Shutdown! The Fed is Driving Through the Fog on a Winding Road

How can we best operate without federal economic data? Good news, there are alternative data sources out there.

Today’s Read Time: 7 minutes

This week, we’re talkin’ the economic data blackout as the government shutdown continues. I provide some helpful private sources for investors, and make a request of big business to help fix data quality.

Let’s get into it.

Today’s Interest Rate: 6.17%

(👇 .14% from this time last week, 30-yr mortgage + the 30-YR FHA rate is at 5.90% today!)

The Weekly 3 in News:

The Fed Pivots! Signals they may stop reducing the $6.6 trillion of assets on their balance sheet. This could mean the end of a 3+ year effort to shrink a portfolio of Treasuries that it acquired to provide stimulus after the 2020 pandemic upended the economy. I.e., stopping balance sheet shrinking = ☝️ liquidity to markets, and speeding up 👇 interest rates. (Powell).

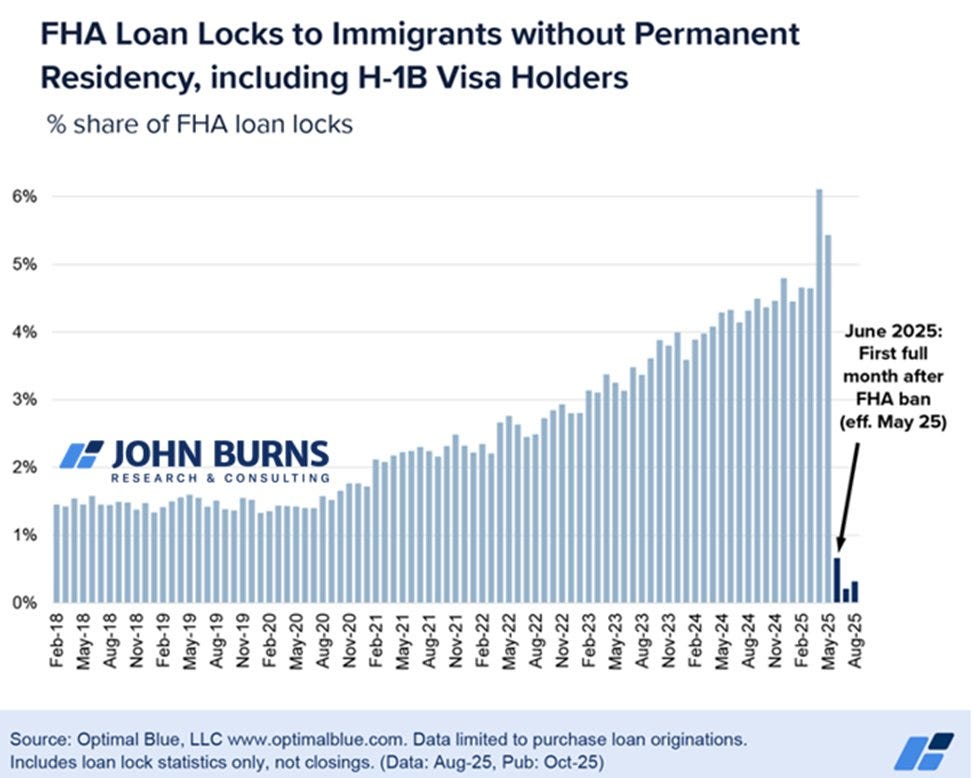

FHA (primary/entry-level) home loans to non-permanent immigrant residents have cratered. Could bring less housing demand pressure for lower-priced homes and more renter demand. WOW, that’s quite the cliff (JBREC).

Nashville News - Nashville cut property tax rates this year to one of the lowest levels EVER! True, property values have gone up, so one’s actual tax owed may be higher this year than last year, but this tax rate cut is a really big deal. And a model for others in good governance (Property Assessor).

The Fed is Driving in the Fog

Well, another week has passed, and our congresspeople seem to be loading up their plates to continue the budgetary food fight. It has been ~3 weeks since the October 1st federal fiscal year started, and Congress appears no closer to passing its annual spending bills.

Will this have a meaningful impact on the US economy?

Mid/long term? No.

