It's Interest Rates, Stupid.

Real Estate is a true store of value. Even interest rates can't stop that.

Today’s Read Time: 10 minutes

This week, we’re talkin’ home and rent growth forecasts, how healthy is the housing market, what to expect from the economy, I share a contrarian’s take to my own point of view and does Wall Street really crowd out homebuyers?

Let’s get into it.

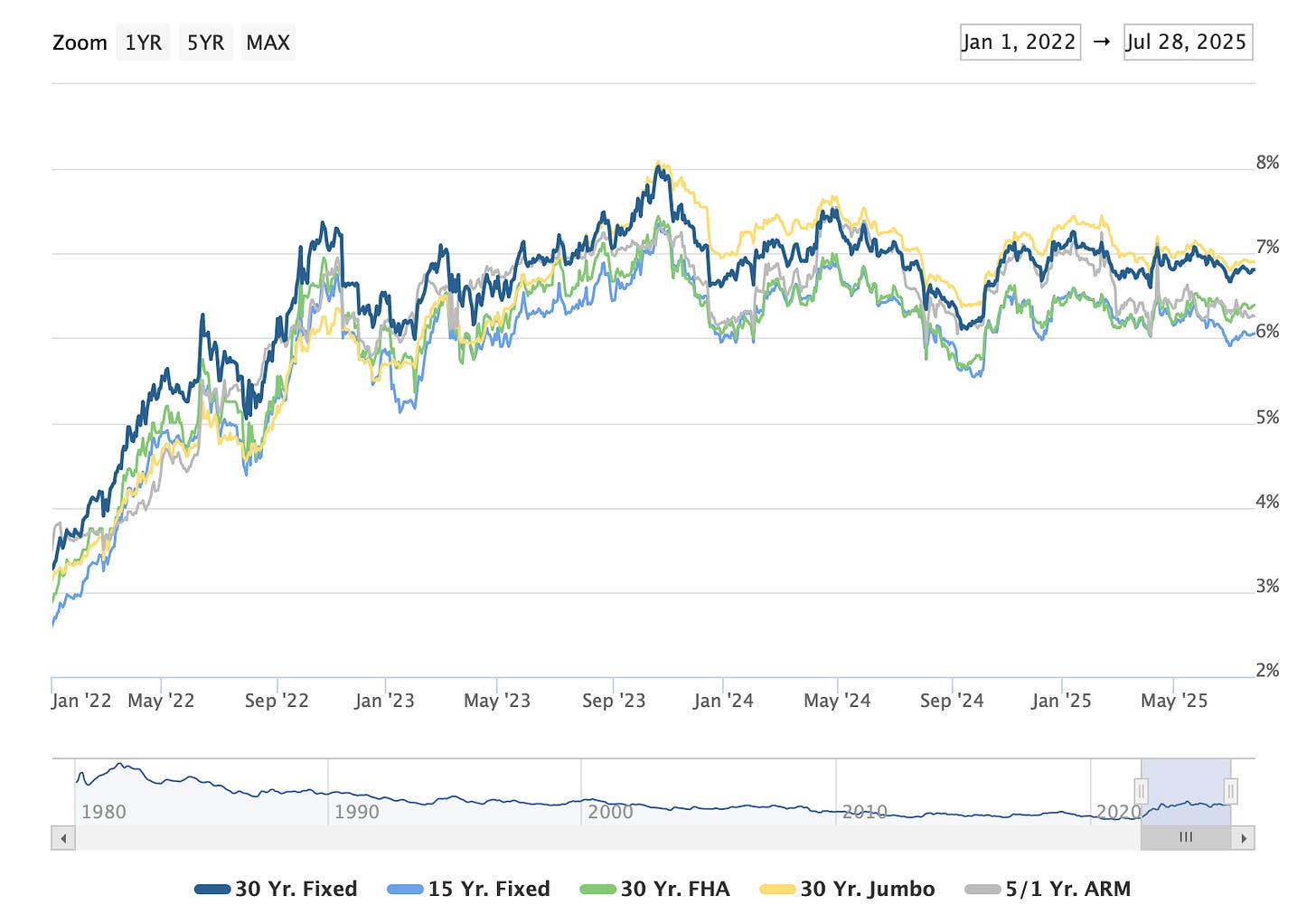

Today’s Interest Rate: 6.81%

(☝️.03% from this time last week, 30-yr mortgage)

The Weekly 3 in News:

Nashville Metro Council Approves Single-Staircase Rule for Mid-Rise Housing, reducing unnecessary rules to lower housing costs. Well done (Nashville).

The US and EU announced a blockbuster trade deal, including a 15% tariff on European goods, $750 billion inU.S. energy purchases and $600 billion in investments into the U.S. (CNBC).

Tariffs still not affecting housing construction. “Tariffs have not had a meaningful impact to our horizontal costs. And in fact, these costs have moderated and access to trades has eased” - Erik Heuser, COO of Taylor Morrison, a Fortune 500 homebuilder (Lambert).

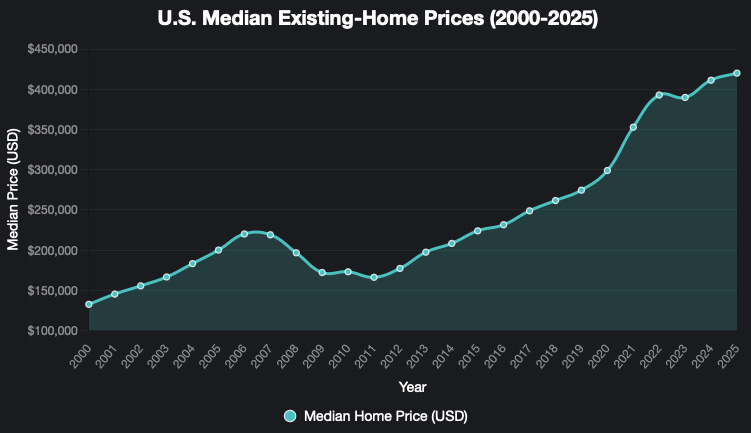

Home Prices are Doing What Now?

We are in year 3 of a housing activity slowdown.

Why?

It’s the interest rate, stupid! (That’s a reference, for the Gen Zers out there).

