We are Reporting Non-Census Statistics

What the hell is happening to Government data?

Today’s Read Time: 10 minutes

This week, we’re talkin’ labor markets, the wildly inaccurate way we calculate economic statistics, and….. I can’t let it go… This Federal Reserve Mortgage fraud is really grinding my gears!

Let’s get into it.

Today’s Interest Rate: 6.50%

(👇.01% from this time last week, 30-yr mortgage)

The Weekly 3 in News:

U.S. Economy expanded faster than expected: 3.3%! This was better than the initial 3.0% estimate. Gosh, we are not good at estimating (keep reading, CNBC).

Zillow pivots to positive home price appreciation over the next 12 months, yet predicts we end down .9% for 2025. Meanwhile 2025 rent growth forecast is at multi-year lows (Zillow, ResiClub) .

Nashville Development: “The Lanes,” a 12-acre wellness-centered neighborhood 5-min from downtown Nashville, shared its plans for its 154 single-family development, and has now broken ground (CityNowNext).

Labor Market Still Has a Few Tricks Up Its Sleeve. Well, Maybe Too Many Tricks….

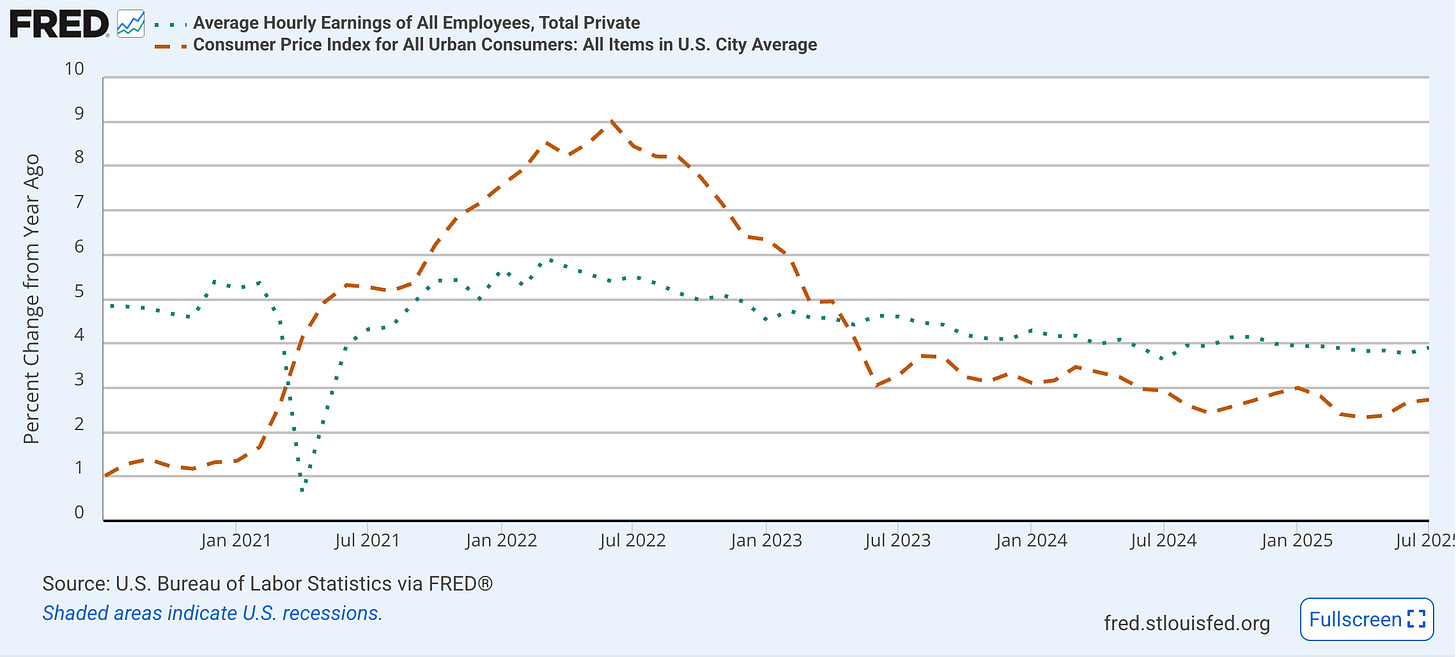

This is merely a signal of the robustness of our economy, but this week we received private sector wage growth numbers, and they were robust, up .7% for the month, or 5% annualized.

