The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, October 25th edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’ effects of high cost of capital in real estate, and I find one of the most revealing charts on US death rates. This was, frankly, astounding.

Today’s Interest Rate: 7.95%

(Even from last week, 30-yr mortgage)

Mortgage Rates Stay steady at near 8%, So now what?

Week-on-week, both the 30-year mortgage and 10-year Treasury remained at last week’s levels of 8% (7.95%), and 5% (4.955%), respectively.

It appears higher interest rates, and thus cost of capital, are beginning to take bites out of the resilient real estate market, and economy writ-large, albeit small, for now. Let’s see what’s happening in the market right now and where opportunity for us investors lies.

Credit Availability is 👇

Want a loan? It’s harder to get today for pretty much anything you need capital for. Credit availability from banks is down from a year ago. And three straight quarters of multifamily / commercial mortgage delinquencies are not helping.

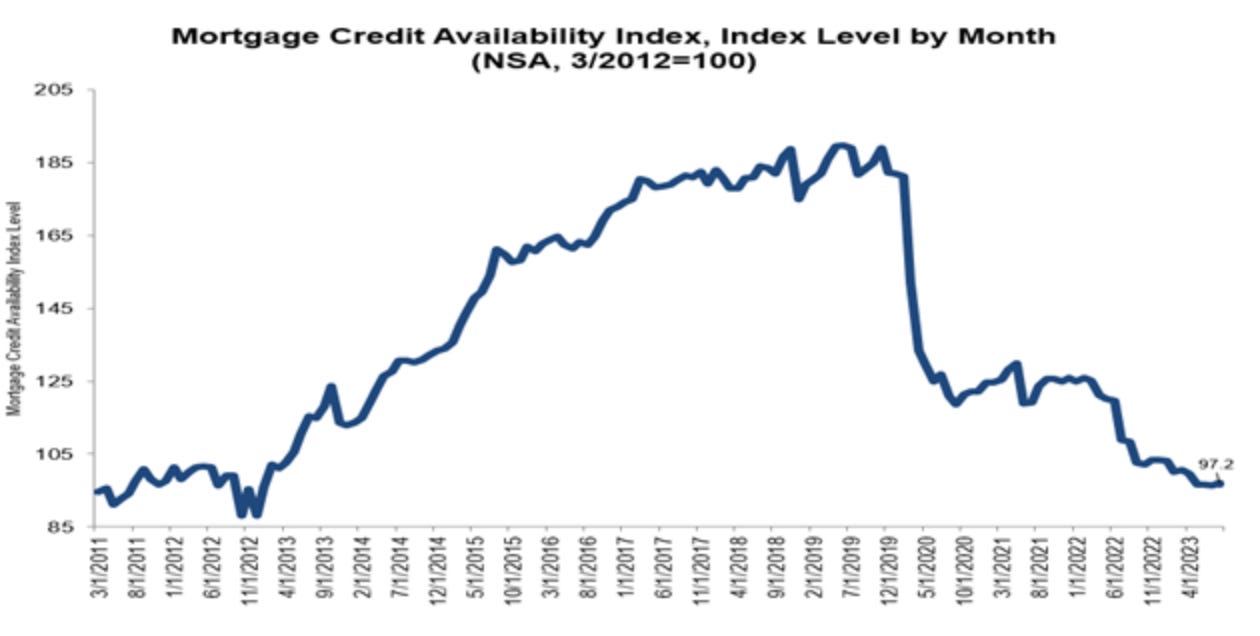

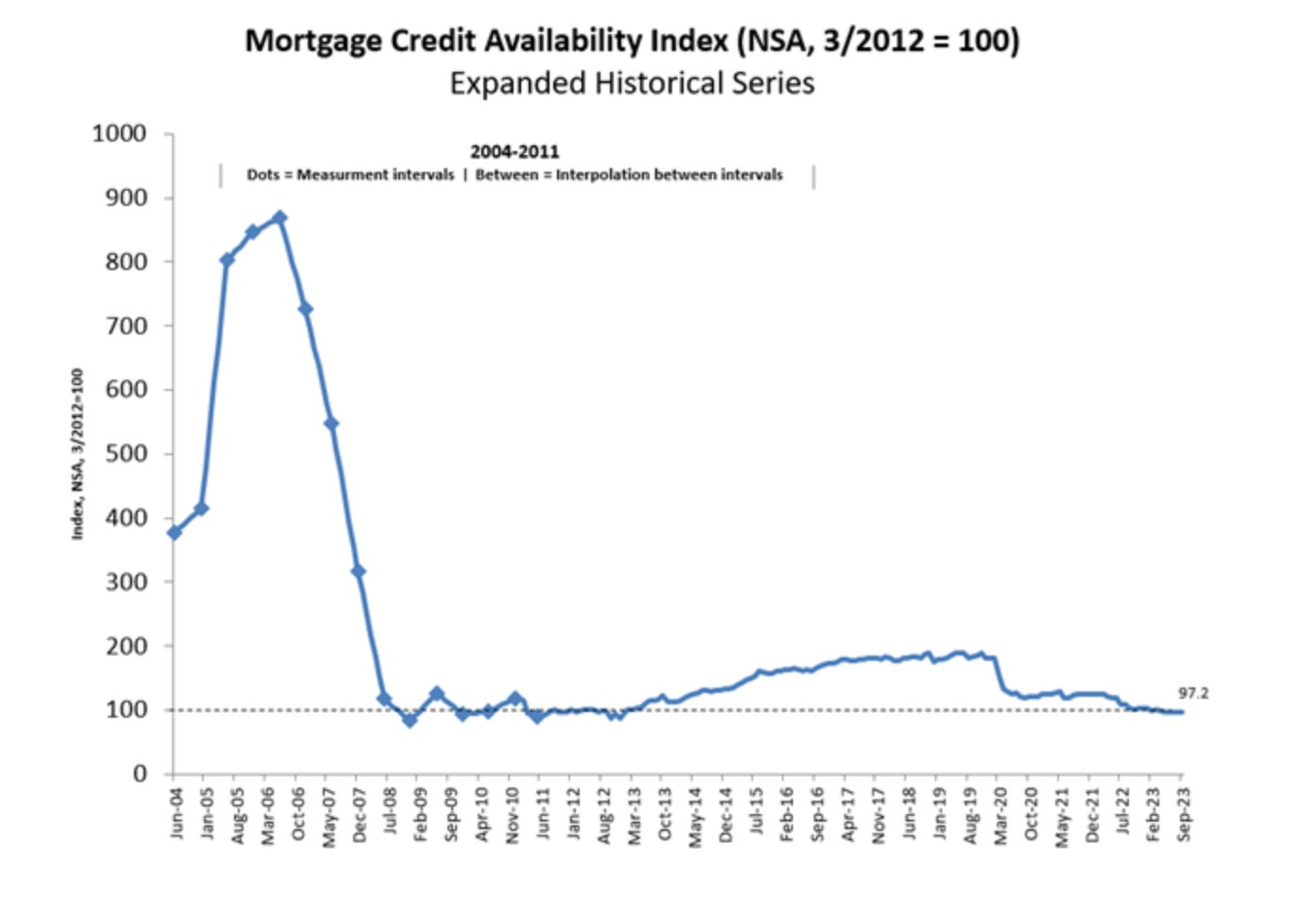

For us real estate investors, mortgage credit availability is down “e-u-huge," we are now back to 2012 levels, the time we were starting to recover from the Great Recession / Housing Crisis.

* Just for fun, it’s important to note we (borrowers and lenders) are in a MUCH better position than 2006, before the last housing crisis. And lending standards were truly non-existent.

We’re not even in the same universe. My dog could have gotten a loan back then.

