Welcome to the Investor Agent Newsletter. A frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

It’s Going to be a Hot Rate Cut Fall!

Homebuyers are Waiting for Greener Grass?

When is a Deal a Deal?

Nashville is Smokin’

My Skeptical Take.

Fuel for the Day:

It’s my b-day tomorrow, but I’m still bringing you some great content readers 😊.

So as I sip my coffee this AM (quick plug to Black Rifle coffee) I was thinking about our wild politics and toxic public discourse.

I felt compelled to look for something of substance for my own sanity, and so …. I just ordered JFK’s Profiles in Courage. Have you read it? Drop me a note if you have. I don’t know why I haven’t, I love a great auto/biography. So I’m pretty damn excited to dig in and hopefully learn more about how a real doer, does.

Less talk. More doing. Perhaps something we can all agree on in these crazy times.

The Weekly 3: News, Data and Education to Keep You Informed

Starter home listings are up, and mortgage rates are coming down. More inventory on the market is a silver lining for young folks (RedFin).

The Hottest New Restaurants in Nashville, August 2024. A must-read for those looking for some great food this Fall. (Eater).

Bonus recommendation: Poolside at Drift Hotel is dope. Great renovation of an old cheap motel into a great pool with a bar and 60s’ vibe in East Nashville. And if you don’t live here, come stay :).

Book Recommendation: JFK’s Profiles in Courage (see above).

Today’s Interest Rate: 6.40%

(👇.02, from this time last week, 30-yr mortgage)

Guten Morgan investors. It’s a lovely day to talk real estate.

Let’s get into it.

Hey there September, it’s going to be a Hot Rate Cut Fall! But are folks going to swoon over the low-er interest rates before winter hits? Actually, likely not (yet).

In fact, the spectre of rate cuts beginning on the 18th of the month now has homebuyers/sellers thinking the grass may be greener in the Spring.

So much for a bird in hand….

So, if they can wait, they are. Pending home sales fell 6.9% during August, the largest decline in nearly a year, and the lowest reading since the index began tracking in 2001 (NAR). I expect this lag effect to continue through the winter, YoY.

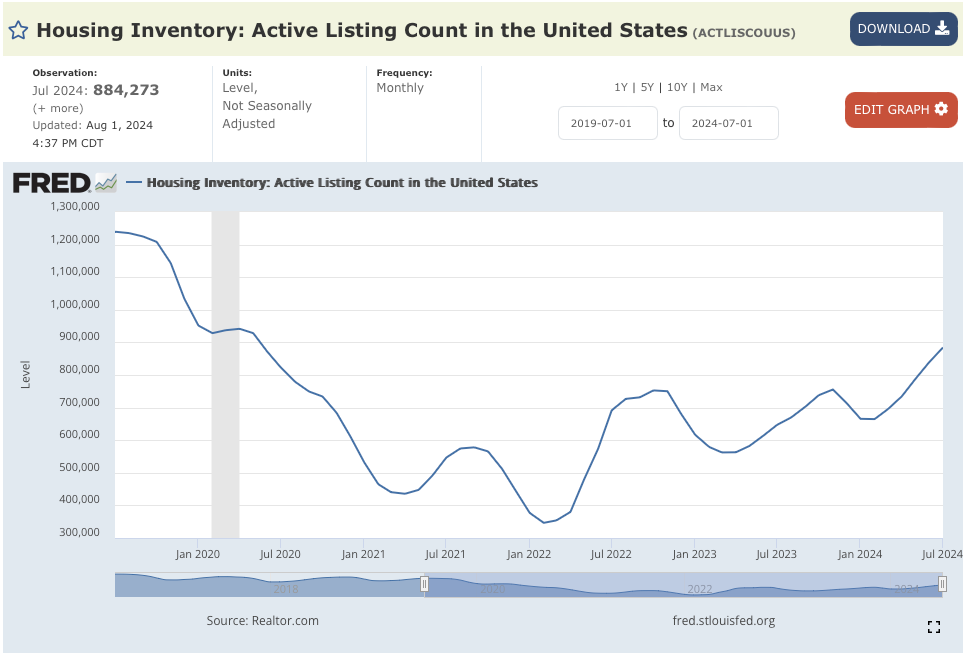

So we may see inventory levels continue their melt up for 5 or so months, as anticipatory buyers hold out for lower rates, translating to higher supply and lower demand. This is good, very good in fact. Why? For homebuyers and investors alike, it will produce the perfect cocktail to pick up a deal.

This may be one of the best buyers’ markets in the last 10 years, and in my opinion, will be the start of a new multi-year bull market in real estate. Remember we are still highly supply constrained relative to total demand, despite this pocket of inventory we are seeing.

