The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, September 6th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: winter, interest rates, and debt, debt, too much government debt!

Winter is Coming

The colder months are normally the time when folks move less, eat more, wear yoga pants and don’t workout, hunker down for the winter, and ….. apparently buy Lexus’ with red giant bowes on them (more on that later, read on its, worth it). They also purchase fewer homes, and thus, apply for fewer mortgages.

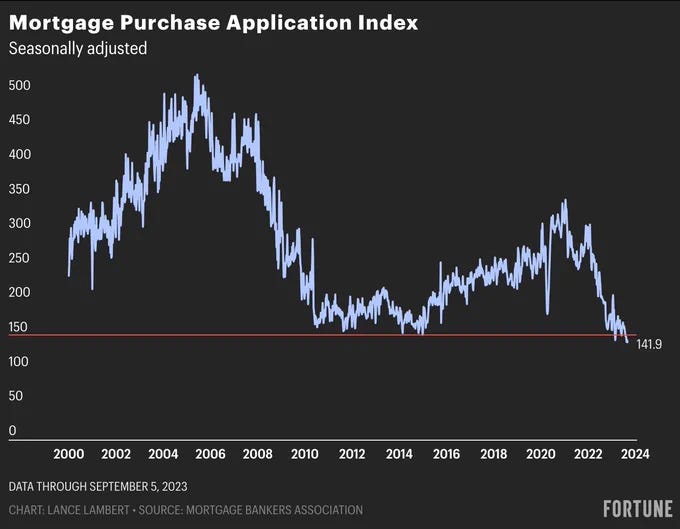

And winter may be coming early. Mortgage applications this week were down 2.9% from last week alone, and 5% when not adjusting for the season. That’s a big drop, and brings us to the lowest level since 1996, even below the post-Great Financial Crisis, despite rates dipping slightly last week. (Mortgage Bankers Association)

As we enter the more mellow mortgage season, historically low mortgage applications will likely translate to fewer home sales than anticipated, especially if we remain at elevated 30-year mortgage interest rates. Will high interest rates and the slow season translate into lower home prices? In my opinion yes, in slower and/or established markets (read San Fran), and likely not in growth regions (read Nashville, Tampa, as long as unemployment remains low).