Sehr gut!

In fact, wages have been growing steadily above consumer inflation for 2+ years, including faster than shelter costs (even though it doesn’t feel that way).

This is not to say that the labor market has not shown signs of weakening, as of late.

It has. (But this is something important to note on consumer resiliency).

Job growth was recently revised down dramatically (again), unemployment claims are trending worse, and the unemployment rate is now 4.2%. Not a problem yet, per se, but we can now see a clear trend in the data.

But there is a big fat elephant in the room...

…Can we trust this data and the actions our government overlords are taking?

This is a question we shouldn’t have to ask…And I’ve written about this recently. We just had massive revisions in the economic data, putting into question the accuracy of our government data. I’ve written about this recently.

And then I saw this…

What is Hell Happening Over at the BLS?

The (embattled) Bureau of Labor Statistics released its job outlook for 2024-2034, calling for just 3.1% growth…. total!

"The U.S. economy is projected to add 5.2 million jobs from 2024 to 2034, the U.S. Bureau of Labor Statistics (BLS) reported today. Total employment is projected to increase to 175.2 million and grow 3.1 percent, which is slower than the 13.0-percent growth recorded over the

2014-24 decade (BLS)."Only 3.1% growth over 10 years??? This is not a serious number. Do we really think jobs will grow an anemic .3% /yr over the next decade? That’s 75% slower than the last 10 years. To put this in perspective, US job growth has averaged ~2.1% /yr since the mid-1900s.

And this, after the head of the BLS was fired for putting out wildly inaccurate data, forcing them to revise jobs data drastically for the second time in the last year.

The BLS should be renamed BS. Because that is the quality of rigor they are doing over there.

Now it may not totally be “their fault.” Their systems for data collection are straight out of 1950. Here is an important example:

Do you want to know how the BLS calculates housing costs?….

It’s called “Owners' Equivalent Rent (OER)” and it’s a joke.

How The BLS Calculates Housing Inflation

You see, housing costs are a key component of the U.S. Consumer Price inflation (aka CPI). But to find that number, the BLS estimates the hypothetical rent that homeowners would pay if they were renting their own homes instead of living in them. They literally call homeowners and ask them this question: "If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?"

That’s it!

It’s a survey of homeowners guessing at what rent would be, having never actually rented the home in the market.

And what does BLS do when they don’t get a survey response?

They…. Guess! (They use the word impute, which means guess, based on an average).

