Welcome to my so-far Unnamed Real Estate Newsletter, August 23rd edition, where I do a brief, hopefully insightful, dive into financial markets and/or real estate. And whatever else is bouncing around my noggin.

Today I want to do an update on real estate market levels: Sales, Prices and Rates, and homeowners vs. homebuyers.

Home Sales: Update

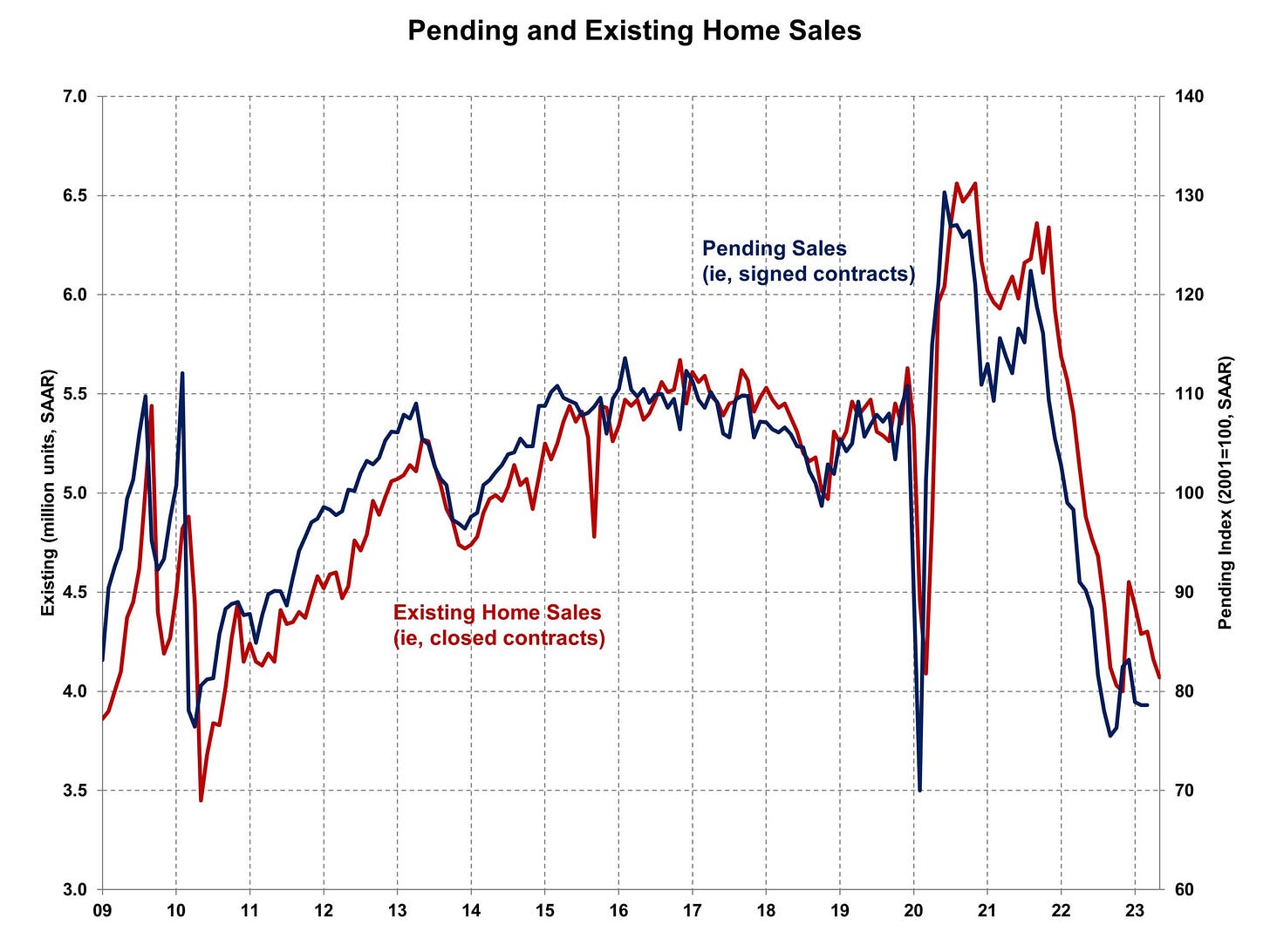

Existing homes sales fell 2.2% in July, back to the January lows and down 16.6% from last year (NAR). Low supply and high mortgage rates (much more on that below) are limiting buyers and keeping potential sellers on the sidelines. More fun stats:

First-time buyer share rose 3%, to 30% in July MoM and was up 1% from 2022.

The July inventory level measure increased slightly to 1.11 million units but was down 14.6% from a year ago.

Existing Home July inventory sat at a 3.3-months’ supply, up from 3.1-months last month and 3.2-months a year ago.

Homes stayed on the market longer in July (20 days), up from 18 days in June and 14 days in July 2022.

In July, 74% of homes sold were on the market for less than a month.

All-cash sales share in July was flat MoM (26% of transactions) and only up from 24% a year ago (which I found shocking). All-cash buyers are apparently less affected by changes in interest rates than I thought.

Geographically, all four regions observed a decrease in existing home sales in July, ranging from 11.5% in the Northeast to 14.7% in the Midwest. On a year-over-year basis, all four regions continued to see a double-digit decline in sales, ranging from 14.1% in the West to 24.6% in the Northeast.

