The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, December 27th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin:

Nashville Exclusive: CNBC Cities of Success

Interest Rates: An Update

Home price predictions and 2024 outlook

The state of the consumer

Am I turning bullish? 😲

Today’s Interest Rate: 6.61%

(👇 .04% from this time last week, 30-yr mortgage)

Top 3 Curated News Articles

Cities of Success: Nashville. A CNBC Exclusive on the growing city. (TV subscription needed, but should be available soon widely)

I found a Free Sneak Peak here:

Among employees who use AI at work, 72% say it makes them more productive.

Interest Rates

Rates continue their slow move downward after the elevator drop last week. But what will this do to home prices? Well 2023 is ending up 4.8% YoY, the strongest annual gain seen in 2023, according to Case-Shiller. Higher mortgage rates, while they certainly had their effect last year, were outweighed by strong demand and extremely low supply.

2024

Building on my thoughts last week, what’s in store for 2024? Likely up, as more demand enters the market. But don’t take my word for it. Let’s take a look at what sources around the industry are saying...

Redfin - Homebuyer Demand Index spiked up 5% from last month, a leading indicator of strong demand and a good sign since the winter months usually bring the reverse. Home tours are also up from last year, although still not to 2020 levels.

NAR - November existing-home sales climbed .8% after a 5 month drop. Home prices should keep marching higher form here. "Only a dramatic rise in supply will dampen price appreciation."

Home Construction - Homebuilders broke ground on a heightened number of homes in November (Census Bureau). Housing starts rose 9% from a year ago, primarily because of an 18% increase in starts on single-family houses. This is significant, but not overboard. At the November clip, companies would have built about 1.1 million single-family homes and (1.56 million homes overall). We are 4 million homes underbuilt today. Homebuilders are anticipating even stronger demand for homes in 2024, riding lower interest rate tailwinds.

Outliers - There will be some markets that lag, like Dallas, which has some real estate industry leaders calling for continued pressure on home prices, potentially dropping 8% YoY and sales volume down nearly 13%. Really? Even I think this is overly conservative. But bears mention (no pun untended).

My Thoughts: The next 30-90 days

I feel confident in saying, the hard landing / recession for housing is behind us. In 2022 we saw home prices down 6 - 20% of the year, bottoming in December 2022 / January 2023. The last time home prices acutely decreased was the great financial crisis, before then, 1992 (and then it was mild, a couple % for a few months) . That’s it, in the last 30 years, 3 times. In my home market of Nashville we were down 12% almost exactly 1 year ago. We bottomed in January are up from there.

Inflation has / is receding in a meaningful way, without a stark increase in unemployment, as historically observed during this point in the cycle. The labor market remains strong and wage growth, while moderating, remains so as well. Still, wage growth is above what the Fed would likely like to be seeing at this time in the cycle. The Fed could slow its anticipated 2024 rate cuts to put more pressure on wages, if needed. Watch out for this.

