The 'Unnamed' Real Estate Newsletter

Market Insights for Real Estate Investors and Finance Nerds

Welcome to my so-far Unnamed Real Estate Newsletter, November 1st edition, where I do a brief, hopefully insightful, dive into real estate and/or financial markets.

Today we’re talkin’ the bull and bear case for real estate in 2024.

Today’s Interest Rate: 7.88%

(👇 .07% from last week, 30-yr mortgage)

Mortgage interest rates remained relatively flat this last week, and, high interest rates (sorry to sound like a broken record) are here to stay. Just this hour the Fed announced the results of its meeting of the Federal Reserve Board, where they kept Federal Funds rates unchanged.

(Tangent! Isn’t it interesting that “sounding” like a broken record and a “broken record” are idioms that literally mean the opposite? ie repeating the same thing and something never achieved before?….Ironic.

I digress….

Real Estate Market Outlook: A look at Bull vs Bear

So where is the real estate market going and what should investors be watching out for in 2024? For now, it’s a strong buyer’s market, they hold the leverage in negotiating. But buyers must also need to be a ‘strong buyers’ ie somebody with enough $ and the ability to afford/stomach/weather the higher interest rates, until they retreat.

Eventually the market will achieve some form of relative normalcy/equilibrium. Buyers and sellers will both feel like they are getting a deal/what they want, flowers will bloom, puppies will nuzzle your cheeks, and my garden will finally grow something other than weeds.

But until then, we may not see a more normal/equilibrium/regular/fair/attractive or whatever term you want to use, for 12-18 months… unless something breaks. But is ‘hoping’ for the economy to break really the recipe for a bull market case? Unfortunately, it seems that way to me. But let’s say I’m wrong (which does happen, I must admit) and we are on the edge of a more normal market sooner. What signals could be pointing us in that direction? Let’s dig in:

The BULL Case

Overall home prices are up just 2% YOY.

For sale inventory is on the rise, even though we are heading into the winter slow season, a potential positive signal for home price deflation.

Price reductions for existing homes are happening, nationwide nearly 39% of homes listed for sale will reduce their price. Anecdote: psychologically, sellers are now much more prepared for the weak demand and weak offers than they were last year. I see this daily.

Large investors in Single Family Homes are starting to buy again in significant numbers.

