Welcome to the Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Are Buyer’s Skipping till Spring?

How the Savvy Investors are Positioning.

My Skeptical Take.

Fuel for the Day: Found this great coffee from Olde Brooklyn Coffee. Silky smooth and grinds with the rich scent of chocolate. ☕

The Weekly 3: News, Data and Education to Keep You Informed

“The US economy is not facing a recession,” says Apollo chief economist Torsten Sløk. Sløk cites strong employment data, wage growth, and consumer spending as key indicators. Corporate profits are at record highs, and GDP growth is projected at 2.1% for Q3, suggesting continued growth ahead (BI).

Maned Spaceflight is back! Polaris Dawn just launched and will bring humans to the highest orbital altitude since Apollo in 1972. More than 3x further than the International Space Station (SpaceX).

Book Recommendation: Long-Distance Real Estate Investing. I’ve recommended this before, and it’s a bit out of date with new software that automates much these days, but with prices only going higher, many investors are looking outside their expensive market for their next real estate deal. Can’t recommend this book any higher for new investors.

Today’s Interest Rate: 6.22%

(👇.18, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate.

Let’s get into it.

Skipping till Spring

Get excited! Interest rates will soon begin the pilgrimage down from their ugly nest atop the mountain. But the welcome spectre of rate cuts in just over a week now has homebuyers/sellers thinking… Perhaps the grass may be greener in the Spring?

So, if they can wait, they are. Pending home sales fell 5.5% during July and the data so far is showing another decline in August (NAR). I expect this to continue through the winter.

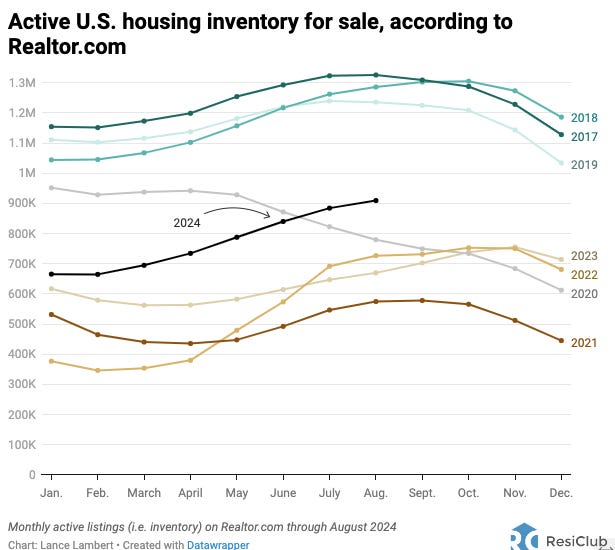

Lower activity will translate into higher inventory levels, which will continue their melt up for another 5 or so months. Buyers are Skipping till Spring, anticipating those cuts. Heck, if they waited this long, and it’s soon to be winter, what’s another few months?

Investor Tip: Look out for more ugly existing homes to snatch up.