BLS Inspector General Report Calls Out Poor Data Collection

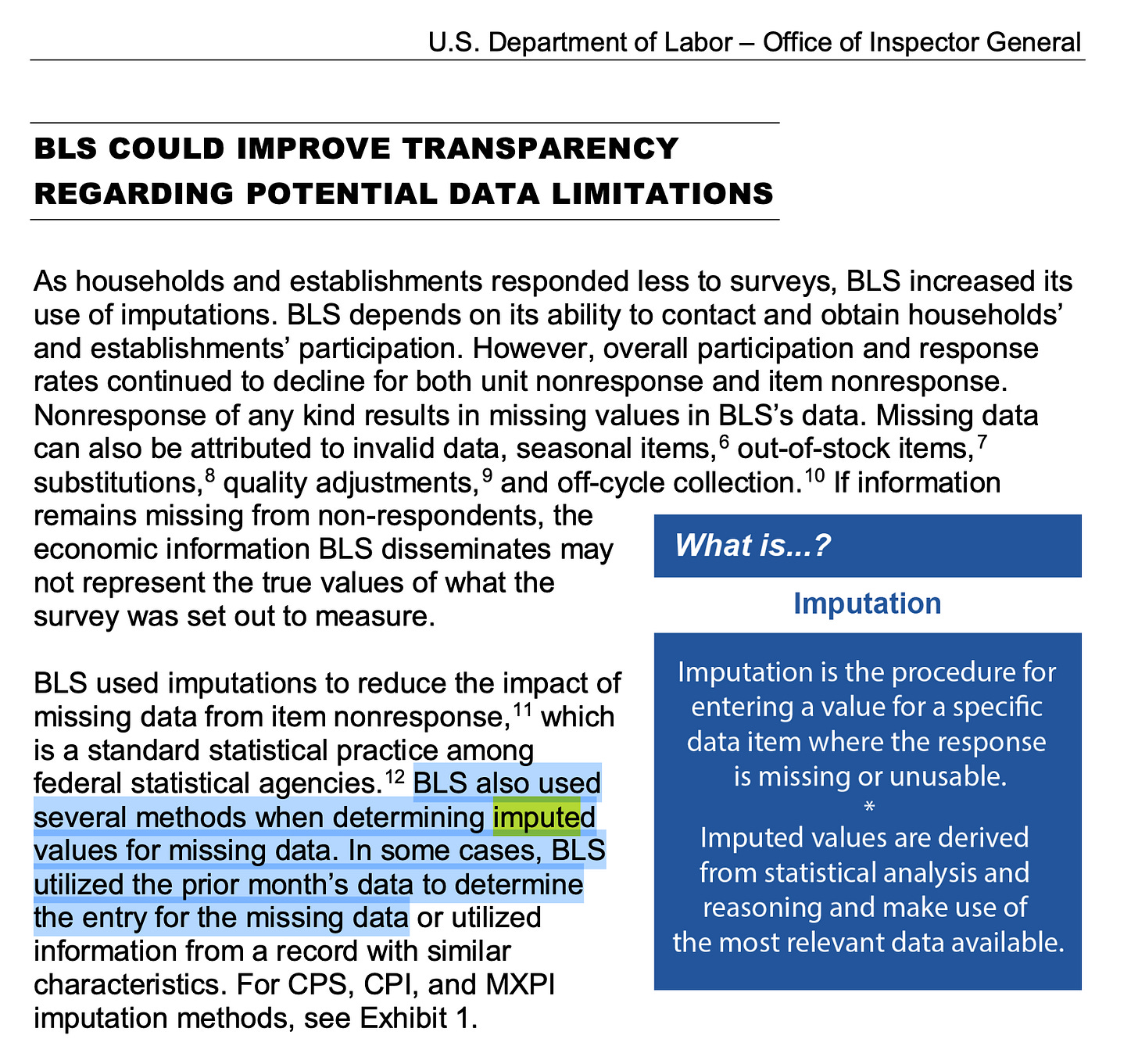

The BLS calls this the “Non-Interview Method.” According to a 2023 BLS Inspector General’s (IG) report on the subject of BLS data limitations, “The non-interview imputation method imputes a price by using the average rent change of other housing units in their respective category.”

Again, this was back in 2023, so this is not political. The BLS is all seasons bad.

Or, instead of guessing, they just simply fill in the same value from… last time!

This reminds me of when I used to just bubble in all “D” on the scantron so I could go on break early in 9th grade…Damn, statistics be easy peasy y’all!

And the IG pointed out that the BLS may not know how this gueswork may be affecting the data they report.

And…

And BLS has not attempted to calculate this effect (unlike other agencies, which have done that analysis).

And the IG pointed out that BLS has not informed the public about the extent of its guesswork. For example, and to its credit, the Census Bureau does. The IG report “found the Census Bureau cautioned users when imputed values made up 20 percent of the CPS program’s estimates and informed users of how many imputations were used” (BLS IG Report).

Oh boy….

What about including other housing costs to help estimate?

BLS shelter data doesn't include actual/measured housing costs like mortgage costs or property taxes. In fact, these types of typical housing-related costs are purposely excluded from shelter costs, as the BLS views them as “investment costs,” not shelter costs.

From the BLS:

“Spending to purchase and improve houses and other housing units is treated as investment and not consumption in the CPI. Interest costs (such as mortgage interest), property taxes, real estate fees, most maintenance, and all improvement costs are part of the cost of the capital good and are also not treated as consumption items. These non-consumption costs of owned housing are out of scope for the CPI under the cost-of-living framework that guides the index.”

What an odd point of view.

Why This Really Matters

Shelter costs are really really meaningful, accounting for,,, wait for it,,,, ~36% of the total consumer inflation number (CPI)! OER is 26% alone. So this is a data point we really should be more accurate in reporting.

