The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, October 4th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: Mortgage rates, treasury rates, government debt, and I get a little more concerned, approaching DEFCON 2.

Today’s Interest Rate: 7.74%

(👆.24% from last week, 30-yr mortgage)

So I got a call last night, there was a leak in one of my rentals, water was raining down from one bathroom unit into the unit below. This is the 3rd time I’ve had this “fixed.” Needless to say, I was pretty frustrated.

So I took the pup for a walk to get some air, finished my current book (Royal Road to Romance, a travel writers journey in the 1920’s, 5-stars) and went down the rabbit hole on a myriad of topics that you readers may care about. This the business after all.

So…Coffee in hand, I’m feelin’ a bit punchy. Let’s get into it.

Mortgage Price 👆, We aren’t Done Yet

Yields on the 10-year treasury bill touched 4.8% yesterday, as mortgage rates hit 7.74%.

IMO: We should see 8% mortgages within a few days. And 9-9.5% “standard” 25% down Fanny/Freddy loans for purchases of investor properties. Likely close to 10%.

How did we get here? Take a look at the journey of US 10-yr Treasuries.

Now take a look at mortgage rates (the 10-yr treasury closely tracks mortgage rates b/c they are a competing vehicle for investors).

Put another way, around March, 2020 the 10-year treasury was launched from the Medeval trebuchet; it’s covered in oil and on fire. Next stop, the castle wall.

Now, the Federal Reserve is likely now to not raise rates again this year (even though they said they will 1 more time) but we are likely to see Federal Funds Rates stay sticky through Summer 2024, i.e. the “higher for longer” mantra you have been hearing all over CNBC etc…

Whoa Whoa Economy….

Why am I so bearish on the economy? In short, there are a lot of speed bumps for our economic truck to navigate over. ( FYI, this is medium-term, I’m very bullish on the US 5-10+ years).

Renown investor Charlie Munger is fond of advising to focus on protecting your downside, as the road to success. And I recommend the same posture.

So, in this vein, let’s take a look at, what I’m calling, the Skeptics List to 2024:

The Skeptic's List to 2024:

Student debt repayments restart with an average payment of $337 / mo (* research discovered a wide variety of stats here: $200-$550/mo). This added cost is estimated to remove $18 billion in spending from the economy, per month.

Total Student debt is now 1.78 trillion, far higher (~75%) than total US credit card debt, which is just over $1 trillion. This cost spiked during the government freeze on student loan repayments, and may drag on the young for a prolonged time.

Housing market will slow even further - Pending home sales fell by 7.1% in August, significantly higher than expectations of 1.0%, the biggest monthly decline since September 2022, and is down 18.8% YoY. The Pending Home Sales Index is now at its lowest level on record, exactly equal to the pandemic lows. There just isn’t enough supply on the market. The housing market is 16.7% the economy.

New Home sales, the strongest segment of the housing market thus far, also fell 8.7% (seasonally adjusted).

House Payments UP - Average new house payment at record $2900/mo.+ 13.9% YoY.

More Households Looking for a Home - There will be a more prospective homeowners who are on the sidelines in 2024. Household formation is expected to re-accelerate with more Millennials and Gen Z coming of age, getting married and looking for a home for their budding family. More folks looking for fewer homes = higher prices and higher rents, as more folks are forced to wait.

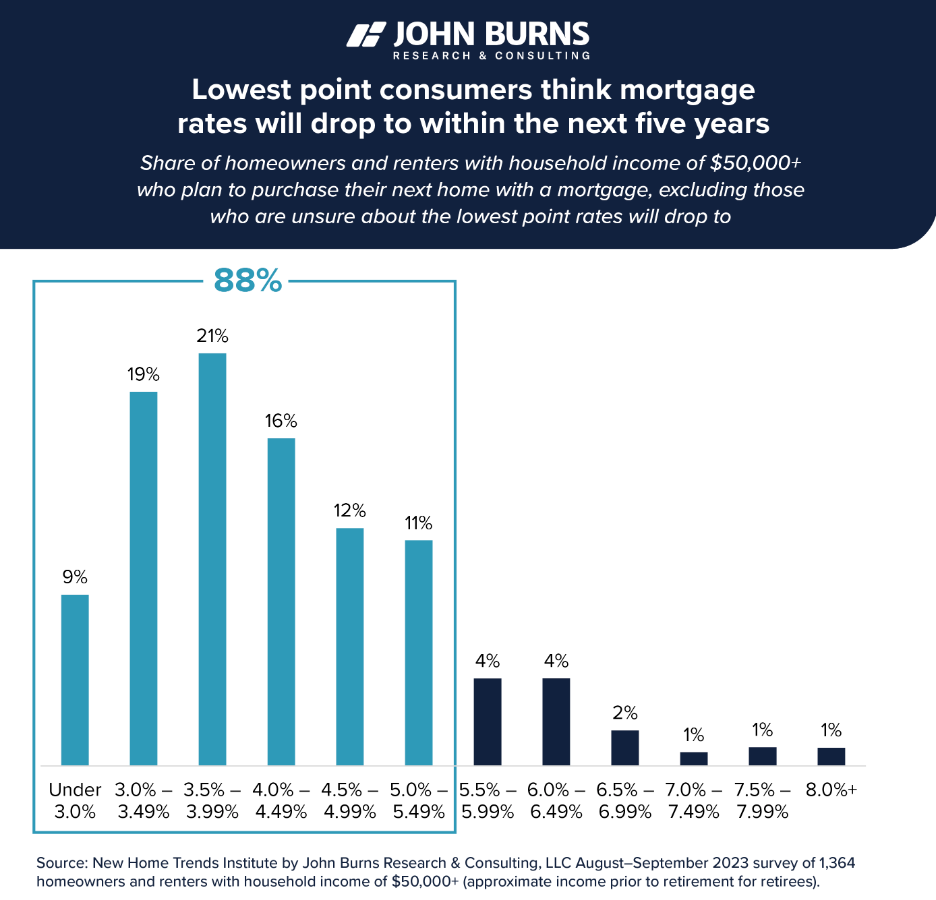

Folks are staying on the sidelines for one main reason, they believe rates will eventually fall: 88% of consumers think rates will dip below 5.5% in the next 5 years. But anyone who believes it will fall much further than that, which most folks do, it’s going to be a long long wait (likely never again).

