The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, October 20th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re keeping it simple. If you are in the market for a home or investment property, is it better to buy today or wait for interest rates to drop? The answer may not be obvious. I run through the numbers for you.

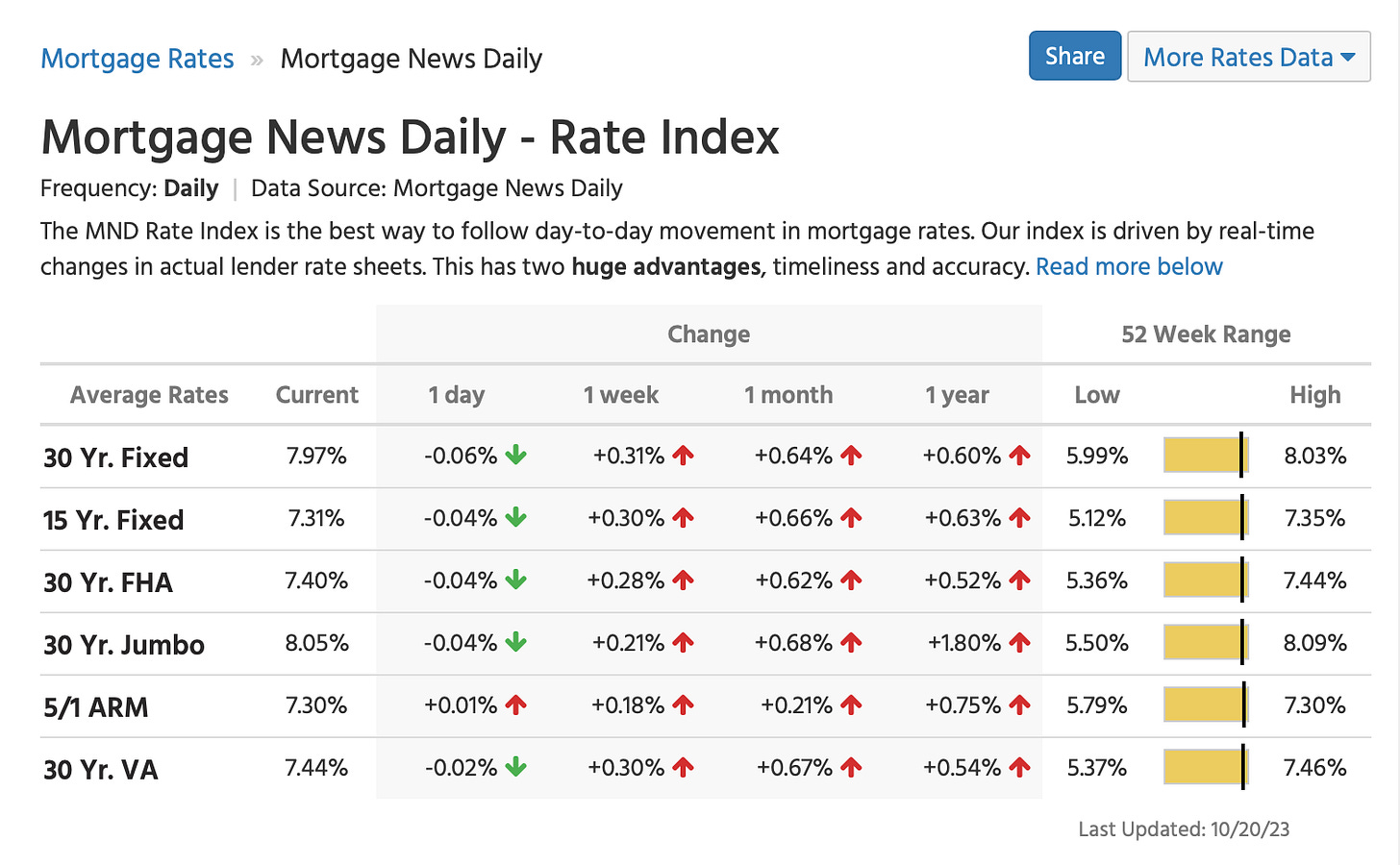

Today’s Interest Rate: 7.97%

(👆.16% from last week, 30-yr mortgage)

Mortgage Rates hit 8%!

Well, we said it would happen and unfortunately it did, the 30-year mortgage just hit 8% this week (8.03%), this, following yields on the 10-year Treasury bill touching 5%, up from 4.65% last week (Mortgage rates track the 10-year).

So Now What?

Yesterday Federal Reserve Chair Jerome Powell continued a slightly hawkish posture when speaking to world economists. During his interview he called the economy “resilient” in the face of higher interest rates and cost of capital. He seemed surprised that the Fed’s actions hadn't yet taken a larger bite out of the economy, even noting that it’s “not a good time to buy a car or a house. Quite the contrary.”

But, is it really not a good time to buy a house?

I would argue no. It’s a fantastic time to buy a house. But, it’s a terrible time to sell one. Follow me here…

It is absolutely true that home affordability is at an all time low. Why? Interest rates have gone from 3% to 8%. To put this in perspective, a $400,000 home with a 20% down payment would have a monthly payment today of nearly $1,000 more than it would have been two years ago. Put another way, the same mortgage 2 years ago would buy you a $600k house, now you can afford a $400k house. Meanwhile, inflation for most of life’s items have also gotten more expensive. Every. Single. Month.

