The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far ‘Unnamed’ Real Estate Newsletter, November 29th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin: Homebuilder profits and challenges, consumer health, federal reserve fun, and I add a new (short) segment. We are posturing toward 2024🔥!

Today’s Interest Rate: 7.30%

(👇 .02% from this time last week, 30-yr mortgage)

Mortgage interest rates continue a slow stair-step lower, as the bond market senses inflation easing and anticipates (tries to) the Federal Reserve’s next move. The market continues to price in a higher chance the Fed is done raising rates and will begin to cut rates halfway through 2024. This, as the Fed continues shrinking the amount of bonds on its balance sheet. Their pincer movement is starting to have an effect.

What’s more, most foreign federal reserve banks are cutting rates, more than tightening, now for 2 months straight. However the US Fed is claiming it will tighten again at least once more. I am dubious. The Fed is selling woof tickets.

As an aside, these two policy actions are losing the Fed money, starting in September 2022. As of Nov. 22 that loss is now at $120.4 billion. Fed losses are virtually without precedent in its history. The Fed funds its work through services it provides to the financial sector and from interest income generated by the Treasury and mortgage bonds it owns. Whatever the Fed earns beyond its operating expenses is then returned to the Treasury Department. Admittedly, the Fed stresses that losing money will not impact its ability to operate. My opinion: I am skeptical when something new happens, especially new ways the ‘government’ is losing/spending money.

The chart is super scary.

Homebuilders

Let’s check in on the folks who actually go through the pain of plotting, financing, building and selling the homes we live in. Homebuilders. (Unless you are like my dad and can build your own house, sehr kool). Homebuilder confidence dropped for the 4th month in a row in November. This measurement is forward looking, and looks at current sales, buyer traffic and the outlook for sales of new construction homes over the next six months. So where are we? We’ve regressed back to 2022 levels, when the Fed was ramping up interest rates.

Large Homebuilders are going On Offense

Their Strategy: Take share. Large homebuilders are actively trying to take small builders’ lunch money, by offering cash incentives, interest rate buy-downs and permanent low interest rates in the 5% range. Speaking on their Q3 earnings call, PulteGroup CEO Ryan Marshall said: “I think it’s also a great opportunity for us to take market share. With our mortgage company, the size of our balance sheet, the ability to be active in the capital markets, I think it gives us an opportunity to do things [incentives] that smaller local builders and maybe private builders can’t, so I think there is certainly a market share opportunity there as well. We’ve made build-to-rent a small piece of our business [too].” Not to be outdone, Homebuilder Lennar is offering a 4.75% ARM, or 5.75% fixed mortgage product when you buy one of their homes.