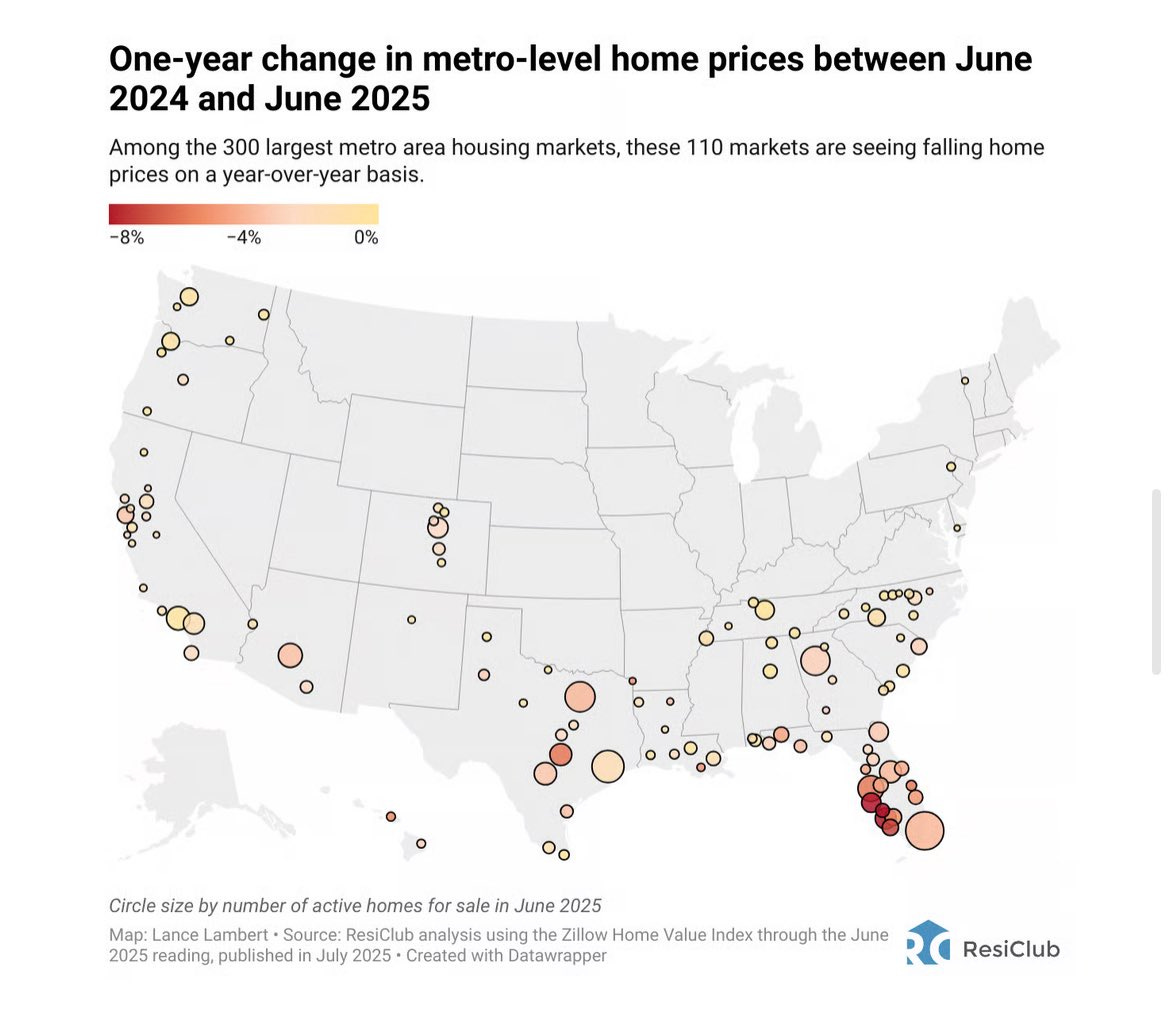

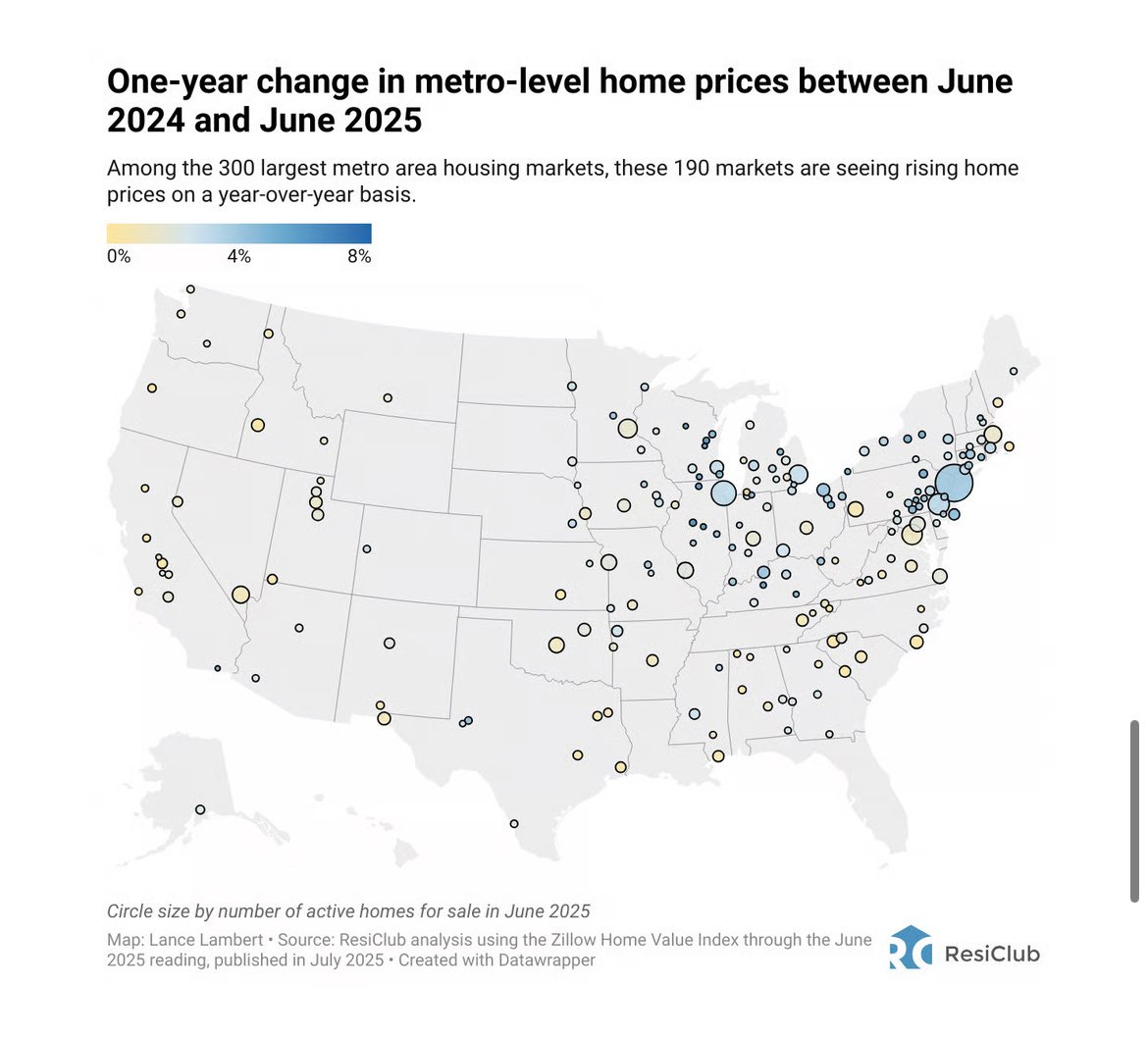

As a result, home-price growth has slowed down Year-on-Year.

But guess what?

Home prices still reached another all-time high this week. That may surprise you, but it’s true.

Let’s go deeper.

NAR Housing Market Report

According to the National Association of Realtors (NAR) the median existing-home sales price just reached $435,300, an all-time high, and a 2% increase from last month. Additionally:

Existing-home sales activity fell 2.7% MoM to a seasonally adjusted annual rate of 3.93 million units, the lowest pace in nine months.

Year-over-year, sales were up 0.5%.

Inventory rose to 4.7 months' supply at the current sales pace, up from 4.3 months in May 2025 and 3.7 months in June 2024.

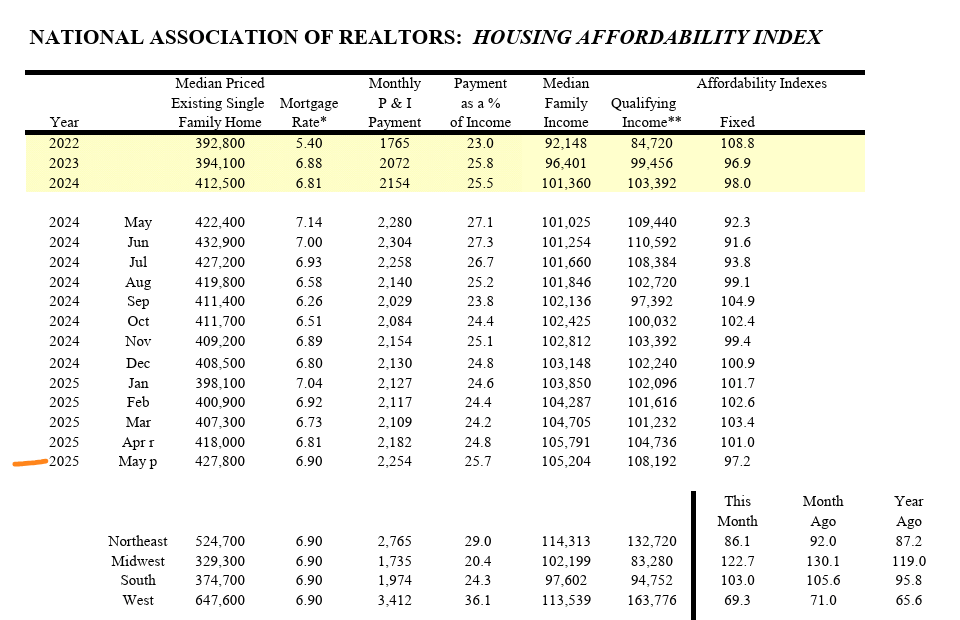

First-time buyers accounted for 29% of sales, down from 31% a year prior.

NAR Chief Economist Lawrence Yun noted that undersupply of housing continues to drive prices higher, with more construction needed to meet demand.

What do all these things have in common? They're driven by 3+ years of high interest rates, which is increasingly affecting the housing market (keep reading).

