The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far ‘Unnamed’ Real Estate Newsletter, December 6th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin: 2024 housing market predictions, how many federal reserve employees does it take to screw in a lightbulb and…hold my beer, Blackstone, your balance sheet is soft.

Today’s Interest Rate: 7.08%

(👇 .22% from this time last week, 30-yr mortgage)

Interest rates? Copy and paste from last week: “Mortgage interest rates continue a slow stair-step lower, as the bond market senses inflation easing and anticipates (tries to) the Federal Reserve’s next move. The market continues to price in a higher chance the Fed is done raising rates and will begin to cut rates halfway through 2024. This, as the Fed continues shrinking the amount of bonds on its balance sheet. Their pincer movement is starting to have an effect.”

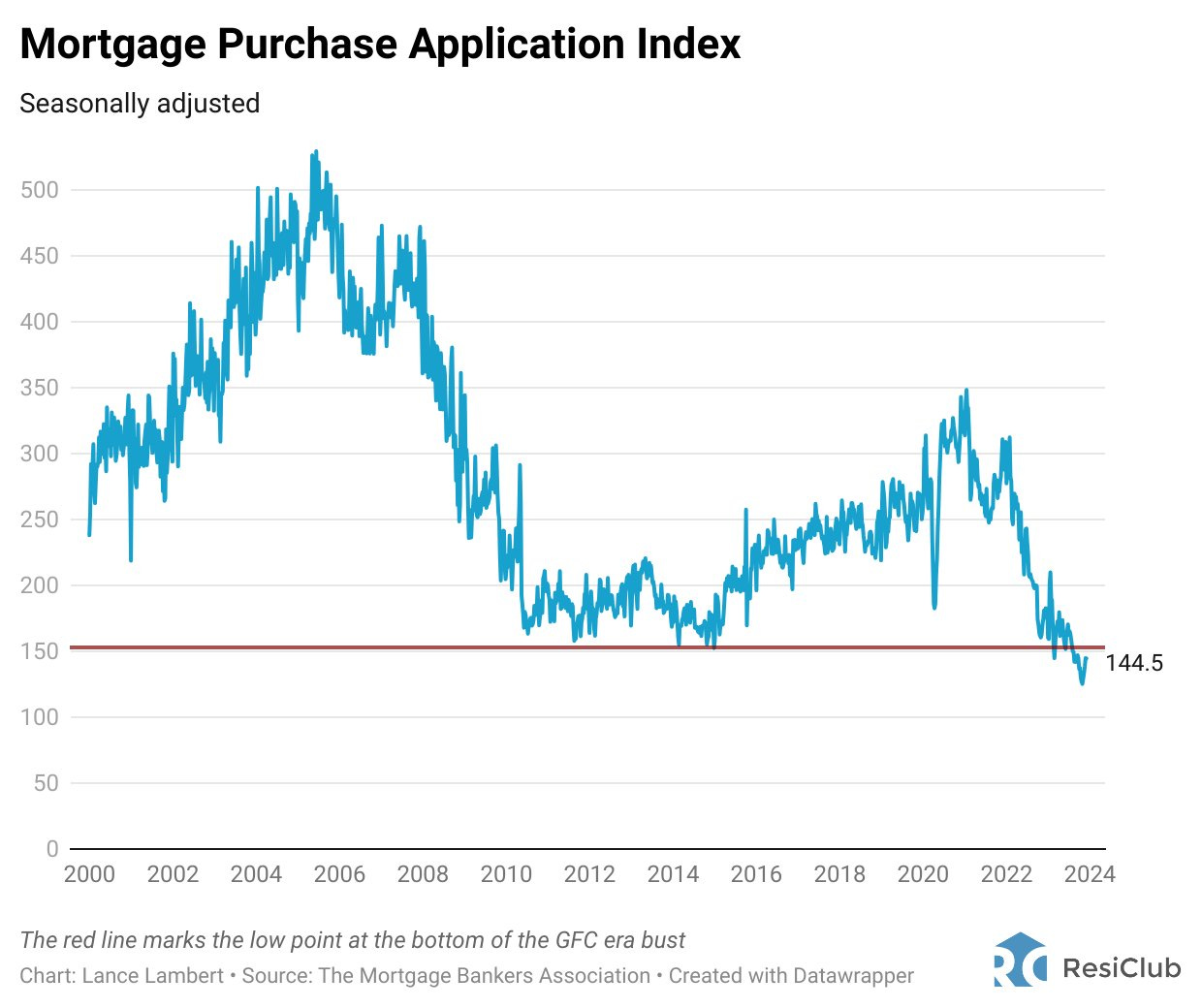

We are now virtually 1% off the 8.03% peak mortgage interest rates for the conventional 30-yr mortgage (i.e. 15% less interest paid by homebuyers) ~a month ago. Mortgage purchase applications haven’t reacted too sharply yet, but are showing signs of movement. Prospective homebuyer-owners (not investors) are likely waiting for 3-tiers of interest rate decreases, I predict a strong wave of mortgage applications near 6.5%, stronger at 6% and then stronger yet at 5.5%. 5% is probably where we will settle longterm. IMO.

