Inflation is Taxation Without Legislation

The Administration is moving rapidly to cut spending, but will it matter?

Today’s Read Time: 9 minutes (totally worth it!)

The Weekly 3 in News:

First-time homebuyers today average 38 years old, which means they are as close to getting their first Social Security check as to when they graduated high school (24 years vs 20 years). Holy hell! (Lambert).

How old are repeat homebuyers today vs the past?

42 years old → The median age of repeat U.S. homebuyers in 1991.

61 years old → The median age of repeat U.S. homebuyers in 2024 (Lambert).

Satellite phone service is here, on your current cell phone. T-Mobile spent $8 million to air its Super Bowl commercial announcing that their satellite partnership with Starlink will now be open to anyone on any wireless carrier. “If you can see the sky you have phone service (T-Mobile).”

Today’s Interest Rate: 7.05%

(Unchanged from this time last week, 30-yr mortgage)

Today, I want to dig further into what the Treasury Dept is attempting to do on mortgage rates. In my view, this is going underreported / under-analyzed. If you are in real estate, this effort is a big deal.

This is a follow-up on last week’s government spending/DOGE article, which is on pace for 100,000 views! (My most popular new letter yet). If you didn’t get a chance, it’s still available for free here.

Let’s get into it.

Mortgage Rates: The state of play

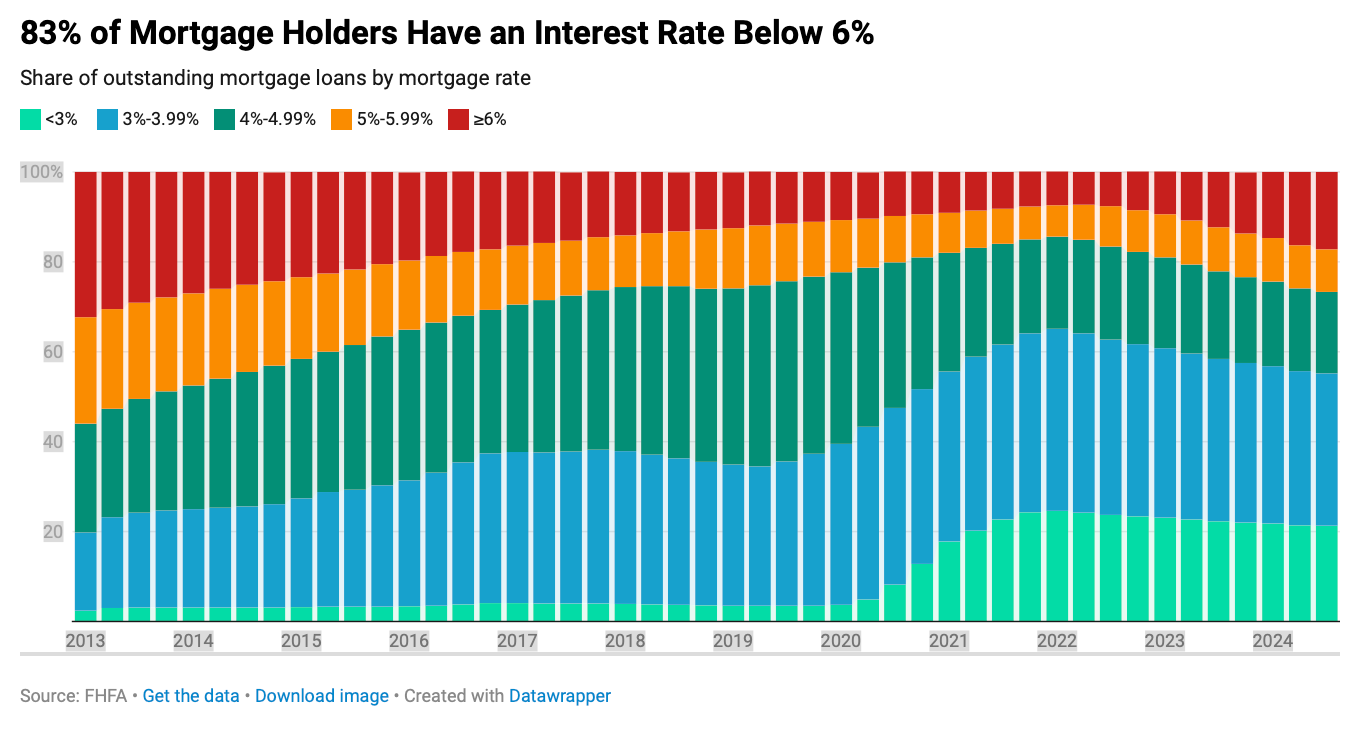

Today, mortgage rates are 7.05%, yet 82.8% of homeowners with a mortgage have an interest rate below 6% and 55% are below 4%. This makes selling a home, only to buy another, quite painful. Homeowners are still handcuffed to their home. This continues to depress real estate activity.