Short-term, yes. Especially if it lasts for another fortnight, and numerous federal workers, including many in the military, don’t get paid and don’t spend that money back into the economy. (Of course, one should note that in every previous Shut Down, everyone received back pay. But missing a paycheck is still no bueno).

And we investors do care because the Fed is in the ~3rd-4th inning of a Fed Rate cut cycle amidst restrictive monetary policy, which has thrown the housing/real estate sector into year 3+ of an activity recession (because of interest rates, oh, and the government borrowed and spent like drunken sailors).

Limited Inflation and Labor Market Data, So We Go Private

The Fed has a dual mandate to promote maximum employment and stable prices (aka low inflation). But the Shut Down means they do not have access to the labor and inflation data they need to make informed decisions. The people who provide that at the various agencies have been furloughed. In fact, we have missed numerous data readings since the Shut Down started, including:

Construction spending, Census Bureau

Initial good job list claims, Department of Labor

Factory Orders, Census Bureau

Non-farm payrolls, BLS

Trade balance, Bureau of Economic Research

Initial job was claims, Department of Labor

Wholesale trade, Census Bureau

Federal budget balance, Treasury Department

Consumer price index, BLS

Real average earnings, BLS

Retail sales, Census Bureau

Producer price index, BLS

Initial job was claims, Department of Labor

Business inventories, Census Bureau

Housing starts and building permits, Census Bureau

US foreign net transactions, Treasury Department

The longer this Shut Down continues, the more fog accumulates on the Fed’s front windshield.

Fed Chair Jerome Powell is well aware. Speaking last week, he said, “We’ll start to miss that data.” “[If the shutdown persists, evaluating how the economy is performing] could become more challenging.”

But, absent their traditional data streams, there are some approximations and alternate data sources we can use from the private sector. And we investors crave data!

So here are just a few I’ve pulled; there are many sources out there (and sometimes they conflict/are volatile on their own, so I recommend you aggregate).

