The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, September 27th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’: Real Estate Market Update: mortgage rates, home prices, supply, Nashville, and what the heck the government “shutdown” means.

Today’s Interest Rate: 7.50%

(👆.20% from last week, 30-yr mortgage)

Last Week

In case you missed it, last week’s article was our most popular yet! Probably because I lost control of my fingers and went on a keyboard warrior rant re: insurance prices and drug companies. Our readers highly recommend, however :)

The Federal Reserve kept rates high last week, but that isn’t yet crashing home prices; in fact, just the opposite. Home prices (and mortgage rates) are continuing their march upward, just like that ants go marching one-by-one song we used to sing as kids. Except up, not into the ground. (Well the comparison made more sense in my head. But the video is cute).

The Fed’s next meeting is Oct. 31st - Nov. 1st.

Home Prices UP

New numbers out this week from AEI show home price appreciation continuing upward. The short version: We are back to record levels.

The long-er version: keep reading.

National YoY (year on year) home price appreciation for August 2023 was 4.5%, up from 3.8% a month ago and down from 10.2% a year ago as we exited the era of low interest rates and “free” money.

The market bottom appears to have been earlier this year, around April. (this is interesting because many of the high growth markets bottomed in January, like my home market of Nashville).

Historically, home appreciation in the low price tier has outpaced home appreciation in the upper price tiers, and that remains the case.

YoY home appreciation varied significantly among the 60 largest metros. For example, Austin’s bubble continues to burst, losing -5.5% (-9.2% inflation-adjusted) yet Kansas City gained +11.3% (+7.6% inflation-adjusted).

National Month on Month (MoM) home appreciation in August was -0.1%, declining for the first time since January 2023 as we have passed the spring and summer home buying season, when seasonal pricing strength is the norm.

Compared to their pre-pandemic level, the volume of existing home sales (not seasonally-adjusted) in August 2023 were down 30%, and housing inventory was down 34% as compared to August 2019, and still hovering around two-thirds of the 2017-2019 levels.

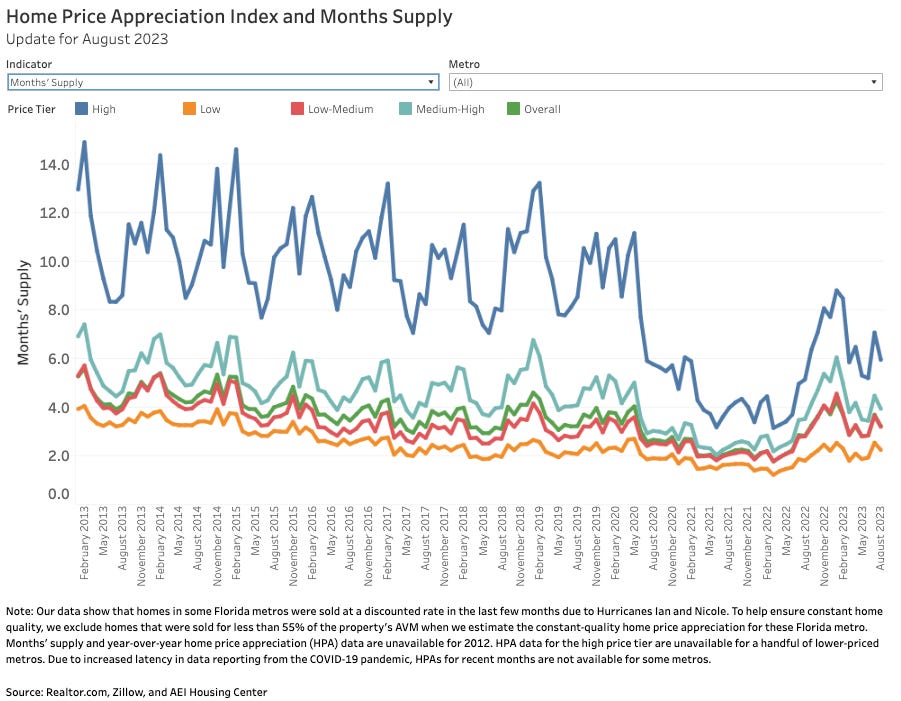

Months’ remaining supply was 3.1 months (not seasonally-adjusted) in August 2023, down from 3.6 months in July 2023 and 3.3 months in August 2019 (pre-pandemic).

Expressed YoY, we can see that the bottom for appreciation (not total prices) nationally appears to have slowed to near zero in April and is now re-accelerating.

At the same time, the supply of homes on the market tightened across all four price tiers in August 2023. As these relate to month’s supply, we likely can already predict what the chart will look like. More expensive homes are sitting on the market, and there are more of them. And the reverse is true for the lower priced homes. No nearly as many of those babies. Although all supply is down from pre-COVID.

