The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, September 13th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: Home prices, Consumer prices, Economic updates and, it’s Homer time, I give an update on the Nashville real estate market.

Today’s Interest Rate: 7.25%

(30-yr mortgage)

Housing Market Update

Fresh off the presses, we have updated price information everything. Let’s dig in. First on the block, home and mortgage prices.

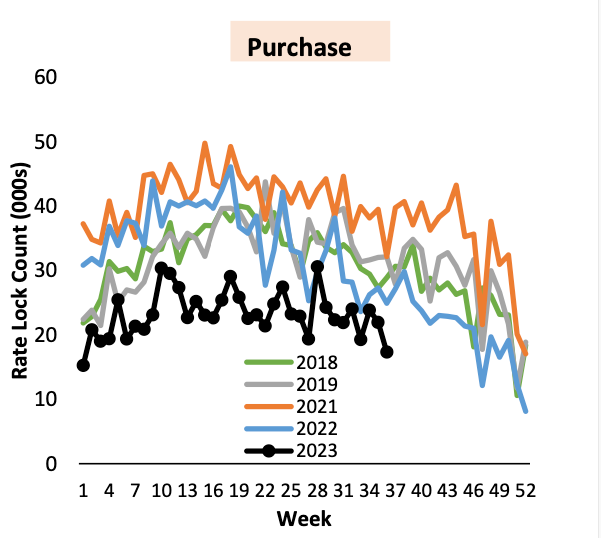

The median mortgage rate for home purchases (30 yr) rose .04% WoW to 7.25% (as of today). Mortgage volume was down 39% from “normal” 2019 levels.

Home Price Appreciation

Ignoring lower purchase activity and historically high rates, home price appreciation has begun to re-accelerate as a trend since January, nationally. Home prices have appreciated 3.5% YoY and are projected to increase 4% for August, September, and the first three weeks of October 2023, according to the AEI Housing Center. Yet another source supporting what we have been saying the past few months, so far the bottom in home prices seems to have been in January.

AEI further projects home prices to appreciate 6% through the end of the year and 7% in 2024.

Home Refinances

Cash out mortgage refinances are down 76% since 2019 and “regular” rate and term refinances were essentially non-resistant, down a whopping 97% since 2019. Cash out refinances are a favorite product for real estate investors and likely are only happening in this high interest rate environment because investors / developers need to refinance even higher construction / short-term loan products.

Consumer Prices: The Trend is Down

Consumer prices continue their downward trend, on par with expectations. The August 2023 consumer price index rose 3.7% YoY, according to the US Bureau of Labor Statistics. However, much of this was attributable to a spike in gasoline prices (10.6%) in August, which is volatile and likely temporary. Gas prices are actually down -3.3% YoY. And Core CPI was up only .3% in August.

This is good news. Core CPI removes volatile/seasonal items like energy and food prices. Important note! Many large media outlets are running stories today classifying the CPI report as “hotter than expected” or as the “biggest monthly increase this year” but these points of view are click bait. Don’t fret, the inflation trend is down.

Additionally:

Rent (shelter) prices continued their rise, increasing .5% MoM and 7.8% YoY.

Airfares were up 4.9% MoM but were still down 13.3% YoY.

Used vehicles declined 1.2% MoM and 6.6% YoY.

Transportation services rose 2% on the month.

Online Retail is also Down

Separately, online prices are finally coming down.

Overall online retail prices sank 3.2% YoY in August, according to Adobe Analytics, providing further evidence the inflation trend continues downward. The most notable rice category drops were in sporting goods (-7%), appliances (-7.3%), electronics (-11.6%) and computers (-14.2%). Food prices doped .2% in August, but were still up YoY 5%.

Economic Update

We also had an status update on current economic conditions from the Federal Reserve this past week, in the form of their “Beige Book.” What did they say?

The economy is growing, albeit modestly, since the last update on July 12th.

Retail spending dropped, especially on non-essential items.

Businesses reiterated expectations for slower wage growth.

The data suggests that consumers may have exhausted their savings and are relying more on borrowing to support spending.

Tourism was stronger than expected, and pent-up demand for travel remains.