Labor Statistics

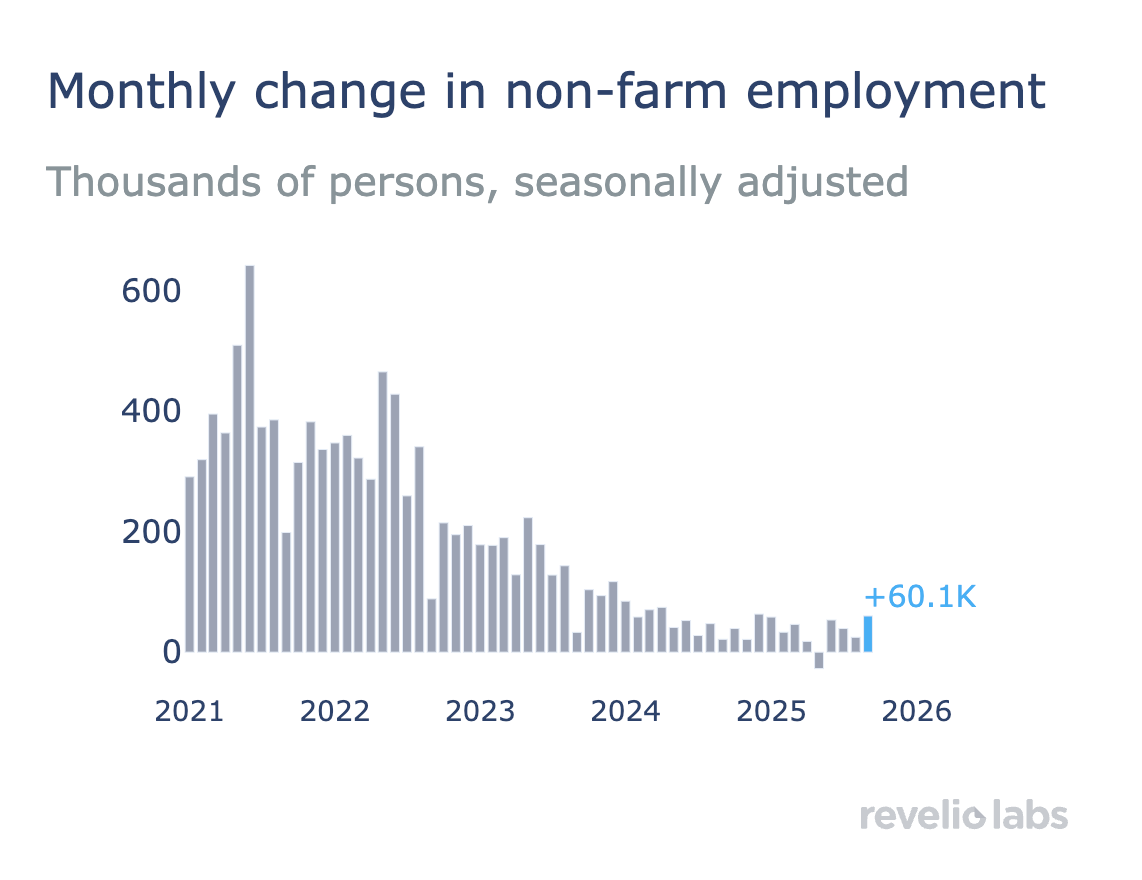

Revelio Labs - uses data from 100+ million U.S. job profiles and follows a similar format to the BLS in tracking labor data. In September, they estimate that the US economy added 60,000 jobs. This is in stark contrast to ADP below, but both still show a trending soft labor market.

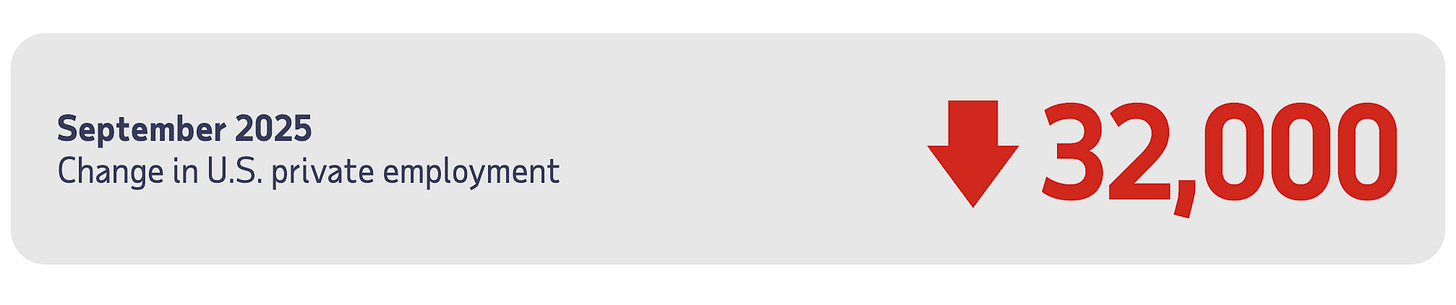

ADP - the payment processor, puts out payroll data, which we can use to extrapolate the strength of the labor sector. In September, US employment contracted by 32,000.

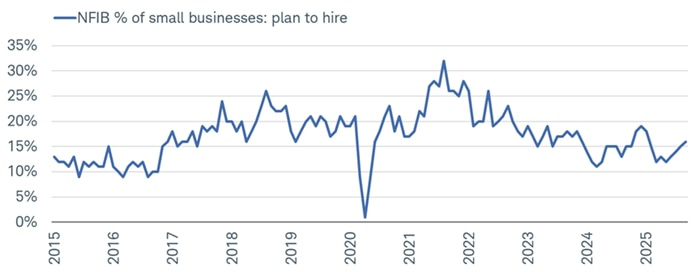

The National Federation of Independent Businesses (NFIB) - The association tracks hiring plans (a survey) from small businesses. Of note: over the past few months, hiring plans have picked up (albeit from a low base).

They also track job applicant quality, compensation plans and job openings, the ladder showing levels that are still above the historical average. In all, 32% of businesses reported job openings they could not fill.

A Quick Ad Break…

There’s a reason mobile home parks are getting so much institutional love.

They remain one of the key affordable-housing sources nationally, have limited supply and high tenant retention (10-12Y). Investors can see tremendous upside with professionally-managed MHP portfolios such as Vintage Capital’s, which targets a 15-17% IRR and makes monthly distributions. Invest directly in individual deals or via a 10+ property fund. 1031s also available.

