Investors Master the Art of Contrary Thinking

A group thinks with the heart, an individual thinks with the brain.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Prices: Remember, It’s All Relative

What Markets Are Doing the Best?

Investors Must Master the Art of Contrary Thinking

My Skeptical Take

The Weekly 3: News, Data and Education to Keep You Informed

Eight potential impacts of Trump's landslide win and a GOP Congress on rental housing. Lower taxes and regulatory burden (Parsons).

Credit cards are swiping left and right. 28% of credit card users in the US are still paying off LAST YEAR'S holiday shopping. Average credit card balances are now 6.9% higher than last year and more than 20% higher than 2 years ago (Kobeissi).

The Fed cut rates again. Mortgage rates are higher, again. It’s the bond market that controls interest rates (NBC).

Today’s Interest Rate: 6.92%

(👇.13, from this time last week, 30-yr mortgage)

Hello world! Post-election certainty has kicked markets into gear, especially the stock and crypto markets, with bonds selling off hard in a fervor of activity; and real estate is looking pretty damn good too.

Let’s get into it.

A Week of New Data is Coming!

And the fun is just beginning. This week we will get an update on inflation, consumer spending, and manufacturing. The market expects and is bracing for inflation to stall, and may even be flat or up for October, interrupting its decline toward the Fed's 2.0% target. This could be a trend for the rest of November as well. If so, we may see interest rates tick up.

Part of the inflation worry is that the consumer… is too strong? Wage increases (inflation adjusted) and their demand for “stuff” (including homes), heading into the holiday spending season continues to be vigorous. Consumer spending has been up in each of the last 5 months and consumer sentiment MoM was up 3.5% in November.

How about job growth? Job growth was hardy in October, up private employment was up 233,000, the number since July, 2023. According to payment processor ADP: “Even amid hurricane recovery, job growth was strong in October. As we round out the year, hiring in the U.S. is proving to be robust and broadly resilient.”

Want to know the states that are most resolute in their growth?

I’ll tell you, keep reading. 😁

Prices: Remember, It’s All Relative

We all know prices are up, duh. But it’s important to remember that it’s not the grocery store or corner deli that is “price gouging.” It’s all part of a national (and most often global) market.

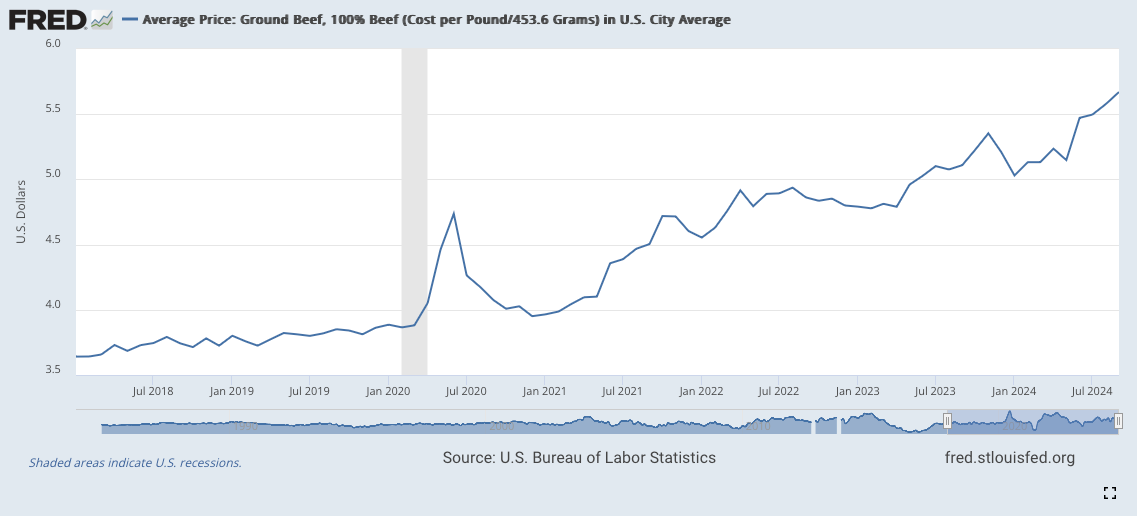

There is a reason why that burger is still more expensive at your local greasy spoon: underlying commodities are still going full 1990s Girls Gone Wild.