Months’ remaining supply was 3.1 months (not seasonally-adjusted) in August 2023, down from 3.6 months in July 2023 and 3.3 months in August 2019 (pre-pandemic). Given historical data, a 7 months’ supply represents a “normal” national market and AEI predicts that would need to increase to 8-9 months to trigger a national YoY decline in home price appreciation. That is EXTREMELY unlikely, mainly because we just don’t have enough homes and household formation continues to outpace home building.

Thus, home prices will continue to march.

Expressed as a historical index of price, it may be easier to see this trend. Again, lower priced homes are more popular and their prices are accelerating most as a result, likely driven by higher mortgage rates pricing out folks.

Or expressed another way…

What I’m seeing in Nashville

When compared to the overall market, my home market of Nashville is appreciating at one of the highest levels, relative to others.

At a more granular level, the 30 day rolling sales price is up (remember September 5th is labor day holiday, hence the dip. (and also my birthday :)

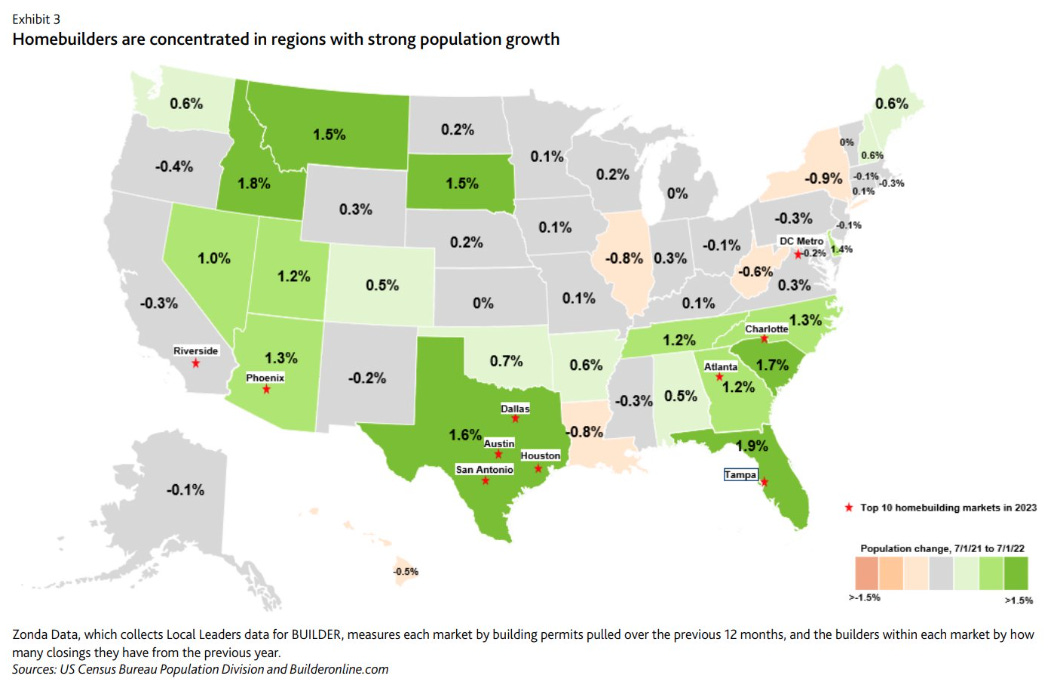

Why you ask? Well, one reason is mo-people. Folks are moving here. Anecdote: 100% of my new tenants this year are transplants. Check out US net migration #’s. Shout out to Montana, Idaho, Nebraska, Florida, SC and Texas too.

For beginning real estate investors, this map is gold. You want to make sure you are targeting a growth market where folks are moving. Looking for a local ass-kicking Realtor in your market? Feel free to reach out. I’m happy to refer you to an investor-friendly, no shenanigans, top-producing agent in your market.

Homebuilders - Incentives are the new Normal

Rate buy-downs, $ off closing costs, low permanent mortgage rates near 5% - homebuilders are continuing to ramp up incentives to purchase a new home. Homebuilders have to build and sell houses they build, no matter what the market is. And they don’t want to be caught holding the bag. They are offering deals, baby! (While homeowners who want to sell are stuck in 3% mortgage rate handcuffs, unable / unwilling to move).

Just check out the pitch Lennar sent me this morning to my inbox.

Government “Shutdown”

Ok, what is this whole government “Shutdown” talk? Does it matter? Answer: no. But it’s worth a look.

Put simply, each year the Federal Government passes 12 spending bills to fund all areas of government operations from Defense to Education (this does not include off-budget items like social security, medicare and the interest on the debt, which I won’t get into). You can see the status of those bills here: (hint: nothing has passed into law) https://crsreports.congress.gov/AppropriationsStatusTable

Historically, since really the Gingrich-Clinton Impeachment era of the late-90s, this has been a total shit show. It’s been tough getting both sides to agree on what to spend $ on. For the last 10 years or so, we can just go ahead and upgrade this to wonton, malicious, dumbassery. And I say this having worked as a senior staffer in the US Congress. It’s bad.