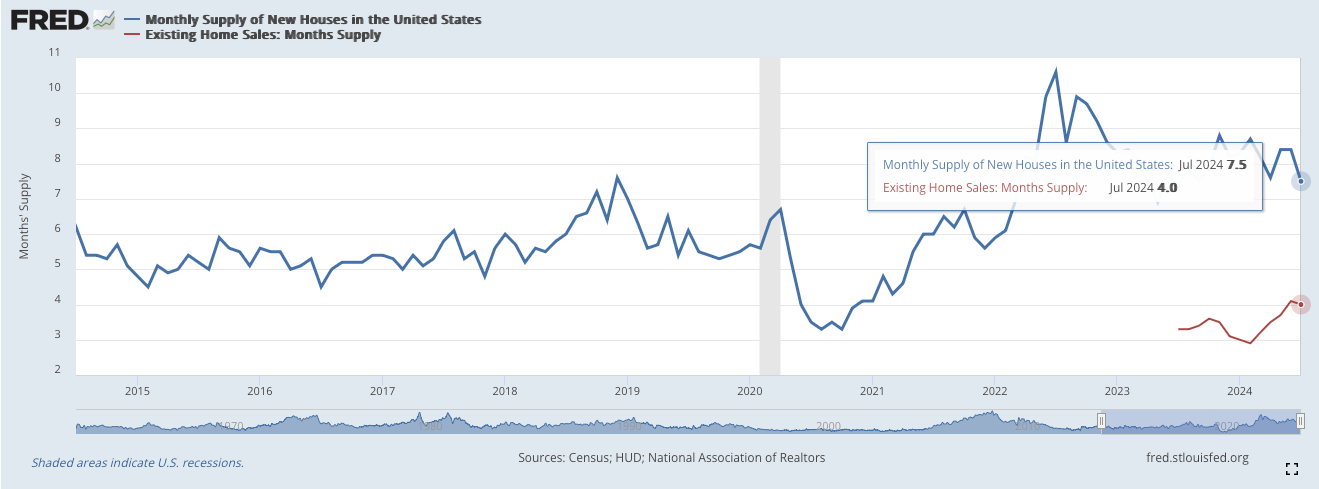

Homes in need of a renovation should start to slowly accumulate on the market. The spread between the supply of existing homes and new homes is at a historical high, close to double what it should be. This is because the 2020-2021 ultra-low interest rate policies incentivized homebuilding and at the same time disincentivized exiting home sales as folks refinanced their mortgages only to have interest rates explode higher 1 year later (2022-present) locking them into that home and preventing them from selling and then buying another (remember, most sellers are buyers).

Although that is not to say new homes aren’t coming on the market, it’s just not enough. Single family housing starts are low, and moving lower fast into the winter cycle.

Inventory is up but Seller’s aren’t Waiting Either

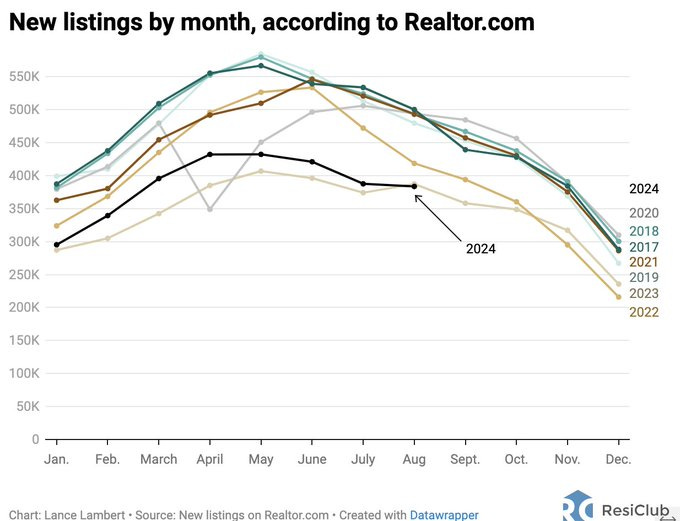

Importantly, median (and mean) home prices are up YoY. And many sellers are not accepting, on average, drastically lower offers. They are also waiting. Inventory is rising because demand has cooled and homes are sitting longer, not from new listings.

Case in point: if their property doesn’t sell, sellers are taking them off the market. Canceled listings are at a 5-year high and increasing into Winter. For more on the why of canceled listings, check out this quick talk from Altos Research. A nice short analysis on the months ahead.

So, What’s the Point Again?

All this is good, very good.

Why?

For homebuyers and investors alike, it will produce the perfect cocktail to snatch a deal! Especially on that ugly home.

We should all take a moment to be in the present. We are likely experiencing one of the strongest buyers’ markets in the last 12 years, right on the tail-end of high interest rates and a homebuyer that is tired of it all. Close your eyes. Take a breath. And remember where you were when you had this opportunity in real estate.

A Worn Out Homebuyer

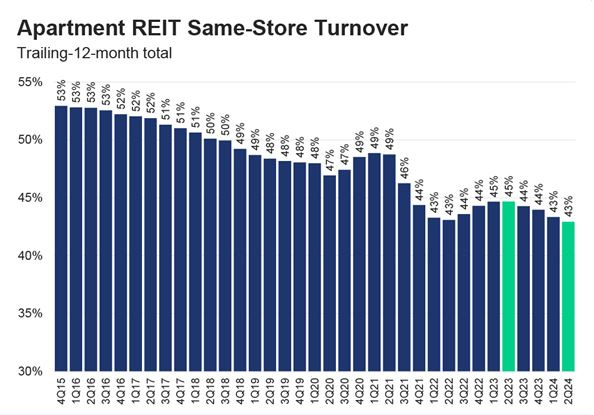

At this point, after a long 2+ years of inflation and high interest rates, homebuyers are resigned to sit on the sidelines until they can get motivated again. We see this in the moving data. A stat I found interesting: 57% of apartment tenants are renewing their leases, the highest in a decade. Starter-homebuying is expensive relative to historical levels and interest rates have been taking a toll on the psyche of homebuyers.

