The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, October 10th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: Mortgage rates, government debt red alert, ‘plastic’ is in trouble, the weakness of the US fiscal state of affairs, and a little commentary on the war unfolding in Israel.

Today’s Interest Rate: 7.81%

(👆.07% from last week, 30-yr mortgage)

Mortgage % 👆, now on a 9-month bender 🤮

Yields on the 10-year treasury bill dipped slightly yesterday and today to 4.65% yesterday, as mortgage rates hit 7.85% at their peak (although as I write this, rates are falling slightly in reaction to the war in Israel, see my closing comments).

After a brief reprieve Oct-Dec 2022, rates have been nothing but up and to the right since late January.

Barring a financial event, we should still see 8% mortgages in the coming weeks, albeit with volatility.

Stock Market and Treasury Bond Markets - Something is going to Break

Treasuries are on a truly peculiar, divergent path from their historical correlation with equities. The expectation for future inflation and other unknown factors (at least to this guy) have been propping up equities. In 2023 only, we have seen a massive decoupling of this correlation, which is not sustainable. Either the stock market crashes or bond prices need to rise (and yields collapse).

Which breaks first/most?

Bank Credit Markets Flashing Red

This chart gives me chills from working on the Hill in ‘07-‘08. Bank credit, as a % change from a year ago, just flashed red. This has happened only once since I have been alive, the Great Recession.

What does this mean? It’s just as hard to get a loan (both their affordability and banks restricting the # of loans). But aside from a few isolated incidents, we don’t have a banking crisis, so what’s the deal? It’s not interest rates, they have been this high before. But the Fed did just raise rates faster than ever in history, that could be it? Either way, the banks are scared, and so for us, access to capital is in the gutter. According to Apollo, lending standards are extremely restrictive, now near 2008 levels.

One effect: Mortgage demand is now at the lowest since 1995, below 2008.

Another Effect: home prices are down so…wait…what? They are still going up? The reason, zero supply, nobody wants to move from their 2-5% mortgage. Why would they?

Plastic is in Trouble Too

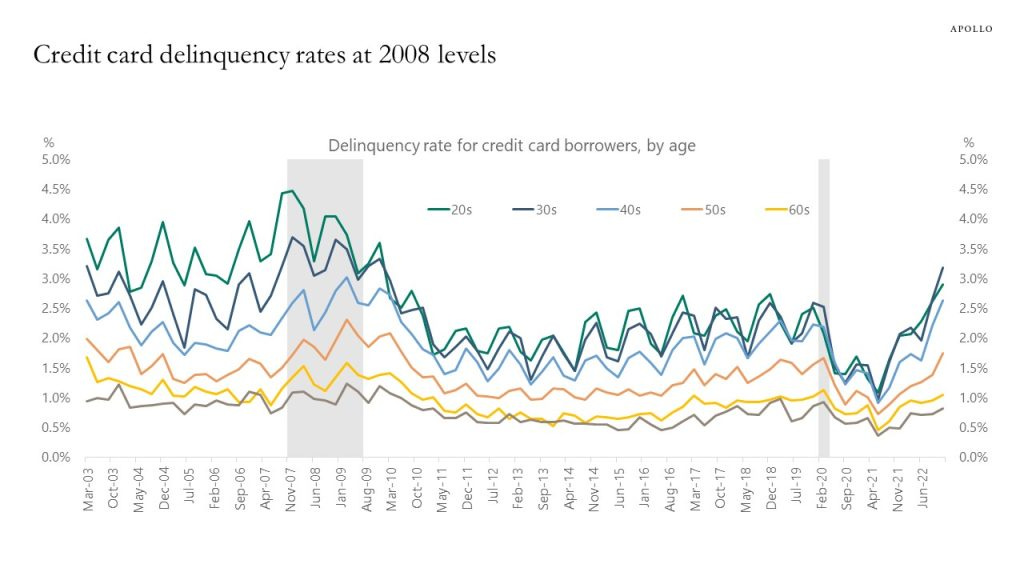

What else just flashed back to the future? Credit card delinquency rates, now at ‘08 levels.