Echoing this, the National Association of Realtors NAR Housing Affordability Index is at 91.7 in August, down from 93.9 in July, the lowest reading since the 1980s. At this level, the median household earner can’t even get approved for a mortgage on a median-priced home.

Home affordability is hurting buyer’s ability to buy, meaning, those looking to sell are having a hard time finding buyers and are being forced to lower their asking price. Price reductions are now not only commonplace, but savvy buyers who are able to afford the mortgage (or have cash) are finding themselves in the driver’s seat.

So while it is true that home affordability is at an all time low, this is a direct result of higher interest rates, not a systemic financial or housing crisis, as there was during ‘08-09. The Federal Reserve is holding rates artificially high on purpose, in an effort to slow the inflation wildfire, which we all see in the grocery store and gas station. Inflation today still is close to 4%, and that is over last year’s prices that were 8% higher than the year previous.

Once interest rate waters recede back to the 5 - 5.5% levels, home prices will spike higher (just like other rate sensitive assets) as literally millions of households get back into the market looking for a home. Demand 👆 = Price 👆. And you will have wanted to have purchased that home already. This may take 12-18 months, but it will happen. During his talk yesterday, Powell said he will hold rates high and that “it may just be that rates haven’t been high enough for long enough.”

Let’s look at a case example on a typical investment property or primary home and determine if the numbers tell us to buy now or wait.

Quick Example

Let’s say you are purchasing a home for $400k in Nashville, TN, using my home market as an example.

At 8%, your mortgage is $2764.

Let’s assume it takes 18 months for rates to come down and that the new “normal” rate will be 5.5%. The 3-4% COVID-era mortgages are likely never happening again.

Purchasing that home today will cost you 18 months of higher interest at 8% vs 5.5%: $531/ mo., or $9558.

So, if you purchase a home today you will want to make sure you get a deal, and pay $9558 less for the home than comparable homes.

The plan would be that once rates come down, you refinance your current loan into that lower 5.5% (or lower) rate. Importantly, make sure to select the right lender, ask your Realtor for their preferred lender list, which any self-respecting one should have in their hip pocket. Many banks are offering free refinancing once rates drop, meaning no or very low closing costs to refinance into a cheaper rate. Lenders are calling this “Buy now, refinance later for free.” And check the fine print for any fees. Don’t pay those.

And let’s not forget we are in a buyer’s market. Why stop at $9558 off the purchase price? We can be much more aggressive in our home purchase negotiations.

So, is it a better idea to purchase a home now or wait?

Remember the chat above?

Using my home market of Nashville, TN (one of the most resilient real estate markets for home prices) as an example, the average price reduction is 14% or $101,401 on an average home of $699,900 (again, see chart above).

So, if we can get just an average deal, 14% off the purchase price, the shrewd investor / homebuyer can save 5.8x their money if they purchase a home today vs wait for interest rates to drop. Sellers are taking a bath.

Further, it is important to note that home prices bottomed in January, and have been rising steadily for the last 10 months. This means, over the next 18 months home prices will likely continue to rise, and you will be missing out on that valuable home appreciation if you are sitting on the bench.

If home prices rise a conservative 5% in those 18 months while you are waiting, that’s an additional $30,000 you are missing out on, or 3x the amount you were trying to save in interest by waiting.

Closing Thoughts + Tangent!

If you are a first-time homebuyer, and especially if you are an investor, it’s a fantastic time to purchase a home. I wouldn’t advise selling, unless you have to. As long as you can afford the higher mortgage, it likely makes far more financial sense to just eat that higher mortgage cost and refinance later into a more normal rate. Your investment will likely make you several times your money back. And if you can improve the home through renovation, even if DIY / moderate, your wealth will grow even more.

Tangent! You know what you should be waiting to buy? Olive Oil! Holy hell have you seen the prices of Olive Oil? Here is a 30 year chart, it’s liquid gold!

Oh s%$t, hold my beer! Said OJ. What are they doing, hoarding oranges like diamonds in Russia? Since the 2020 low, the price of orange juice is up 315%, including 105% this year alone. This is insane. I’m leasing my next property soley for orange groves and olive orchards.

Ok, I digress…

I still predict that the Fed is done raising rates, and will start to lower them Summer 2024. Energy prices are unfortunately going to be volatile / up due to world events, as will bond prices as China, Japan, and other large external actors buy fewer treasuries. All this should contribute to deflation. While it may be 12-18 months before rates reach 5-5.5%, the era of 3-4% mortgage rates are future fiction. If you are buying a home, I recommend being aggressive in your negotiations:

Offer 10% less than comparable 2022 sales and 14% less than the list price.

Make your offer contingent on $ back at closing, which you can use to ‘buy down’ the rate to 5.5%-6% today OR get $ to renovate the property (my favorite). Every investor I know is getting serious (5-10%) cash credits at closing from sellers in today’s market.

Don’t be afraid to lose the deal and move on to another. Chance are you aren’t looking for your “dream home,” whatever that means. Make an offer and if you get rejected move on or counter. In fact, if your first offer is accepted, you likely offered too much. In negotiations, the person who cares the least, wins.

I hope this has been insightful. Obviously I made some assumptions in calculations here but I tried to keep them conservative. I’m actively looking, wheelin’ and negotiatin’ for that next investment property. This is a fantastic time to be in real estate, waiting on the sidelines for interest rates to drop is like stepping over a nickel to pickup a penny. Just remain disciplined.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.