Welcome to my so-far Unnamed Newsletter, August 10th edition, where I do a brief, hopefully insightful, dive into financial markets and/or real estate. And whatever else is bouncing around in my noggin.

Welcome back, to me! I was off last week, in parts unknown. Let’s just say my voice is gone but I still have my phone, wallet and keys. Inferences ensue :)

Today I want to talk about credit markets, consumer sentiment and the housing market + a local perspective on Tennessee real estate.

USA! USA! USAA+?

Quickly, to address the elephant in the room, this week the credit rating agency Fitch downgraded debt of the good ole USn’A. Big news. Frankly, I’m glad they did it; our deficits and spending is out of control and the cost of debt because of this inflation fight has escalated considerably this last year; but, in my opinion this is a nothing burger today. Maybe/hopefully in the future something like this will matter but for now I’m moving on.

Borrowing Continues to get Harder

We all know mortgage interest rates are high, and will likely remain high this year, but the ability to borrow in the first place, especially the availability of credit for mortgages, has fallen off a cliff twice in the last 3 years. First, at the start of COVID, and again in 2022 last year, according to the Mortgage Credit Availability Index. This trend continued last month, hitting a 10 year low, particularly for larger loans, which fell .8% vs the .3% average loan.

Lack of Borrowing Contributes to Higher Rents

Higher interest rates have reduced the volume of loans being requested/made, which in turn reduces profits for banks, which forces them to cut the number of loan products offered, which results in fewer loans, which reduces loan demand and on and on… the downward spiral continues. As Warren Buffet said, "Interest rates are to asset prices […] like gravity is to the apple. […] They power everything in the economic universe." (2013) In this vein, a particular loan product, cash-out refinances, have essentially stopped. Anecdote: my 2 lenders tell me they haven’t done a cash out refi this year. Not one. And I myself and waiting for rates to drop to cash-out refi a few of my rental properties. Cash-out refinances are an often used tool for real estate investors/developers, allowing them to make renovations to a home to increase its utility and value, or purchase another investment property to renovate. This is sometimes called the BRRRR method of investing. Thus, higher rates particularly affect a real estate investor’s ability to purchase distressed properties and renovate them for folks to live in. Interrupting this cycle of rehabbing, renting and refinancing homes contributes to higher rent prices, because there is less supply of homes available for rent.

Of course, having credit availability that is TOO relaxed, is not good and is how we got ourselves into the Great Recession. Take a look at how “easy” it was to borrow back in 2005…

Now that’s relaxed….glad we fixed that. And we can also see in the chart that we are in roughly the same post-crisis credit availability market that we were from 2009-2013. Of note: home prices last bottomed in 2011…take from that what you will.

Consumer Confidence

So how are consumers feeling this summer? In a word: Improved. The Federal Reserve’s Survey of consumers points to a more optimistic view. Perceptions of credit access is higher when compared to a year ago, as is consumers’ views about the availability of credit in the future. Consumer outlook about household financial status improved as well, with more respondents reporting being better off than a year ago, fewer respondents being worse off, and year ahead expectations stronger across both measures. Similarly, the University of Michigan’s Consumer Sentiment index showed consumer sentiment rose a significant 11% above June levels, and reached its most favorable reading since October 2021. Steadily lower inflation and strong labor markets were largely the culprits for the sharp rise in consumer sentiment. However, sentiment for lower-income consumers actually fell, as they anticipate a less positive future prospect. Moreover, 12% of consumers polled in the Fed’s Survey believe they will miss a minimum debt payment over the next three months, the highest reading since January, and, again, mostly among consumers with lower income and education levels.

Consumers and Housing Prices

Let’s continue our dive into consumer perceptions/sentiment. This time, regarding housing prices.

Since 2007 the University of Michigan Survey has tracked consumers’ expectations of forward looking housing prices, over 1 year and 5 years. As you can see, since January, consumers have been perceiving that home prices will go up and continue that upward trend.

Are consumers often right? We can compare sentiment to the Case-Shiller U.S. home price index of actual home prices. As you can see, aside from an overreaction at the beginning of COVID - where expected growth plunged, then soared back - sentiment follows actual home prices fairly well. And prices, since January, are on the uptrend again.

