Today’s Read Time: 9 minutes

The Weekly 3 in News:

73.3% of U.S. mortgage borrowers have an interest rate under 5.0% (Lambert).

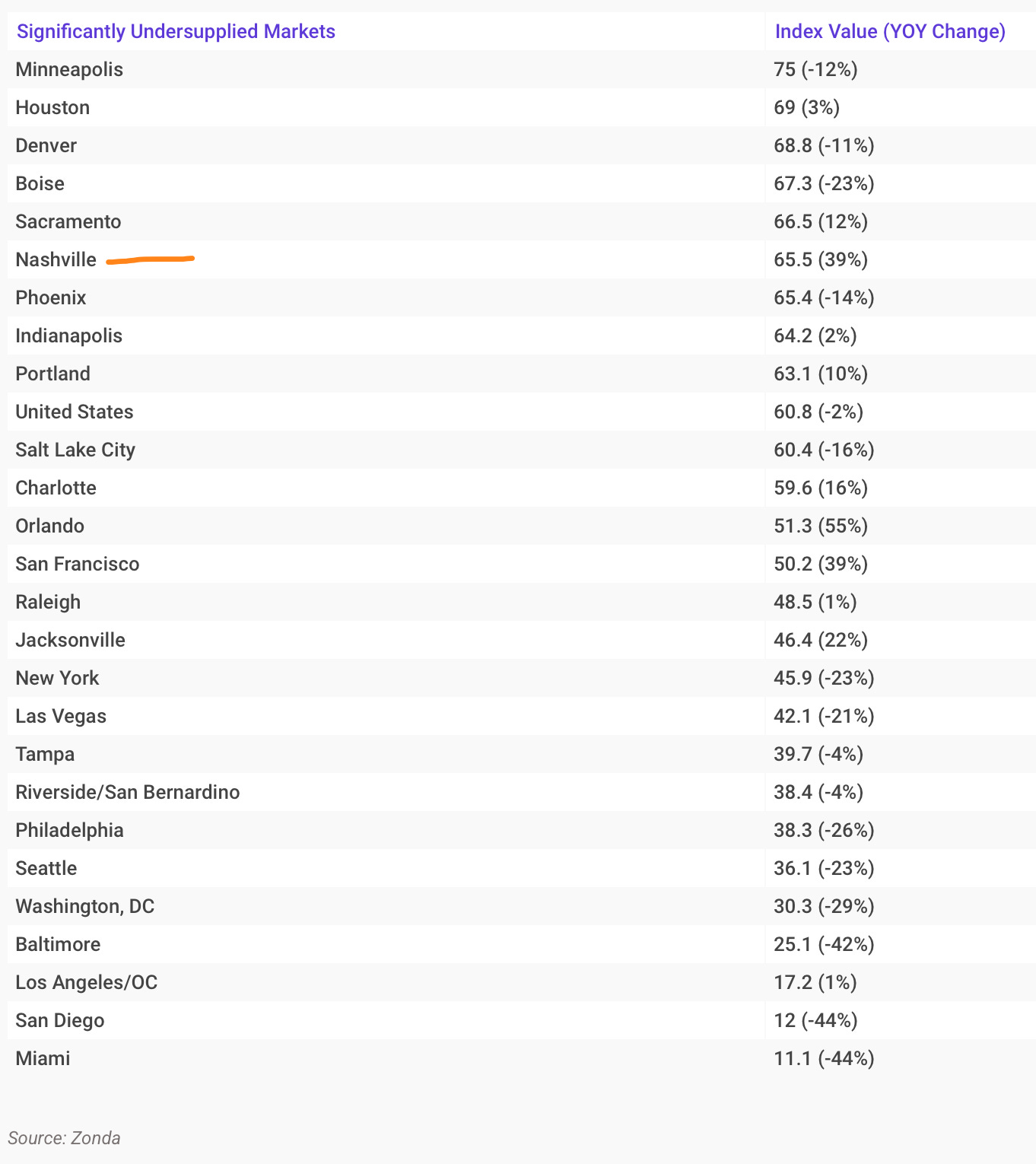

Most housing markets are significantly undersupplied for new lots to develop, including Nashville. We need more housing (Zonda)!

