The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, September 20th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: Federal Reserve, Insurance Costs, and I go off on a big big Tangent…Squirrel!

Today’s Interest Rate: 7.30%

(👆.05% from last week, 30-yr mortgage)

Week’s News Item: Federal Reserve Keeps Interest Rates Where they Are

The Federal Reserve today voted to hold interest rates at current elevated levels, as it battles inflation in the economy. This would keep the Federal Funds rate at their 22 year high (5.25%-5.5%), which is in large part why mortgage rates are also at record highs (today: 7.30%). However, according to the Fed’s meeting notes, they do anticipate one more rate hike this year, and if so, likely a .25% hike. Given current economic data, which has remained surprisingly strong in the face of rate hikes, the Fed predicts lower rates (around .5%) sometime before the end of 2024, which is about as helpful as Comcast saying they will be there between 10am and 10pm.

Why isn’t the Fed lowering rates sooner? Fear, and rightfully so. They fear lowering rates only to discover, in the coming months, that inflation was not tamed and is starting to heat up again. They would prefer to dip the economy into recession (negative GDP growth) rather than spike prices for everything.

The Fed’s next meeting is Oct. 31st - Nov. 1st.

Home Insurance Costs: Up and to the Right

Speaking of inflation, if you own a home you know, you know homeowners’ insurance is only going up. The average homeowners insurance costs $1,582 or $2,090 per year for a policy with $350,000 or $500,000 of dwelling insurance, respectively, according to Forbes Advisor’s analysis (9-20-23). That is 5.5% higher than last year. (really, just 5%? It was 20% higher for me, read on…)

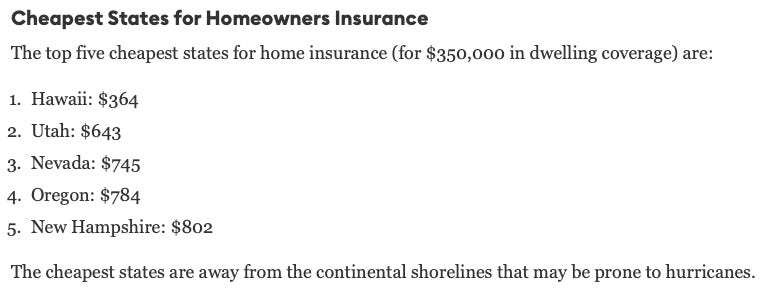

The cheapest and most expensive states for insurance may surprise you (it did me), according to Forbes:

I also saw Vermont and Delaware in the bottom 5 from other sources during my research.

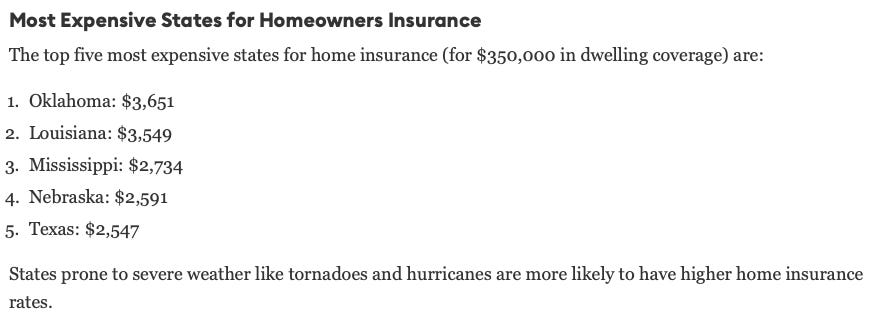

And Most Expensive…

I also saw Kansas in the top 5 from other sources during my research. I was pretty astounded to not see CA, FL or NY on this list. Maybe they just dont have many homes worth only $350,000 or you can’t get insurance?😅

Shopping for insurance? According to Forbes, the cheapest home insurance companies are Progressive, Westfield, American Family and Nationwide. (*And USAA for military, veterans and their families).