Redfin: 2024 will be “a season of hope for aspiring homebuyers”🔥

According to Redfin, 2024 will begin a significant turnaround in the housing market, led by a mortgage interest rates and resulting in movement - a la 2021 - around the country as inventory loosens up. Let’s dig in to their predictions.

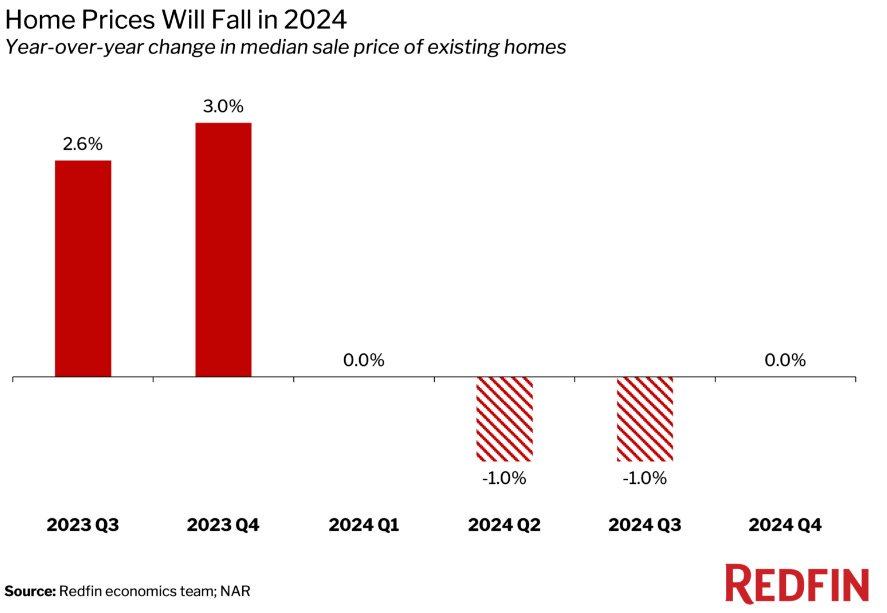

Prediction 1: Home prices will fall 1%

Come summer time, home prices (YoY) will decrease nominally 1% (not inflation adjusted?) Interestingly, Redfin claims that home prices haven’t fallen since 2012, which is incorrect, I guess they missed 2022? See chart:

My take: home prices bottomed in January of this year and are up from here. There is just too much pent up demand, which will gobble up any and all increased supply resulting from interest rates dropping. This will be a theme of this article. Redfin’s chart:

Prediction 2: New listings will tick up

According to Redfin, home prices will fall because supply will rise more than demand (the point at which we disagree). That would be a favorable shift for buyers: 2023 Prices are up around 3% YoY and the typical monthly payment is just $150 below an all-time high. I am dubious. Redfin points to a double-digit increase in homeowners contacting Redfin for help selling their home, alongside a drop in requests from prospective buyers. Mortgage rates are projected by major institutions (more on that below) to decline to 6% by the end of 2024, which will start to ease the lock-in effect, but not entirely by any means. 80% of homeowners have a rate below 5%.

My Take: I think Redfin is severely underestimating buyer demand. One variable that bears mention: wealth transfer from boomers to their kids/grandkids is happening now. We are in the beginning of the largest wealth transfer in history, upwards of $129 TRILLION, according to BofA. How many homes does that buy? 🔥🔥🔥🔥 many.

Hold my beer, Blackstone, your balance sheet is soft.

Prediction 3: Home sales will increase and end the year up 5%

According to Redfin data analytics, in Q1 2024, existing home sales will be on pace for 4.1 million total, up from 3.85 million in Q4 2023. Sales will continue rising throughout the year; they’ll be on pace for a total of 4.5 million by the fourth quarter. Home sales will speed up throughout 2024 as affordability improves and more homes hit the market. Overall, Redfin expects 4.3 million sales in 2024, up 5% YoY. A crucial difference between 2024 and 2023 will be sales gaining momentum throughout the year instead of losing momentum.

My Take: I don’t disagree with any of this per-say, just that the balance toward demand, again, is being underestimated. Too many people and gobs of money and credit (don’t underestimate a rejuvenated credit market) on the sidelines. Anecdote: of all the investors in interact with regularly, ALL of them are raising money to increase buying next year. One told me that he is concerned about there not being enough supply in his local market of Nashville; asking for a friend of course 😆.

