to get political (although the Fed is a-political, despite many media pundits claiming otherwise.

I expect the Fed to cut .25% at most all of the next few meetings, with the potential to even pause at a meeting or two next year. Interest rates will begin to tick lower in the next 30-60 days, and remain volatile, but will steady after the next cut or two, once the market sees a better picture of how the economy is doing and that the Fed is steadfast in its mission to bring rates down. In my opinion.

If I had to put a number on it, I’d say mortgage rates hit 5.9% by February.

And a reminder, the Fed is still in a highly restrictive posture to the US economy. They “reduce[d] the degree of policy restraint;” as Powerll said. A 4.75%-5% Federal Funds rate is still highly restrictive. And they are continuing Quantitive Tightening, not tightening less (or god forbid Quantitative Easing).

But Mortgage Rates are….Higher?

In short, the Fed may alter its interest rate but the market is the ultimate decider.

If you listen to the news, you would believe that when the Fed cut interest rates it would directly translate to a decline in mortgage rates. This point avoids important nuance.

Mortgages are predominantly influenced by the market demand for 10-year Treasury bonds, not the Federal Reserve's adjustments to its short-term Fed-Funds rate. The 10yr and 30yr mortgage are competing assets investors buy in our public marketplace, expecting a return for their expected risk. If investors expect higher risk to the economy, they buy 10-yr Treasuries, if the future seems less risky, they buy 30-yr mortgages (in general). Thus, a reduction in the federal funds rate does not directly or immediately impact mortgage rates (slightly oversimplified).

But they do rhyme.

See the last year of the chart. No change in Fed funds, but a volatile 30yr mortgage.

So Why Are Rates Higher Right Today vs Last Week?

The market was largely expecting a .5% cut and thus mortgage rates had already ticked down in anticipation in the previous weeks. When the Fed affirmed the market’s assumption, trading of the 10yr Treasury continued on as normal, and in this case, investors sold the 10yr. If I had to guess, I would say the few details Powell gave in his press conference on the likelihood of future cuts and reiteration that “[their path is not pre-determined]” allowed for some froth in 10yr bond market trading. I.e. there was less certainty than there could have been in his comments.

Unless inflation reaccelerates, the Fed’s rate cut should begin to influence mortgage rates in the coming weeks/months. And it’s not unheard of for 10yr bond yields to rise when the Fed cuts rates (which affect mortgage rates, remember). The 10yr Treasury yield rose on the day the Fed trimmed rates in about a third of the prior 52 central bank rate cuts since 1990 (Mishkin).

For their part, I am glad to see that the National Association of Realtors’ economist Lawrence Yun FINALLY changed his tune, expecting mortgage rates to fall as low as 5.9% this year. A stark reversal from when NAR said 6% mortgage rates would be the new long term normal. Welcome to the warm water Lawrence.

Fed Funds is also a target, not a directive. Even the Fed Funds rate is in constant flux. Think of the Fed as a captain on a ship, they can control the boat (Fed Funds Rate) but not the Ocean (the Market).

My Skeptical Take:

All signals are pointing to a hot and sexy Spring housing season, fueled by a strong economy and lower (sub-6%) mortgage rates. Until then, investors may have a window to buy properties, as homebuyers Skip Till Spring. Fewer buyers in the arena and increasing in housing inventory on the market is a perfect cocktail to pickup a deal!

You are on the clock, I think we have a ~5 month buyer’s window.

- Me

But, this path is not guaranteed and there is one big big elephant in the room that will eventually disrupt our good economic vibes…

Inflation and Gov Spending Yellow Alert

I must continue expressing my concern from last week.