Anecdote: back in April of this year I was doing my annual review of property insurance (which I highly recommend you do every year, get 3 quotes). My insurance agent told me that “most all” policy premiums she had underwritten were being revised up 20-40% YoY! (Including mine, which is also why I was shopping).

Anecdote #2: This year I switched from Geico (who actually doesn’t insure real estate directly, they broker it out to someone else like Travelers) to Erie. Same coverage, saved 10%-25% on my landlord policies here in Nashville.

Anecdote #3: My charming family home that my dad built in Berkeley, California in the late 70’s has had its insurance canceled 3 times in the past 3 years. I won’t name names…..But they rhyme with Mike-O and Armers…..(I could write a book of insurance anecdotes, can we agree insurance companies suck? No need to answer). I currently use Steadily for my landlord policy in CA, and for a few elsewhere. They aren’t always the cheapest but it’s tough to get landlord insurance out there, with many companies leaving the state, so I hope that is helpful for someone out there. I had to shop dozens of providers before I found a decent one. Highly recommend. (* I accept no sponsorship or $ from any of these companies).

Lack of Data

Insurance costs are going up. This is obvious to any US Homo sapiens. As with the cost of eggs, we don’t need a study to tell us it’s so. Yet, in writing this piece I have become even more skeptical (if that was even possible) of the data I’m finding on insurance costs. It seems that many websites, even though they claim to be independent, are in some way sponsored by insurance companies, and are underreporting insurance premiums, claiming they are only increasing slightly over time. The advertising influence is pretty blatant:

Here is a favorite “disclaimer” of mine you may find on some of the more forthcoming sources/media outlets.

The US Bureau of Labor Statistics does have some data, but reading the fine print the data is based on a self-reporting survey and it’s a producer price index. Why no consumer price numbers BLS?

According to the BLS’s index, we saw roughly only a 2% increase in homeowners insurance 2022-2023 and 2021-2022. This does not track with what I’m seeing for myself, my investor friends or real estate clients.

Insurance Costs are Up & Coverage is Less

One source of data that seems reputable came from multiple specialty sources in a Wall Street Journal article. “Since the start of the last year, double-digit rate increases have been approved in 31 states, according to an analysis by S&P Global Market Intelligence for The Wall Street Journal. Arizona, Texas, North Carolina, Oregon, Illinois and Utah had the biggest total of approved increases, ranging from 20% to 30%. Travelers insurance, said on a July call with investors that a 19% increase in premiums was just one prong of its “profit improvement” effort. In states such as California and Florida, some insurers are halting sales of new policies due to increased natural disasters.

We are also seeing less coverage, a reminder to read the fine print. Tim Zawacki, an S&P analyst, said insurance companies are “tightening the screws around the edges on coverage to limit their expenses” and are limiting coverage for older roofs to their current value, rather than their replacement cost. Side note: if your policy stats that you will be reimbursed the “Cash Value” for something, beware! This amount can be significantly less than the replacement cost.

According to the ironically named Insurance Information Institute, insurance companies are losing money because of natural disasters and expect to do so through 2025. Really? According to Travelers’ Earnings Statement: (sorry to pick on you guys but story is the same everywhere and you are a public company so, much of your data is required to be available :).

Q4 2022 - Net income $819M, a total capital returned to shareholders of $721 million, including $501 million of share repurchases; full year: total capital returned to shareholders of $2.941 billion, including $2.061 billion of share repurchases.

Q1 2023 - Net income $975M, and total capital returned to shareholders of $680 million, including $462 million of share repurchases.

Q2 2023 - $14M net loss, and total capital returned to shareholders of $633 million, including $400 million of share repurchases.

Q3 2023 - I’ll be watching…

So where are these “losses” again, Insurance Information Institute?….

