If you're Waiting for Life to Hand you the Goods, it's Going to be a Long Wait

Don't wait to act, act so then you can wait.

Today’s Read Time: 10 minutes

Today’s Interest Rate: 6.95%

(👇.01% from this time last week, 30-yr mortgage)

Today, we’re talkin’ filtering through the noise in the economic data, housing demand, price cuts, interest rates and I get a kick in the ass. If you're waiting for life to hand you the goods, it's going to be a long wait.

Let’s get into it.

The Weekly 3 in News:

Aggregate construction material price inflation has settled down. In April 2025 prices were just 2.1% higher than April 2024 (ResiClub).

Fannie Mae is now the #25 ranked company on the Fortune 500 (rankings by revenue), representing a concentration of risk in a handful of mortgage giants (Fortune).

Thinking of staging your home? Well, it’s a good idea. But that doesn’t mean you need to doll out many thousands to stage everything. Focus on the living room and master bedroom suite, by far the most important (NAR).

June Check-In: Real Estate and Economic Outlook

What’s happening in the world, the US economy, and real estate?

I’ve read dozens of financial reports, gathered housing and economic data, furrowed my brow at pundits’ projections, braved Twitter during civil unrest, and sat through a hopelessly boring National Association of Realtors’ real estate presentation in DC… so you didn’t have to. I even turned on the TV, and after 5 minutes of traditional news, I nearly threw it off my balcony.

Let me give you the Cliff Notes.

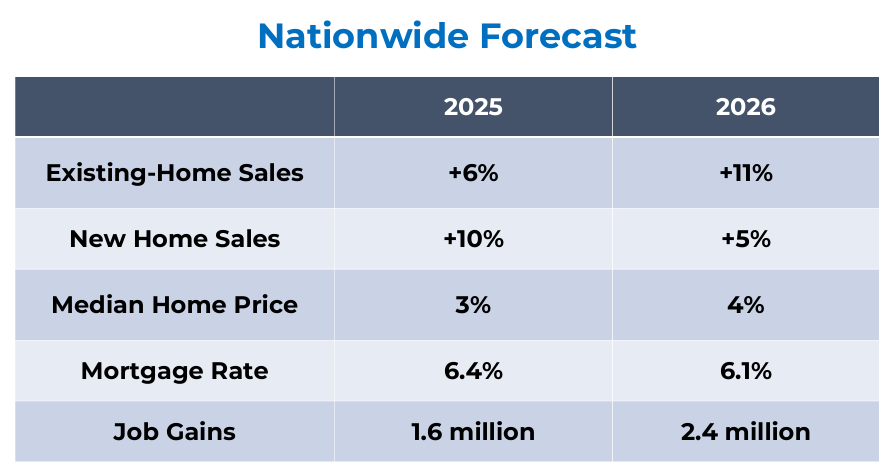

Housing Market Steady: Sales not great but, not bad either

Despite all that is happening in the world, people still need a place to live. And homebuyers and investors alike are active, albeit from depressed levels relative to a few years ago. But stable and growing nonetheless. Over the next 12 months, existing and new home sales look poised for continued growth (NAR).

This gradual recovery reflects improving market conditions, including stabilizing mortgage rates and a slight easing of inventory constraints.

And an increasing number of homebuyers are getting ready to buy a home. Home purchase applications are now up for 18 weeks in a row. This is impressive given the stubbornness of mortgage rates. And, because of those high rates, there are tens of thousands of potential homebuyers on the sidelines who can’t afford the monthly mortgage payment, just waiting for rates to drop. Mom and dad’s guest room is getting a little cramped.

Now that May is over, we are nearly through the most active time (Spring/early summer) for home purchases. Will homebuyers keep the search alive? We will see if this strength can continue through the summer.