Home Sales - Lower Volume, Higher Prices

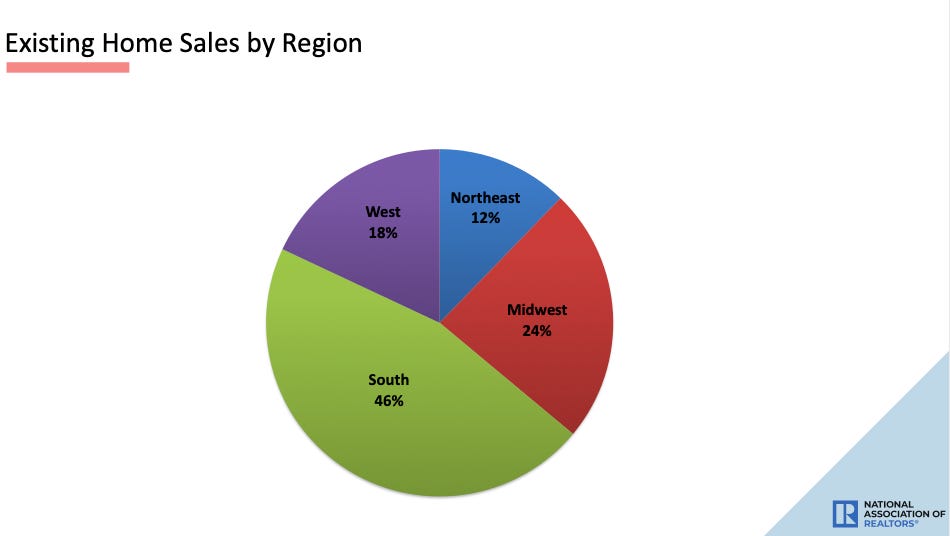

Interest rates continue to have their cooling affect on the market. According to the National Association of Realtors, existing home sale volume also fell in June by 3.3%, down almost 19% from June of last year.

But home prices have continued to march higher. In fact, prices have nearly recovered their losses, and are only .9% lower than the all time high of a year ago. The average month’s supply of homes stayed flat month on month at 3.1 months, but was down 13.6% year on year.

And geographically, the South Continues to dominate existing home sales volume.

Like what you are reading? Consider sharing this article with a friend!

Local Market Highlight: Tennessee Buyer’s Market

Speaking of sentiment, the strength of the housing market can also be measured by examining the average price a home is listed for, to the final price a home is sold for. I call this “Seller Sentiment.” Let’s take Tennessee, my local market of course, for example. As you can see from the chart below, the gap between the two measurements - listed price to sales price - widened sharply in June 2022 and has continued to remain wide through today. This gap, which one can measure, indicates an overly enthusiastic seller. In fact, in July 2022, Seller Sentiment gap was $24,900. Last month, one year later, the Seller Sentiment gap was $83,037, a more than 3x increase! This indicates a strong shift from a seller’s market to a buyer’s, market, where the final closing price is much further below the listed price and buyers have greater negotiation power. Said another way, home sellers, since roughly June 2022, have been overly confident they would get their desired price, but then had to drop their price to what the market was willing to pay.

We can also see that 2021 was an extremely confident Seller Sentiment, and the peak appears to have been December 2021, where list price and sales price were nearly the same. The Seller Confidence Gap is now closer to the more “normal” market of 2018, as we are to the absolutely insane market we saw from 2021 - early 2022.

And prices here in Tennessee have started an upward climb again, after bottoming out in January. We can still see that despite the buyers market, home [sales] prices have continued their upward trend, albeit relatively flat this past year.

Bottom Line

The ability of consumers to borrow is at a historical low, but it seems that the labor market is so strong and unemployment is so low that consumer sentiment is still continuing to improve from last year’s low. However, in the grand picture, sentiment is far below pre-pandemic levels, especially for lower income level households, who are not reporting the kind of recovery as other demographics.

The real estate market has started to rebound, or at least prices have; although, I am still concerned that the full weight of higher interest rates has yet to be felt in the consumer credit market, which will ripple across all markets, including real estate. Housing prices are being buoyed by an abnormally low supply and pent-up demand but could continue to plateau as rates likely aren’t going down anytime this year. And perhaps into next year.

Anecdotally, in my personal real estate investments, the wide Seller Sentiment gap is presenting a silver lining. Deals can be had at below “market” prices with the right buying strategy and smart negotiations. So for me, personally, I’m starting to go on offense, aggressively buying real estate.

Aside from U.S. real estate, I am still concerned about the overall economy, the Nasdaq 100 trading at a seemingly inflated 32 times forward earnings and a consumer where the less-well off aren’t feeling what the cable news shows and politicians are touting as a strong economy.

Count me still (Level 7 of 10) concerned.

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.