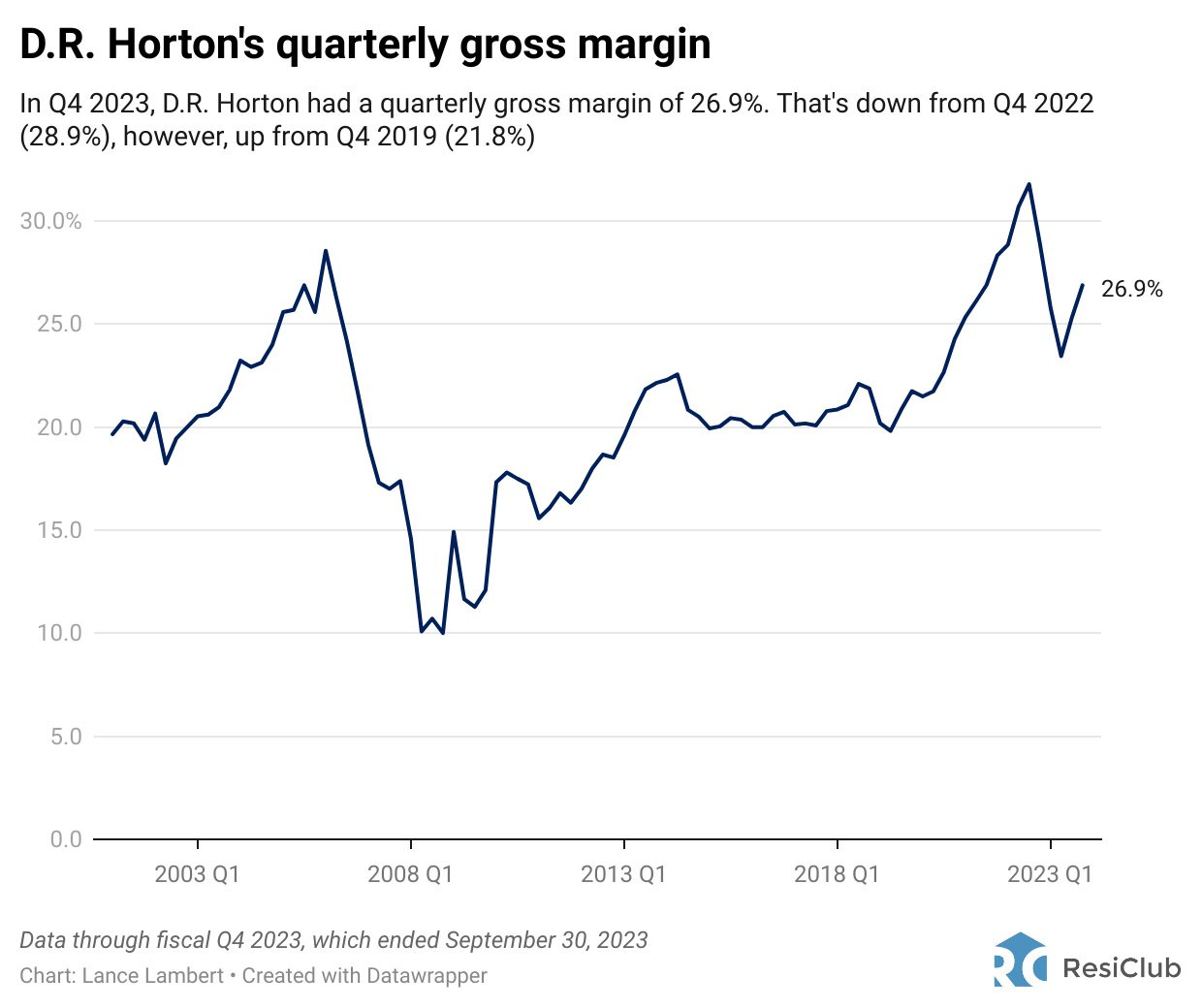

When asked recently on CNBC if incentives will cut into margins, Marshall responded, [“we build that into our gross margins, which are an industry leading 29.5%.”] Those kind of margins are also historically high.

Not a bad business.

So how are they able to keep margins up? 2 Main reasons:

It’s a supply story. There is just not enough homes. Plus, and this is my experience, they are building smaller homes on smaller lots. I have also heard heightened complaints of lesser build quality, but I can’t point to any specifics, but that’s the scuttlebutt in the industry.

Homebuilding is typically a 3-4 year operation. So say they bought the land 4 years ago, when they were going to sell the home for $500k, now it's worth $700k. So they have more margin than normal built up in the property, since they acquired the land for cheaper and home values have inflated. So they're really just giving some of it back to the homebuyer. The interesting thing will be what happens 2-3 years from now with their margins? I know some folks buying long term puts on homebuilder stocks, expecting margin compression.

Consumer Corner: Credit Cycle shifting?

How is the consumer doing? Well, if you look at credit card delinquencies, the trend is not your friend.

*Tangent… Isn’t the label “consumer” a funny one? What am I a humanoid version of Hungry Hungry Hippos? Compelled to keep buying stuff, which will likely insulate the attic one day. It’s a funny picture.

I digress…

A potential default cycle within the credit cycle has started, according to Apollo.

High yield and leveraged loans are experiencing growing default rates, which will likely get worse if the Fed continues to hold interest rates high. Businesses/consumers at risk of defaulting gotta have lower rates - like we gotta have Will Ferrell on that sexy Cow Bell - so they can refinance. If defaults continue, unemployment and layoffs may be occur.

To better understand the mechanisms of our economy’s credit cycle, including how default cycles like this happen, I HIGHLY recommend this animated video from legendary investor Ray Dalio. Simple yet edifying. Must watch TV.