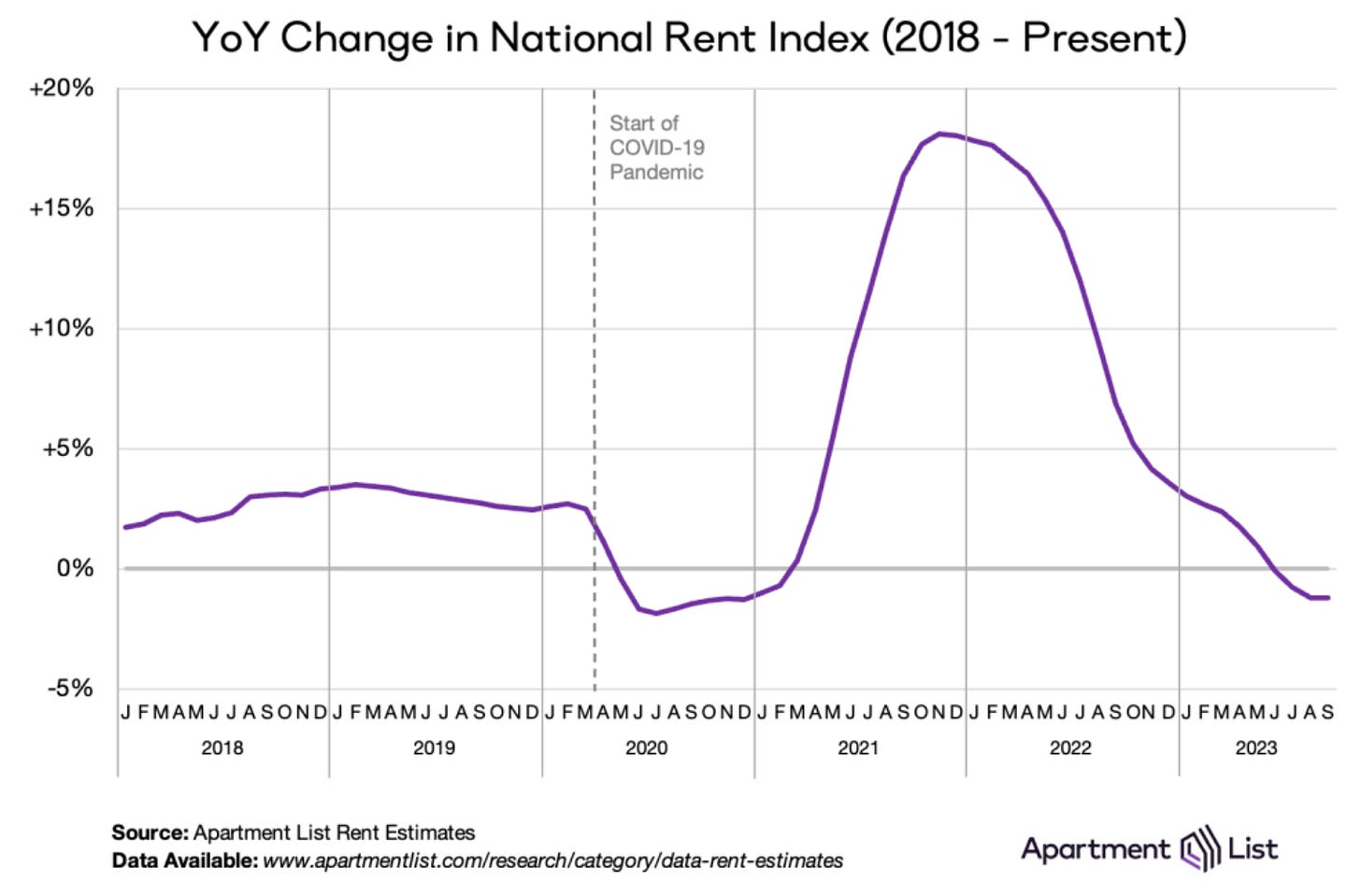

Rent growth for apartments is deflating. This is widespread, rents cooled MoM in September in 85 of 100 top markets and in 70% of markets, YoY.

The BEAR Case

Interest rates are likely remain high for a while. Why? The government is issuing a TON of debt right now as well as next quarter, as they just announced. In total, $1.6 Trillion, yes that’s right. Trillion, in 6 months. And, put simply, government debt (treasury bonds) compete with mortgage debt that are resold by your bank into the bond market. So as the government floods the market with new bonds to finance their spending, and since folks (investors, institutions, foreign governments) aren’t clamoring for Treasuries right now, bond prices will go down, and their yields up. High yielding Treasury bonds that are risk free, backed by the US gov, are attractive vs risky-ish mortgages, so fewer folks will buy mortgage bonds, and thus mortgages rates also go up, in competition.

And here we are, even higher mortgage interest rates (8%!) in the last few months and for the next few months (at least) even though the Fed is not continuing to raise rates (*yes yes I know there is more to these mechanics, but this is a primary reason why this is happening, IMO).

Whew, thats a lot I know. Need a refresher on how mortgages are broken up into little pieces and resold in the bond market? Here is a quick 1 min video:

Additional Reasons for the Bear Case:

Home prices are at an all time high and continue their increase. (this is both part of the bearish and bull case for the market).

Foreclosure activity was up 28% from the previous quarter (ATTOM)

Household savings is below 2019 levels for 80% of Americans. Only the wealthiest 20% of the country have savings levels above what they had in 2019. In total, “... excess household liquidity (cash-equivalent assets) has fallen from peak of $3.4T to $1.0T.” (JP Morgan)

After a great start to 2023, new starts for apartments have fallen sharply, starting in June of this year.

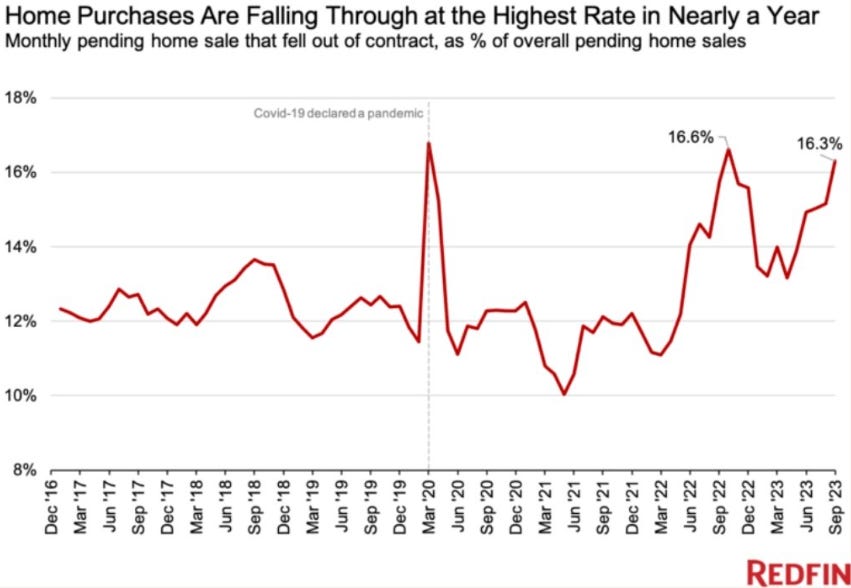

Home-purchase agreements are being canceled at a historically high rate.