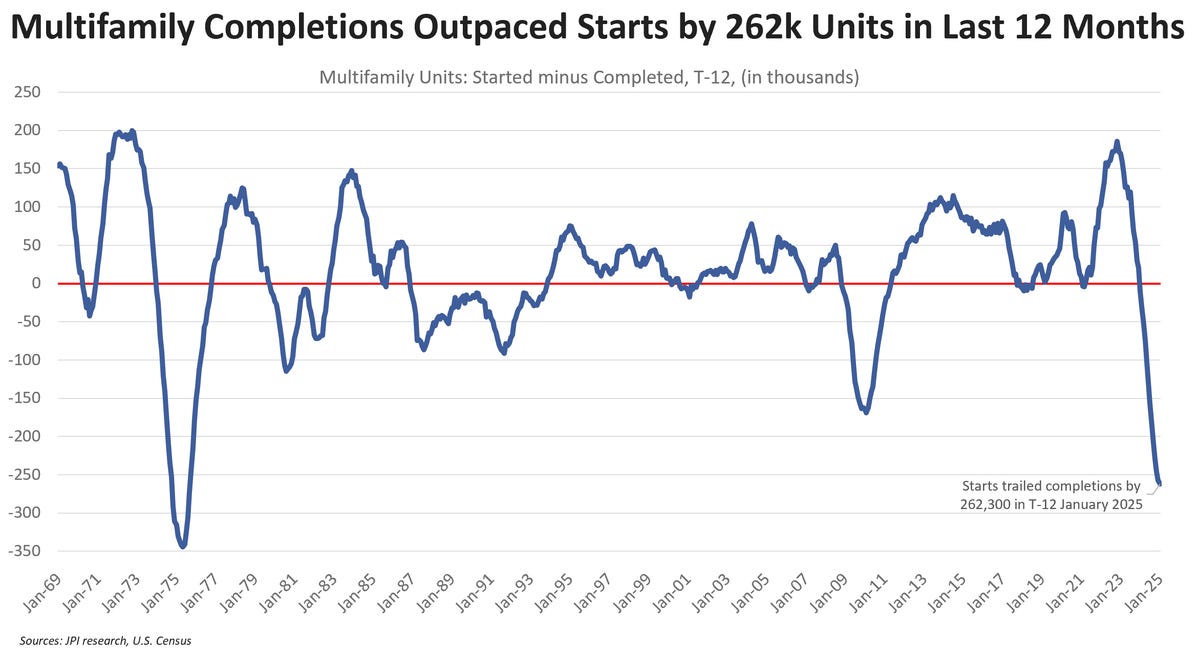

New apartment construction continues to plummet. Apartment development starts are trailing completions by the most since the 1970s. We are entering into a severely undersupplied housing moment as interest rates weigh on development (Parsons).