Just look at ground beef prices.

They didn’t slow in 2024.

But, it’s all relative. Think prices are bad here? Well, you could be in Europe.

Electricity prices are crazy high in the UK/Europe.

Wow.

And remember this filters down into everything, you can’t do much of anything without electricity.

So what’s the point?

This writer thinks the re-inflation worry will be strong enough to coax the Fed into not cutting in December. But this will not mean home prices come down, at best they may decelerate but if you are waiting for a “housing crash” from high rates, well it’s going to be a long wait.

Let’s take a look at where we are in the housing market.

Housing Market Update

These housing market stats are courtesy of Altos Research (and their President Mike Simonsen is a fantastic follow on Twitter). Highly recommend you follow.

In short: we are seeing home sales up, inventory up and prices up.

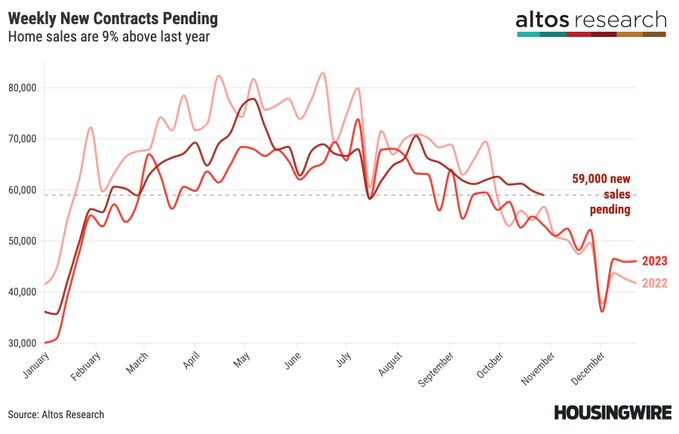

Sales Up, Slightly

Home sales are holding steady and consistent, still higher than 2022 and 2023. Last week we had 59,000 new pending SFH sales, 9% more YoY.

Inventory High

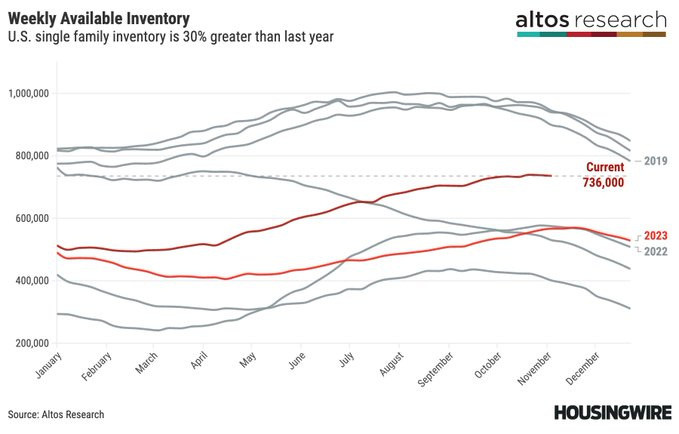

Inventory remains elevated, albeit down ever so slightly from last week. We have 736,000 single family homes on the market, 29.8% more homes YoY!

Inventory may have peaked for the year but, a flash uptick in rates these last 2 weeks may result in higher than normal inventory levels for the sluggish winter season.

I expect the bond market to remain fearful of long-term higher inflation. The 10-yr Treasury is at 4.388% today. And has risen .603 since Oct 1st. The 30 Yr mortgage is at 6.92% today. Higher (high 6%) interest rates are likely no fleeting phenomena, and may hang around until Spring.

Check back on this newsletter and my Twitter feed these next 3 weeks heading into the holiday season. The market is not easily predictable.