Foreclosures are Ticking Up

In this most recent quarter, foreclosure activity was up 28% from the previous quarter, a total of 124,539 properties had foreclosure filings — default notices, scheduled auctions or bank repossessions. MoM, fillings were up 11% in September and 18% YoY, from September 2022, according to a recent report by real estate data firm ATTOM

Savings is Running out for 80% of Households

Only the wealthiest 20% of the country have savings levels above what they had in 2019, according to the latest Federal Reserve study of household finances.

For the bottom 80% of households by income, bank deposits and liquid assets were lower this year than they were in March 2020. And the personal savings rate has now been below 5% since January 2022, just before the Fed started raising interest rates. Historically, a savings rate below 5% has been correlated with a significant economic event/slowdown.

Tangent Alert: Cause of Death, by Age Group Has Shifted Dramatically

Unrelated to our current discussion but related….The change in the 18-44 demographic is astounding. Opioids, particularly drugs containing fentanyl, and suicide are the new overwhelming cause of death. Young adults, those of us in our “prime” are in real trouble in this Country.

Some Positives: Rent Growth 👇

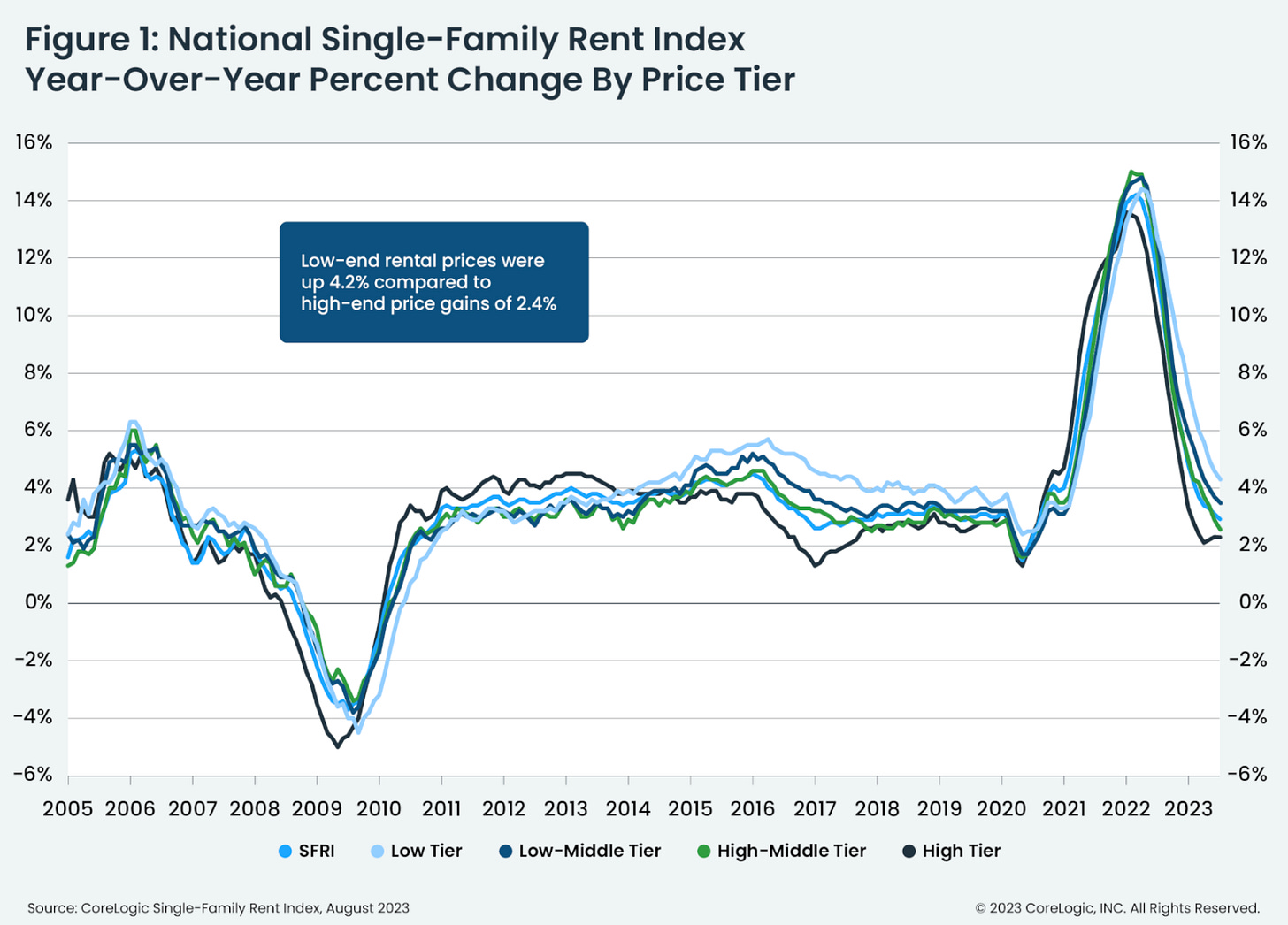

Rent growth (we are talking apartments here) has begun to deflate, albeit on an average still remaining relatively flat. This is widespread, rents cooled MoM in September in 85 of 100 top markets and in 70% of markets, YoY. A significant shortage of vacant units helped drive rent growth in 2021 and 2022.

However rents still remain high, and relatively flat YoY.

Apartment builders have been active for the past year, responding to the demand for more rental housing.

However, after a great start to 2023, new starts for apartments have fallen sharply, starting in June of this year.

My 2 Cents: Apartment rents should stay flat for 2023 and beginning of 2024, as new supply in the pipeline comes on the market, after which rent growth will resume. The story is different for single family homes and small multifamily (2-4 unit), where rents will continue upward and demand will outpace supply. Detached/single family home prices will remain strong and inflationary, particularly lower tier priced homes.

The Bottom Line