And in some markets inventory is already above 2019 levels.

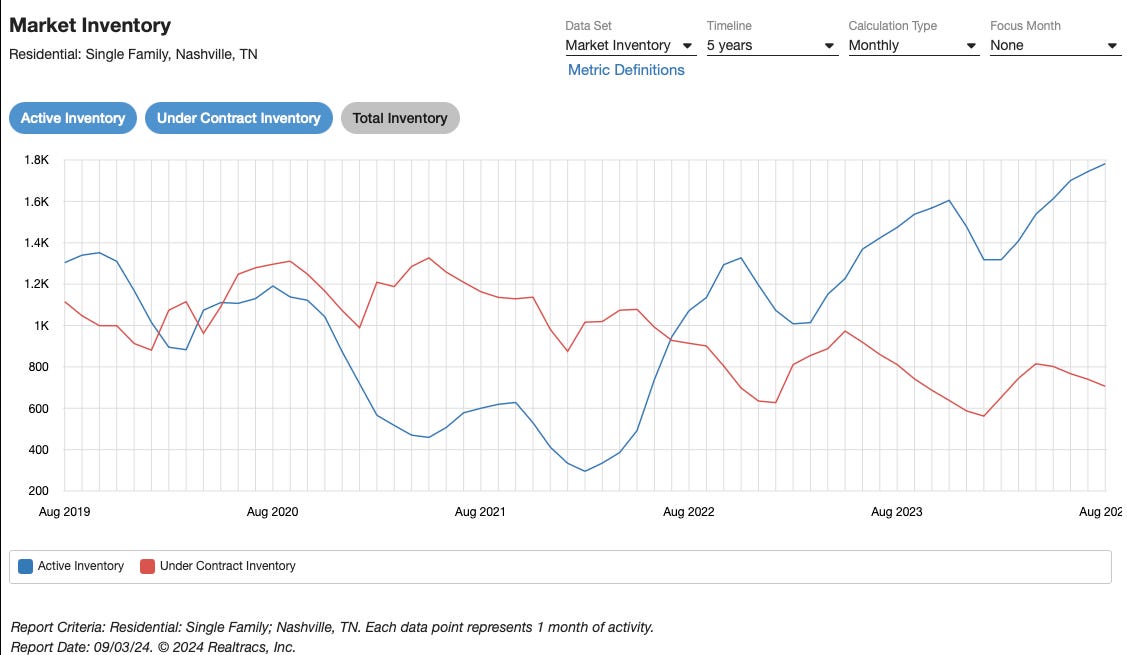

In my home market of Nashville, active inventory is now higher than 2019 levels, with pending home sales declining.

Homebuyers (and sellers, who are really just future buyers) are waiting for rates to drop, now that the reality of lower rates by Spring is setting in. Pending home sales show us they are taking their foot off the pedal and becoming more patient. Anecdotally, I just had 2 buyers scoop up a smokin’ hot deal, taking advantage of sellers who had properties sitting on the market for 45+ days. We are now at 5.58 months supply, the second highest level in 5 years.

It’s the Skip till Spring pause on home buying.

Importantly, median (and mean) home prices in Nashville are up YoY. And sellers are not accepting, on average, drastically lower offers. They are also waiting. If it doesn’t sell, they are taking it off the market. See canceled listings, at a 5 year high.

So a smart buyer / investor has to be discerning, and it’s a certain type of property that one should be considering in order to get a deal (keep reading).

When is a Property a Deal?

Talking about deals begs the question: what does “getting a deal” really mean?

I’ll tell you: for residential real estate (single family and up to small 4-unit multifamily) it’s buying below market value, i.e. getting that property below the median price of comparable properties that have recently sold.

Need help calculating this? Call a realtor who is also an investor, like these guys.

What am I Seeing Investors Do Now?

The smart money is focusing on those ugly / 1960s outdated properties in C+ to B class neighborhoods, that are sitting on the market 30+ days and are directly in the path of growth. Cities expand in growth paths, I don’t know why, but they do. And you want to be right on those railroad tracks when the growth train comes a chug chuggin’.

Nashville is Smokin’

An important note on Nashville, since I singled it out.

Nashville is growing rapidly but isn’t overheating as cities like Austin, TX have. We have one of the lowest unemployment rate amongst major cities at 2.9% (compare to Austin at 3.6%), and that’s with 90 folks moving here every day. Those folks need a place to live, which is why it is commonly ranked in the top 10 for most attractive real estate investment. In CBRE’s 2024 Global Investor Intentions Survey Nashville comes in at the number 4 spot.

Speaking about real estate investing in Nashville, CBRE told the Nashville Business Journal. “They like the culture, the potential for growth, and it's also not a huge market yet. As the overall economy improves, investors feel that Nashville will recover faster than other markets.”

