We have a new name! (again I know, let’s see if this one sticks).

Welcome to the Nashville Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Recession?! Says who?

Economic Review.

Nashville Development Update.

Tangent! - There are now more obese children, than malnourished. Wow.

My Skeptical Take.

Fuel for the Day: Joko’s sugar-free, nootropic, monk fruit blend to pep me up and get me into a flow state. Good human, good drink, with NO crap in it, highly recommend.

The Weekly 3: News, Data and Education to Keep You Informed

Big shakeup at Bigger Pockets online real estate investor community. It appears they have lost their focus on their core customer, the beginner investor, which makes sense after being bought by a private equity group. Sad for the once great investor community. I recommend pivoting to follow 1-Rental at a Time. A fantastic source for real estate news, finance, and education (NickZuber).

Real estate in Dallas suburbs is weakening. Prices are falling and inventory is piling up (Nixon).

Education Recommendation: 15 Conversations with Real Estate Millionaires. A fantastic review of successful, everyday real estate investors, and how they did it. Highly recommend.

Today’s Interest Rate: 6.49%

(☝️.15%, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate. Let’s get into it.

The American economy remains resilient, corporate earnings are exceeding forecasts (albeit moderately), and real incomes are rising. This continues, despite last week’s yen carry trade tumult, which roiled stock market participants. True US GDP and hiring are slowing, but so is inflation; the perfect cocktail to gently coax the Fed into taking action.

Fed’s Eye is on Labor Markets

Now that inflation is near their target (and assuming it stays there this month), the Fed is on a labor market stakeout. Today, we got the Consumer Price Index numbers, which were right in line with expectations, at 2.9%. Importantly, shelter costs remain stubbornly high and were responsible for 90% of the current inflation increase. Food prices climbed 0.2% while energy was flat. Yesterday, we got the Producer Price Index (wholesaler) inflation numbers, which were on average cooler than expected (.1% vs .2%, MoM). In fact, MoM food and energy prices for producers were flat.

The slow trend of downward inflation continues.