However, transactions are still happening, albeit far below the historical activity levels. Existing-home sales in December 2024 was the lowest level in nearly 30 years (4.06 million annualized), while the median price reached a record high of $407,500.

The Fed Has No Good Reason to Cut Rates

The Federal Reserve has largely achieved its dual mandate of maximum employment and stable prices. But there is no good excuse for the Fed to cut interest rates, at this time. The Fed needs the labor market to break or slow more significantly. Although it is softening. One glaring example: we had an explosion in government hiring the last 2 years. This will definitely not happen again in the current political climate.

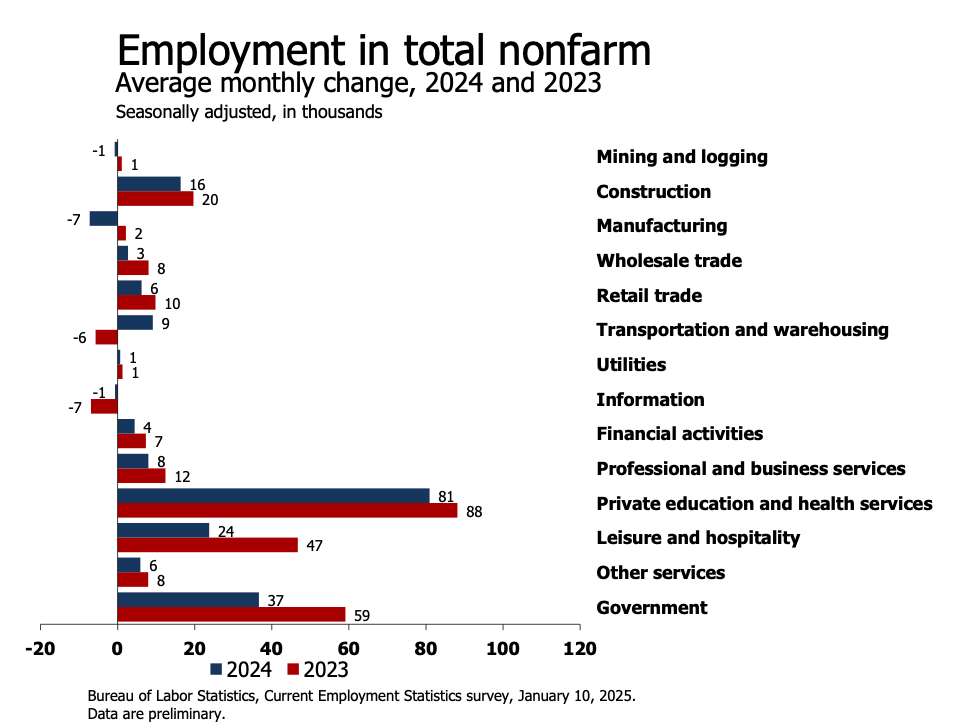

Wild Fact: did you know the Federal Government added 37,000 employees per month in 2024? And that this was down from 2023, when they added ~60,000 per month?

Holy hell.

In fact government, was the second fastest growing employment sector.

Wow.

But I digress…

Labor Market is Still Strong

The labor market is still quite robust, unemployment is staying low at 4% and wage growth is still a solid 4.2%, growing much faster than current 2.6% PCE inflation.

These are not conditions in which the Fed will cut rates.

So with a strong economy (yay!) and great jobs numbers (also yay!) mortgage rates are poised to stay elevated for much longer (boooooooo!).

This has caught the attention of the new folks over there at the US Treasury.

US Treasury Dept: Mortgage Rates are in the Crosshairs

The Fed is not likely to cut more than 2 times in 2025, if that. Bank of America and Morgan Stanley say there will be one, or possibly no, rate cuts this year. And most financial institutions agree: Fannie Mae, Wells Fargo, Mortgage Bankers all think mortgage rates will end up around 6.5% in 2025.

