Sometimes taking a risk, is the safest thing to do

Real estate is your base for abundance. Remember your why.

Today’s Read Time: 7 minutes

Today’s Interest Rate: 6.98%

(👇.01% from this time last week, 30-yr mortgage)

The Weekly 3 in News:

Zillow turns bear, projects that U.S. home prices will fall -1.7% between March 2025 and March 2026. Last month, Zillow said home prices would rise this year. Uncertainty is pervasive and self-fulfilling (Zillow).

Stocks turning Bear, down close to 20% from the January highs (AP).

Surprising demand resilience for housing: Despite high rates, housing demand is up, with existing-home sales 4.2% higher MoM, driven by increased inventory and steady buyer interest. April 24th is the next existing home reading, and will be telling (NAR).

Today, we’re talkin’ total market update, sans trade/tariffs (I think we are all a little tired of that subject). Pessimistic news and tumbling stock market got you down? Stop hitting refresh on your Robin Hood account for a moment and tune in. You can’t do anything about it anyway.

As the old Hank Williams song goes: “The interest is up and the stock market’s down and you only get mugged if you go downtown…” and when you panic about the economy and do something stupid you will regret.

Instead, fellow Skeptic, you can protect yourself.

Let’s get into it.

The Pulse of Our Shared Prosperity

The economy, in a capitalist society, is a fragile dance of opportunity, aspiration and execution. And when someone or something rudely cuts in, that delicate balance is disrupted.

This may or may not be the case today.

Unfortunately, we often identify economic problems - including the dreaded R-word - in hindsight. Data is lagging, and it takes time to collect and analyze. Many economic indicators are untrustworthy, often showing conflicting or mixed signals that are difficult to filter. Plus, for some reason, human psychology resists acknowledging downturns until they’re unmistakable.

In an era of fractured certainties, let me offer this with precision: I do not think we are in a recession, nor do I think we are headed for one…

…Yet. (I’ll let you know, if I can resist my biology).

We are far more likely, even if uncertainty persists, passing through a fleeting moment of adversity, fraught with: gross political turbulence, pessimistic sentiment and - perhaps - slower economic growth. But growth nonetheless.

What does exist is heightened risk, because the state of affairs could completely change tomorrow, to the up- or downside. The unique attribute about this political environment is: execution happens rapidly, no matter how you judge it. It’s an interesting time to be alive on this cosmic molten stone, that’s for sure.

Are we headed for or entering a recession? I’m quite skeptical. Up until now, the worry has been the opposite of recession, an overheating economy and inflation.

And it bears mentioning, recessions happen all the time (again, not saying we are headed toward one). It is not the end of the world and is healthy for a thriving long-term economy, much like small fires are beneficial for a thriving forest.

Markets run in cycles. And the thing about both bull and bear markets is, they are self-fulfilling flywheels. Negativity can rapidly set in, even if it’s not warranted. Remember, 2/3 of GDP is consumer spending. If the consumer starts to get too pessimistic, that eventually starts to really matter. After all, one household’s spending is another household’s income.

We have been in quite the bull market for quite a while. Now we have a correction in the stock market. Will this proliferate to the economy?

Here is the stock market with stock markets, recessions are marked.

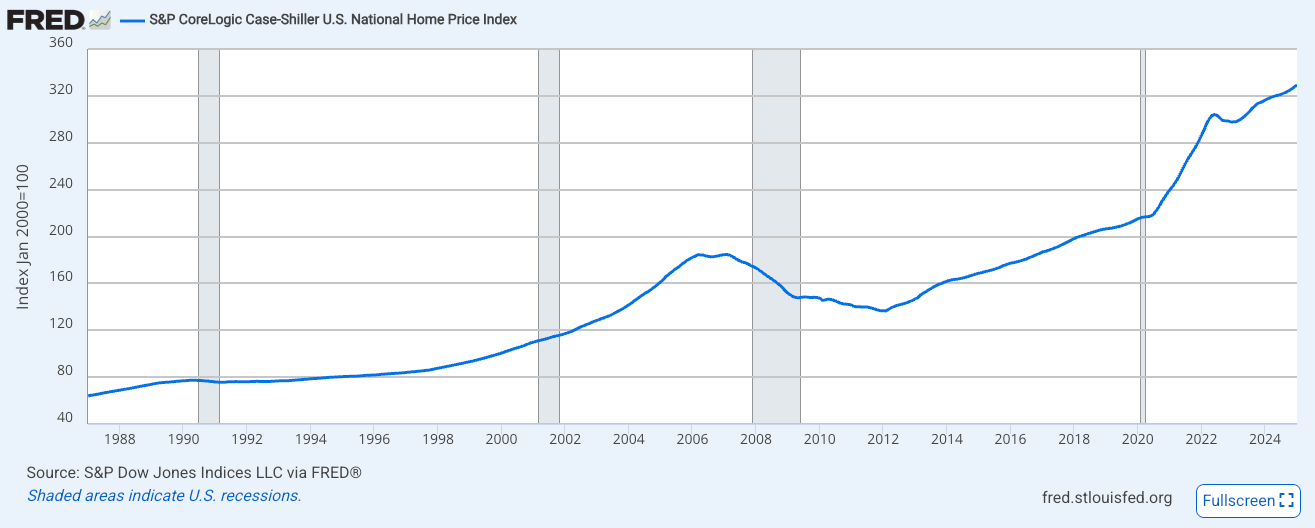

And home prices, again with recessions marked.

Recessions and economic slowdowns happen. And the world keeps spinning, especially here in the US. Just keep everything in perspective.

Ok, let’s look at some numbers.