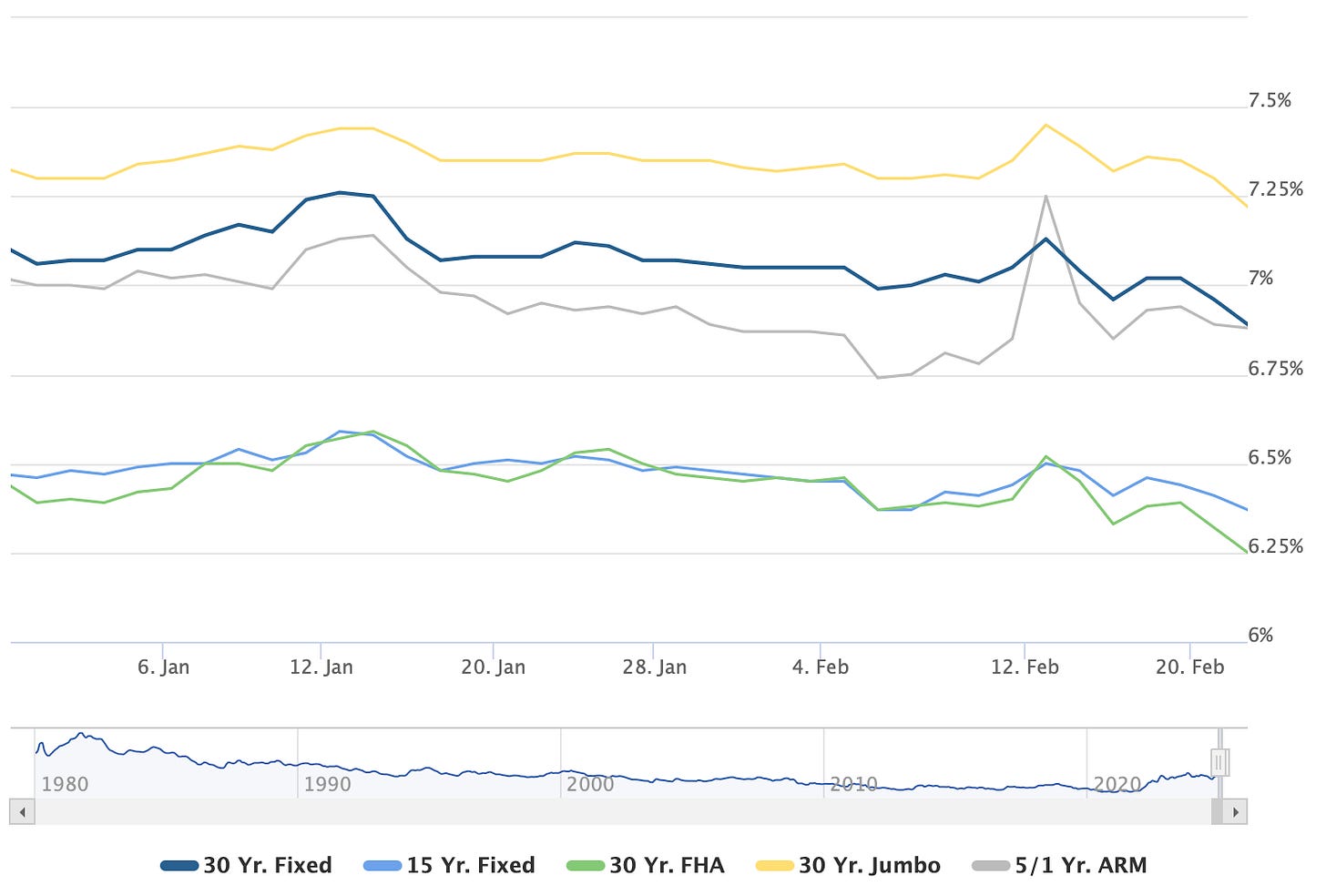

Today’s Interest Rate: 6.87%

(👇.09% from this time last week, 30-yr mortgage)

Today, we’re talkin’ markets, and where they go from here. Is inflation at risk of reigniting or is the long-term downward trend still intact? Will there be a catalyst for housing activity like lower interest rates? Or will rates continue to stay high?

I found some interesting countertrends this week.

Let’s get into it.