Industry Special Interest Groups a Plenty

I did find a special interest “trade” group called the Insurance Information Institute (remember them from above), which is a non-profit, but its data is behind a paywall, and only available if you are a “member insurance company.” Let’s be clear, this is a group made up of insurance companies to promote insurance industry. However, what I found interesting is that unlike with most trade groups, they offer almost zero sourced data on their industry. Their entire site is devoted to promoting the insurance industry, unpublished economics for the industry itself, word-salad advice, and some social issues. I did find this one chart in their cursory annual report, which is hilarious to me. It shows 1) homeowners insurance inflation significantly below the overall inflation rate in 2023: 2.5% vs 3.5% and 2) insurance inflation was lower in 2022 and 2023 …Uhhh…where? Maybe Uranus? ( I couldn’t resist)

The group also claims to be “strengthening public trust” because their representatives appeared on TV “317% more in 2022,” to tell us to get more insurance. And fearing everyone into getting more disaster coverage (which you do want to have in certain areas of course, but many times they don’t even offer it where it’s really needed: ie FL, CA). Maybe you could save all this effort, time, money and just pump the brakes on raising rates?

They do have a small portion of their annual report devoted to “data.” I’ll give you the cliff notes version: ‘don’t worry our insurance companies aren’t broke. In fact, we are doing quite well.’ Reassuring. And still nothing on insurance costs and why they need to continue increasing premiums everywhere in the country, with numbers. There is loose mention of construction costs, as there are in media articles, but with no data to back up anything and no rigor in the statements. This is likely their best argument and I would actually agree construction costs - because of inflation/COVID/Gov shutdown - were very significant problems in 2020-2021, and part of 2022. But not in 2023.

Not to be outdone, the related group, the American Property Casualty Insurance Association,,,similarly sucks. I found this line particularly ammusing:

Fun Insurance fact: did you know that if you have typical flood insurance and your home floods from “rain accumulation” and not as a result from the overflow from a “body of water” many times that’s not a flood, and thats not covered, especially if its not a “widespread” event. Pretty steadfast there, APCIA.

Terrible Fact: For example: in the aftermath of hurricane Ian, insurance companies are refusing to pay, underpaying 80% and/or have blown past the 90 day requirement for them to pay the homeowner, according to a local news reports in FL. Like with this unfortunate Vietnam veteran, whose house blew down, yet the insurance is only offering $ for the roof.

So what’s my point with all this? I just want more public, unadulterated data to be made available on insurance costs and coverage. It’s near-impossible to get.

This practice of influencing media or data sources by the insurance industry reminds me of the pharmaceutical industry and its influence. And because I’ve now had 4 cups of coffee…I must digress….

*** Tangent warning, skip to the end to avoid wry humor and non-real estate topics ***

In researching insurance premium costs, I was constantly frustrated by incomplete data. And more often than not, data on insurance premiums was co-located with advertising for insurance companies, or even worse, directing me to immediately get an insurance quote from a few select insurers right in the webpage feed. It reminded me of the constant barrage on TV, social media and our hopefully-trusted news organizations by large pharmaceutical (Pharma) companies, aiming to push their drug of the month.

Fun Fact: did you know that prescription drugs accounted for nearly 17% of TOTAL health care spending in the US? And that was in 2015. (Harvard Medical School)

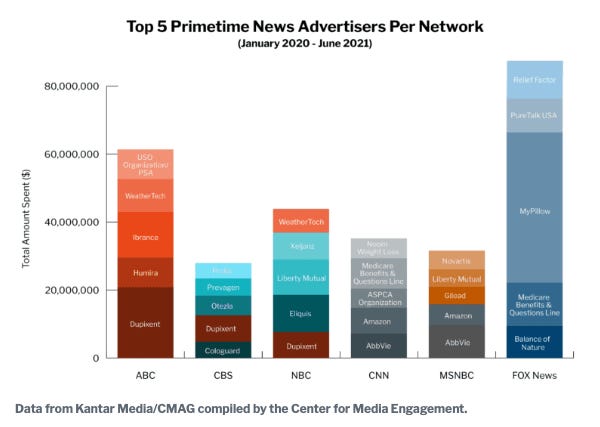

Pharma advertising also makes up a significant % of all major media outlets’ advertising dollars (think CNN, FOXNEWS, ABC, NBC, CBS, MSNBC etc…).