If you are one of the financially shrewd, cheap, frugal folks (or just lucky) ones out there and have access to some cash, especially if you are a first-time homebuyer or real estate investor, this market is presenting better and better opportunities to scoop up assets on the cheap. Banks are still lending to folks with decent credit and enough cash stowed away for a down payment. Pay a few hundred bucks more a month in interest but negotiate that property for 10% less than 2022 prices, you will come out far ahead in just 1 year’s time.

The old adage buy low sell high remains true and timeless.

What’s next for the real estate market and the economy? Property appreciation, in real terms accounting for inflation, is likely to remain flat for the year. I’m skeptical of those calling for a new bull market (stocks or otherwise) and am still processing how bad the bond market is without large foreign governments and the Fed not participating like they used to. This will keep mortgage rates high for the foreseeable future. I’m still calling 12-18 months of high interest rates, or until something breaks. High rates will mean continued low supply so I don’t expect real estate prices to fall, highly unlikely. Especially in markets where population is growing fastest.

Could we have a recession? Yes. In fact, it could be that those Bears calling/predicting a recession for this year were simply early. Institutional analysts/pundits are predicting Q1 of 2024. But what’s the difference between being early and being wrong? Nothing.

I still predict that the Fed is done raising rates, and will start to lower them mid-2024. Energy prices are unfortunately going to be volatile / up due to world events, as will bond prices. All this should contribute to deflation. 12-18 months until we have 5.5% mortgage rates. Again, unless something breaks.

Unit next time… to paraphrase Steve Jobs and a particular magazine…

“Stay Hungry, Stay Foolish [and Stay Skeptical]”

-Andreas

** Bonus! Do you know the magazine I’m referencing in the below quote? For my subscribers, if you can guess the magazine I’ll arrange a free 1 hour conversation with yours truly to talk through any real estate / financial questions you may have! (see below)

What Magazine is this from? (Hint, it was a favorite of Steve Jobs).

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.