How was it? Did you watch? I know you didn’t, just copy and paste the link in your calendar for later. Go ahead, I’ll wait…😊

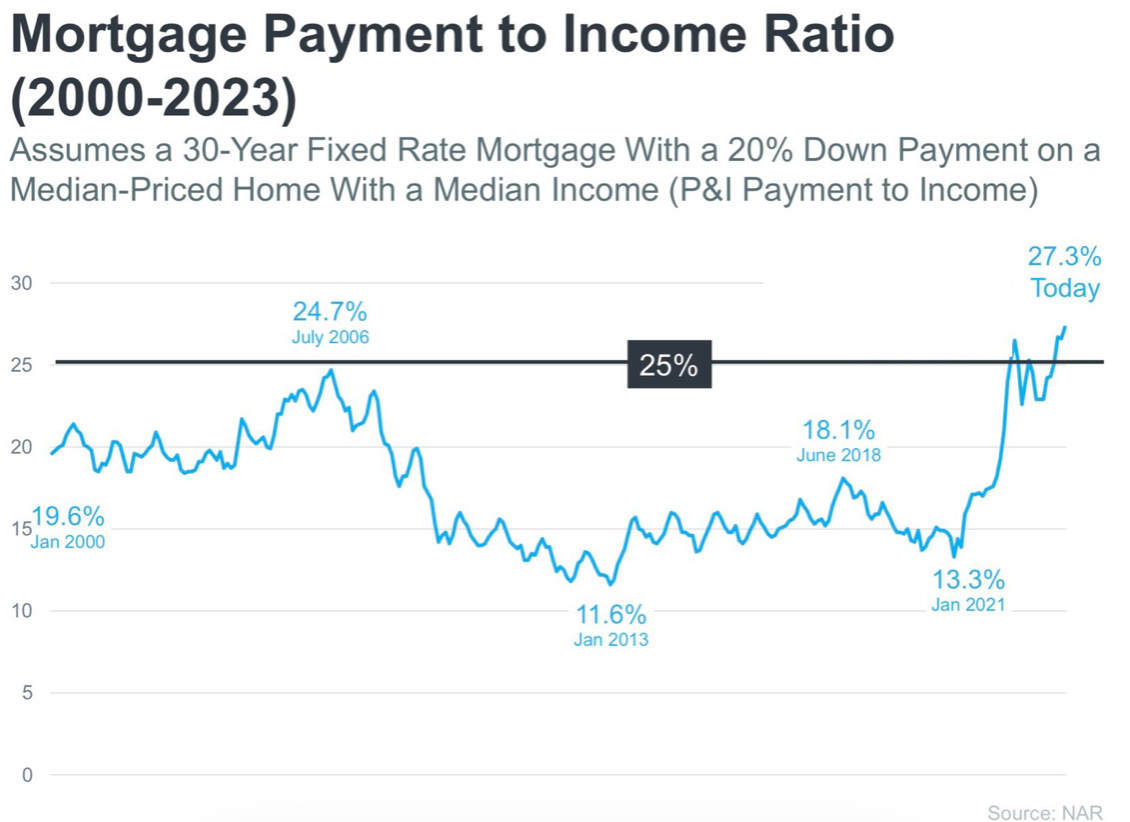

Historic monthly housing cost is another pressure point on the consumer. Not only are housing costs outpacing income growth (duh), the ratio of income/mortgage payment has broken through the dreaded 2006 level. This will continue higher as rates remain high in 2024. The effect? Defaults, unemployment, then recession. That may need to happen and frankly it may be the quickest and “best” way to get back to a normal economy. Or at least back to monetary policy where the government (the Fed, and yes I know hey are quasi-governmental) is not jerking on the marionette controller constantly.

Moreover, how are homebuyers (mostly young folks) paying for the down payment on the home? Mom and Dad. For 40% of homebuyers under age 30. And this is now a very large segment of the population, just surpassing Boomers.