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI rose 0.3% from 76.6 to 76.8 in June. On a year-over-year basis, pending sales were 15.6% lower than a year ago, per the NAR data.

But the story is very different for new residential sales, which were UP 4.4%, as new homes continue to sell well. Of note, this number is 31.5% higher than a year ago, yet the supply of new homes sits at 7.3 months, more than double the 3.3 months supply of existing homes on the market. Wowza.

Homebuilders are well aware of this fact. Construction spending has been up, albeit slow and steady so as to not get caught off guard.

Perhaps there is room for government to incentivize more home building, and for local/city governments to allow construction of a second dwelling on one’s property? California, Vermont, and Boston, Portland, and Denver have been leading the charge on the latter. Sorry New York.

Homebuilder Confidence Starting to Crack?

Despite the steady increase in spending and profits, homebuilders are getting weary of higher mortgage rates. Homebuilder confidence, after rising 7 months in a row, decreased in August to 50 (which I guess is ‘indifferent?’). Respondents to the NAHB homebuilder survey cited mortgage rates and inflation as the cause for the decreased confidence. One month a trend does not make, but this is something to pay attention to.

Like what you are reading? Consider sharing this article with a friend!

Home Prices: Update

Median sales prices rose 1.9%. It was the first YoY increase in prices in 6 months AND marks the first year-on-year price increase since January.

More Fun Facts:

It was the fourth time the monthly median sales price eclipsed $400,000, joining June 2023 ($410,000), June 2022 ($413,800) and May 2022 ($408,600), according to the National Association of Realtors.

The July median sales price of all existing homes was $406,700, (1.9% YoY).

The median existing condo price was $357,600 in July, up 4.5% from a year ago.

Mortgage Rates: Update

10 Year Treasuries (rates) are down slightly today as of this writing to 4.217% but continue their steady 5 month march up the mountain. Mortgage rates closely follow the 10-Year, and at this level, the implied mortgage rate today is close to 7.4%! Anecdote: rates for Conventional loans for non-owner occupied owners (aka investors) are much higher. Last week I was quoted 8.3%, with required point buy-down for an investment property I’m offering on.

That’s higher now.

HomeOwners vs. HomeBuyers

Homeowners are sitting back and enjoying their popcorn.

The 7.48% average 30 year US Mortgage for today’s homebuyer is the highest in more than 22 years and ~17% higher than a year ago (5.72%). However, 91% of homeowners with a mortgage have a rate below 5%. So why move? And as we saw above, resilient demand for new homes - including buyer incentives for rate buy-downs from historically profitable homebuilders selling homes at record prices - means more folks are considering a new home. The average new home is now just about 7% more expensive than existing homes. ($406,700 vs $436,700)

Everything is Likely to Stay High: The Government

Fannie Mae expects home prices to rise 3.9% in 2023 followed by a -0.7% decline in 2024 (big credit to @NewsLambert for this pull) (assuming due to interest rates because the Fed says inflation is coming down) AND….

And expects mortgage rates to come down slowly, to 6.7% in Q4 2023 and 6% a year later, in Q4 2024…. Wait, what?!?!

Rates still at 6% more than a year from now?

What are others in the industry saying? Some agree, some disagree, and this disconnect has me concerned rates will stay much higher than that.

Here is what folks in the industry are predicting vis-a-vis Fannie Mae:

Mortgage Bankers: Disagree, predict the rate on the 30-yr mortgage will come down to 5% by Q4, 2024 (below).

Morningstar: Disagree, also 5% in 2024. (and 4% in 2025).

Goldman Sachs: Agree, 5.9% in 2024.

National Association of Realtors: Agree, 6% in 2024.

Morgan Stanley: Agree, 6% in 2024.

Moody’s Analytics: Agree, 6% in 2024.

Realtor.com:Agree, 6.1% in 2024.

The Good news/silver lining is that Fannie Mae is also saying that mortgage rates are peaking this quarter (Q3, 2023). The bad news? Everything else…..

So rates are up, so what?

The average rate on US Mortgage debt is 3.6%. So compared to today’s rates, “it’s just a couple extra points, right Andreas? Not a big deal…” “…Well Ronald, case in point, at today’s rates, the monthly payment for a $500k home is $1262 HIGHER than the average.”

Again, all good for homeowners, horrible for homebuyers.

Credit to @NewsLambert and @JSeyff for this amazing data + charts. And extra credit for causing me to literally spit out my “coffee.”

Bottom Line

Everything is up and should continue that way.

What I’m seeing? Anecdotally, existing homes that need work are sitting, as folks are shifting to considering new homes, move a little further outside the city, and take advantage of homebuilder mortgage rate incentives/buy-downs. Sales of new homes in metro centers are down 25.6% from a year ago. For those of you with an HGTV bone in your body, you can get a deal on a fixer-upper. And for you, it’s great to be a homebuyer.

This is the silver lining for buyers in this market that I must reemphasize: Buyers have Negotiation power for existing homes.

For homeowners? Unless you have a problem and need the money today, don’t sell. Wait for rates to come back to earth around 5.5%, and for the flood of homebuyers to un-pent up that demand, rush into the market, and make multiple offers on your lovely home. You will be happy you did.

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at AndreasMueller@kw.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.