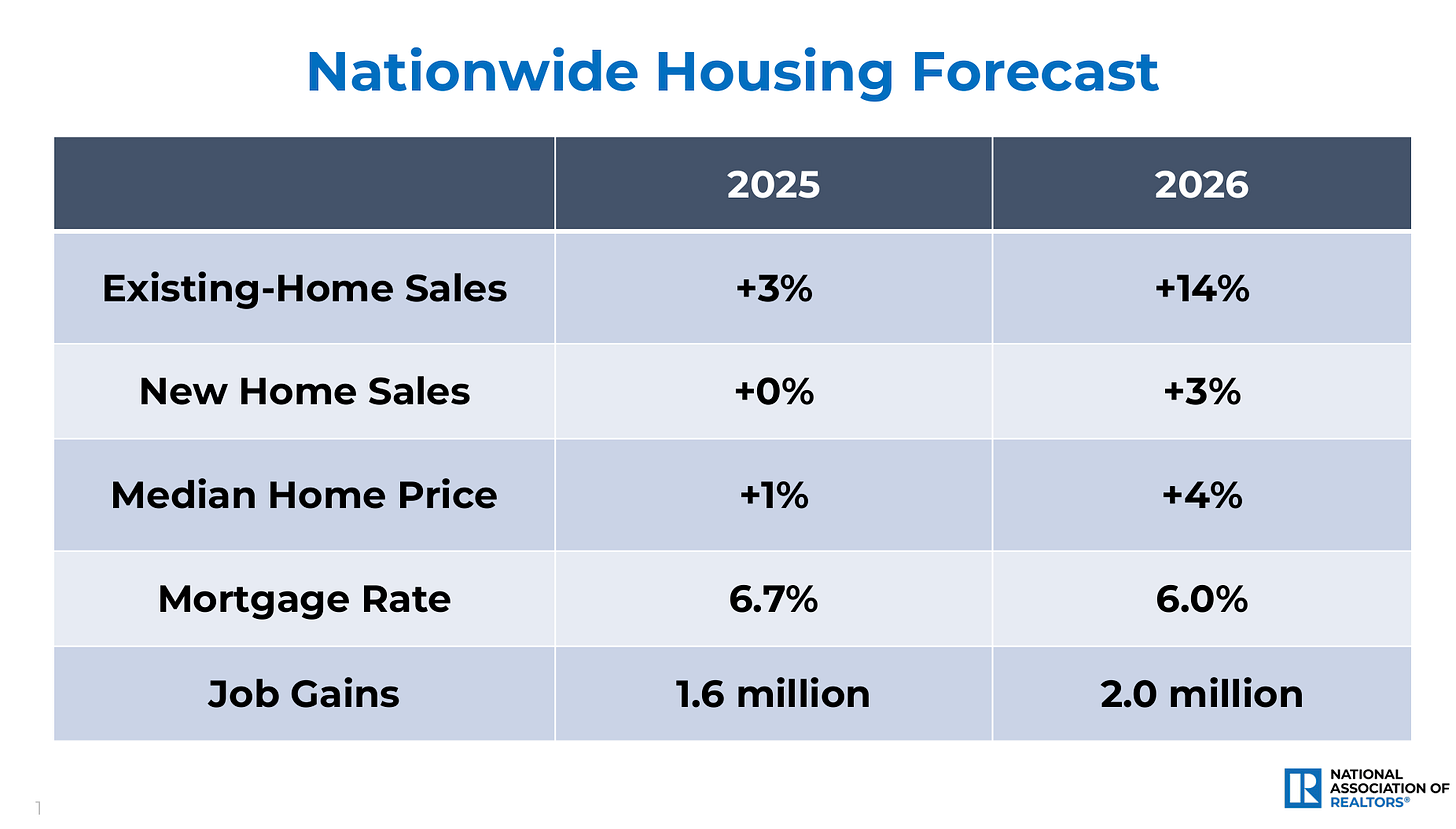

But, a reminder. While rates may be staying elevated, we are still in the down part of the cycle. They will come down in the medium term, especially as the Campaign to Cut continues. And as interest rates do their best itsy bitsy spider impression, the 18-month forecast is looking quite positive.

IMO - I still hold that we will see rates with a 5-handle sooner than we think, within 12 months. Right around the time Fed Chair Powell becomes a lame duck. It could even happen this year. Look out for high-fives! 😆

Housing Affordability is No Bueno

Higher home values combined with interest rates double that of 3 years ago is an evil witch’s concoction for potential homebuyers and sellers alike. High interest rates mean an estimated 160,000 renters are stuck, unable to buy (NAR). And sellers with a 4% mortgage (or less) don’t want to trade that out. No way Jose.

Rates are lingering longer than the Reaper pepper hot sauce I’m fermenting. Obligatory pict:👇

It doesn’t mess around.

Economic Growth and Housing Inventory

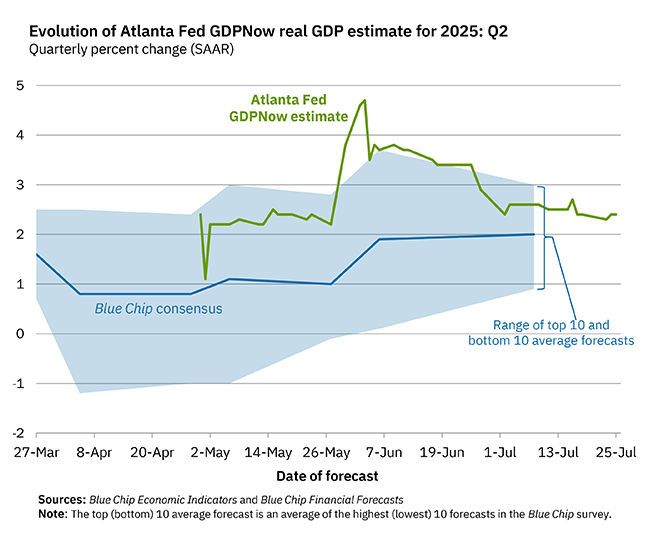

The Atlanta Fed is out this week with a new GDP growth forecast, now 2.4%. Robust but lower than they previously estimated in June. But be Skeptical of this number, the same Atlanta Fed was projecting negative -1.5% GDP earlier this year for Q1 2025. A crazy number. This was after first projecting +2.3%. The result for Q1 ended up in the middle of both, and was skewed by one-time increases in imports.

What are they putting in their coffee down there in Atlanta?

IMO - I am skeptical of this number. This is low. And I think the Atlanta Fed knows it. I would not be surprised if their forecast starts to levitate starting in August to closer to 3% for this quarter.

Why?

Well, they are notoriously inaccurate.

Also, for Q3 on, we are about to get a big economic boost. The recent federal budget, a.k.a. the Big Beautiful Bill that just passed, and will add an estimated 1.2% boost to the US economy (TaxFoundation). And while I've been critical in the past over its deficit-inducing size (still feel strongly on this), the labor market is holding and inflation does seem to be abating. I think we may be past much of the reinflation risk, with current data.

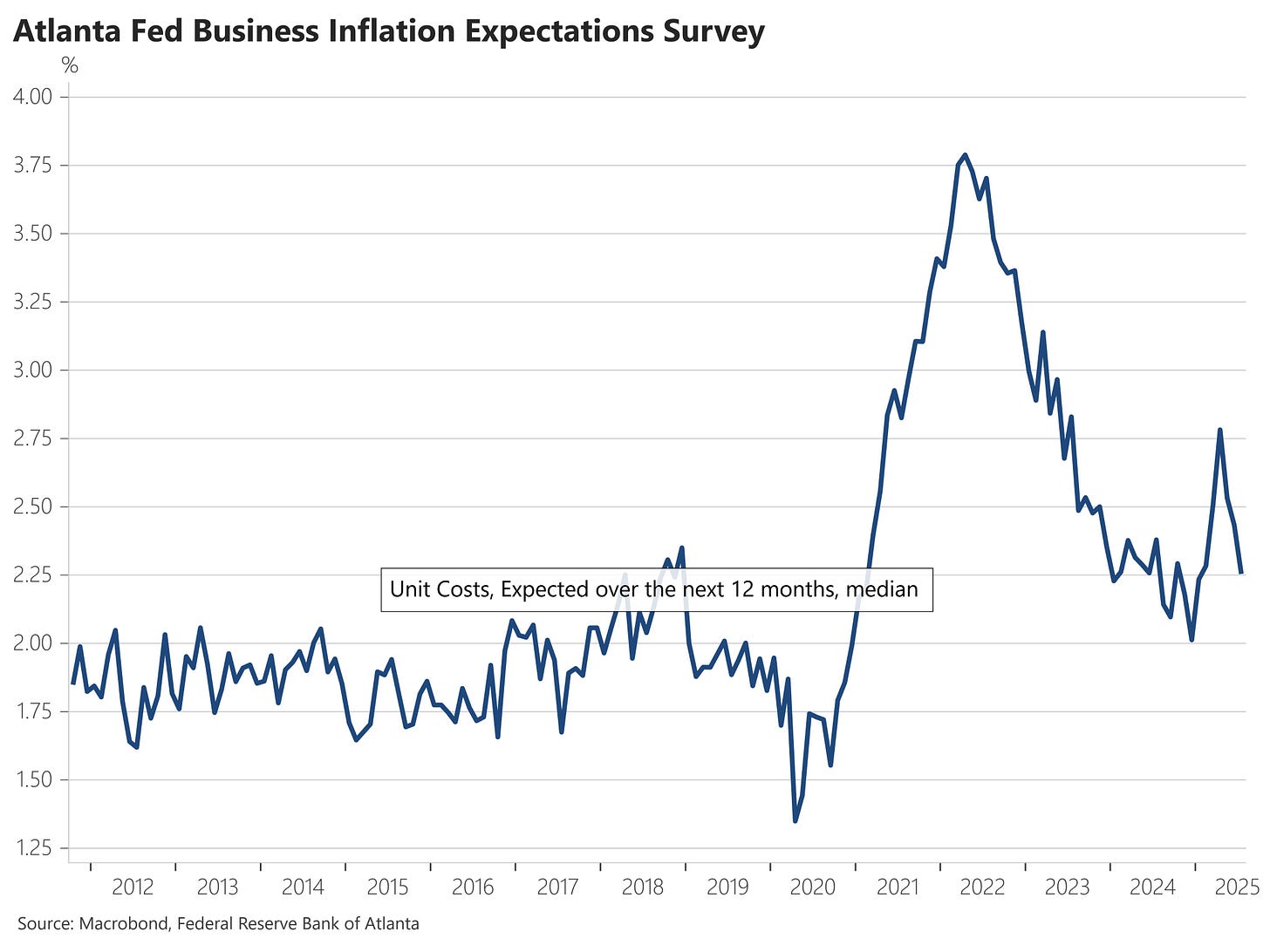

What does the same Atlanta Fed think about inflation risks?