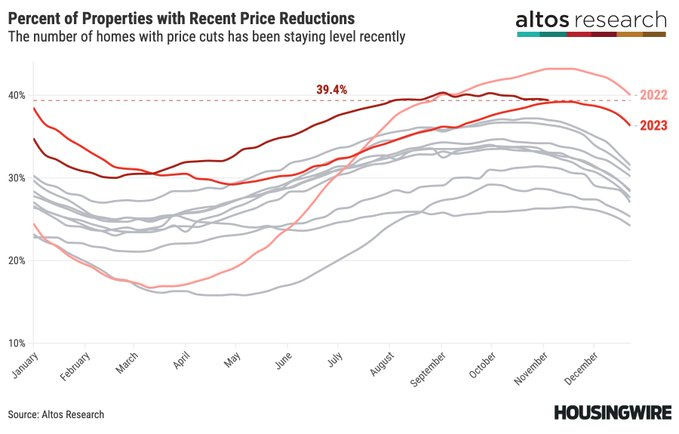

It’s a Buyer’s Market, for Now

The % of home receiving a price reduction remains high, higher than all years except 2022, which was the beginning for interest rate increases. Buyers, especially investors looking for ugly existing homes. We will see what happens this winter and as the Fed starts to ease monetary policy.

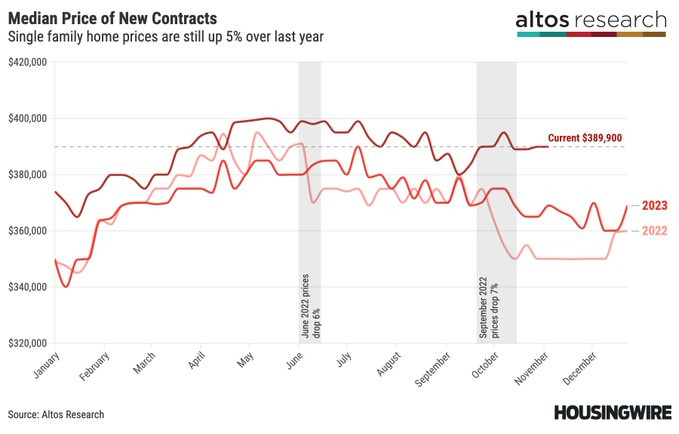

Home Prices Continue Up

Like everything else, prices are up. I don’t find this surprising. Median price of the new pending home for sale is $389,900 this week, which is 5% above last year. Demand still exists to buy homes at these levels, but we aren’t building enough and not enough existing home owners want to sell. Hence, prices up.

Again, I am not surprised. I assume folks who bought before 2022 are happy as a clam in their ~3% mortgage (remember those?!). They have such a low real mortgage rate they could even be getting paid to borrow money, given inflation % is higher than many of those mortgages.

Why trade in your low mortgage rate for something double that if you don’t have to move?