So if you’re waiting for the Fed to come to the rescue, it’s going to be a long wait.

It appears that the incoming Treasury Secretary Scott Bessent recognizes this and will be concentrating on the bond market and inflation, saying:

“We are not focused on whether the fed is goin to cut [or] not cut, what we are focusing on is lowering rates…the 10yr is the important price to focus on…it’s mortgages, it’s long term capital formation…I think the 10-yr will naturally come down… and on top of it, what if we do get some big savings from the DOGE program?”

This is positive for a variety of reasons, particularly since the President has said that he may want to try to influence the Fed’s interest rate decisions, or even have direct control over them. He has been quite critical of Jerome Powell personally. The Federal Reserve has been an independent organization, insulating it from political pressures and Fed members cannot be fired without cause.

Bessent has released an economic plan, which he formulated last year and pitched to the President during the campaign: The 3-3-3 Plan (this plan was reported as a key reason the President chose him).

What is Bessent’s 3-3-3 Plan?

‘Modestly’ grow the Economy - Achieve economic growth of 3% (Q4 was 2.3%, but 2024 was close to 3%) so deficits matter less and revenues grow,

More Energy - Increase oil (and also natural gas) production by 3 million barrels a day to put downward pressure on the input costs for goods and services, as well as fuel prices for the consumer, and

Cut Spending - Reduce the budget deficit to 3% of GDP (currently 6.3%).

Essentially, Bessent’s goal is to put downward pressure on inflation, while growing the economy, so the deficits we do have, matter less. And while the plan has received much criticism for it’s potential tactics and lofty goals, the Administration is plowing ahead.

Counterpoint: Economist and Former National Economic Council Director under Obama, Larry Summers, believes these spending cuts will not be enough to quell inflation, calling our current economic state the, “riskiest period for inflation policy since the early Biden Administration….even without tariffs, immigration restrictions, deficit bloat and attacks on the Fed there would be serious grounds for inflation worry.” He also does not think Bessent will be successful in reducing 10-yr interest rates.

Cutting Spending and the DOGE Effort

Number #3 above seems to be where the most action is today, specifically with the DOGE team.

What is DOGE again? It’s the Department of Government Efficiency (DOGE), was formally established by executive order on January 20. Its aim is to: “[cut spending, reduce regulation, restructure federal agencies and enhance government efficiency.]” The initiative, despite its name, is not a department and it automatically shuts down early next year. The effort works through the Treasury and the Office of Management and Budget, the budgetary arms of the White House. It is headed by Elon Musk, who is now an official “special employee” and advisor to the President.

In a recent Bloomberg interview, Bessent emphasized how serious he is about the need for spending cuts and explained his support of the DOGE effort, saying, “I believe that this DOGE program is one of the most important audits to government we have ever seen.” In the interview, he does acknowledge that past efforts have failed, such as the Grace Commission in the Regan years, but insists that this time is different.

DOGE’s reception as been a tale of two cities, one side hates it and the other side is extremely excited. I’m not going to pass judgment or wade into the politics here. But it has the full-throated support of the US Treasury, which has operational control. Speaking in the same interview, Bessent said of DOGE, “the Treasury Department is in control and that there is “no tinkering with the system.” “The DOGE team is read-only. They can make no changes. It is an operational program to suggest improvements.”

So all the media reports of what DOGE is “doing” appears to be announcements of what the US Treasury is actually acting on, with their support. Again, staying apolitical, I found this nuance very important.

Why we care: This matters for us investors. The bond market won’t look positively on an effort that is not effective, serious and successful. It was important for the Secretary to make this clarification so that, if true, the markets react rationally.

Lowering Energy Prices and Mortgage Rates

Speaking in the same interview, Bessent made his case for lowering energy prices as a critical part of their war on inflation, saying, “The bond market is recognizing that energy prices will be lower and we can have non-inflationary growth.... We cut the [federal govt] spending, we cut the size of government we get more efficiency in government. And we’re going to go into a good interest-rate cycle.”

Bessent is attempting to put downward pressure on the energy input costs for goods and services, as well as fuel prices for the consumer, all in an effort to coax disinflation.

In other words, Bessent is clearly focused on bringing down interest rates at the long end of the yield curve, which in turn will mean mortgage rates do the same.

My Skeptical Take:

Keep reading with a 7-day free trial

Subscribe to The Skeptical Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.