Want to advertise to the more than 30,000+ weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Inflation Statistics

On the inflation side, we actually don’t have great data that is made public, which seems odd. Private sector, sellers ultimately have this data, so this should be an easy thing the Department of Commerce and Labor could fix, I would think, perhaps if companies were incentivized to provide it and it was aggregated to prevent any business intelligence shenanigans (aggregating it is key for it to be representative of what is happening in the economy).

Nevertheless, we do have several sources that provide a good inflation measure:

Adobe Digital Price Index - tracks inflation specifically in the digital economy by analyzing online transaction data from Adobe Analytics. It covers categories like electronics, apparel, and groceries sold online, providing monthly insights into price changes in e-commerce (Fun fact, Fed Governor Goolsbee cited below helped develop this, further evidence gov data accuracy needs a looksee).

PriceStats - From State Street Global Markets, this index scrapes online prices daily to estimate inflation across 25 economies, with detailed sector views for the U.S. (e.g., imported goods, core items). It’s useful for spotting short-term trends and has shown recent rises in U.S. prices.

Nielsen Scanner Data - This comes from Nielsen’s tracking of retail scanner data at major grocery chains, offering insights into food and beverage price changes.

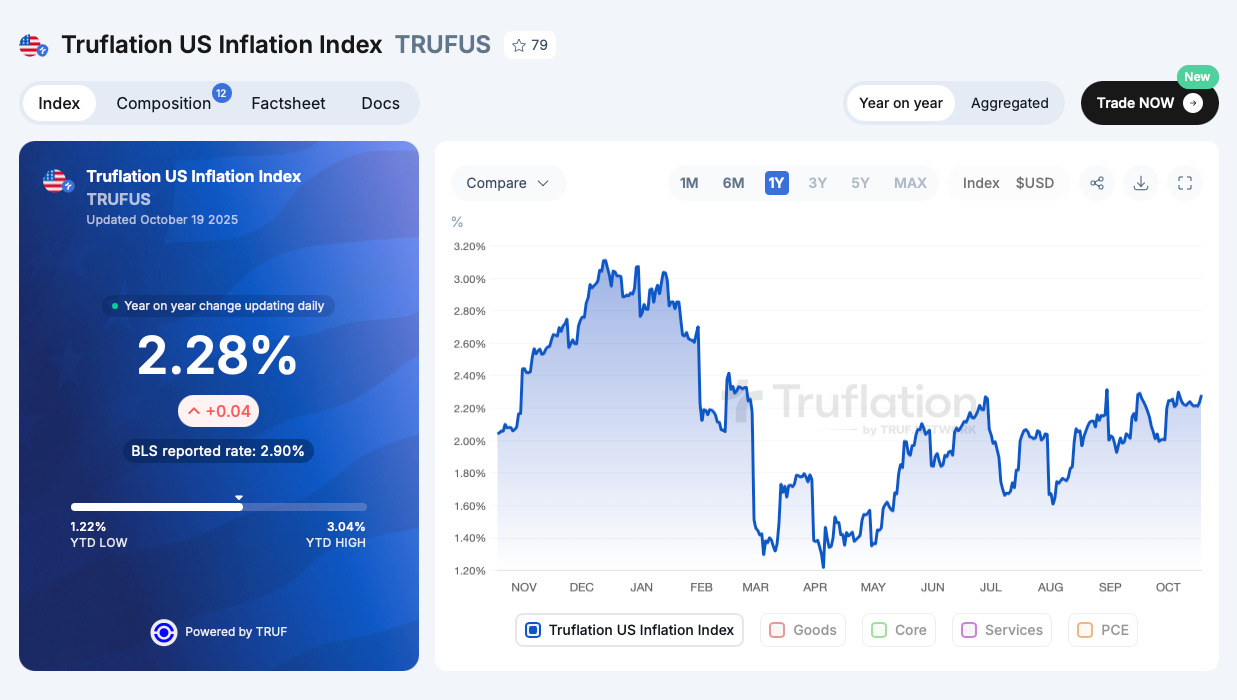

Truflation - This has gained a cult following from those who are more bearish. According to this measure, inflation is significantly lower than the last BLS number of 2.7%, but both have shown a trend higher since March.

But the question remains. Why don’t we have better data?

Remember everyone, the Fed needs to make a rate cut decision on Oct. 29th!

My Skeptical Take:

Keep reading with a 7-day free trial

Subscribe to The Skeptical Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.