New auto sales expanded, but this had more to do with better availability of inventory rather than increased consumer demand.

Manufacturing supply chain delays improved to better meet existing orders, however new orders were stable or declined, and backlogs shortened as demand for manufactured goods waned.

Housing supply remained considerably constrained.

New construction activity picked up for single-family housing.

But construction of housing units remains challenged by higher financing costs and rising insurance premiums.

Loan demand was mixed, depending on location, but most indicated that consumer loan balances rose, as did consumer credit delinquencies.

Job growth slowed nationally, however significant imbalances persist in the labor market as the availability of skilled workers and the number of applicants “remained constrained.” ie we don’t have enough workers.

Wage growth is expected to increase in the second half of the year, but should slow broadly.

Like what you are reading? Consider sharing this article with a friend!

Homer Time: Nashville and the SouthEast

So it’s time to give an update on what’s happening in my backyard: Nashville, TN. Yes, I’m a homer.

First off, Southeast economic actively more broadly is looking very positive, per the Federal Reserve’s Beige Book, Atlanta District. “Economic activity in the Southeast (which includes Tennessee) grew modestly. Labor markets improved, and wage pressures eased. Nonlabor costs moderated, on net. Retail sales were robust. New auto sales were strong. Domestic leisure travel slowed, while international and business travel rose. Transportation activity slowed. Energy demand was strong.”

How about the housing market?

The Southeast construction and real estate market remained healthy, despite elevated mortgage rates. Home prices continued their January assent, and volumes remained depressed with supply shortages worsening. Builders, happy to build homes with supply constrained, continued their steady ramp up of construction, however it appears they are becoming more reliant on incentives such as rate buydowns to attract buyers. Interestingly, builder future optimism fell, as rising interest rates, insurance premiums and construction costs continue to increase homebuyer costs/home prices and may dissuade new home buyers from pulling the trigger (or purchase a fixer-upper instead).

Commercial real estate conditions slowed, including for popular high-end multifamily units and industrial real estate, although the market there remains healthy. Commercial real estate operators did report growing concerns about financing availability, as lenders heightened underwriting standards and reduced funding commitments. For commercial office assets, the availability of financing and transaction volume continued to deteriorate, noting growing uncertainty amid declining asset values.