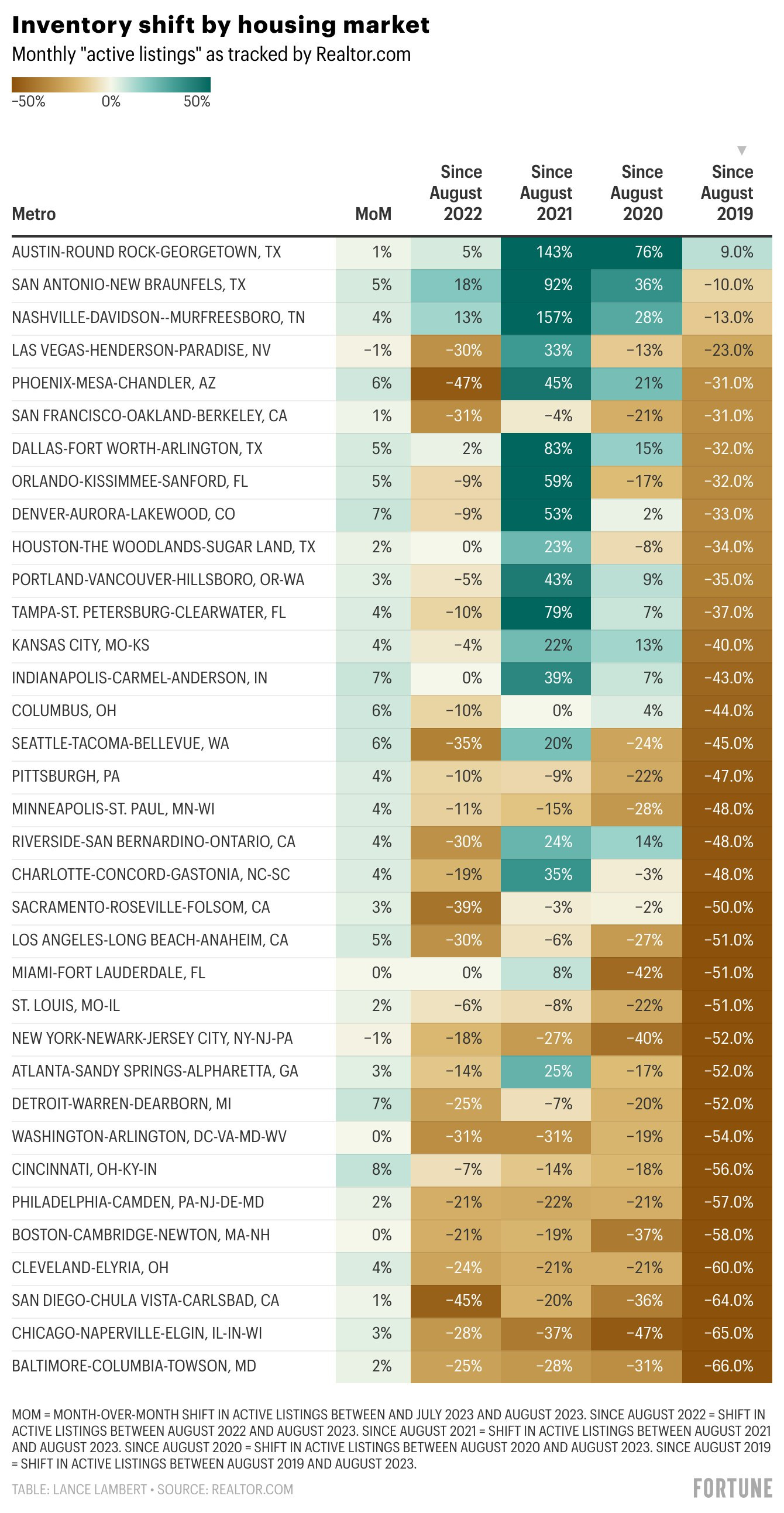

Case in point, home listings, an indication of market health, are generally lower than “normal” (pre-COVID) but as they say, the devil’s in the details. It’s all relative.

For example, in San Diego listings are up 1% MoM, yet down 45% YoY and down a whopping 64% since 2019.

In my home market of Nashville, listings have remained relatively steady: up 5% this month, up 13% from last year and down slightly (10%) pre-COVID.

Today, home mortgage interest rates are up, to 7.21%. This will affect different market’s differently. But, still pretty gross.

However, there is a serious economic concern I’d like to talk about today, which is the direct result of the prolonged high interest rates from the Federal Reserve: the National Debt and its potential impact on the economy.

Is our Immense National Debt Starting to Actually Matter?

For decades the U.S. has spent more than it takes in. It didn’t matter who was in Congress or the White House (except a short surplus under Clinton) we just keep spending. Now, as long as the amount we spend compared to our GDP is low, the cost (interest rate) of that debt remains low, entities keep wanting to purchase that debt, and our debt profile compares favorably vis-a-vis other countries’, there isn’t a major concern. We (the US Government) can keep growing and printing money/borrowing.

However, we may now have a problem as a result of a confluence of events. To put it simply (and yes I know I am oversimplifying here):

Large purchasers of debt, like Japan, are not buying our government debt like they used to.

Neither is the Federal Reserve. In fact they are doing the opposite (quantitative tightening), to curb inflation.

The US Treasury is issuing record amounts of debt, the fund the astronomical $6+ Trillion in deficit spending by the Federal Government since 2020 for COVID, stimulus and infrastructure programs. This is in addition to the “normal” deficit spending the government does each year.

As the Government issues new debt (again, the US Treasury issues debt to fund government spending, which are bought for a % return), the cost of that debt issuance is now at historically high interest rates. Today it’s averaging near 6%. Two years ago it was .1%. This is a BIG deal.