Consumer Confidence

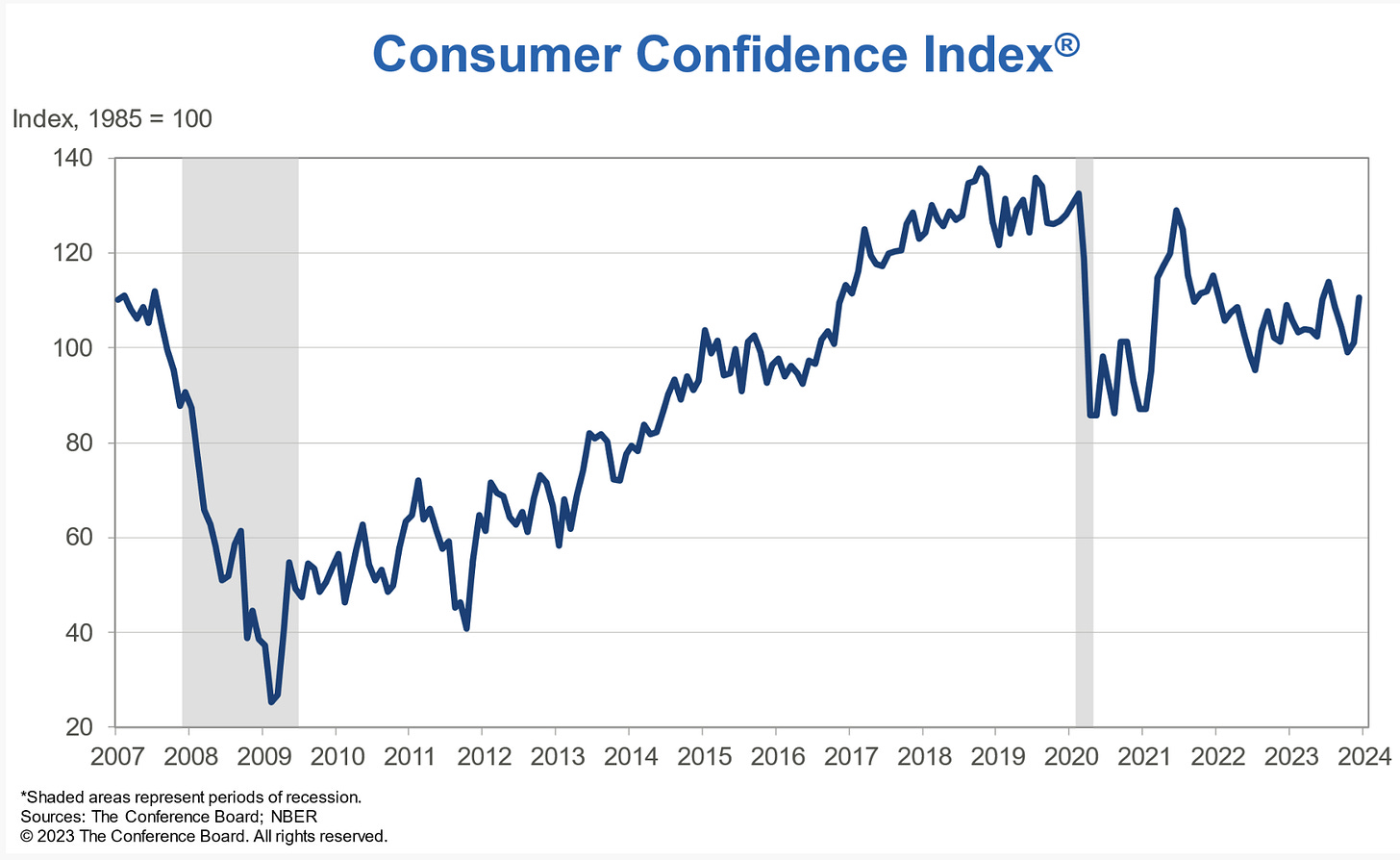

US consumer confidence rose in December by the most since early 2021 (Conference Board). Folks are upbeat about job availability and the inflation outlook, ending 2023 with positive momentum.

Gains in consumer optimism were largest among those aged 35-54 (a key indicator of good vibes). The survey’s top issue affecting consumers remains rising prices in general, but, importantly, politics, interest rates, and global conflicts all saw downticks as top concerns. Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months abated in December as well, to the lowest level this year. “Consumer expectations for the next six months also increased in December, reflecting improved confidence about future business conditions, job availability, and incomes.”

Bottom Line

There is a saying, I don’t know to whom to best attribute it: “Strong opinions, loosely held.” In the face of new / changing information one is ‘obligated’ to change one’s mind. And that’s what I’m doing. For the next 30 - 90 days, count me Bullish. For now.

IMO: 2024 will bring an almost 2021 bull market feeling. This aided by consumer confidence as 1) inflation recedes, 2) the Fed cuts rates 3—6 times and 3) bitcoin skyrockets due to a slew of ETFs beginning trading in the next 30-90 days. It’s going to be a banner year.