Now, the BLS also calls actual renters (this is called Rent of Primary Residence) and asks them their rent rate. But, fun fact, the weight for that number is just ~7.5%. Relatively tiny.

So homeowners’ guesswork and not quantitative/measurements make up most of how we calculate shelter costs.

More fun facts:

They only try to call the same folks every 6 months.

They only get a hold of 55% of those folks each time, as the number of respondents has declined significantly in recent years. So ~half the respondents are new/not repeat. Distorting the data.

In 2025, due to budget cuts and resource constraints, BLS literlly just didn’t collect CPI data in some cities.

We’ve been doing this OER survey since 1983.

What the actual fuck…It’s 2025. Why aren’t we collecting this data directly from private sector operators? The government doesn’t have this data; businesses do.

Meanwhile, over at the Census…

Census is Putting out Non-Census

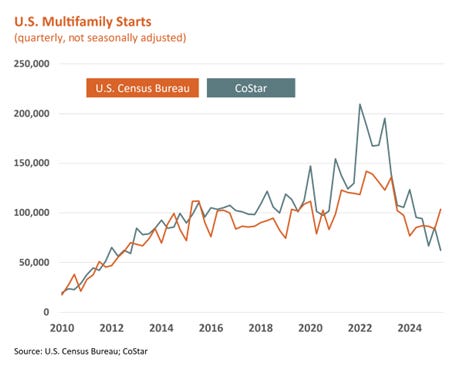

I wrote about this before, but it bears re-mentioning. The other week, we received new housing construction numbers, showing new construction starts for multifamily apartments apparently jumped 11.6% month over month in July and 27.4% YoY. This would be “the highest number of starts for any July in the past four decades (MFD).”

Really? Where is this happening? Most operators in the space are seeing an annual decline of 8%-10%, not an increase, let alone a 27% increase!

And since my last article, multiple operators in the space have questioned this housing data, saying:

“The numbers don’t make a lot of sense.” — Jay Lybik, senior director of market research at Continental Properties.

“Laughable.” — Ryan Davis, CEO Witten Advisors.

“Doesn’t represent what we are seeing from our clients, third-party data providers that we subscribe to, or what our surveys are saying.” — Chris Nebenzahl, VP of rental research at John Burns Research & Consulting

“…something has got to change because our policymakers who rely on Census data are being fed critical misinformation.” — Jay Parsons, housing economist

According to Parsons, Census housing data has likely been inaccurate and lagging since 2016. Comparing the Census to private sector business data, like from CoStar (whose business is housing information), we see “divergence starting in 2016, with Census consistently undercounting starts, until this year, where it's flipped. Could be some of the Census 2025 uptick is simply catchup of earlier/missed starts.”

To put the Census number in context, 27% new construction numbers would be more than we had in the zero interest rate policy / uber-cheap debt COVID era (2020-20222). The data just doesn’t align with the current financial/economic environment. Remember, the Census is an estimate (aka a guess), as is far too much government-sourced data, I am just now really finding out. CoStar tracks individual projects actually happening.

Blah…. this just crazy to me. The Census is putting out Non-Census.

Hey BLS and Census: CHANGE YOUR DATA COLLECTION SYSTEM. Call businesses and get accurate data. STOP THE SURVEYS.

Whew,,, ok I’m good now.

This made me think of the current Fed Governor firing controversy. And this topic really gets me going…

…now, for my second cup of coffee….

The Eye of Sauron Pivots to the Fed and Fed Governor Lisa Cook

I want to revisit what is happening over at the Federal Reserve. With some new information.