Cost of our National Debt will drag on GDP - This is starting to become, in the words of our curent President, a big F&*%ING DEAL. US Federal Debt is $33 trillion, 120% of our total GDP and is growing faster than the economy (remember the above treasury bill loop discussion). Not sustainable. Our dysfunctional Congress is in charge of this, and they did just vote to remove the Speaker…so… fingers crossed?

Want more? The national debt 2024–2033 is now projected to rise by ANOTHER $20.2 trillion due to increased spending. That’s $53 Trillion. 😵

Small Business bankruptcies are up sharply - Up 60% from 2020, 35% from 2021 and 40% from 2022. Higher cost of capital, for longer, will be especially bad for small business. As Warren Buffet says, [interest rates are like gravity, they affect everything.] This is another after effect.

Credit Card debt delinquencies are up - While the numbers are only just above near pre-pandemic levels, the steep trend/chart is highly concerning, this acceleration will be made worse by: the student repayment restart, end of “free money” from the government, banks restricting lending, interest rates far higher than 2019, inflation remaining high, etc…. Those aged 19-29 are most affected.

Personal interest payments are up to mid-2008 levels. (Although near historical levels BUT the trend is slingshotting upward fast).

A Quick Pause for Reflection. How can one best position themself in this housing market, particularly if one is trying to invest in real estate? For me, I’m focusing on 3 things: finding a great deal (i.e. cheaper in comparison to 2022 prices), adding value to the real estate through renovation (which adds a buffer to the home’s equity and is something outside the market that I can control) and focusing on great/Blue Chip locations. Pointedly, I am not looking for high cash flow to be a main criterion for investing in this environment, and I’m not speculating. Cash flow break even is just fine, and I’m building into my numbers high interest rates + assuming they stay there for longer (2+ years). Now is a great time to strategize and research like this. For example, I highly recommend this recent real estate podcast episode where others are putting into action the above strategy. (Another shout out to David Greene for his sage insights, per usual).

Ok back to the list…

Gas Prices UP - Oil is down 5% today (yay!) to $85.91, but is on trend to hit $100 / barrel. Which would equate to higher gas prices. I’m fortunate enough to be in Nashville, where prices are $3.30 at my local pump. However, where my mom lives in Novato, CA prices today were $6.10 today. Yuck.

Organized Labor is on Strike and there may be more to come - UAW & Kaiser Health Care workers are striking now, strikes, especially one as widespread as the auto industry, will likely increase wages and add to inflationary pressures. Other labor organizations are thinking of doing the same, and are paying close attention. Increased wages, while of course helpful for those getting the raise, will add time to the Fed’s higher interest rate environment for everyone. So far, the UAW strike alone has cost the economy $4 billion, and counting. Fortunately, the Hollywood writers just came to a deal, so the rest of us can finally get some much needed chill time. 😉

Potential Silver Lining - Home Prices - If the above gets bad enough, home prices could come down and interest rates may fall down the elevator shaft. Moody’s Analytics forecast model is now predicting US home prices will fall -4.4% in 2024. Not a lot, but something. This small # shows just how many folks are trying to buy or are waiting to buy a home, that’s propping up the housing market quite robustly despite high interest rates. And of course it matters where you are. The South and Midwest should remain resilient. * Counterpoint - Goldman Sachs still sees home prices up 3.5% in 2024. Damn.

My Take

The cost of capital is tightening its “leg-lock” on the economy.

The Federal Reserve is likely now to NOT raise rates again but when will they lower them? Summer 2024 will likley begin a slow stairstep downward. As this gradual reduction in federal funds rate permeates the economy, it may take 2 years from today for mortgage rates to reach 5-5.5%, where they are likely to indefinitely settle. (sorry 30% of folks who think rates are going sub-3.5%)

The wildcard is if the economy tanks or we have some king of financial event, which will cause the Fed to speed up their rate reduction timetable and perhaps pause QT. It is my expectation that something happens that causes a speed up in rate drops, which would mean something bad happened to the economy, unfortunately. The bond market, which has sank considerably and is still having trouble attracting investors even though yields are historically high, is telling us: watch out.

And these high rates come at the same time the Federal Government is flooding the market with MORE Treasury bonds to fund its deficit spending. A concerning loop which will add to Federal Debt considerably. Recall that last week we pointed out that the interest the federal government is paying each year on the debt is now more than we spend on our military? That still shocks me. And it’s going to get much much higher, and fast.

Even Captain Sully couldn’t bring this one in for a landing. Something is going to break, a recession (not mild), bond market yields, stock market crash, significant bank and hedge fund failures, I don’t know what, but something. Folks are going to get caught off guard in 2024. Which is why I am…

…staying default skeptical.

Stay nimble out there, protect your downside.

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.