Glad you asked, they are out with their year-ahead inflation expectations and a survey of businesses on their projections. The result, folks expect a decline in inflation, a sharp reversal in sentiment over the last 6 months. The expectation is now 2.25%.

The Next 18 Months Look Promising

Why?

We will have federal spending + a much lower tax policy.

But won’t more government spending lead to inflation?

In the long term yes. yes. yes. We still need to get our debt under control or we will spin off the track (more on this in a future newsletter). This is my #1 concern for our economy long term.

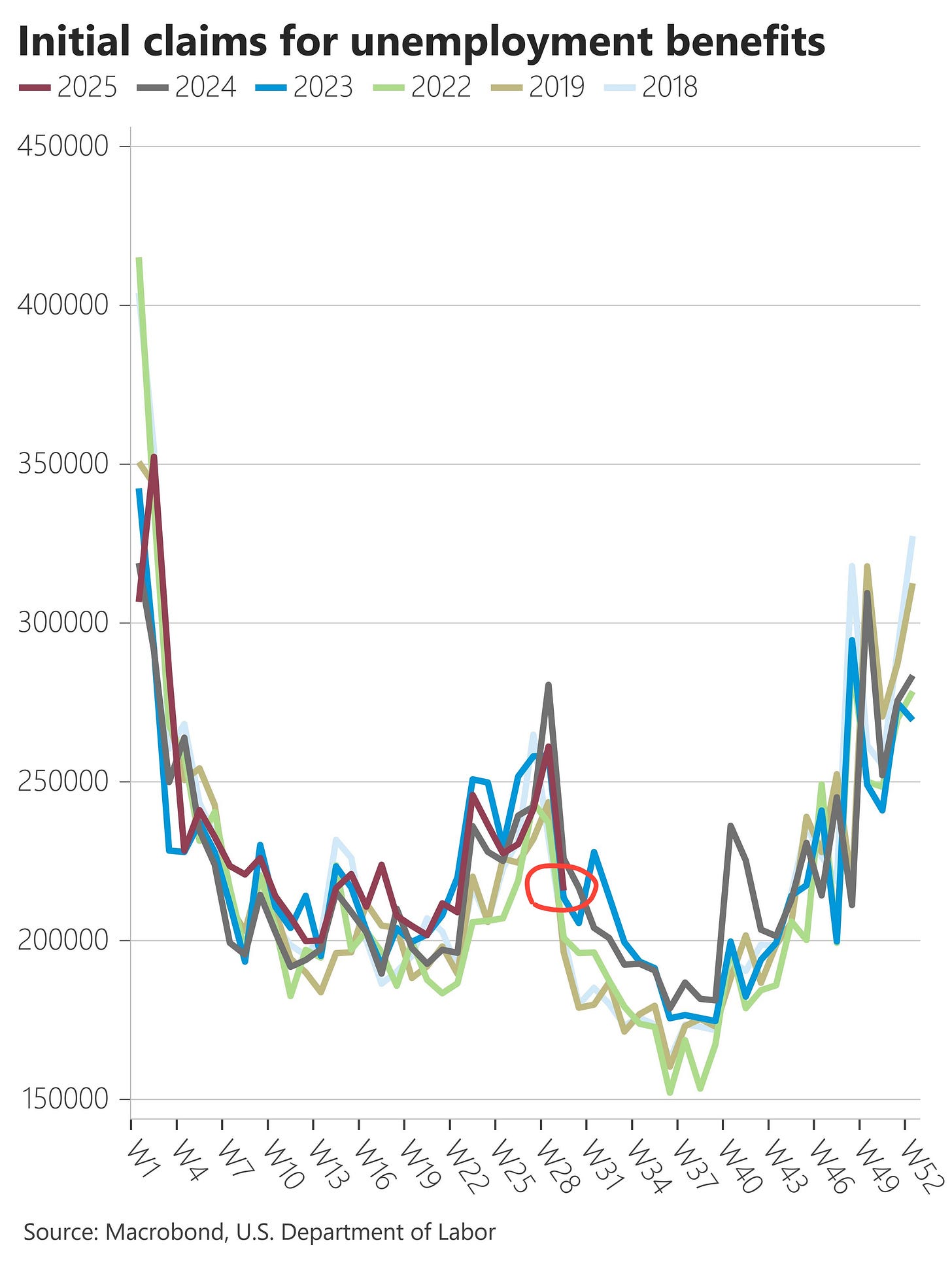

But, in the short-medium term, let the good times roll. Inflation is ticking down and, importantly, the labor market is staying strong. Initial claims for jobless benefits fell last week, running at trend and below 2024.

The Inventory Backstop

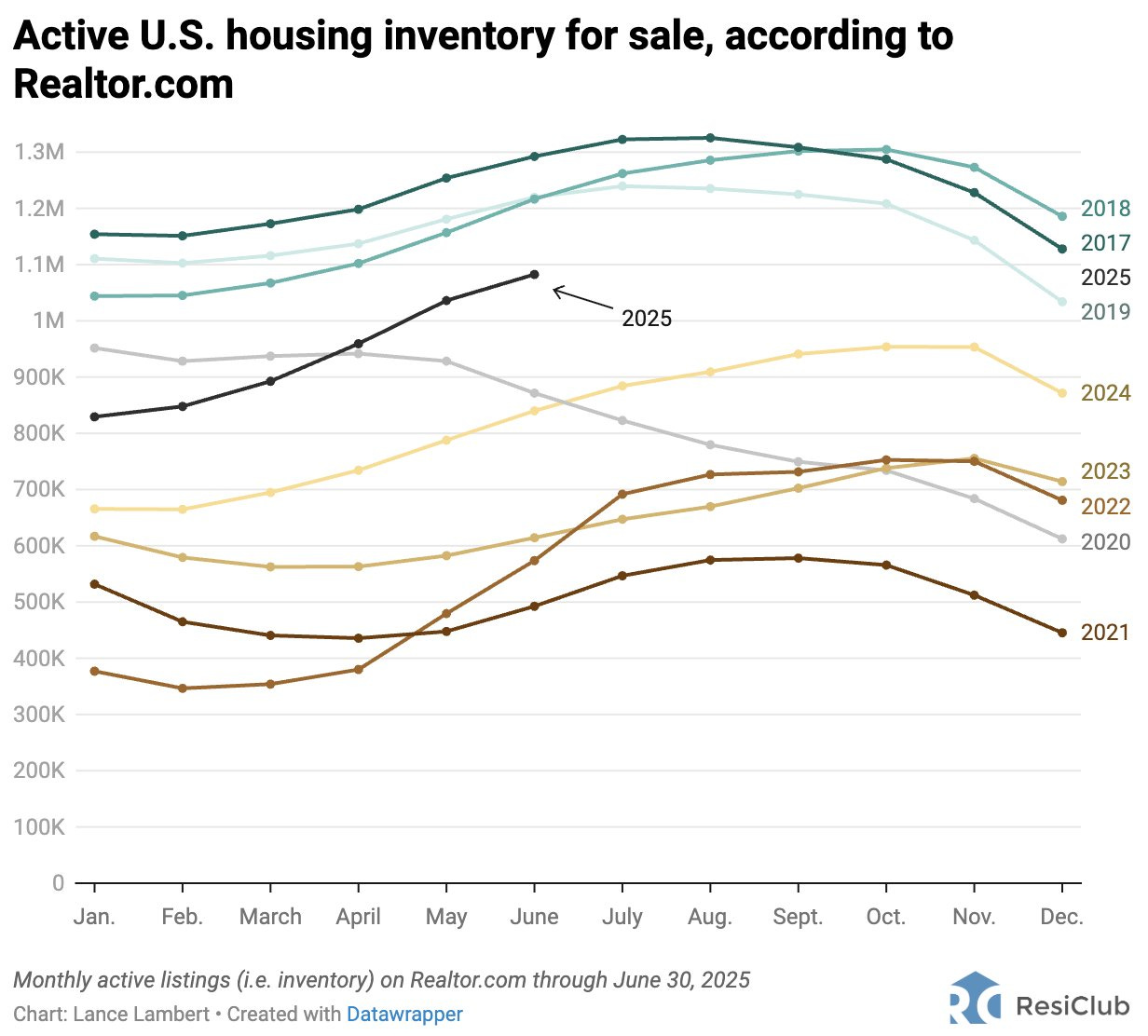

Ironically, it may be housing inventory levels that are keeping home prices under control. Inventory is steadily normalizing. We aren’t at pre-2019 levels yet, but we’re getting there. And we need more of this to get back to “normal.”

June 2025 -> 1,082,520 (Lambert/Realtor).

In a way, the inventory backstop is giving federal lawmakers the leeway to turn the economic spigot back on. Good for homebuyers. The growing supply is welcome news, offering more choices and softer price growth. Don’t forget that a broader housing shortage persists—estimated at 4 to 7 million units nationwide—due to years of underbuilding, making terms like "housing shortage" or "low inventory" still relevant in many markets. Homebuyers are still on the sidelines, and we won’t have enough homes for them once rates drop.