And where are folks looking to buy? Here are the top places prospective Redfin buyers are searching for (and where they are leaving). Bye bye LA, hello Vegas and NashVegas!

Prediction 4: Mortgage rates will steadily decline–but remain above 6%

Redfin predicts the average 30-year mortgage rate will linger at 7% in the first quarter, then decline throughout the year. Mortgage rates will fall to about 6.6% by the end of 2024. The gradual decline in rates combined with the small dip in prices will bring homebuyers some much-needed relief.

Mortgage rates are likely to remain well above pandemic-era record lows because financial markets increasingly believe the country will avoid a recession in 2024. The Fed will likely keep interest rates at their current level at the start of the year even though inflation is largely under control. But then they’re likely to cut rates two or three times starting in the summer, which is why mortgage rates will decline as the year goes on, according to Redfin.

My Take: I think they are actually being too conservative here. IMO mortgage rates should be more closer to 6% than 6.5% in Q4 2024. Many financial institutions agree, and those that don’t have yet to put out a revised estimate this month, now that rates are close to 7% today. But Redfin is remaining steadfast in their prediction, which is closer to the government’s number (Fannie Mae). See 2 charts.

AND…

* TANGENT *

Speaking of interest rates, and the Federal Reserve who basically controls the mechanism. How many people work at the central banks? 22 THOUSAND?! Holy hell, what do they all do?! How much does this cost? I’m envisioning a large room with typewriters and people pulling levers. I guess we know how many economists it takes to screw in a lightbulb.

I Digress….

Prediction 5: Change will come to the real estate industry

Redfin predicts the traditional commission structure will change, as newspapers and real estate portals publish more information about commissions. Homebuyers/sellers will become more aware of how much an agent costs, and less apologetic about negotiating commissions.

My Take: This position is convenient, given that Redfin is a “discount brokerage” their agents charge 1% not the traditional 3% per side. But I don’t disagree, and I honestly hope that it changes in favor of homeowners. There are frankly too many real estate agents, heck New York City alone has 80k! Weeding out the casual agent and underperforming broker will allow some needed consolidation in favor of excellent service/expertise who can do higher volume and reduce margins (ie commissions paid by homeowners/buyers). I also agree that rather than hiring their own agent, many homebuyers will work directly with the listing agent and not “pay” a buyer’s agent OR hire a buyer’s agent and go direct to a homeowner when the property isn’t listed on the market. This is common for new development sales and finding great off-market deals. Both strategies, when just 1 agent is involved, is only for savvy sellers/buyers/investors but I can tell you I, and my investor friends, do both all the time. Why pay 2 agents when I have access to Redfin/Zillow/Facebook/Old School Doorknocking etc… and can source deals?

There is also the possibility of legal action to force / accelerate this trend. The DOJ continues to look into whether listing agents should be involved in setting the fee paid to a buyer’s agent. The National Association of Realtors (and many brokerages) recently lost a civil suit totaling $1.8 billion. Changes are just getting started.

Prediction 6: Renting will lose its stigma

This is the age old adage. Rent or buy? Well it depends, and there is an emotional aspect (that cozy feeling of homeownership). Do you like working your home? If you are handy you can add tremendous value, at a discount to having to hire a contractor. That’s equity in your pocket. But if not, renting can be much less stressful. Have the landlord handle those pesky maintenance, repairs, deluge of water coming from the washing machine on the 3rd floor that just exploded (Happened to me in my home. Ah the humanity!)