In fact, Pharma companies spend more on marketing than on R&D. Let’s take a look at just March of this year…

And split amongst the top news sources…

More fun facts:

Promotional spending prescription drugs averages $20.9 million per drug.

Harvard Medical School found Prescription drug ads are up more than 100% since the 1990s and have become a multibillion-dollar industry that promotes treatments you may or may not need.

Johns Hopkins - A majority of top-selling prescription drugs in the U.S.—more than two-thirds— have low added benefit compared to other drugs.

Manufacturers of the top six best-selling drugs spent the bulk of their promotional budgets—more than 90%—targeting consumers directly, rather than informing clinicians, for a range of treatment options for conditions including HIV, multiple sclerosis and numerous cancers.

The US “doesn’t currently rate prescription drugs,”or tell you how effective they are (Gerard Anderson, Johns Hopkins).

The proportion of advertising spending allocated to direct-to-consumer ads was an average of 14.3 percentage points higher for drugs with a low added benefit compared to those with a high added benefit

.

Further infuriating reading:

But all Countries do this, Right?

Nope. Just 2 countries in the whole world allow drug makers to market prescription medications directly to consumers: the US and New Zealand. The American Medical Association opposes Big Pharma advertising. How is this ok?! As a result, my skeptical mind just can’t trust the news and it’s captive view on the subject, much like insurance companies sponsoring data on insurance costs next to “factual” articles or new stories.

Fun Fact #188: did you know the FDA has an office of “Prescription Drug Promotion?” The head analyst there is Dr. Kathryn Aikin (PHD not MD), who considers herself the “FDA’s authoritative source on direct-to-consumer (DTC) prescription drug advertising research.” What the hell is she doing? How are these massive companies allowed to influence the media with their $ to near monopoly to sell us drugs? Get your stuff together Kathryn.

More fun facts, because, well, I find it funny: Dr. Aikin also has an Etsy store, which she links to on her professional LinkedIn profile, and an apparent company “Lincoln Street Design” where she has sells jewelry she actually “fabricates” because she has an “obsession with jewelry.” Maybe she should spent more time policing the Pharma industry and its influence on data sources and news media that is being piped to the public…? Records show she listed 16 new “playful” items for sale on her page so far in September. No need to answer.

What can I say, the data doesn’t add up, and, in the words of Dr. Aikin, “I am inspired by the strange and unusual.”

Ok…Ok…I digress…..This topic just get’s me fired up! Apologies.

The Bottom Line

In my experience, it pays to be skeptical. Not negative, skeptical. Don’t believe everything you read (including this article) and always try to best verify the information you are consuming. After all, you have agency over your own body, you can choose what affects you and what doesn’t, what you believe and what you dont. Just remain cautiously skeptical but be willing to change your mind when new information presents itself. It’s just good policy.

So what’s my point with all this insurance (and big Pharma) talk? I believe that sunlight is the best disinfectant. We need more public and unadulterated data to be available on insurance costs and what is covered. State and Fed regulators have a role here to ensure a more uniform ad comprehensive coverage expectations, as insurance requirements differ state to state . This will help us all shop for policies, know what is in that policy, and will promote market competition amongst insurers. Transparency is something we have required in other industries, the food industry comes to mind, so in something so life and death as our family’s home, the government should be playing a more helpful role. I do not mean over-regulation, I mean ensuring fairer market competition through data availability and cost transparency. It seems like most government oversight focuses on ensuring the insurers are capitalized and don’t go broke during a disaster, like appears to be the job of the Federal Insurance Office. While this is important, let’s move forward. Their stock price and stock buybacks would say they are doing just fine.

And, if you know of better, apparently hidden, data sources, please email me!

Ok, time to go on a run with the pooch, he is sick of all this data dearth talk. Unless there is food in the deal. He’d sit through a timeshare talk for that.

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.