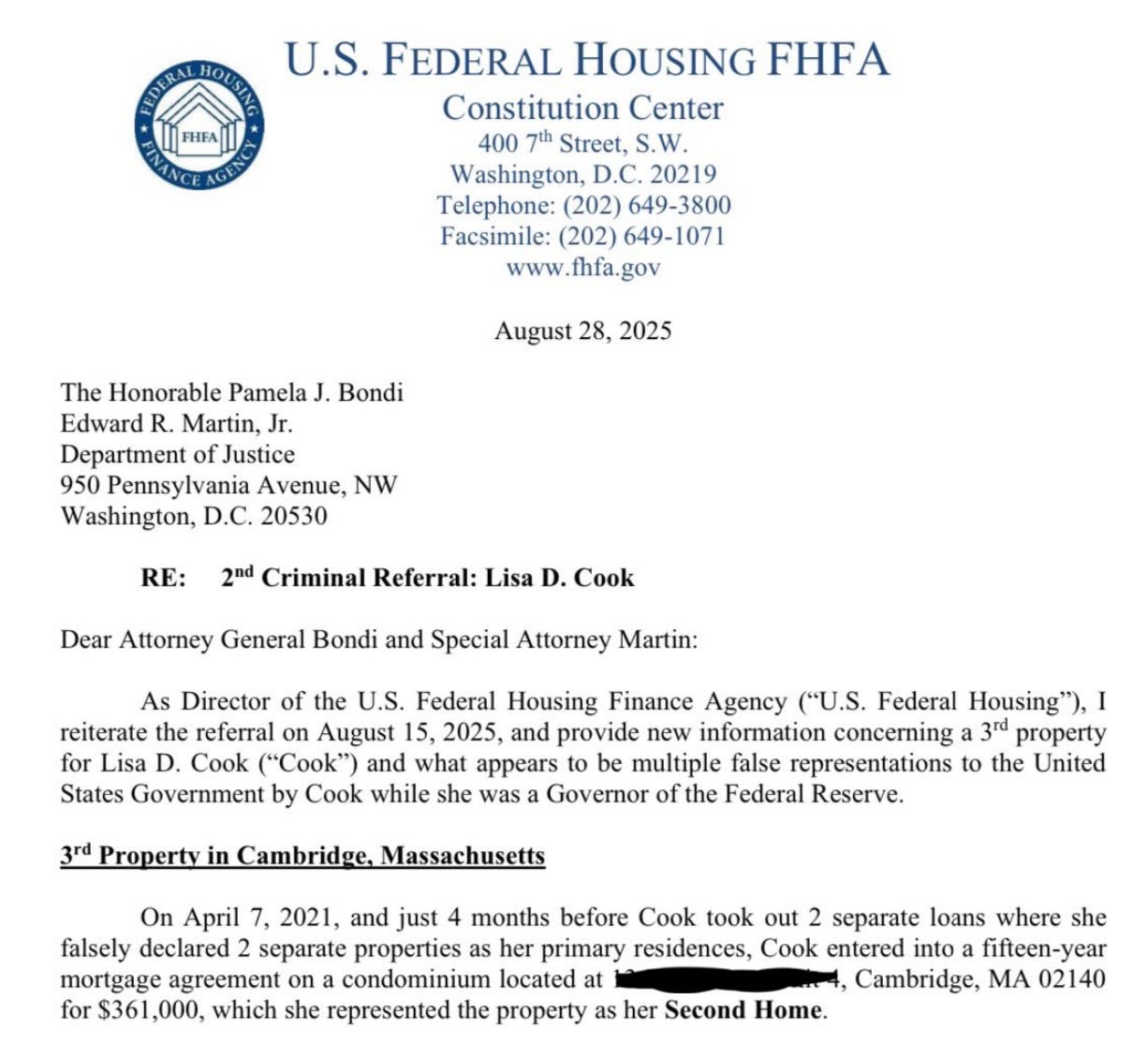

Earlier this week, I posted my comments on Fed Governor Lisa Cook, and her alleged Mortgage Fraud. To review, Gov Cook took out two simultaneous primary residence loans, which require the buyer to occupy the home (allegedly…). Instead, she rented the home (allegedly…). This would be considered mortgage fraud, misrepresenting or lying to gain a favorable interest rate on her mortgage.

And we real estate investors, who pay a premium for our mortgages, just hate that someone in government is trying to game the system to get favorable treatment.

Ah! This really grinds my gears more than a classic episode of Family Guy.

Since then, Reuters, CNN, and The Washington Post are all now reporting on the facts of the story and, well, it doesn’t look good for the Governor.

Ok, But Should/Can the President Fire a Fed Governor?

As expected, there seem to be two sides to the President trying to fire Fed Governeor Cook. And, unfortunately, opinions in the media and amongst government officials are split based on partisanship and loyalties:

“The President is putting undue pressure on the Fed.”