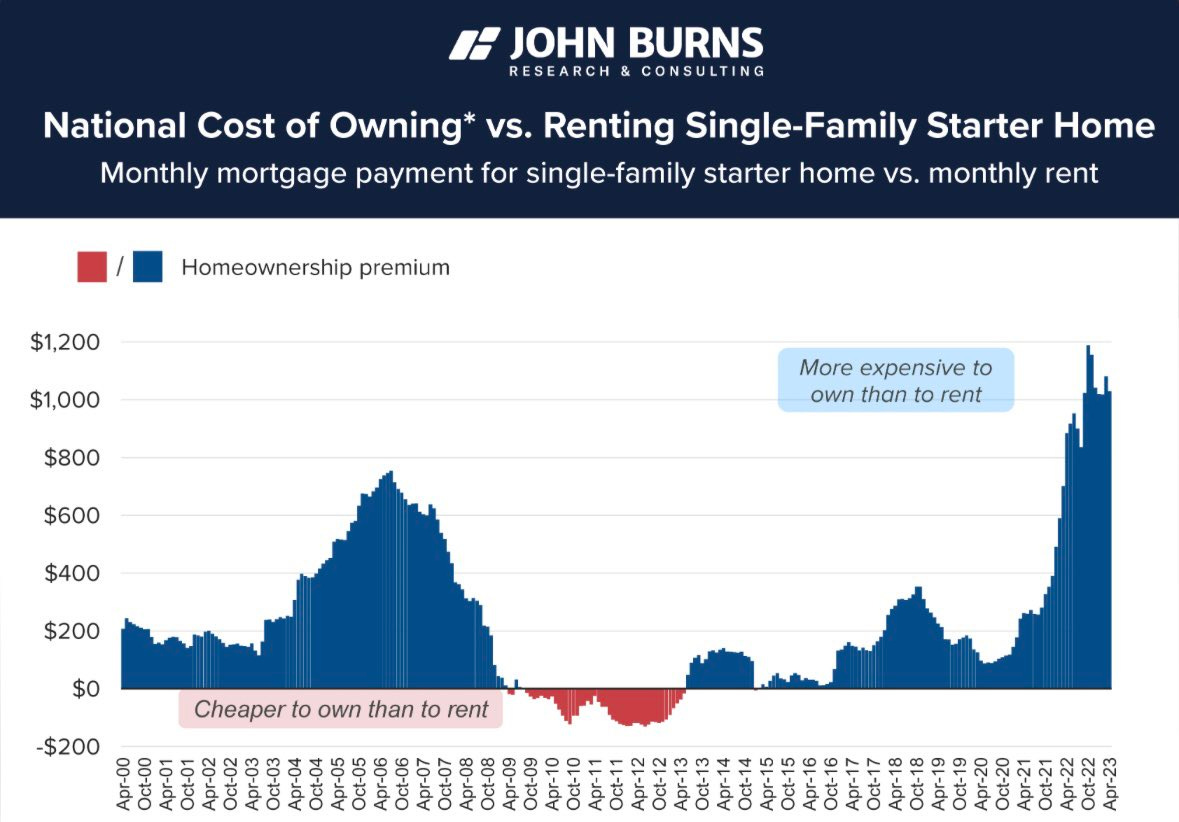

How “expensive” is it to rent vs buy? According to John Burns research, interest rates have made it just too “expensive” in general to own, vs rent.

Further, according to Redfin, demand for large rental apartments and houses will climb, one in five millennials who responded to a 2023 housing survey believe they’ll never own a home. Nearly half said homes are too expensive or they can’t afford to the down payment. But others just prefer renting: 12% said they aren’t interested in homeownership and 7% said they don’t want to put in the effort to maintain their own home. As a result, Redfin expects prices of large rental units to climb next year as supply fails to meet demand, but smaller rentals may drift slightly lower because there are more of them and a backlog waiting to hit the market.

There is a 3rd option however…: Rent where you live, and rent-out what you buy. Why? Well, tax incentives for one, which you don’t get when living in your primary residence. Real estate mogul Grant Cardone agrees. If you can stomach his brash and boisterous attitude, he preaches in his books that owning your primary residence is a “trap” and that money is better put to use in buying investment properties and renting where you physically live. And if renting in your area is “cheaper” than owning, more reason to pay rent and have your tenants pay your mortgage. Plus, there are 4 other ways you make money real estate investing that likely make it financially a better choice of where to put your money.

Prediction 7: Biden has a housing problem, which could hurt his re-election bid

Ooo now we are getting political! Essentially Redfin believes the government will be “forced” to act because “Even though the overall economy is strong, high housing costs are making many Americans feel poor.” I agree. And both/all candidates are going to offer “plans” to “fix” the housing shortage/high costs. Specifically, Redfin believes the Democrats will focus on subsidizing down payments, rental housing vouchers and first-time homebuyers. They believe Republicans are more likely to focus on reducing regulations that limit development. My take. All of the above. In fact, one need only look at news articles from 2009. All those policies are going to be recycled.

Bottom Line

We are approaching a change in policy by the federal government in 2024. Interest rates will decrease, as inflation is tamed. In all likelihood this will happen, the question is how fast?

Homebuyers may be faced with a conundrum: If mortgage rates fall, demand will increase. Bidding wars may follow. Maybe not as insane as 2021, where we had work from home (still do), Millennial buying (still do, and Gen Z), constrained supply (more now), increased costs (still increasing, just slower), aging (about the same), worker shortage (still do, and more if border policy/immigration is tightened) etc….

But, I assert, demand will be strong in 2024, like...sourdough bread, sopping up all the goodness on the plate (housing supply) to the last drop. It likely won’t matter if supply is strong. Hopefully it is!

What do you think about Redfin’s predictions, and my comments? Leave a note in the comments or email me directly. I love taking questions!

Most Interesting Tweet of the Week

Strong case for renting here from the Economist, or option 3, be a landlord.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time, stay skeptical.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.