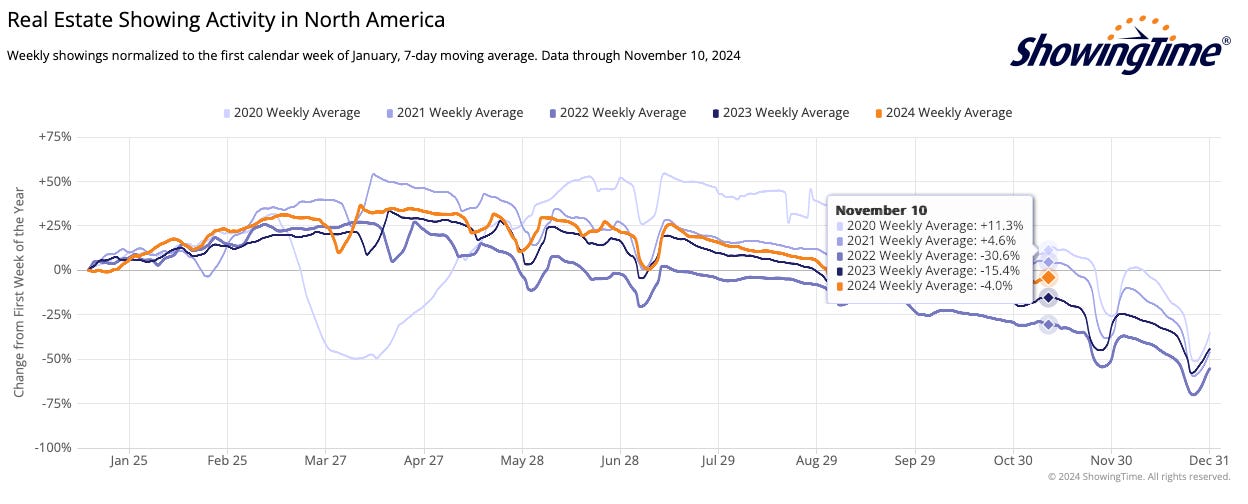

Case in point, home showings by potential homebuyers and their real estate agent is above 2023 and 2022, at this exact same point in the season. This is fairly strong; potential homebuyers are circling. We aren’t quite to 2021 levels, but we are close!

What Markets Are Doing the Best?