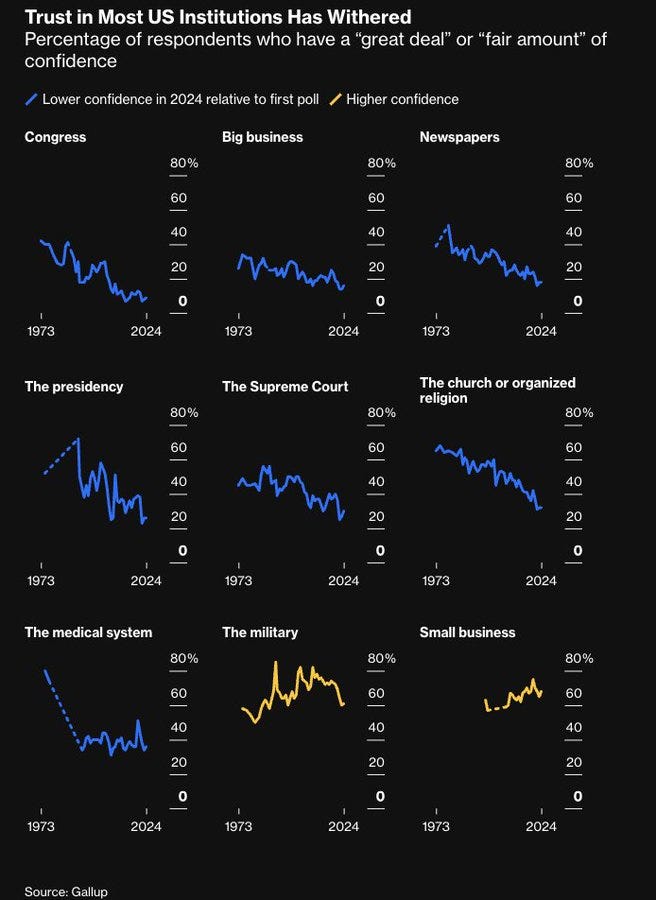

I know we always lament the issue of the debt and government spending but, its time to actually care about this.

Government spending is out of control and if left unchecked it will cause inflation to rear its ugly ugly head, forcing the Fed to compensate by raising rates right back up again.

And it very well could.

We are in an odd time, the Fed has been in a highly restrictive posture, working to keep a lid on an inflating economy, again a result of the out-of-control government spending. But now, the Fed has begun to slowly release its grip.

Meanwhile, Congress and the Administration haven’t done anything.

Zero. This is partially why trust in many US institutions is at an all-time low.

They continue to spend like drunken sailors behind the bar serving other drunken sailors. And excessive spending stimulates the economy, which is precisely what the Fed has been working so hard to stop for the last 2 years!

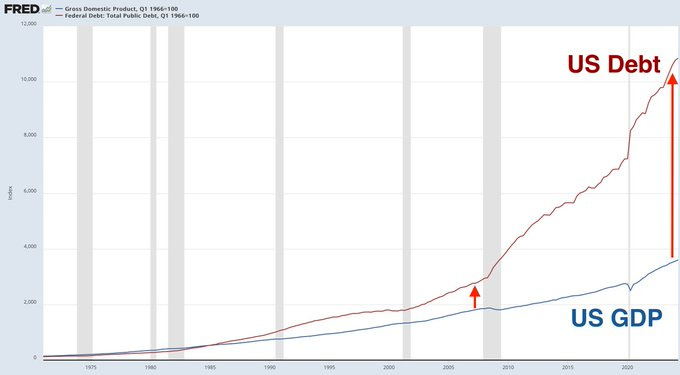

U.S. Federal Debt is $35 Trillion, growing at $3 billion per day (double the rate of 2020).

We spend $1 Trillion every 100 days.

We spend more on interest on our debt than we do the military: $1.1 Trillion.

This is how civilizations fail. Not trying to be alarmist, but it’s true.

"A system that relies on exponentially increasing levels of debt for each incremental unit of productivity eventually becomes so unstable that it simply collapses under the weight of its own leverage"-

The Fed, to its credit, seems more concerned about our lavish fiscal policy and its effect on the economy. What’s more concerning, is that both political parties are in full campaign mode, which often results in promises for new, bigger programs; and thus, even more new spending. The proposals we have seen so far, from both sides, would be highly inflationary, particularly for housing costs.

As Powell said in his remarks housing shelter costs are a problem., “Housing is the one piece that is dragging…we just don’t have enough housing”

So… I am concerned that the “robust” state of the current economy may be a lingering result of the stimulative drugs Uncle Sam slipped in our martini. Consumer spending is 2/3 of the economy and it’s hard to ignore the sheer volume of free dollars the federal government pumped, and is continuing to pump, into the economy.

When the drugs stop, yes we will have a short come-down (aka recession), but that is healthy for an economy to experience every so often in the economic cycle. If we don’t, a crash will be in our future.

We have to STOP deficit spending at the current rate. The young generations are shouldering this inflation and it’s building.

The Congress and Administration need to get their fiscal house in order. It’s been too long since ideological opposites Bill Clinton and Newt Gingrich were able to strike a balanced budget deal.

It’s time for some 12-step. We need to get off the Sauce.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville, where we are seeing record tourism this year. 90+ people per day move to Nashville and our city population is still under 700k. We have 3 professional sports teams, massive healthcare and entertainment industries, more than a dozen colleges, and no state income tax, to name a few.

Looking for a realtor in the Nashville area? We work with the best here who specialize in helping investors find great properties.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likely errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and do not constitute financial advice.