If Congress is not able to fund government operations before the end of the fiscal year (i.e. when the money runs out on Sept. 30th), or they dont extend their timeline, or they extend and then cant pass spending bills, or they only pass certain spending bills (it gets really complicated fast) then we will have what the media refer to as a “Shutdown.” In reality, this means that general operations will cease and only essential operations will continue. Think of this as the government’s version of Safe Mode.

In practice, for everyday folks, this means you may find your national park closed, but you will likely not notice the effects. There are however a multitude of programs that will hit the pause button and this delay could be consequential for few, like a delay in FEMA providing disaster grants. Not great if you are in Maui or FL. Nobody in the federal government loses their job and back pay is provided for any bureaucrat that is temporarily furloughed.

There is one additional difference with this Shutdown (I hate calling it that) the credit rating agencies are getting more actively involved. These 3 agencies - Moody’s, Standard and Poor’s and Fitch - have been getting increasingly anxious about how the federal government’s inability to cooperate on spending and debt issues as the sausage is being made, due to a stark political divide between Dumb and Dumber, I mean Republicans and Democrats.

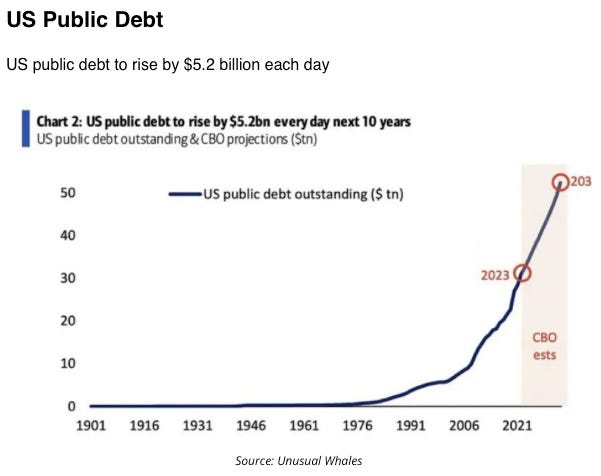

Moody's, the last big credit rating agency giving the US a top credit score, is getting nervous about a possible government shutdown and is rumored to be thinking of downgrading the credit of the United States if one occurs. They're watching how Congress is struggling to agree on the spending bills and how crazy the interest on the debt is getting.

“A government shutdown would demonstrate the significant constraints that intensifying political polarization continue to put on US fiscal policymaking during a period of declining fiscal strength, driven by persistent fiscal deficits and deteriorating debt affordability,” Moody’s said of the political situation. Their confidence is wavering.

Some quick history: S&P cut the U.S.'s credit rating in 2011. Then Fitch followed suit just this August. So, Moody's is now considering a similar move. A rating cut may push US Treasury rates higher, and thus accelerate the cost of the interest on the debt.

No bueno.

Also, if you are interested in learning more about the state of the economy, tech industry, and want to laugh, I highly receommend you watch the latest All-In Summit. Fantastic programming from many of our greatest minds today.

Silver Lining for Mortgage Rates

One potential positive affect could be, and I am not routing for this, that a Shutdown and credit rating cut could slow the economy and thus make the decision for the Fed easier to stop raising rates. Or even pull forward the timeline next year to start cutting rates. Which in turn will lower mortgage rates and reinvigorate the housing market.

But, higher rates will likely hurt consumers and the economy more, even if it benefits the one transaction, purchasing a home in the next 12 months. The interest on the debt is getting out of control and we really can't afford this.

The Bottom Line

While we shouldn’t be concerned with “headline” news pounding us over and over about how one side of our political perspective is better or worse than the other, and I hope we can agree that they all suck, we can take action today to improve our own status. You have faculty over your own behavior. When it comes to finances, do that opposite of our politicians: work hard, invest your savings, don’t speculate and cut down on costs.

Fun fact, do you make more money when you make a dollar or when you save a dollar? Answer: you make ~50% more when you SAVE a dollar, because you pay taxes on those extra dollars you earn.

Always be ready for the unexpected and gird for potential downsides. For example, higher gas prices are moving higher, rapidly. And this, if you didnt know, often precedes recessions, so take this time to tighten the belt and do some additional financial education. It’s free. I love Khan Academy, following financial folks on Twitter like @BobEUnlimited, @NewsLambert, and @KobeissiLetter, YouTube, or pickup a new book! Here is a great one on real estate investing, that I highly recommend. Oldy but goody. Shout out to David Greene.

Until next week, count me default skeptical, one-by-one.

That’s it for this week! If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out! You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and is intended for educational purposes only and does not constitute financial advice.