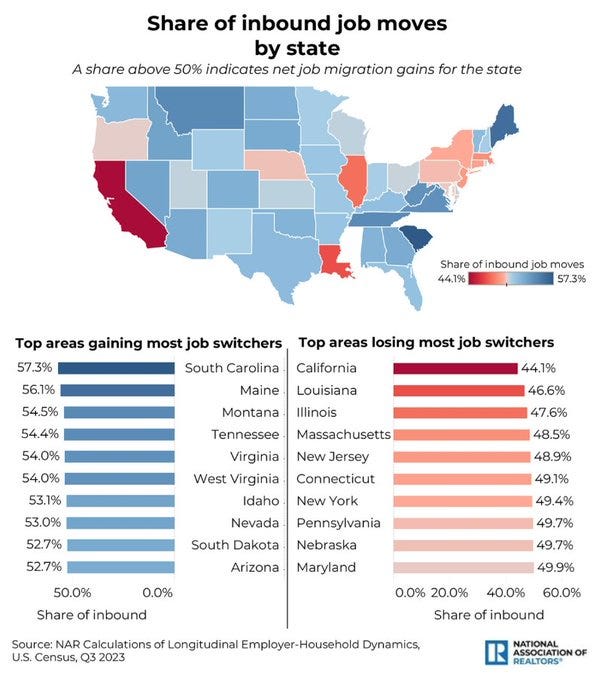

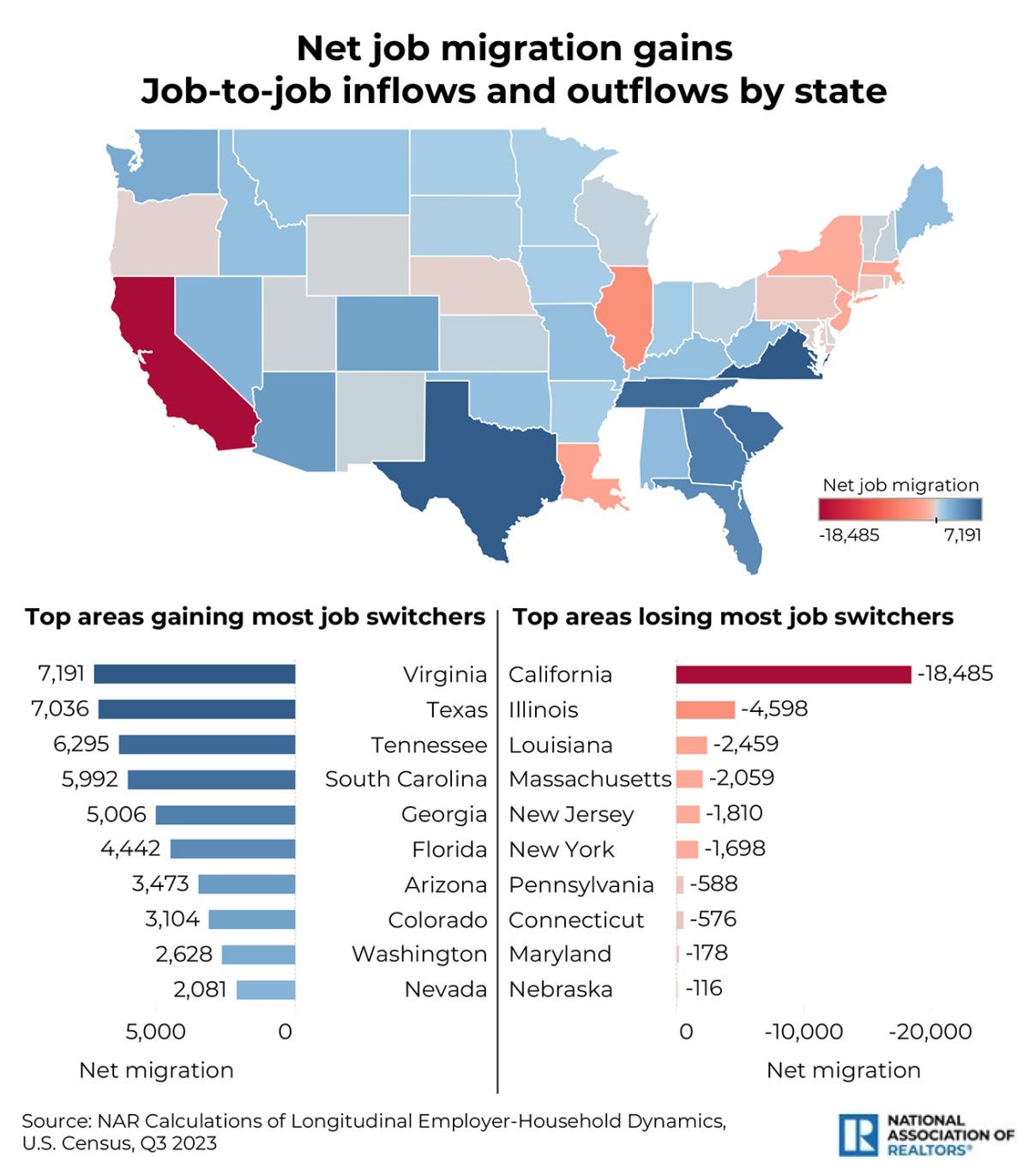

What housing markets are hot right now? I like to look where workers are moving (they have to and most are renters remember) and where unemployment is low. Just because COVID is over and rates are high, doesn’t mean folks aren’t moving.

Several job markets continue to attract new residents. Areas like Nashville, Charleston and Greenville are growing new companies, startups and jobs. Montana? Who knew. Guess it’s really Big Sky time. What a gorgeous mountain state.