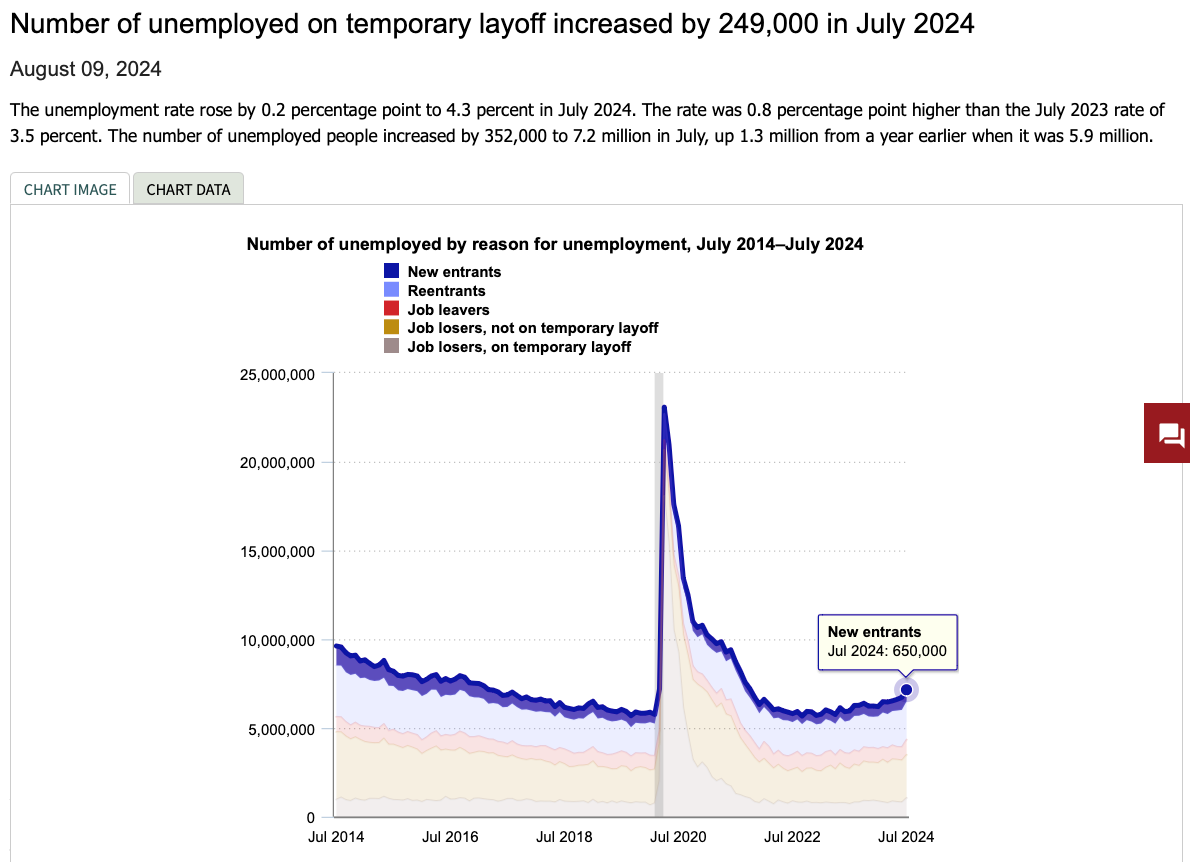

On the labor market side, unemployment ticked up .2% last month to 4.3%, still strong and what is considered “full employment,” which is generally around 5%. If we break above 5-5.25% we will start to get concerned about a slowdown in GDP, which may indicate a future recession. We will continue to monitor this.

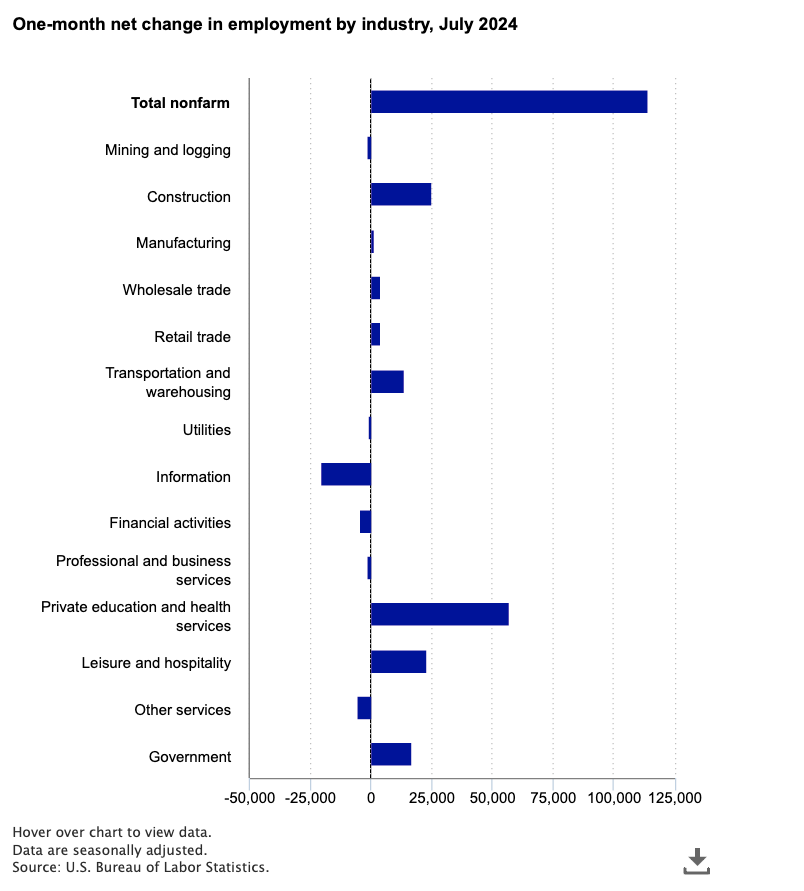

Looking at industry categories, health care, construction, government and transportation / warehousing were stand out gainers, while information / technology, finance and mining workers lost jobs in July. Of note, technology (aka information) was particularly weak.

Interest Rates Start to👇 in September.

It is expected that the Fed cuts rates in September, by .25%. But not yet, not in August. And don’t count on an emergency meeting / rate cut, like some of the TV personalities are calling for.

That is fiction.

Fortunately, the bond market is starting to do the Fed’s job for them. In the last 30 days, the 10-yr treasury has come down to 3.83%, with the 30-yr mortgage now at 6.49. A spread of 266 bps. And I will continue to remind you all of this, if the spread between the two was at historical levels (175 bps), we would be at an interest rate of 5.58% today. Even before the first rate cut. This means that it is within the realm of possibilities for interest rates to end up at 5%, sometime next year. I vehemently disagree with the National Association of Realtors, which claims rates will stay around 6%. Their chief economist Lawrence Yun has lost touch with the market. Keep a Skeptical eye on them.

It’s Morning for the Real Estate

If you're looking for signs of a crash / slowdown in the economy, you won't find it in real estate, especially the rental market. Overall demand for rentals, despite rents at historical highs, is strong, with wages growing fast (see above). Of course, again, we will be watching the labor market to for signs of weakening past what we view as ‘normalizing.’

And it’s here that we have to talk about something important. Sentiment. For some reason, there is a feeling of negativity about the economy, stock market and generally about life. My thoughts? I blame the election cycle, and the divisive politics on both sides blaming each other for inflation and stoking fears about the end of democracy. Really?