For the lowest-income renters, it's even worse: a shortage of 7.1 million affordable and available rental homes. This isn't just a today problem; we're millions short of current demand, and the younger generations coming up who want to buy or rent without getting crushed.

Again, for emphasis, the increase in housing inventory available for sale is:

Not yet back to “normal” 2019 levels and

Not due to panic selling or some flood of new listings being put on the market. It’s older listings that are not selling and piling up as inventory.

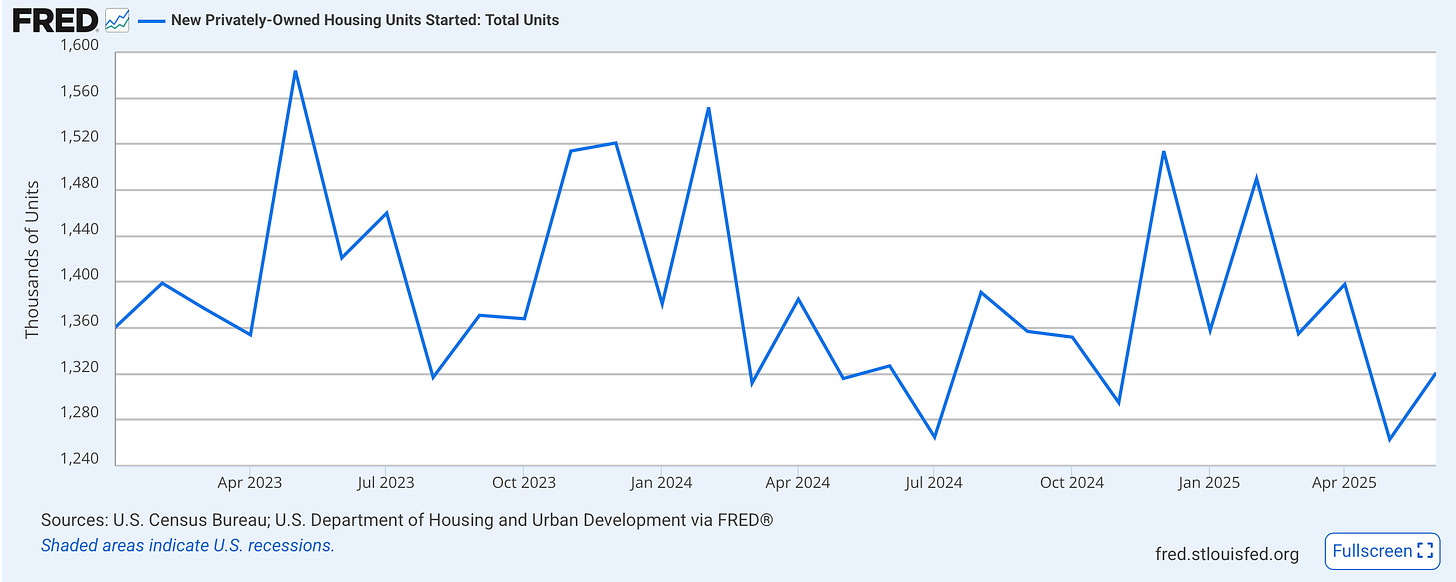

Home construction continues to lag population growth.

Why?

It’s interest rates, stupid.

And it may not be until the Fed Chair retires in May that we get to a sub-6% rate (again, I think sooner). But when we do, it‘s going to be game on. You will want to own real estate before then. Here is the infographic from the NAR.

Homebuying is in a slow uptrend from 2022 lows

Some positive signs in activity.

As rates stay range bound at 6.8% (+/- .5%), folks are dipping their toes back in. Mortgage purchase applications are up 3% this week, and fun fact, that is 12 consecutive weeks of double-digit YoY growth (Mohtashami).

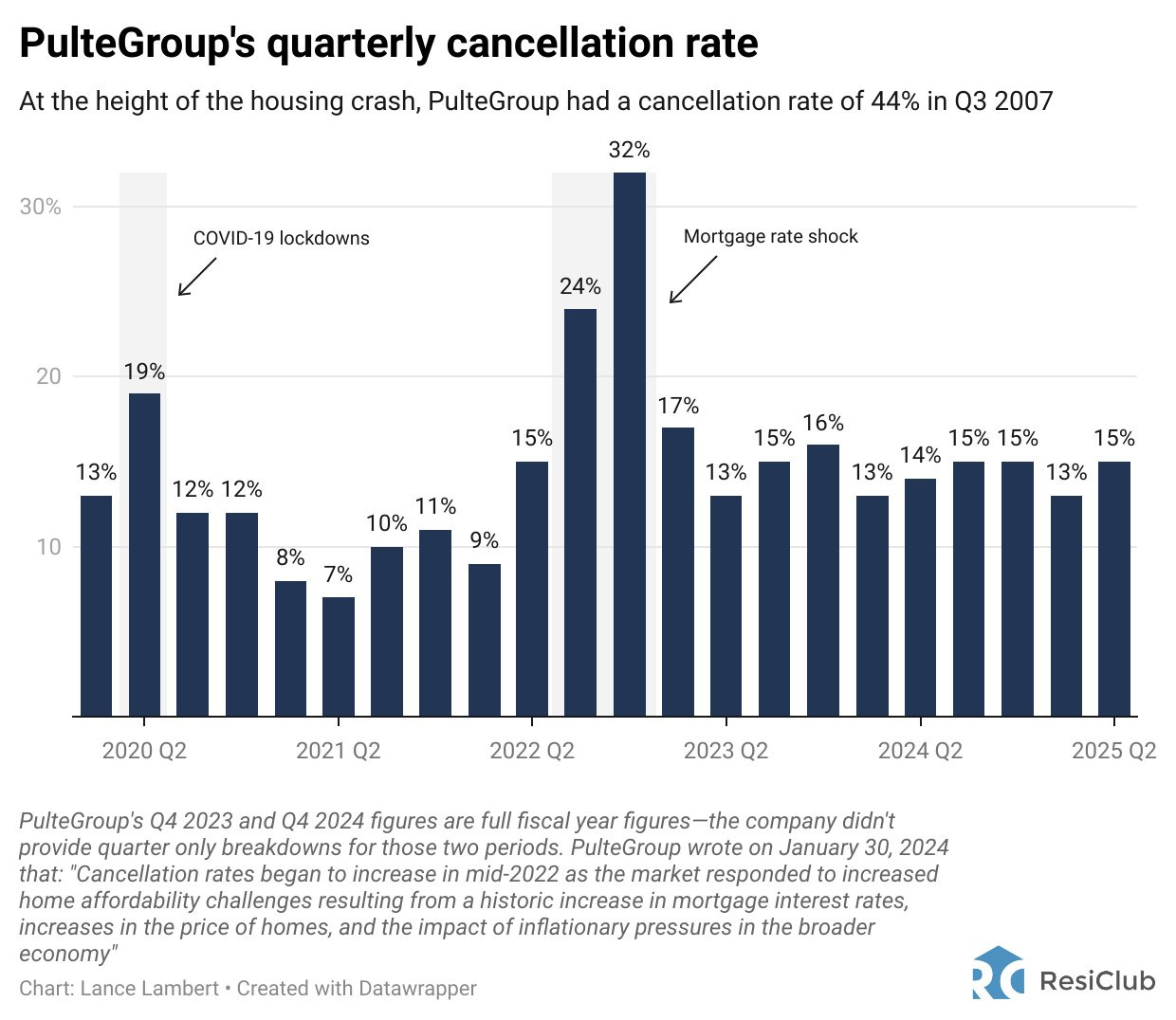

And new home purchase cancellations are low, as we tend to see during times of pocketbook distress and forward-looking frustration. For example, during the ‘08 housing crash, homebuilder PulteGroup had a cancellation rate of 44% in Q3 2007.

Today, despite the housing market “softening,” the cancellation rate is only at 15%. Normal.

But interest rates are still taking their pound of flesh.