Similarly, the founder of Hard Rock hotels Isaac Tigrett, one of our newest residents here in the city, agrees, saying in a recent interview, “Nashville is smoking, and there’s nothing even close.”

and he continued:

“It's a tiny little place with this explosive energy happening. It's really something, and that is why I feel blessed to be here. This is the perfect place for me,” Tigrett said. “I could be anywhere in the world, but something drew me here. I'm here to testify that Nashville is awesome.” - Isaac Tigrett, Founder of Hard Rock hotels

We also don’t have those pesky property insurance problems as they do in CA, FL and TX. Just this week, Allstate announced a 34% home insurance premium increase in California! Yuck.

And Tigrett had a very interesting take on traffic, which of course nobody likes but we all may want to appreciate…

“One of the greatest things about Nashville is the traffic. People should be worshipping the traffic. If there was no traffic, there'd be no new Nashville,” Tigrett said. “That is the river of money and people moving in and exciting and everything. This is the most happening town, and the traffic is the lifeblood of it. It just shows you all these people are going everywhere, and they’re on every street.”

Well said, and I can’t wait for autonomous cars to drive us all, so we don’t have to deal with it anymore, we can avoid the 40,000+ driving fatalities annually and I don’t have to stress avoiding those dangerous folks who think they drive for Formula 1! Although those new Teslas are getting really really close to full self driving.

But I digress…

My Skeptical Take:

Real estate is and has been in a home sales recession for a long time. The current pace is 3.95 million home sales vs 5.3 million in 2019.

But there is fantastic news for real estate investors on the horizon. We have a 5+ month window to find our next deal.

We have more choices, and more inventory. While there is immense pent up demand, some buyers are playing the waiting game, hoping interest rates fall more before they pull the trigger.

Again, I think this could last until the early spring/late winter.

And an important note: more inventory on the market, especially if it’s outdated and ugly, is like being in a blackberry patch in late Spring: plenty of ripe deals, but you have to mind the thorns.

That second point is quite important. Too many folks think it’s easy to invest in real estate. They watch HGTV and listen (or hopefully don’t pay $) to Guru’s online and say, I can totally do that, look at how easy it is!

Well it’s not, and if you are just getting started, for god’s sake make sure you get honest advice that you aren’t paying for, like a realtor who is also an accomplished investor. Something that can give you frank, sometimes uncomfortable, advice that is in your best financial interest.

A not-so-fun fact:

42% of real estate investors reported losing more money than they’ve made in their real estate investing careers (CleaverRE).

So we have to make sure we are one of the 68% that are successful. It’s not easy, but with the right strategy it’s not difficult either.

The Skip for Spring pause in real estate activity will present a nice buying opportunity for the savvy investor, before the herd of demand tramples all in the late winter/early Spring.

You will want to be before the herd, not flattened by it.

And the underpinnings of the U.S. Economy is providing a strong environment for real estate in the coming months.

Economic indicators are signaling the start of a new long-term real estate bull market, out of the doldrums of wildly low home sales activity, which have plagued us since 2022. And the economy is an a good place, so far:

US GDP grew at a robust 3% in Q2, these past 3 months.

The labor market is still operating at full employment, with unemployment at just over 4%.

Unemployment has been edging up recently, but this is appears due to more labor supply and not less labor demand, as layoffs are low.

Productivity growth is a robust ~3%.

Inflation has likely already reached the Fed’s target of 2%.

Interest rate cuts should start in a couple weeks.

The 30-yr mortgage should be close to or below 6% by the end of the year.

Again, the spectre of rate cuts and economic worries, mixed with inventory rising is the perfect storm, of opportunity.

I’ll leave you with a favorite call to action from the late great Charlie Munger that is apropos of today:

“The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.” —Charlie Munger

So get limber, stretch out those hammies, and get ready to jump on that growth train.

It’s coming.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

Please Share this Article!

It takes several hours to write this weekly article, and they will always remain free. All I ask is that you share it with 1 friend. Just 1. If you do, you will get two gifts: free education for one of your friends, and good karma for helping to grow a community of folks trying to figure out a way to create wealth for their family.

Contact Us Here in Nashville!

If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a market to invest in? There is always a bull market somewhere, and one of them is Nashville, where we are seeing record tourism this year. 90+ people per day move to Nashville and our city population is still under 700k. We have 3 professional sports teams, massive healthcare and entertainment industries, more than a dozen colleges, and no state income tax, to name a few.

Looking for a realtor in the Nashville area? We work with the best here who specialize in helping investors find great properties.

* I write this myself and get it out for you all on the same day. Apologize in advance for the likley errata. Don’t have a team of editors, yet.

** The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.