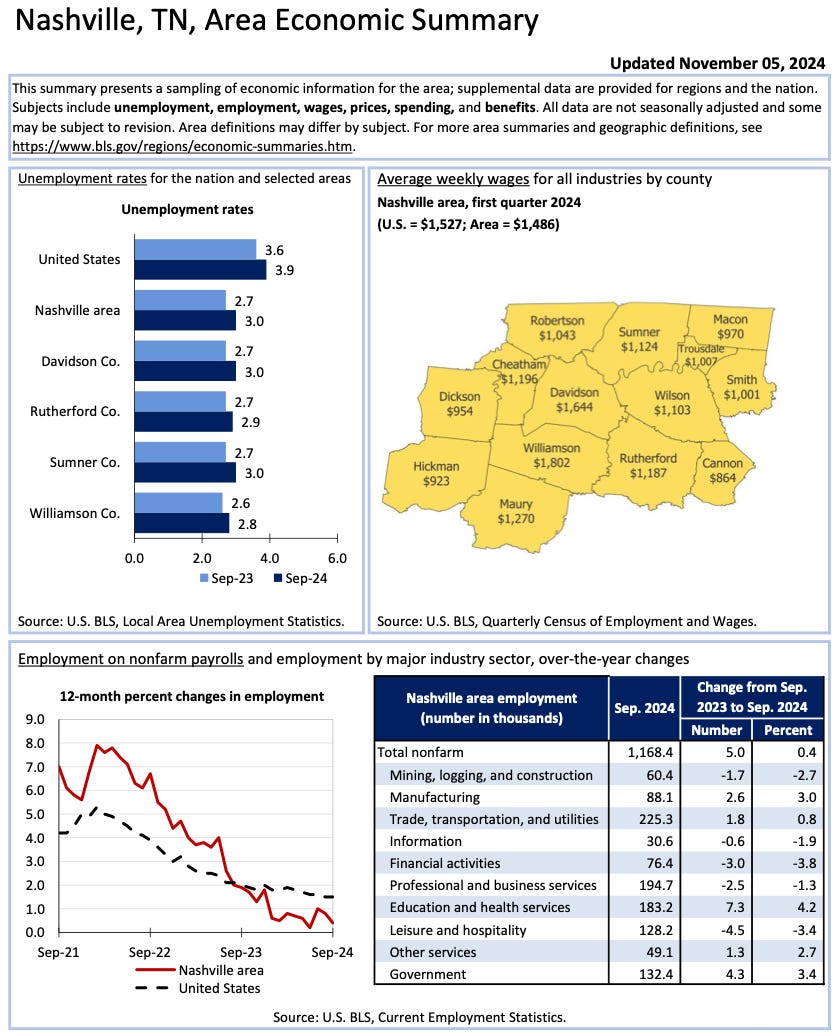

In my home market of Nashville, our net job migration is strong, just below the much more well known/established state of Texas.

But, fun fact, Nashville has the lowest unemployment rate of any large city in America, property taxes and insurance costs are middle of the road, and we have no state income tax. We continue to punch above our weight. 👊

And we could be growing jobs faster, we just don’t have the workers to do it. Thus, our low unemployment rate, which is almost a full % point lower than the national average.

My Skeptical Take:

Interest rates up asset prices down I think there’s a great window to buy while these rates are high (I know I’m a broken record).

We will see how long the election high lasts, or if it’s merely a part of this bull market.

I think it will be the latter, as long as we can avoid re-inflation.

This is not just my opinion, it’s in the data. Investors, Ich auch, are swooping up deals today.

It does, however, take a contrarian mindset to get in when you perceive prices as high. Most people think this way; in fact, the sameness of thinking is a natural human attribute. So you may want to and expect to practice contrary thinking, in order to get into the habit - as the great author Humphrey Neil once wrote - “of throwing your mind into directions that are opposite of obvious (Neil).”

Investors must master the art of contrary thinking. I’ll paraphrase Neil to explain: “[Contrary thinking is a method of ruminating over a broad range of public questions; political, economic, and social. The object of contrary thinking is to challenge generally accepted viewpoints on the prevailing trends in politics and socioeconomics. The purpose is to contest the popular view, because popular opinions are so frequently found to be untimely, misled (by propaganda), or plainly wrong (Neil).]”

The great investors naturally think this way. You’ve probably heard legendary investor Warren Buffett talk about getting bullish when others are bearish.

“[When masses of people succumb to an idea, they often run in the same direction because of their emotions. But, when one stops to think things through, one is more logical/sane in their decisions. It is when some occurrence arises that has wide emotional appeal that you find the crowd going wrong. ]”

“If you don’t think things through, you’re through thinking.” - Humphrey Neil

Could the election be one of these times?

Perhaps, yes.

For instance, the stock market is soaring this/last week on the expectation of untold number of assumptions. Is this warranted? Are there bull markets within this market that will sustain and ones that are running on a sugar high?

I would argue real estate is one of those robust, insulated markets you want to be in today.

Take a moment to pause, to detach. Remember, a group thinks with the heart, an individual thinks with the brain.

This writer thinks real estate, owning assets will be the wise investment during a time of high inflation, if what the data show becomes reality.

But don’t take just my word for it.

You have agency over your life and your own decisions. Take a moment. Pause and reflect. Think for yourself.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,