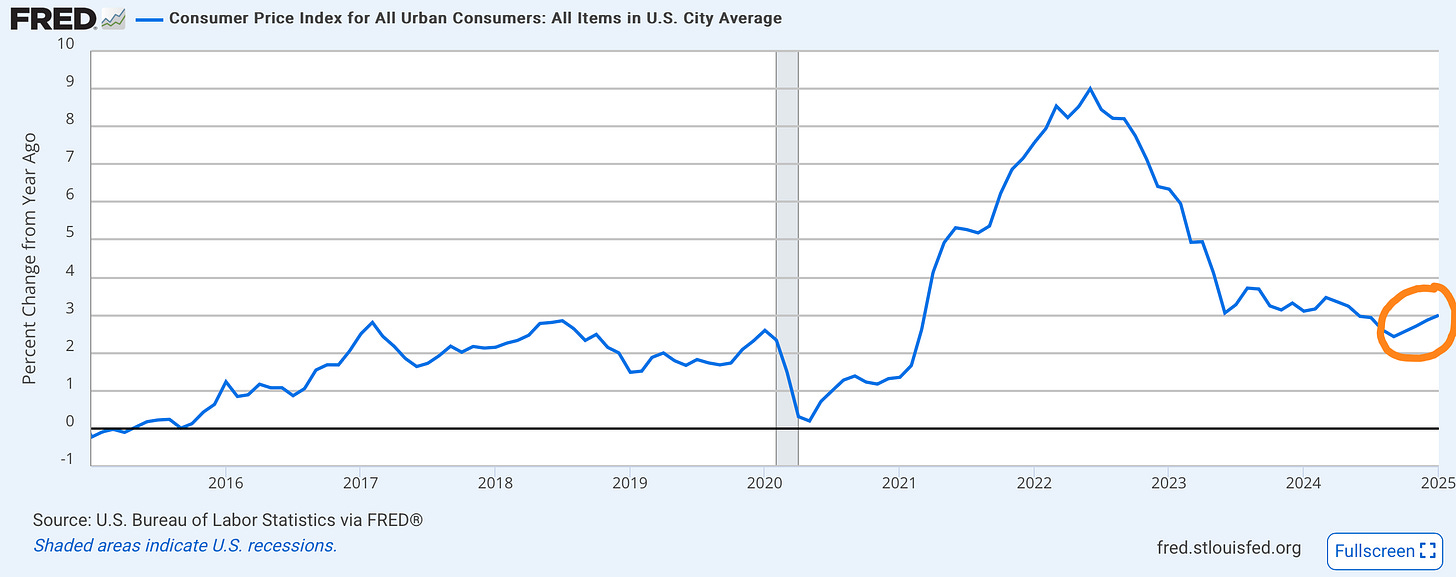

Inflation has been trending higher

Inflation has come down significantly since its peak. A few years ago prices were going up 9%, and now we have settled ~ 3% price growth. But this ain’t good enough, and is still 50% higher than the Fed’s 2% target.

And to his credit, Federal Reserve Chair Jerome Powell seems in no rush to cut rates with inflation above target level. During his congressional testimony last week, Powell said, “If the economy remains strong, and inflation does not continue to move sustainably toward 2 percent, we can maintain policy restraint for longer.” And that “the Fed would not lower its policy rate until there is “greater confidence that inflation is moving sustainably down toward 2 percent.” This is a welcome, cautious approach prioritizing inflation data over premature rate reductions.

However…. it appears that inflation may instead be reversing course.

It’s been four straight months of price increases.

October - 2.57%

November - 2.71%

December - 2.87%

January - 3%

Four, a trend does make.

And oddly, Fed Chair Powell seemingly brushed this off in his testimony, saying “A couple of months doesn’t make a trend.” This is not accurate. I couldn’t believe it.

This is a big deal, and it seems nobody is talking about it. A not so fun fact, we have not had more than 2 consecutive months of inflation growth since the end of 2021.

Until now.

I’m getting PTSD from when the Fed and former Treasury Secretary Yellen insisted for months and months that inflation was not a worry, it was “transitory..”

How did that play out y’all?

So count me extremely skeptical. Inflation has a real risk to the upside here.

* A quick break for a real estate request! *

Send us deals and get paid - If you have a multifamily property/deal of any size, we are buyers! And we always pay commission to anyone sending us deals. Shoot me a note or simply reply to this email if you have something and let’s talk turkey.

Need a property manager? - Don’t let just anyone manage your property baby. Our experienced property manager team knows how to handle all property management needs, because we are investors ourselves. No hidden fees, just simple straight-forward pricing. Get a free on-site quote today.

Follow me on the artist formally known as Twitter @andreasmueller, for daily market insights and whatever sage thoughts are darting around in my noggin. This is going to be the secondary content conduit.

Ok, back to business.

Where do interest rates go from here?

Now, here is where it starts to get interesting.