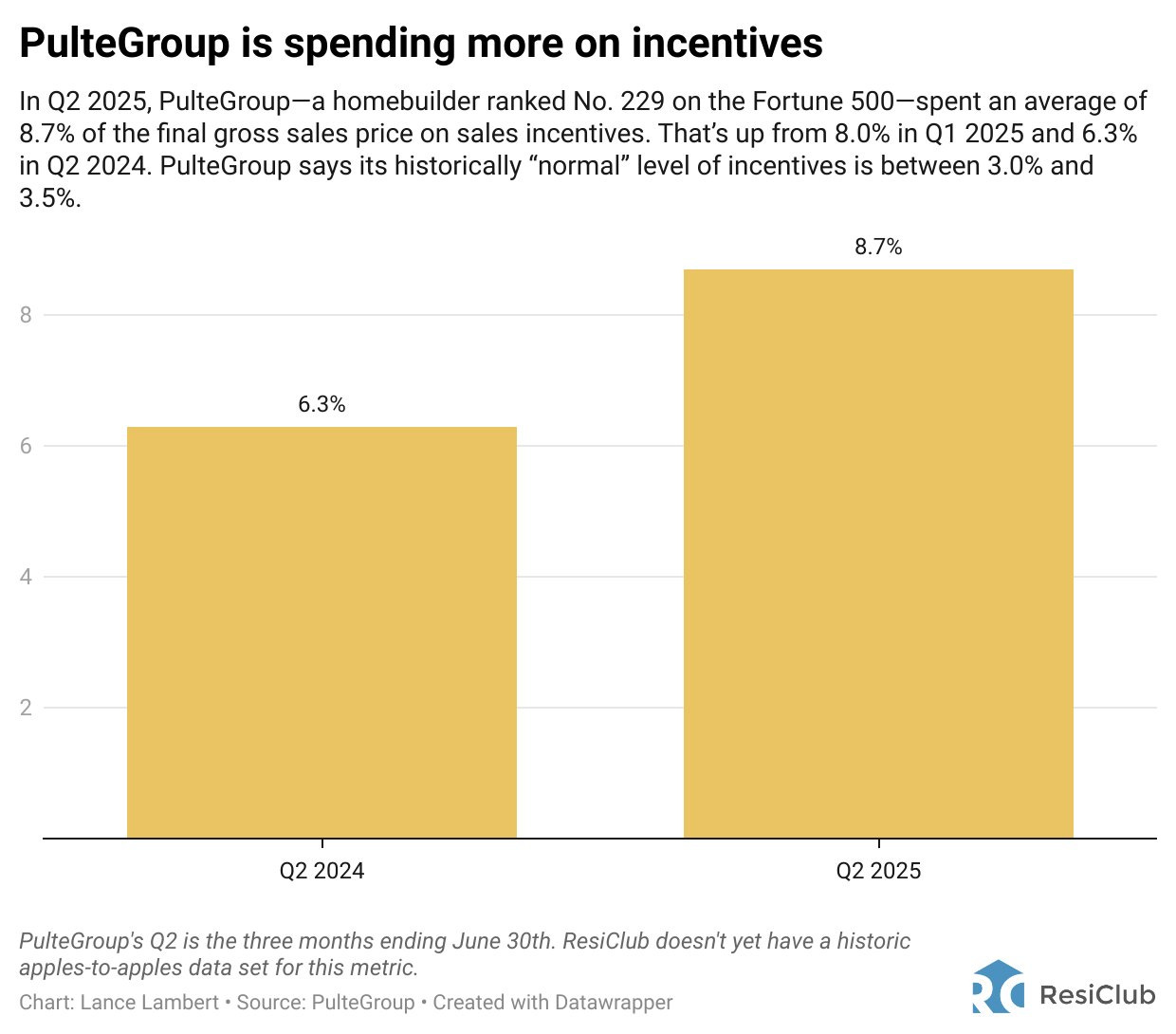

On a $500,000 home sale, during “normal times,” PulteGroup would spend $15,000 to $17,500 on sales incentives. Currently, it’s spending around $43,50 (ResiClub).

Rent and Wall Street

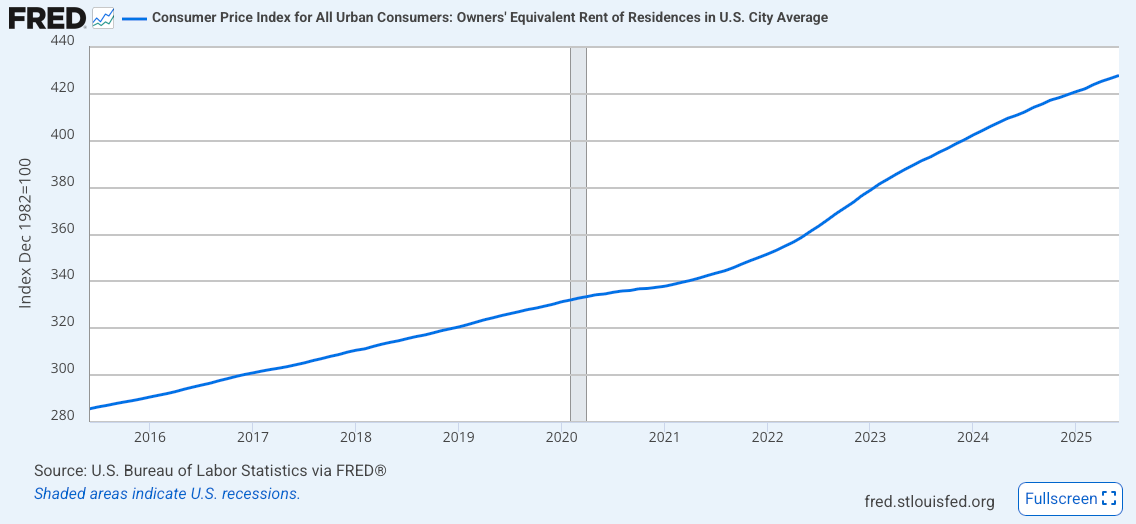

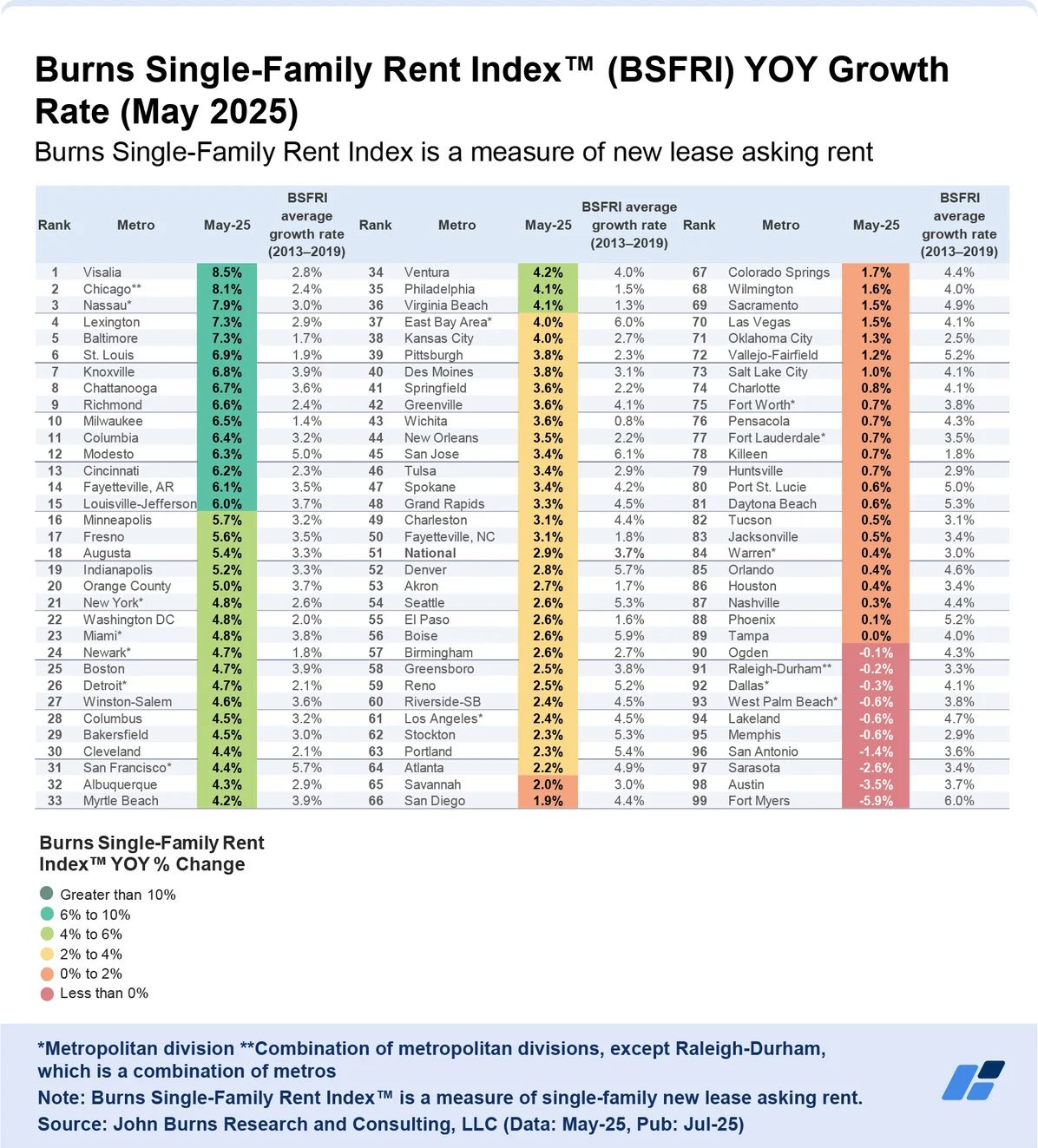

Housing affordability in the doldrums has an effect on rents. Rents too are making all-time highs.

But don’t get sucked into the narrative that “Wall Street is crowding out homebuyers and contributing to affordability.”

This is just not the case.

Contrary to popular belief, dumb politics and salacious headlines, Wall Street institutions are not driving rents up. Most renters rent from regular people, and it’s not even close. Most landlords are mom and pops with 10 or fewer rentals. And large institutions own fewer today, just 2.2% of the housing stock, down from of 3.2% in 2021 (Parsons).

“The investors who dominate the single-family rental market are and always have been small investors. Most institutional investors and REITs haven't been bulk buyers of individual homes in many years -- long before the jump in rates and home prices (Parsons).”

In fact, it’s the housing markets with fewer institutions active in the market that have the highest rent growth. Chart on! 👇

The South is building.