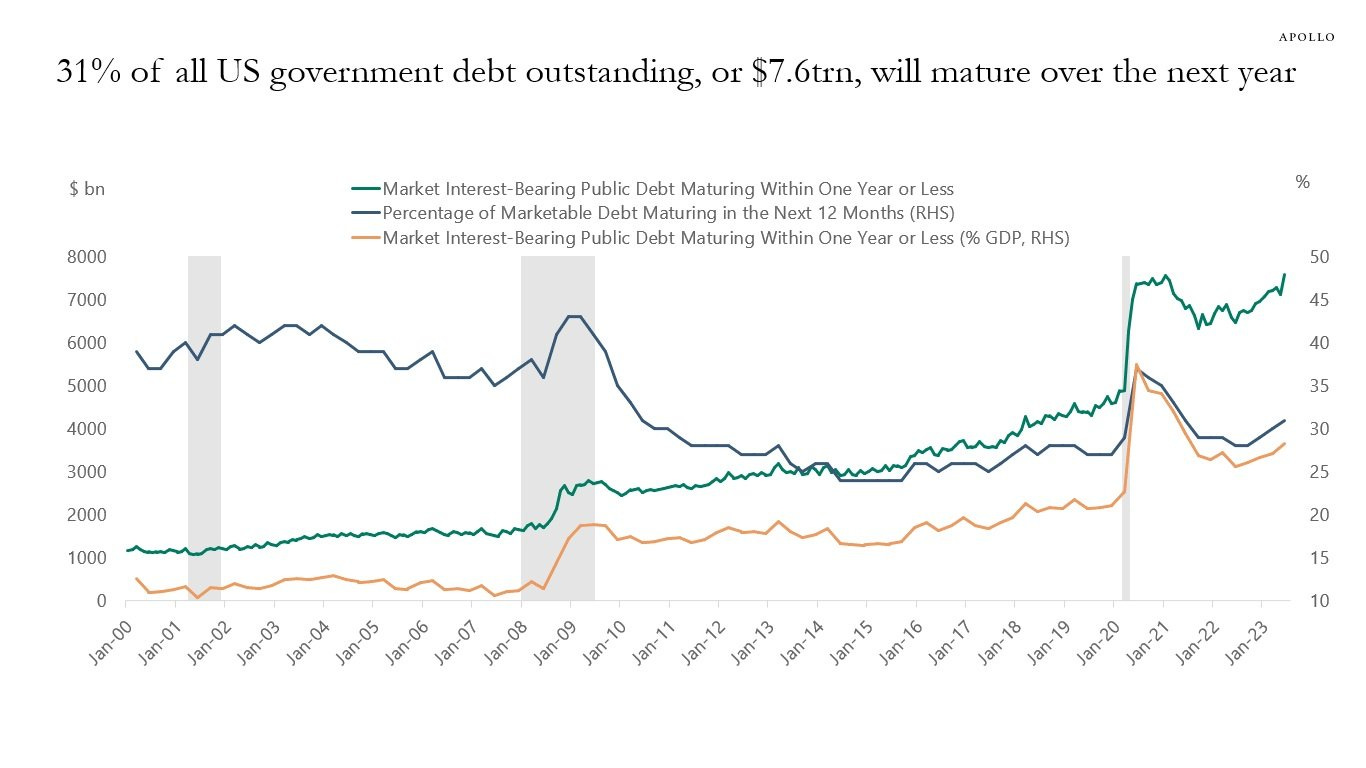

In fact, a record $7.6 Trillion of US debt is set to mature next year. This represents, 31% of ALL current US government debt! 😲

Now, debt rolling over has not been a problem for the last 15+ years, with low interest rates. This debt would simply be refinanced at the same or lower rates.

Now? Refinancing this debt at these rates becomes a potentially extreme problem.

And the Treasury Department is also on track to take in substantially less in new revenue this year, which means more debt insurance to finance Gov spending.

Case in point, the cost of the interest on all this debt is now nearly $1 TRILLION. Every Year.

To put this in perspective, we now spend more on just the interest on our debt, than we do our ENTIRE MILITARY BUDGET, EVERY YEAR!

Let that sink in…

What happens over this next year when the cost to the Government for issuing debt remains high? Well, I would offer that the effects from our government stimulus policies have yet to be realized and will have a meaningful impact in our economic health. For example, deficit spending will likely push/keep interest rates higher for all Americans. And may lead to less spending, slowing the economy.

Call Out: Durable Goods

Let’s look at a specific example. Durable goods, which is a measure US industrial activity. As its name implies, it reflects orders placed for long-lasting (durable, 3+ year items) goods that are manufactured by domestic companies. Cars, machinery, airplanes, computers, electronics etc… What caught my attention? New orders of durable goods decreased $15.5 billion or 5.2 percent to $285.9 billion, following four consecutive monthly increases. But excluding transportation equipment, new orders were were actually up, .5%. (Transportation equipment led the monthly drop, down 14.3%). And because these items are meant to be used for multiple years, they have a high price tag, and thus, are normally financed. High interest rates make these financed items more expensive.

Like what you are reading? Consider sharing this article with a friend!

The Bottom Line

High interest rates for homebuyers, “Stuff Buyers” and even the U.S. Government at some point have to start taking a bite out of the economy. Further, durable goods are a good indication of how US businesses are investing in the medium to long-term future by buying things like production equipment and vehicles. A sudden drop after 4 strong MoM gains piques my interest. Are businesses seeing less activity (a leading indicator) and slowing their capital expenditures to gird for an economic slowdown? Is the government sugar high from 2 years of stimulus spending finally starting to wear off? I think both are true. And I’ll leave it at that.

Speaking of durable ‘stuff,’ is it going to be a “December to Remember?”… Careful!

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at AndreasMueller@kw.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.