STOP.

This will be an unpopular take, given most of us have picked a “team,” but we will be just fine no matter who wins. Vote for who you want and let’s move on to real sh!t that’s happening in our world, like generating wealth for you and your family through real estate.

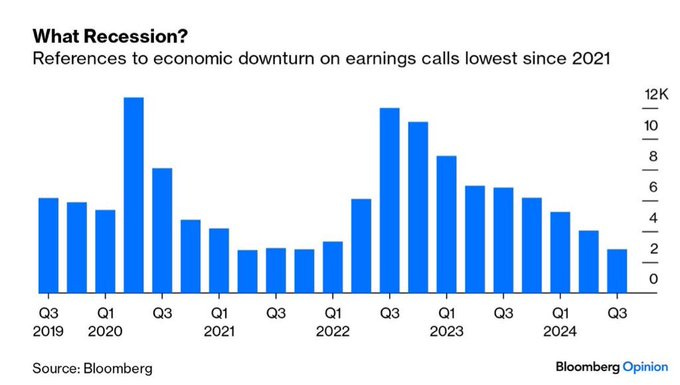

Case in point, there is a massive, gaping disconnect in sentiment between individuals and business leaders. Individuals think the world is ending, and business leaders see the clouds of past recession fears parting. This is a telling positive signal, IMO.

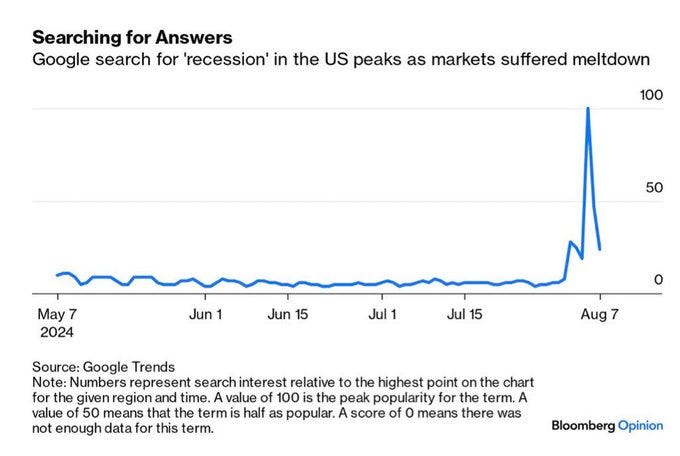

Example: Google searches by individuals for the word “recession” are spiking…

Yet mentions of recession fears from CEOs doing business in the real world are down, and have been, consistently, for the last year.

So how Should We Posture? Bullish.

5 Letters for everyone out there: R-E-L-A-X. We’re going to be ok. In fact, this may be one of the greatest times to buy real estate in my 40-yr lifetime. As I have said before, I believe we are at the beginning of a new 10-yr bull market. There is too much pent-up demand, like a coiled cobra, ready to spring once interest rates tick down.

Here are 3 pieces of evidence:

An anecdote, from Redfin: “Recent mortgage rate drops have created an optimal window of time to buy a home before competition and prices pick up….Don’t wait to buy; buyers who were scared off by high rates are poised to enter the market, which may boost prices.”

Another anecdote, from my investments: lower rates and higher inventory (aka choices) are bringing out the investors. I had 3 multiple-offer situations last month. First time in over a year.

Last anecdote, from a survey of rental investors (ResiClub and LendingOne).

Key survey findings: “Most single-family landlords … are cautiously optimistic, expecting a balanced single-family rental market over the next 12 months. Many plan to buy properties, raise rents, and anticipate rising home prices and falling interest rates. 60% of single-family landlords say they’ll likely buy at least one investment property over the next 12 months.” “And 76% of single-family landlords expect to raise their rents over the next 12 months—including 35% who say the increase will be over 4.0%.”

Very positive market signals.

Nashville: A Closer Look

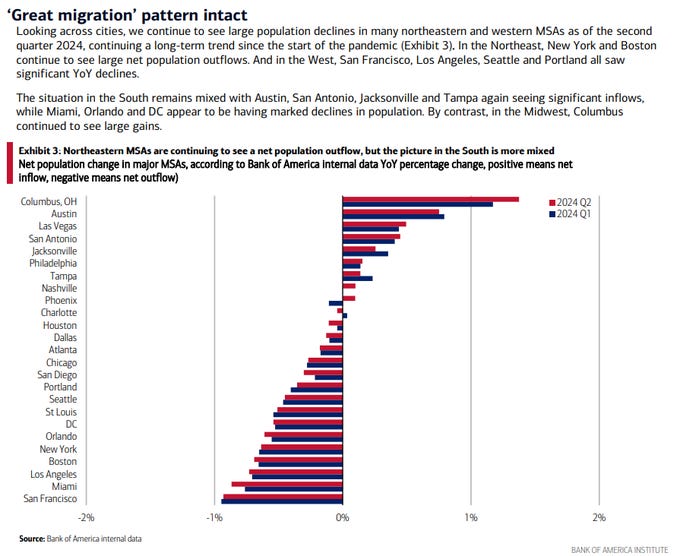

Speaking of labor markets, remember that all real estate is local. And Nashville is one of those steady growth markets that have endured, no matter the macro-headwinds.