Food prices still high? Too tired to cook? Meal prepping at home is the answer. Saves money, time, lowers stress, promotes healthier eating, customizes to what you want (and don’t want) in your diet, and it’s actually pretty fun and low-stress, with the right kitchen tools. Frankly, I couldn’t do it without my Vitamix. It takes meal prep and cooking to a whole new level and cuts my prep time by 80%!

Plus, act now and get 30% off!!! Use my special Skeptical Investor Amazon link 👉. Go Vitamix!

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? Advertise with us; we can help you grow your business. Email me directly.

Ok, back to business.

Positive Economic Indicators

Coming off the all-time highs in January, the stock market is close to hitting a true Bear Market (-20%) today, after last bottoming April 7-8. (the tech-heavy Nasdaq has entered a Bear Market).

Was this the bottom of the market correction? Could be. Or maybe we retest those lows but IMO we have seen the worst reaction from markets, barring a new surprise of course.

Labor Markets Holding up Well

Unemployment doesn’t look bad at all, labor is still scarce, and job quitting has normalized to historic levels. Last week, jobless claims came in at 215,000, a decrease of 9,000 from the previous week. The 4-week moving average was 220,750, a decrease of 2,500 from the previous week's average.

Job openings remained robust and largely unchanged at 7.6 million from the previous month, with some increased separations seen in government employees. Job openings are still above pre-pandemic levels.

Perhaps the rate of hiring could slow from here, but again, so far so good on the labor front.

Consumers are spending at a higher clip than last year. Retail sales were up again last month.

Inflation is still trending down, both core and headline.

Total industrial production is still holding up, positive YoY.

Wage growth is still at historic levels, and is more than 1% higher than inflation. This is very positive, in my view. The trend looks down, but I view this as normalizing, not concerning. We are way above pre-COVID levels.

Lots of positive data out there as you can see.

Negative and Mixed Economic Indicators

Consumer confidence in March was down again, for the fourth consecutive month the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead (Conference Board). “Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects.” Now, confidence surveys are historically not great indicators, but this is definitely at yellow alert levels. When consumers stop spending, that pessimism can be a self-fulfilling prophecy of recession. More than 60% of our economy is attributed to consumer spending.

Durable goods orders are positive YoY and in total dollar amount, but could be trending down after pulling through so much during COVID.

Housing starts eked out an ever so slightly positive number, but this is likely attributable to high interest rates.

Luxury brands like LVMH have begun 2025 on a poor note, with sales falling 2% in the first three months. Could be nothing, as the company says. Could be a trend/signal.

Business investment remains positive, but could be in a downtrend. Capital expenditure may remain strong in certain sectors (e.g., tech) while others contract, creating uneven signals.

Purchase Manager’s Index (PMI) was 49% in March, 1.3% lower compared to February (PMI above 42.3% generally indicates economic expansion. PMI is a composite index that measures the performance of the manufacturing and service sectors of an economy). Of note: the New Orders Index contracted for the second month in a row following a three-month period of expansion. A PMI near 50 can also indicate a mixed sentiment in the market, rather than clear expansion or contraction.

Where does all this put us, real estate investors?

The indicators overlaying the political environment make me slightly worried re: interest rates. Fed Chair Powell may be reluctant to cut rates, as folks are arguing he perhaps should, so as not to appear political. I fear that avoiding the perception of acting politically in the face of the President calling him names for not cutting rates, ironically, makes the decision not to cut in May, June or even July, a political decision.

Last week (April 16th), Powell signaled patience amidst uncertainty, saying, “For the time being, we are well-positioned to wait for greater clarity before considering any adjustments to our policy stance.”

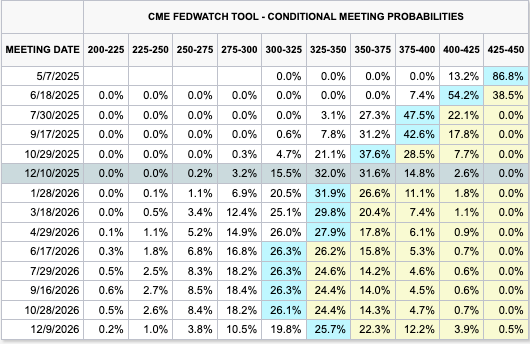

I still think the Fed will not in May, and markets agree, and renewed political pressure on the Fed by the President could backfire, resulting in fewer cuts in 2025 (2 or fewer).

As of now, markets are pricing in a razor-thin 50.9% chance of 4 rate cuts in 2025. Tough call. I think we get 3 x .25% cuts, given the above data.

My Skeptical Take:

More these days, I’m hearing fellow investors and prospective homebuyers utter the phrase “that’s too risky… I don’t want to take a risk.”

But, sometimes taking a risk is the safest thing to do.

If the economy is in trouble, you want to own real estate. This protects you against the volatile stock market crashes…checks notes, we are still down 10%+ this year, albeit better than the down 18%+ the other week, but this week? Next week? Who knows…. Real estate investing provides you with monthly income while simultaneously hedging you against the erosion of your wealth through inflation and is highly tax-advantaged. When times are good, appreciation of this asset, rent growth, and low tax bills accelerate your wealth generation.

Moreover, you will not end up where you want to be unless you act, and action requires risk. What’s riskier is the dread of regret if you don’t, not if you do.

Want to know a secret? Real estate investors aren’t buying real estate.

They are buying financial freedom and peace of mind.

Just ask Frank (John Goodman in the Gambler) why we own real estate (warning, colorful language inside).

Real estate allows you to take risks, from a position of strength, or as Frank put’s it a little more colorfully, “Every asshole in the world knows what to do, you get a house with a 25 year roof….”

Find your fortress of f%$k!ng solitude. Real estate is your base for abundance.

Remember your why.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to protect yourself from stock market volatility and inflation? Own assets, buy real estate. Don’t know where to start or know a friend looking for a home? Give us a call! We got you.