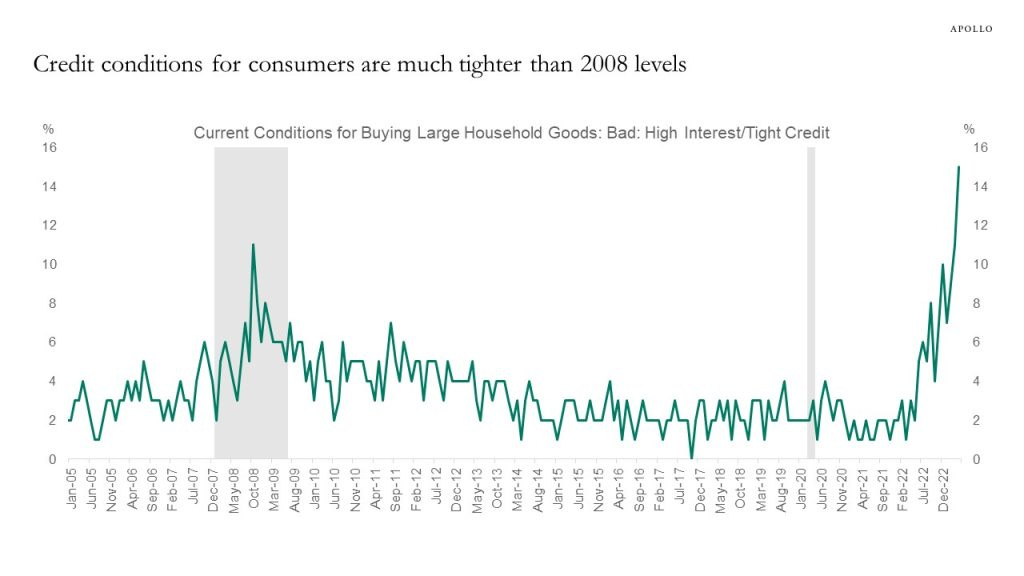

As are large purchases. Recessionary levels.

US State of Government Affairs - A Historically Weaker Position

From a financial perspective, the US government itself is in a fairly week. High federal debt and high interest rates on that debt mean the cost to borrow is exceedingly high, and getting higher. Why does this matter? If the economy plunges into a recession that is significant enough, and we get involved in yet another war, the Federal Government and Federal Reserve have already used much of their fiscal and monetary “ammo” and further deficit spending could worsen our long term economic outlook. Moreover, there is the risk that other foreign entities don’t buy our bonds like they normally do (Japan, China etc..), making their cost to borrow for the Government even higher. Did I mention that there is no Speaker of the House to even pass debt-cutting legislation?

This concern in US fiscal status should be concerning to us all, and we need to keep up on the state affairs because they affect our pocketbook. Here are some additional facts we need to think about:

US Debt is now at $33 Trillion. In fact, just in interest, we are now spending $3 billion PER DAY and at the same time we are spending $11 billion PER DAY in additional federal spending, or 120% of our total GDP. Coincidently, this is also how much we recently just sent to Ukraine. We are likely to do the same for Israel.

Scratch that, the Federal Government says Hold my Beer: “the US added another $33 billion of debt in ONE DAY yesterday [Oct 4th], bringing the 2-day total to $308 billion.” US Debt has now increased by over $2 trillion since the debt ceiling was suspended just 4 MONTHS ago.

Let’s look at this problem another way: Federal Debt, as a % of Tax Revenue, just reached a historic high. The concern? This happened in 1 year, and is on pace to go full astrophysic by 2032.

Lastly, the strategic petroleum reserve still hasn’t been filled up from when the Administration emptied it in 2022, and is at historically low levels. We are now involved in a war in the Middle East.

No Bueno…

Some Closing Thoughts…

It would be hard to talk about anything today and ignore the latest international crisis: cowardly Hamas terrorists attacking Israel and taking hundreds of innocent people hostage. Absolutely insane, and yet another deadly war. But if you are looking for commentary on the war itself, this won’t be your source. I recommend taking a journey on Twitter/X and seeing first-hand accounts from the ground. I’m going to stick to finance and real estate. But as it relates to you at home and your finances, I do have some brief thoughts.

I do see there being a modest effect to slow our consumer economy and lower mortgage rates as a result of this war, but only if it becomes protracted and over a period of 3+ months. In that case, what I see happening is a slight dip in consumer spending - which represents 70% of US GDP - to the downside and slower business investments/capital expenditures. Just psychologically, this is what will likely happen as this war gets drawn out. We may also see gas prices up if we start to go after Iran, or if this spills into the rest of the Middle East in some way. Either way, the Fed, who is already sounding more dovish, will likely continue that narrative and make it publically clear that they have already made the last rate hike. This news, and the general slowdown I mentioned, will lower inflation expectations, boosting investment in US Treasuries - like the 10-yr Treasury - and its highly correlated asset: mortgage interest rates.

Regardless, I still predict that the Fed is likely not raising rates again, and will start to lower them Summer 2024. It will be another year before rates reach 5-5.5%, where they are likely to settle. Again, 3-4% mortgage rates are fiction moving forward. Higher rates for the next 12–18 months will make it tough to afford a mortgage (more on affordability next week). But if you need to buy a home, make your offer contingent on $ back at closing, which you can use to ‘buy down’ the rate to 5.5%-6%. That is totally doable and a great strategy in today’s market (if you need help figuring this out, feel free to reach out to me! My personal email is below 👇). The average mortgage on a home is now approaching $3000 for the first time ever. Maybe this is why 50% of young adults are living with their parents.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.