For example: unemployment in the Nashville metro area is far below the national average, at just 3%

Nashville has a robust labor market, with heavy manufacturing, technology, entertainment, and health care jobs.

People make and so stuff here.

Today, Nashville still has about 2 job postings for every unemployed person. We aren’t overheating like other markets, just steady growth. And folks continue to relocate here for a better quality of life.

Nashville Development Update

Very cool new development just breaking ground downtown.

“1010 Church St. will. now be known as Paramount (60 stories, 750', 360 apts., 140 condos, 517 capacity garage). It will be Nashville's tallest tower when complete. Foundation work is currently underway (NashUrbanPlanet).”

Our skyline continues its evolution. Amazing.

TANGENT!

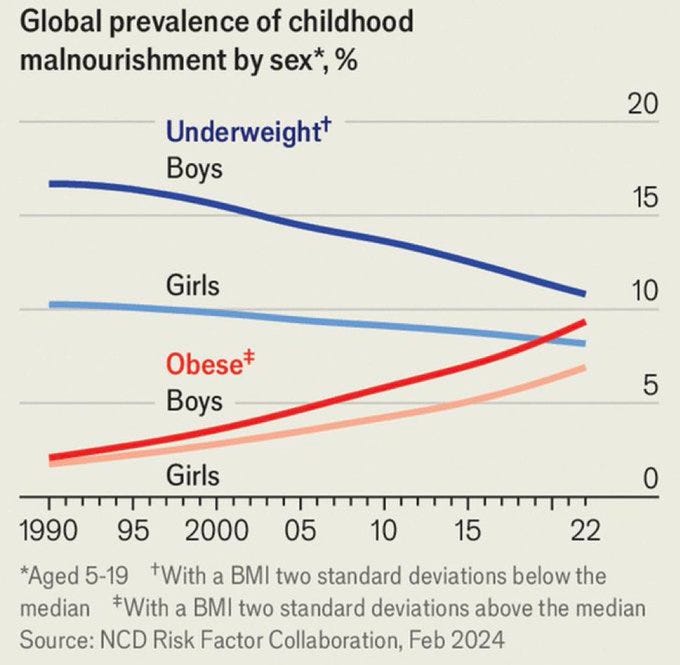

There are now more obese young folks globally, than malnourished ones.

Really?!?!

Global levels of obesity for children and adolescents aged five to 19 years surpassed those for moderately and severely underweight youth from the same age group in 2022 (WHO).

In a world of overabundance, wealthy countries are screwing it all up, and those without, are still very much without.

In light of this, perhaps we all should consider 2 things:

Donating to UNICEF to help a child in need.

Cutting sugar out of your and your child’s diet. It’s not easy I know, the food companies put it in everything. Literally everything. When you can, as much as you can, COOK! Perhaps watch a free cooking show/chef on YouTube (here are 32 10-minute, simple recipes from Chef Gordon Ramsay) and make some simple recipes at home where you can control the ingredients.

It’s fun, healthier, and far cheaper anyway.

But I digress…

My Skeptical Take:

Business is good. But inflation still be too damn high.

Fortunately, this too shall pass.

Hourly wages are growing faster than inflation, and business sentiment is in a year long positive trend, including small businesses which just reported today as extremely bullish, the highest since February 2022.

People need a home, and they can’t hold out much longer. In my experience, consumers can typically change behavior for about 6 months, then they revert to mean. Cost has prevented this reversion; so homebuyers are stacking on the sidelines ready to buy a home and form a household. Inflation is trending down, as are interest rates. The negative sentiment of the election will soon pass.

It is about to be Morning in Real Estate.

Let’s get after it.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

You can share it here:

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville, where we are seeing record tourism this year. 99 people per day move to Nashville and our city population is still under 700k. 3 professional sports teams, massive health care and entertainment industries, more than a dozen colleges….Look for bullish drivers like this.

Looking for a realtor in the Nashville area? We work with the best here who specialize in helping investors find great properties.

* I write this myself and get it out for you all in the same day. Apologize in advance for any typos / syntax errors. Don’t have a team of editors, yet :).

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.

You got it Xandra. Tough market in the burbs. For now.