More housing units built and owned by large institutions is a positive for the housing market. Shocker, supply and demand is actually a thing.

What market grew rents at the fastest clip over the last year?

Boston.

And guess what, institutional investors comprise <1% of Boston's single-family rental market, and yet Boston led the nation in SFR rent growth.

“Boston single-family rents are running at +4.7% YOY…Ironically, many of the markets with larger institutional ownership are experiencing flat to falling rents (JBREC).”

Or, as another housing analyst put it, “The top rent growth markets are basically all ~non-institutional markets (Parsons).”

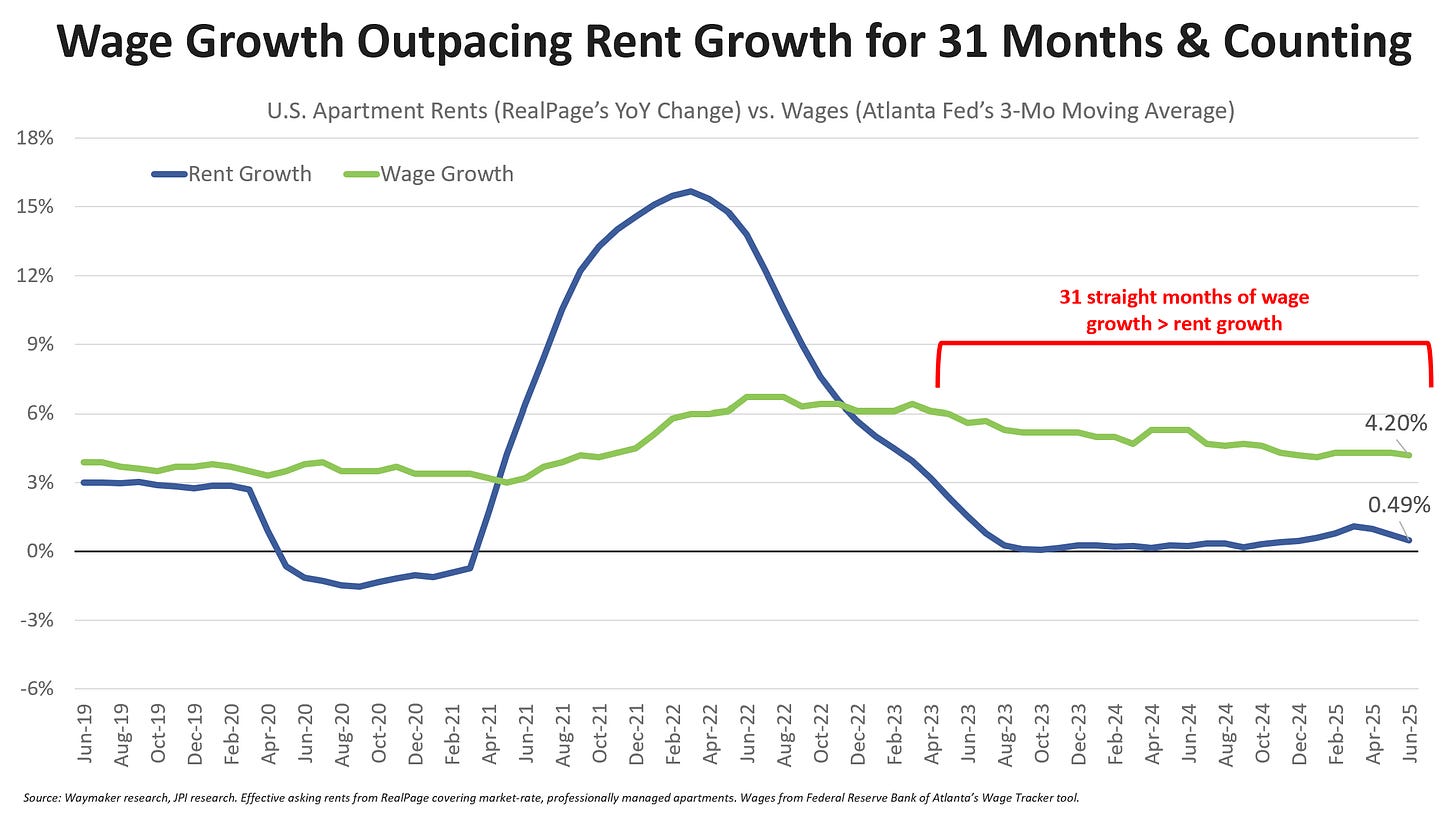

Another positive economic reminder, wages are up.

Wage Growth Outpacing Rent Growth

Something else that may seem shocking, wage growth is still outpacing rent growth for 31 consecutive months. I know it doesn’t feel like it, but it’s true.

Why? That darn supply and demand, is once again the culprit.

Rent growth slowed from all the construction we started when interest rates were near zero back in 2020-2021; this is a supply-induced rent slowdown story, driven by the largest wave of new apartment supply in 40+ years, which came on the market in 2024 and the beginning of 2025.

But this supply has just peaked and is about to plummet.

We won’t have the new units in the pipeline to keep this going. New housing starts are way down.

Why?

Don’t make me say it again….

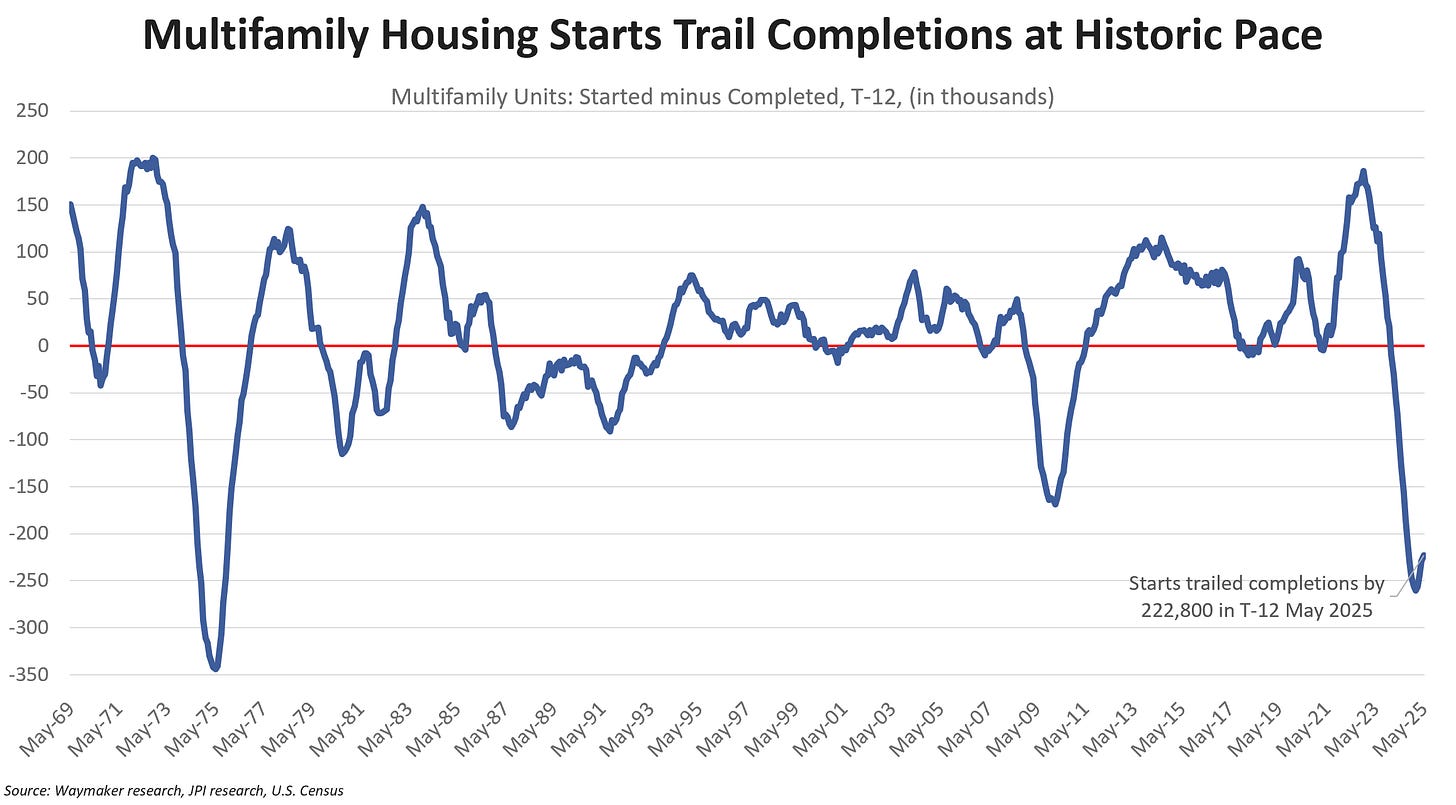

The cliff is coming. Especially in apartments and cheaper single-family homes, which are sorely needed to suppress rent and home price growth. This chart is scary.

Kudos to analyst Jay Parsons for continuing to put this chart out. Multifamily construction starts trailed completions by 223k units over the last 12 months (Parsons).

We have officially stepped off the cliff and are in supply freefall.

Burn this into your brain, this is coming and you will want to be a landlord/homeowner before the effects slam the marketplace.