Inflation rate may be increasing again.

Interest rates for the 30 yr fixed is projected to remain above 6.39% through 2024 and current 8% mortgages will likely trigger a recession. (Wells Fargo)

For the first time in history, you may need to make $100k to afford a home.

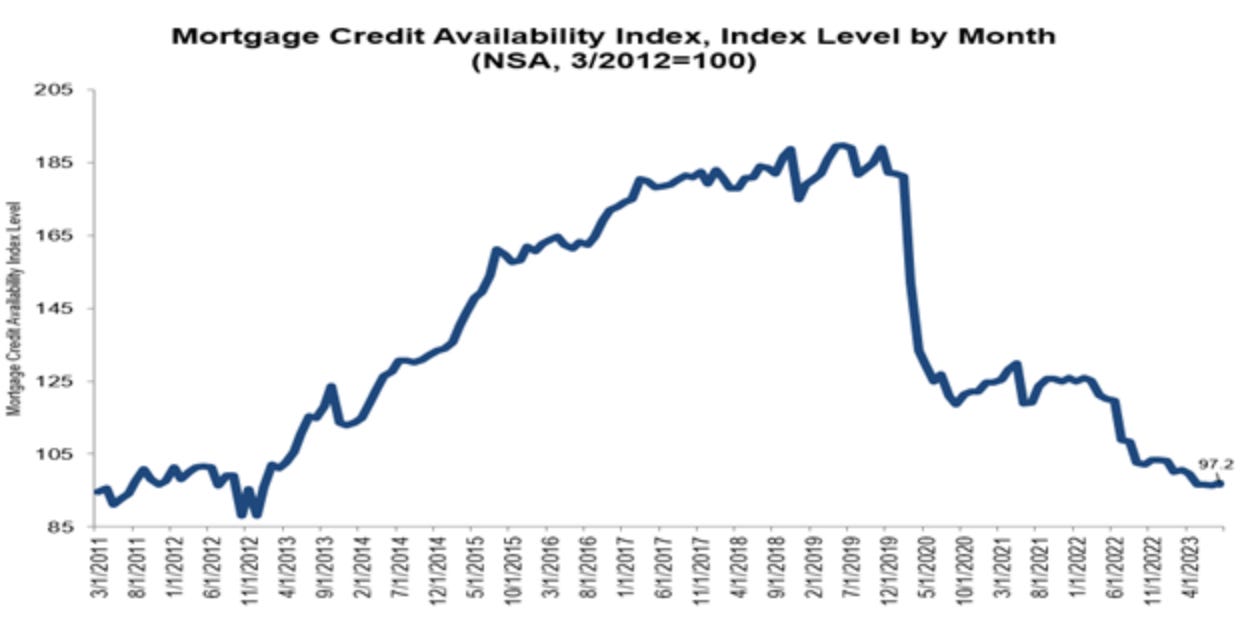

Credit availability from banks is down considerably from a year ago. Its hard to get a loan, for pretty much anything big you need to purchase/invest in.

The Bottom Line

With each case in mind, we are setup for next year to be volatile. If mortgage rates stay high (or heaven forbid rise even higher on the backs of heavy bond competition) any 2023 home price gains will be wiped out. If mortgage rates ease, we’ll see both pent up buyers and sellers entering the market, and home prices will increase in 2024.

IMO, there is a 70% chance that something in the economy “breaks,” within 6-10 months requiring the Fed to act, resulting in lower mortgage (and bond) rates. However, I am posturing my investments / real estates activity more conservatively, assuming that will not be the case and we don’t see lower rates for 12-18 months. In fact, we may be in a housing recession right now.

With this much uncertainty, it is more prudent than ever to stay skeptical. Keep on alert for great deals. To paraphrase Warren Buffett: there are no balls and strikes in investing, just wait for that fat pitch and swing.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me directly at Andreas.Mueller01@gmail.com

Until next time, stay skeptical.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.