So, they are Skipping till Spring (or when your lease ends in 2025) and just renting.

Anecdotally, I have several tenants who are young couples and were originally planning a move-out this year into a starter home. They want to start a family. But are frustrated with prices, interest rates, and the process in general. They all just renewed their lease this summer.

Savvy Folks are On the Hunt

So for investors, and homebuyers who have remained resilient (props to you!), in my opinion, will are starting a new multi-year bull market in real estate.

And you have a 5 month head start.

Remember we are still highly supply constrained relative to total demand, despite this pocket of inventory we are seeing.

Many more homebuyers (and sellers, remember) are waiting for rates to drop, now that the reality of lower rates by Spring is setting in. Pending home sales show us they are taking their foot off the pedal.

Anecdotally, I just picked up another great deal on an ugly house in the country that had been sitting on market. After some elbow grease, this is going to turn into a smokin’ hot deal. I’ll be looking for my next one in November.

My Skeptical Take:

I want to emphasize, once again I know, the unique state of play for the real estate market.

We are currently experiencing a Hot Rate Cut Summer-Fall.

But many buyers are Skipping till Spring.

If you are looking to invest, don’t get stuck in analysis paralysis. Take action.

You have a 5 month head start.

For the Federal Reserve, I expect their first rate cut in one week, by .25%. And the $46 trillion U.S. bond market agrees. In anticipation of rate cuts and a potentially slower economy, in the last 30 days, the 10-yr treasury has come down to 3.629%, with the 30-yr mortgage at 6.22% today. A spread of 259 bps. And I will continue to remind you all of this, if the spread between the two was at normal / historical levels (175 bps), we would be at an interest rate of 5.37% today. Even before the first rate cut. This means that it is within the realm of possibilities for interest rates to end up in the low 5’s, sometime next year.

Forced Sellers this Winter

Another reason why this the present time is such a great time for us investors. Real estate is cyclical/seasonal, and most activity is in the Spring. Folks selling in the off months, especially in the slow winter months, have a much higher likelihood of being “forced sellers,” in other words they’re selling for some life event reason. A move, a death, debt issues, divorce, job change, etc…. They have to sell and they wont be taking the home off the market, they will be reducing price.

Add to this, a housing inventory that is at 2019 levels, and buyers skipping till Spring, and we have quite a cocktail of opportunity for those looking to pick up a deal.

Find Fall Deals

So when are others are enjoying the pumpkin patches and apple picking, the savvy investor is hard at work in the office, scouring listings, running numbers and talking to expert investor-agents to find that Fall deal.

When will Demand Roar Back?

This also begs the question, how long will this last? When is demand going to roar back?

Move over March Madness, its going to be Makin’ Moves March in 2025! (I’m full of alterations today, and plenty of coffee).

That should be about the time rates are near or under 6.0% and should be timed perfectly with the hot Spring real estate cycle.

Will Rates go under 6%? Yes.

A note, and I’ve said this before. I vehemently disagree with the National Association of Realtors, which claims rates will stop at 6%. Their chief economist Lawrence Yun has lost touch with the market. And you know what they say about economists….

…Well I’ll let renowned mathematician, trader, investor, philosopher, and author of The Black Swan Nassim Taleb tell you, in the colorful way that only he can:

“Those with brains and no balls become mathematicians, those with balls and no brains join the mafia, those with no balls and no brains become economists.” — Nassim Taleb

Boom.

Keep a skeptical eye on statements from economists. It’s a lot of guess work and ego involved.

Again, the spectre of rate cuts and economic worries, mixed with inventory rising is the perfect storm of opportunity for investors. Sharpen your pencils, real estate deals are going to be plentiful for the next 5+ months, likely until interest rates have a 5-handle, IMO.

So don’t Skip till Spring. Put down that apple picking basket. And start running your numbers!

Oh and call your friendly Investor-Agent :)

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville. Nashville has the lowest unemployment of any major metro, 90+ people per day move here and our city population is still under 700k. Plus, we have 3 professional sports teams, massive healthcare and entertainment industries, large tech and manufacturing operations at Ford, GM, 3M, Nissan, Bridgestone, Oracle etc…, world-class universities, and no state income tax, to name a few.

And these folks need housing!

Looking for an agent in the Nashville area? We work with the best here who specialize in helping investors find great properties. Highly recommend.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likley errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.