We are about to hit a multi-year rent and home price reacceleration because interest rates have remained high for so long. Remember, it takes 6-12 months+ to build a home and 3+ years to build large apartments, start to finish. And the latter only makes financial sense to do when rates are low. Even if we started building like it was 2020 today, it may be 5 years before we could hit another cycle of slow rent and home price growth, like we have today.

Do you really need a “mentor“ when it comes to real estate investing?

Probably not.

The single most important part of real estate is finding a deal and educating yourself. Go read some books, listen to free podcasts, and get your finances in order. Here is a list. If you do that, everything else will follow.

BUT if you think you must get some help, for the love of god, do not buy an expensive course, or pay for a “coach,” or “mentor.” Do NOT hire a guru.

Get professional advice from someone who actually owns, manages, and brokers real estate.

You can consult with me, The Skeptical Investor.

Get clarity on how to grow your business. Let’s run the numbers together and chart your path of success.

No BS. No fluff. No Gurus. Only results. (The swift kick in the pants is free 😂).

Just $250 bucks for a 30-min call. No lame subscriptions.

Call me now, and if you aren’t satisfied for any reason, I’ll refund you. Try asking your “coach” to do that.

I’m not your guru, I’m your guardian. I’ll keep you out of trouble and fill your jet with fuel so you can take off on your own.

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

A Contrarian View from Economist Mark Zandi:

I love being wrong; it means I’m learning. So this week I wanted to share the raw take from Economist Mark Zandi, who has a different, more mainstream point of view from mine. Give it a read and let me know your thoughts. I’m not going to dirty it up with my commentary.

“A ton of economic data comes out this week, and the storyline will be that growth has slowed sharply so far this year. GDP will grow 2.8% in the 2nd quarter, but this is a tariff-induced bounce from the 0.5% decline in the 1st. First-half growth will be less than half of last year’s nearly 3% gain.

Cautious consumers are largely behind the slowdown. Real consumer spending has gone nowhere since the end of last year, and with the release of the June data this week, we will see that consumers are still on the sidelines. And this is before the tariff-related price increases kick into full swing.

We’ll also get a read on inflation with the release of the June PCE deflator, the inflation measure the Fed uses to set its 2% target. We anticipate a 0.3% increase in core inflation, putting year-over-year growth at 2.7%. That’s above target, and given the tariffs, the direction of travel is clear.

Then there is the headline employment report for July, which should show a 90k gain in payroll employment. Fewer industries are adding to their roles, and hiring is moribund. But layoffs remain low. This is the remaining firewall between the weakening economy and recession—let’s hope it holds.”

Again, I vehemently disagree with this take, as you can see by this week’s article. But I'm always looking for more data, more information and more opinions, aka learning, which you can only do if you consume all the information, not just stuff you agree with.

So, what did you think? I want to hear, let me know!

My Skeptical Take:

So, my message to you today is ignore the doomers. Home prices are the ultimate store of value. Not gold. Not Bitcoin. Not Stocks. Not classic Cars. Not fine art (ok well I must admit I dabble in all of these, except art. Im clueless there).

And the economy appears to be set to really boom.

We just have 1 problem. Interest rates.

And this frustration with the Fed boiled over on live TV Monday. “Our biggest problem is we have so much growth that the Fed won’t cut…. what the fuck?”

Here here Jim. What the Fuck indeed!

It’s a wild world out there. Just this last week the US struck a trade deal with the EU, the President visited the Fed and sparred over interest rates and spending, and on Friday 15%+ tariffs go into effect across the globe.

And while the world may move fast, the real estate market is more like an oil tanker: it’s really hard to turn or capsize. That’s (one reason) why I like it. Prices, construction, inventory, even mortgage rates all take a little time to get moving.

Real estate is the champ when it comes to store of value.

And on a microlevel, it’s something I have some modicum of control over, and isn’t beholden to the headlines. I can add value myself through renovation and know how much a piece of property will be worth in the aftermath. Every dollar I put into a renovation should return at least 50%, dollar-for-dollar, in the value of my property. Want help calculating this? Here’s a great book.

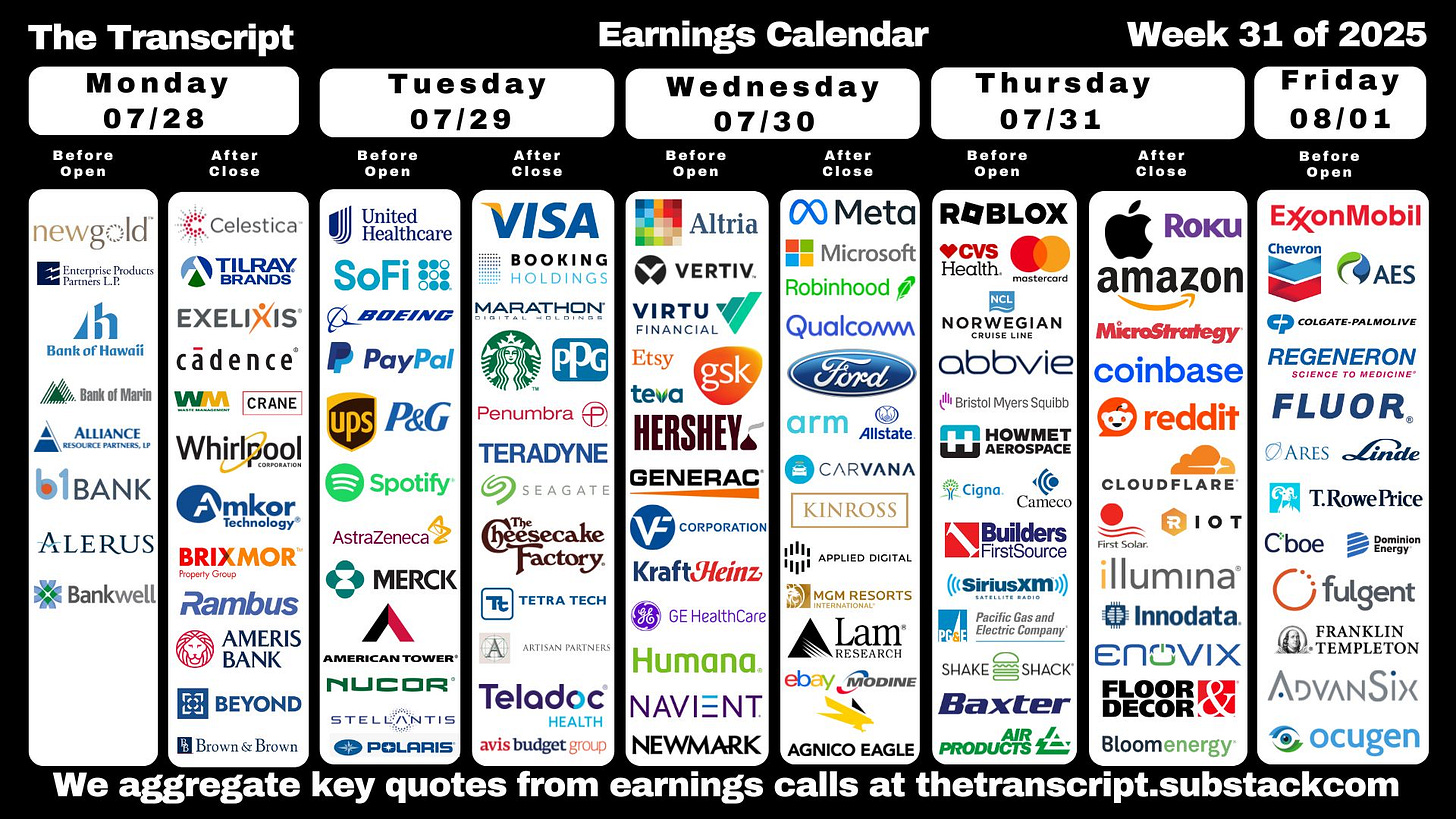

One could also invest in stocks, but holy hell, what a rollercoaster. Just look at the stock market this week, dozens of meaningful companies are coming on the carpet for their required 3-month earnings report (Transcript).

This is the risky volatility I like avoiding.

So when I’m deciding what to do with my hard-earned skeckles, I always come back to real estate. It’s not passive. You can’t just click a button and sit back, like you would a stock. You have to run it like a business, improve it, protect it, and take care of your tenants, hell, it’s their home!

Again, we don't have a bubble; we have a supply crisis that's propping up prices and rents. Home prices will keep hitting highs until we build millions more units—simple as that. My advice? Don't wait for the perfect moment. Start buying real estate as an investor to sidestep the craziness. Get smart about it: house hack with an FHA loan, run the numbers conservatively, and talk to an investor-friendly real estate agent who specializes in deals for folks like you. That's me—hit me up if you need help finding properties that cash flow and build wealth without the guru BS.

Real estate can be daunting.

But, I often observe that when it feels scary to jump, that is exactly when you must.

Otherwise, you’ll end up standing in the same place for the rest of your life.

It’s time to jump.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. if you need a little push, here is my new book! (shameless plug for the $1 I’ll make on the sale). The 5 Ways Real Estate Investors Make Money and Build Wealth: Anyone can create wealth through real estate. Including You!