Bottom Line

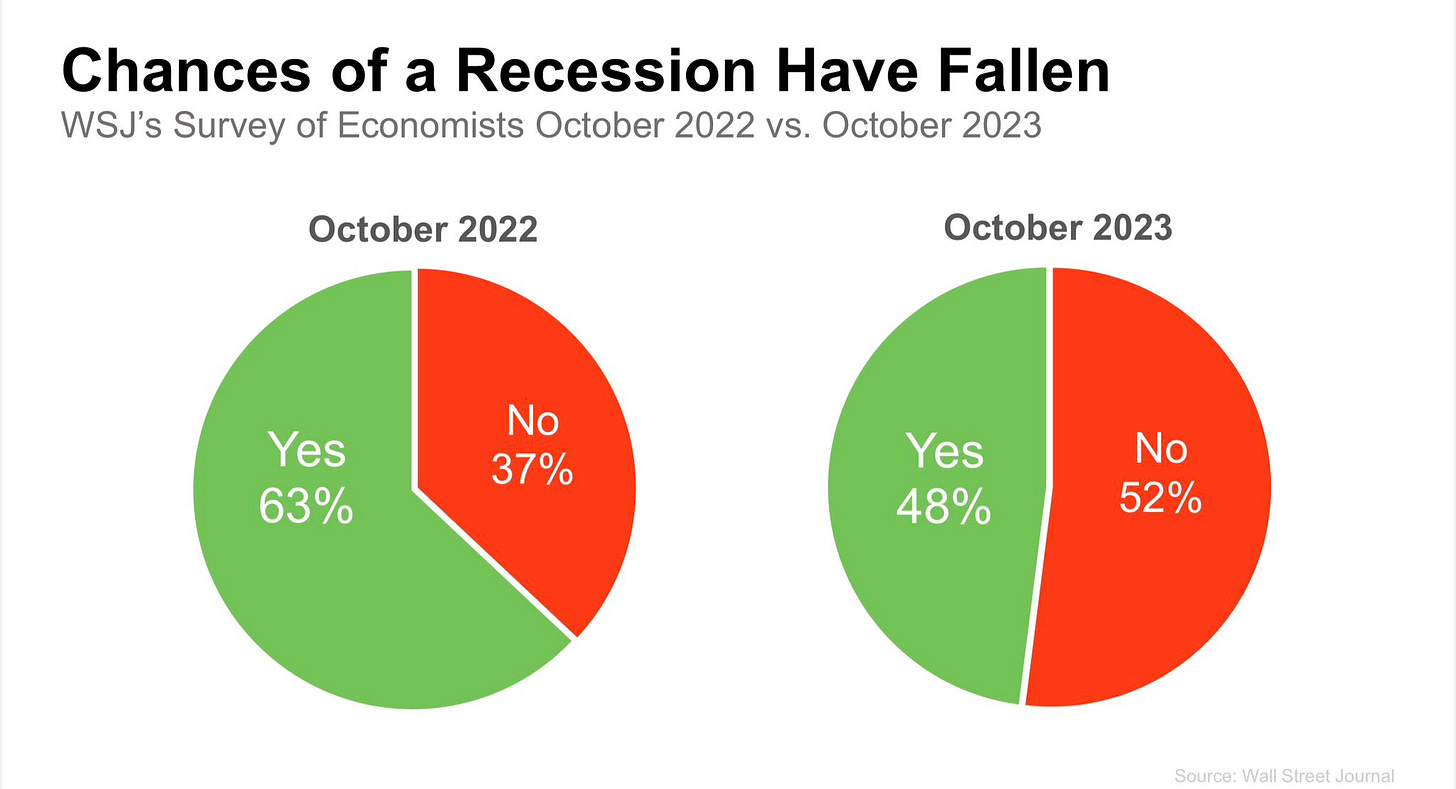

So what to make of all this? Well if you watch CNBC its coming up roses. For the first time in a year, a majority of economists do not believe we will have a recession (WSJ). This kind of dramatic shift sets off my skeptical spider sense (say that 3x fast) in a major way. My Opinion: those who have money are feeling rich and reporting that feeling as positive for the future, likely because household wealth of the upper-middle class is riding a 2023 stock market recovery. But that feeling would be fleeting and shift right back if the Fed holds rates high like this into 2024. I am girding for something to break. Again, in my opinion.

So when IS it a good time to buy real estate? In short: Always and Never.

There is always a tendency to overly weigh macroeconomic concerns when making an investment. Perhaps one shouldn’t get hung up too much. Over the last few years, the excuses were plentiful and perhaps warranted. In 2020 it was "There is too much economic uncertainty, I will when we know more about the economy." In 2021, "prices are too high, I will when prices come down." In 2022, "interest rates are too high, ill wait till they come down." In 2023, "I'll buy when prices and rates go down." In 2024, we will likely be back to “there is too much economic uncertainty, I’ll wait to see if we have a recession.”

My posture. Tune out the noise and keep going. Get doing. There is always opportunity.

Could home prices reverse and go down in 2024? Potentially, Morgan Stanley thinks so now. But just -3%. This is the bear case. So does it really matter?

And what does a recession mean for home prices, historically? Well it’s mixed. Recessions aren’t the end of the world. Except for 2008, which was caused by a housing / financial crisis / Wall Street. Much different beast today. (Core Logic)

Stay Skeptical all. But not sidelined.

Most Interesting Tweet of the Week

What the [heck] is happening to juice?!

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time, stay Aware, stay Skeptical.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.