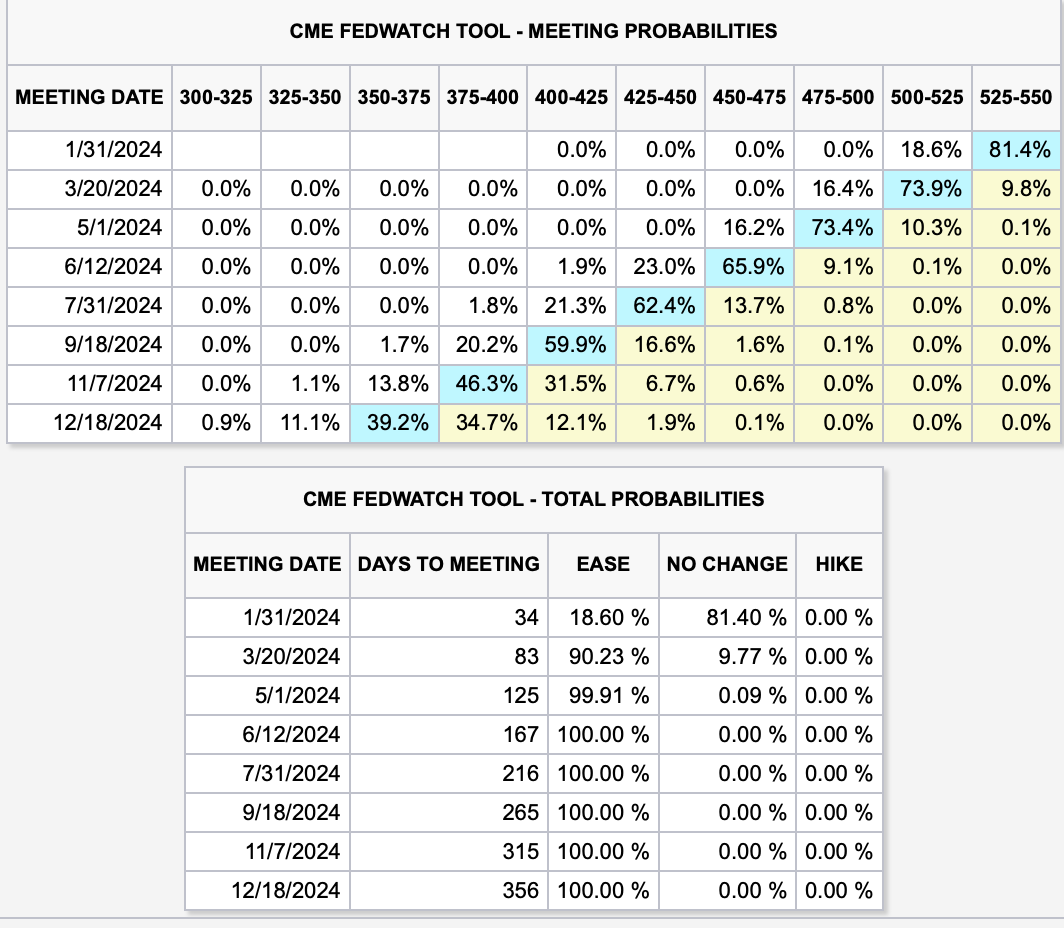

Still. I would urge vigilance over the market and cautious of what’s to come. Some investors may be getting a bit over their skies, assuming rates will slam back down to 3%. I do not think this will happen, frankly ever again, in my lifetime. Case in point: the bond market is starting to price in 7 interest rate cuts (.25% each) in 2024, according to the CME watch tool! There's even a 10% chance of 8 rate cuts into 2024 with roughly a 1% chance of 9 rate cuts. Now that’s pretty bullish. I’m percolating on this possibility…

I do remain ‘default skeptic,’ which has always served me well. I’m always trying to - as the great, late Charlie Munger was fond of saying - “be consistently not stupid, instead of trying to be very intelligent.” Protect your downside. In short: several rate cuts will come in 2024, and housing demand will follow. But be careful of building into your numbers / debt service / mortgage rates that are too bullish / low. You don’t want to high-side and face-plant.

Most Interesting Tweet of the Week

Toyota caught tampering with safety data 🫣. Frankly, Tesla appears to be emerging as the safest and most popular car company.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.