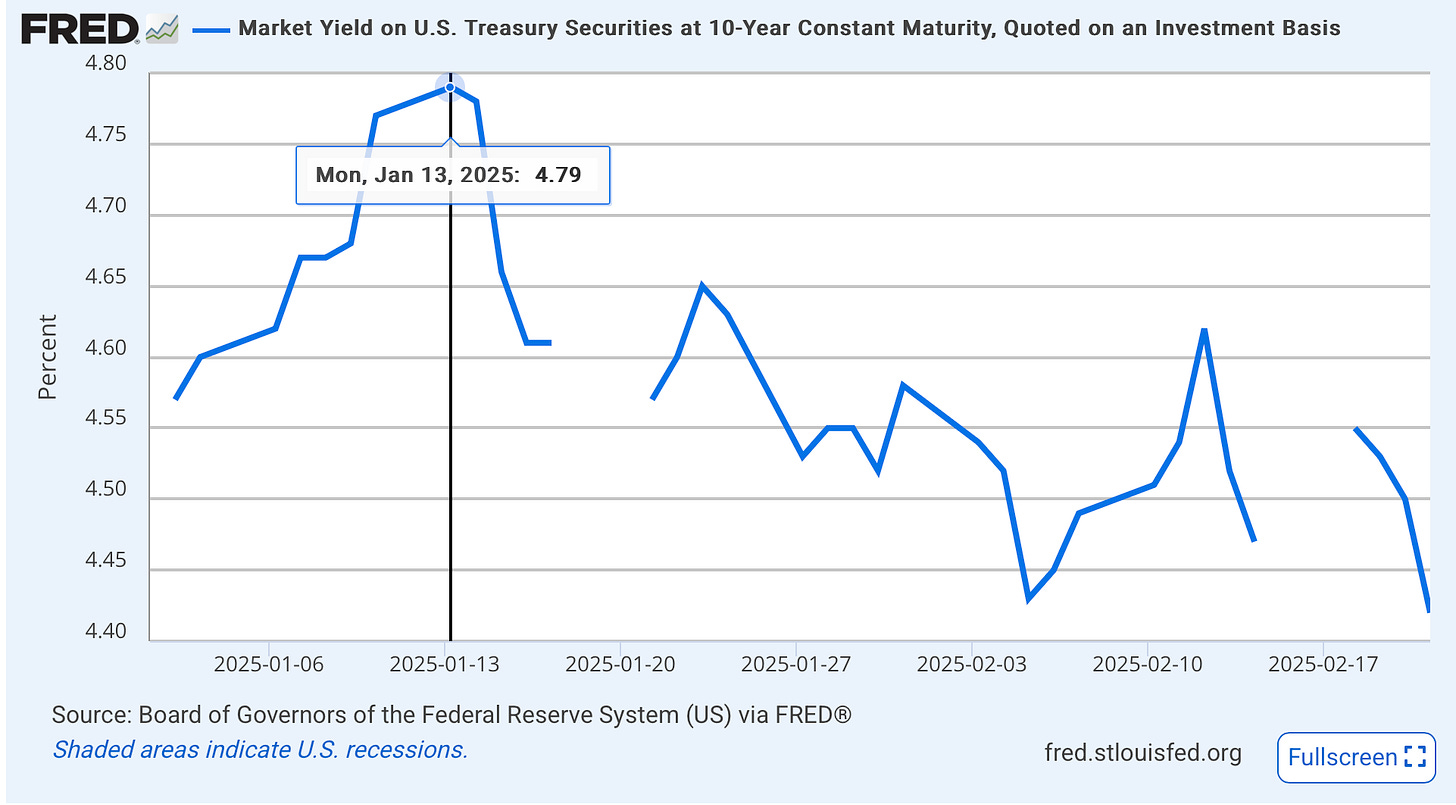

After having a bit of a tantrum to start the year, where the 10-yr treasury spiked to ~4.8%…

…bond vigilantes have been feeling better about inflation’s prospects these last few weeks (the breaks above are holidays).

This has translated into (slightly) lower mortgage rates.

Since peaking on Jan 13th (matching the 10-yr Treasury peak) at 7.26% the 30-yr mortgage rate has been down each week since (with some volatility last week).

Very interesting.

And, ironically, this could continue.

In an interview this past Friday, Treasury Secretary Bessent told Bloomberg that the Fed may stop selling Treasuries off their balance sheet, which the Fed has been doing while lowering interest rates. These two actions were working against each other, so if they do stop Treasures rolling off, this will make it easier (with lower supply) for the Treasury to issue/sell 10yr bonds and potentially lead to lower long-duration bond rates, and thus mortgage rates.

The Fed doesn’t control mortgage rates, but they do own mortgage bonds

It is often said, including by yours truly, that the Fed doesn’t control the long end of the yield curve. Ie, when the Fed cuts it’s short-term Fed Funds Rate that does not have a direct affect on 10-yr Treasury rates, or 30-yr mortgage rates.