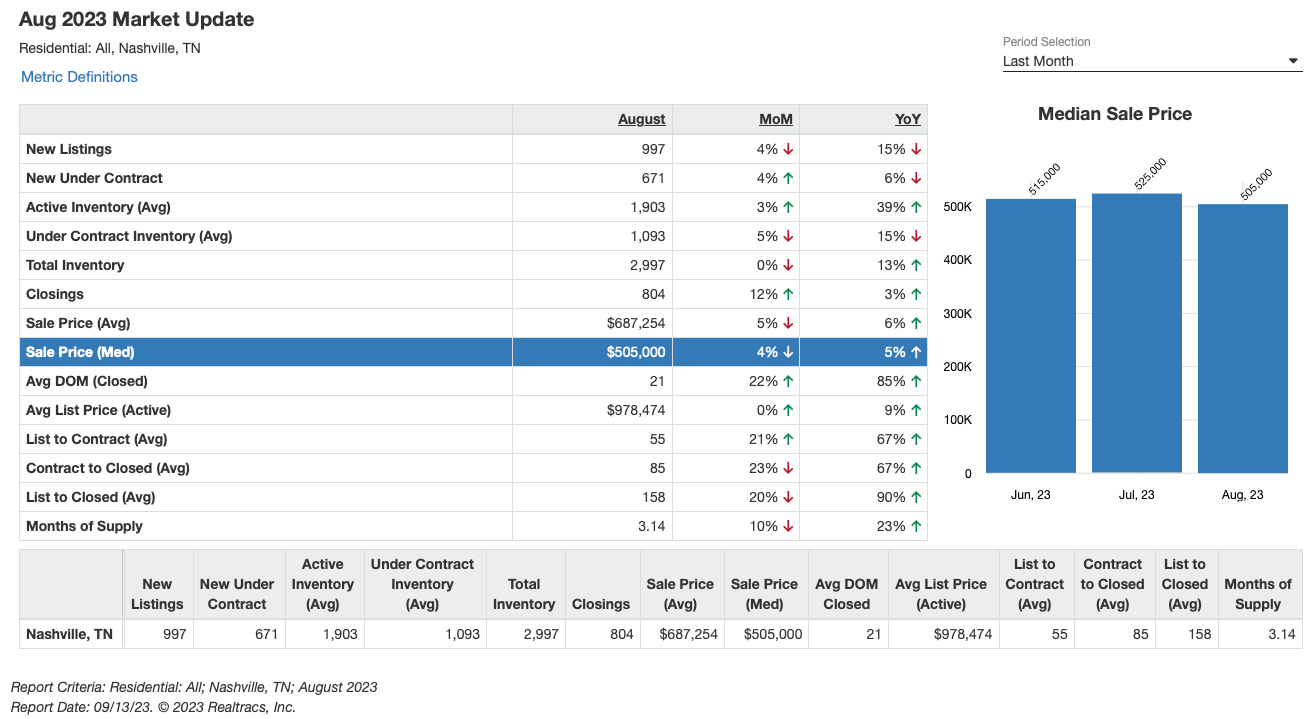

Nashville Real Estate: Prices Dip

Average prices (both median and mean) were down in August, dipping once again as they did in June, showing continued volatility in the housing market. While the trend is still to the upside and we are entering a seasonally slower time of the year for real estate, this lower number is noteworthy. Next month’s number will be important to see if we start to trend downward and perhaps test the January lows. As of now, prices remain much above that level.

My favorite measurement, Seller Sentiment dipped once again in August, with the gap between list price and final sales price widening to its largest margin in 3 years. Median list price decreased just .8% while median sales price dipped 3.8%, MoM.

Buyers retain their firm grip on the market.

Personal anecdote: as a Nashville Realtor I continue to see buyers demanding - and successfully - receiving better terms, lower prices and higher closing cost incentives. Both YoY and MoM: new listings are down, but Days on Market are up, so total inventory is up. ie properties, mostly existing/outdated homes, are sitting longer.

Additionally, a snapshot of data for Nashville real estate MoM:

The Bottom Line

Well-qualified and highly motivated home buyers continue to form households and purchase homes, despite high mortgage interest rates. Home prices, buoyed by a historically tight supply, will likely remain at these levels for the foreseeable future. Cooling, yet still strong job numbers, low levels of foreclosures in most areas, work from home, and continued rent price increase will further support home price appreciation. However, folks may face a number of economic bumps this year, which could lead to a recession in 2024, including:

Student loan payments resuming next month.

Dwindling savings accounts.

Difficulties accessing credit.

Mortgage rates remaining high.

Inflation, while trending down, remains double the Fed's 2% target.

European and Chinese economic decline.

Potential issues surrounding the War in Ukraine.

Businesses may reduce investment, expecting weaker consumer consumption in the coming months (According to the Fed’s Beige Book).

Next week (Sept 20th) is the Federal Reserve’s meeting, where they are largely expected to NOT hike rates further, yet the expectation is also to keep them elevated for months to come. However, if they do decide to tighten further, throw out everything I said above. Bond market futures pricing has been volatile beyond that, with traders putting about a 40% probability of a final increase in November, if at all, according to CME Group data.

My thoughts? This data is propelling me into even more bullish territory to buy real assets, in my line or work, that means real estate. I’m seeing investors in the Nashville area snap up homes for 10+% under market value and what a comparable property sold for last year. I’m also anecdotally seeing a strong retail market, particularly in the restaurant lease and construction services sectors. Both are red hot here in Nashville.

On the overall economy, my position remains in default mode, which is set to skeptical (Seneca-level skeptical). I don’t know what to think. I’m default skeptical and scared of a potential business/corporate earnings recession, which could kick off a recession in 2024 and could be exacerbated by a crazy election season, recessions in large foreign economies and a Federal Reserve who is, to their credit, hell bent on squashing inflation like a grape: their Fed Funds Rate should likely remain elevated (5-5.5%) for 12+ months, while they continue Quantitative Tightening (reducing their bond balance sheet, and thus, US money supply).

Big week next week.

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at AndreasMueller@kw.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.