He very obviously is putting pressure on them, but the question is whether this is not warranted/or too invasive so as to upend the independence of the Federal Reserve as an institution. One could argue this is too far and that he is making accusations in order to gain an extra Fed Governor seat that he would not otherwise be able to appoint during his term. We know his opinion is that interest rates should be lowered. He's made that abundantly clear. Cook’s firing would give the President a path to obtain a majority of Governors who ostensibly support his position for lowering interest rates sooner (although it should be said, even Chairman Powell has made it clear. We are in a restrictive monetary policy environment. The question here really is how soon and quickly the Fed should lower rates to the equilibrium level.

“The Governor Should Be Fired.”

Then there are those who think: if a Fed official committed mortgage fraud, this should be examined, and that they shouldn't be serving as one of the nation's leading financial regulators. And what we haven't heard from Governor Cook at all on is whether she did it or not! She keeps saying the President can't remove her, and her lawyer (she hired Hunter Biden’s defense attorney, eh maybe not a good look?) has only said that the process of the President firing her is not legal. The courts will have to decide this. And the Fed, specifically Chair Powell, has been silent on the issue. And in court filings they literally say they are taking no sides. Is she actually fired as of last week? Is she allowed in the building and coming to work?

In all likelihood, both are true.

The President may be applying undue pressure and disrupting the independence of the Federal Reserve. At the same time. This person should be fired and has likely committed mortgage fraud, multiple times.

This is Not a “Check the Box” Error

According to statements by Cook and her Lawyer, this may have been a “clerical error.”

This cannot be the case. Here’s why:

When you apply for a loan, the lender asks you directly, on the phone/in person, what the loan is for. It’s not just a “box you check.” The bank will want to know exactly what asset they’re lending on.

Remember, when you buy real estate, the bank owns the vast majority of it, normally 75 to 80%+. They really, really care about what it’s going to be used for, and they’re very direct in asking the borrower this.

Saying it’s a “clerical error” is not a possibility; to say otherwise is disingenuous.

One more thing…

Breaking news: now, we have a third Property that Gov Cook may have misrepresented.

Oh boy….

With a Fed Interest Rate decision coming in just a couple of weeks, this cloudy situation is not a good look for the Federal Reserve, and is detrimental for businesses and homebuyers trying to operate in this environment.

A Quick Ad Break…

Cut Costs. Not Corners.

Economic pressure is rising, and doing more with less has become the new reality. But surviving a downturn isn’t about stretching yourself thinner; it’s about protecting what matters most.

BELAY matches leaders with fractional, cost-effective support — exceptional Executive Assistants, Accounting Professionals, and Marketing Assistants — tailored to your unique needs. When you're buried in low-level tasks, you lose the focus, energy, and strategy it takes to lead through challenging times.

BELAY helps you stay ready for whatever comes next.

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

New Coffee Table.

All this really gets me steamed…time to take a few and finish up my coffee table. Something I can actually control.

But first, my closing thoughts…

My Skeptical Take:

I’m officially on tilt.

On the Fed Governor, it’s so highly unlikely that this is unintentional, especially for such an accomplished person and for one who in large part controls interest rates.

On the BLS, god, this data inaccuracy just continues to be embarrassing. As a result, the President fired the previous head last month.

Is the President likely trying to get his way, meddling in the Federal Reserve and BLS by replacing current leaders who are more pro-growth and less risk-averse and agree with the Administration’s policy approach? And who are “on the Team,” politically?

I believe this is obvious and true.

But it is likely also true that both of these folks deserve to be fired for poor performance. Hell, the Fed hasn’t exactly been on target and their mistakes is a primary reason why we have such high prices, resulting from years of “transitory” inflation denial.

So we are here now. The Courts have some work to do.

The bottom line now is: we have an interest rate cut decision in a few weeks. I hope the Fed, courts, and the Administration can figure this all out this week, so that the decision is both unmired and we have some clarity on the allegation/causes for firing.

Oh, and they should still cut rates in September. Housing is still in a 3-year sales activity recession.

Folks, get your shit together.

Sincerely, -The American People

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. If you need a little push, here is my new book! It is a MUST for all real estate investors. The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You! (yes yes, it’s a shameless plug, but we authors make ~$1/book, FYI. This is about education!). So pick your copy up today!