True. But…

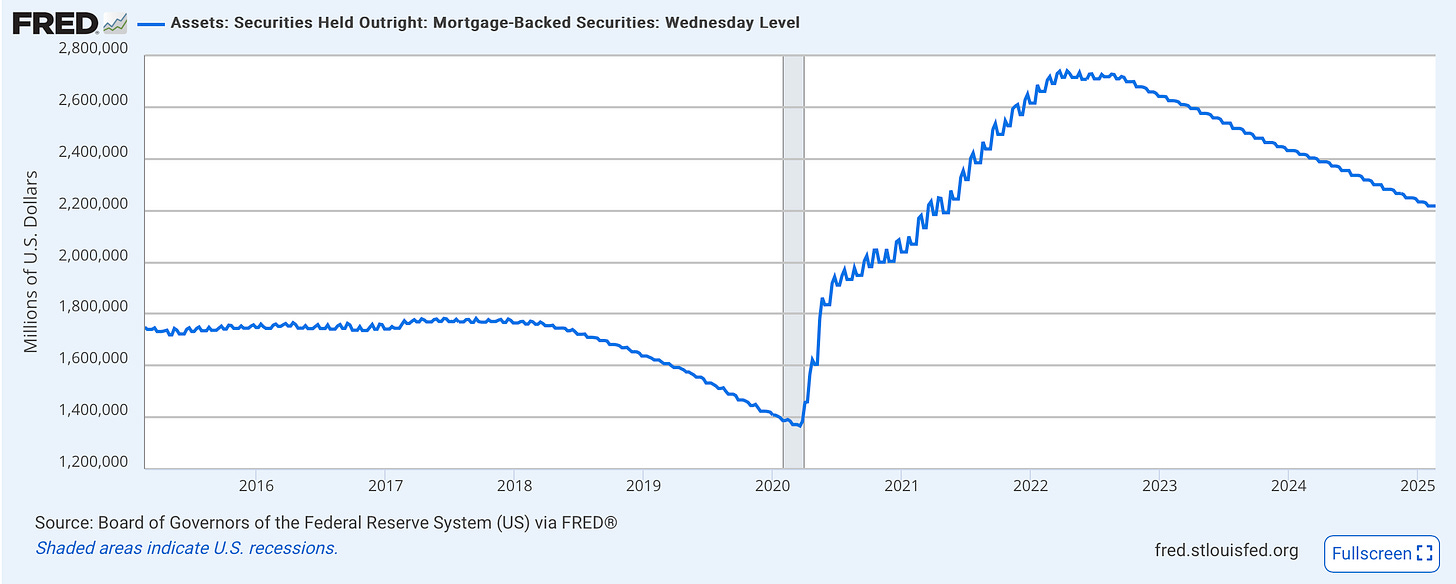

The Fed does buy mortgage bonds (mortgage-backed securities). Currently $2.2 trillion worth, in fact. This is called Quantitative Easing (QE) and it very much affects interest rates. Treasury bonds are long-term debt securities issued by the government to finance its spending. When the central bank engages in QE and buys treasury bonds, it increases the demand for these bonds. Higher demand for treasury bonds leads to an increase in their prices. Bond prices and yields are inversely related: when bond prices rise, yields fall. Therefore, QE lowers treasury bond yields. And since the 30-yr mortgage follows the 10-yr Treasury rate (put simply: they are competing investment tools) the Fed very much can affect mortgage rates.

This QE mortgage rate manipulation became a policy tool in 2009, following the Great Financial Crisis. And it will remain so, until the Fed mortgage bond portfolio drops to zero. So when the Fed buys mortgage bonds they can manipulate mortgage rates down by introducing additional demand. This contributes to a higher-than-usual premium in the spread between the 10-year Treasury and 30-yr mortgage rates i.e. higher mortgage rates.

The complication today is that since buying a hell of a lot of these bonds from 2020-2022 they have been steadily selling them back into the market or allowing them to roll off/expire.

This does put upward pressure on mortgage rates.

The Market Lives in the Future

Beyond directly lowering treasury yields, QE increases the overall money supply in the economy. This influx of money can lead to lower interest rates across various financial markets, including mortgage rates. The signaling effect of QE also plays a role. When the central bank engages in QE, it signals its commitment to keeping interest rates low for an extended period. This influences market expectations and reinforces the downward pressure on mortgage rates.

Labor market softening could further help with rates

In his testimony, Powell also remarked that the labor market has "cooled from its formerly overheated state" but remains "solid." He continued, saying “[the Fed can] "ease policy if the labor market unexpectedly weakens or inflation falls more quickly than expected." This shows that the Fed is prepared to lower interest rates if the job market suddenly deteriorates or if inflation drops faster than anticipated.

Welcome reassurance to the market.

Additionally, Powell noted that the Fed is in the midst of a framework review, evaluating its monetary policy and communication strategies. This should wrap up by late summer 2025 and could provide a pivot point for Fed policy.

My Skeptical Take:

Keep reading with a 7-day free trial

Subscribe to The Skeptical Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.