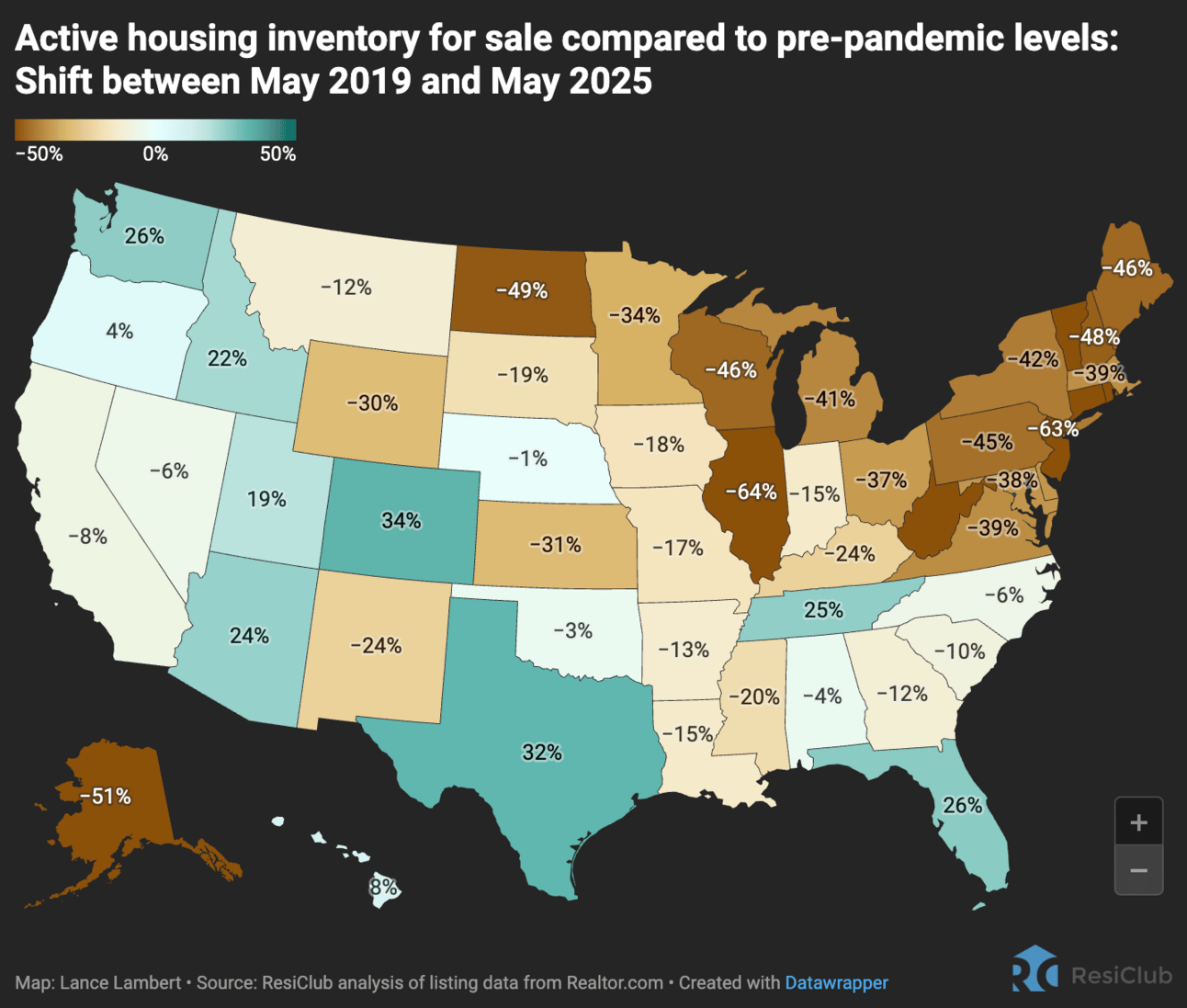

Inventory Normalizing/Less Constrained

The good news: Inventory of available homes for sale is rising. This is positive. This is what normalizing looks like.

The housing market has been unhealthy and out of shape for years. Inventory levels were paltry even before 2019. And then COVID happened. “The past two years marked the lowest periods for new home listings in history (Mohtashami).” Available inventory is critical for a healthy real estate market. Real estate investors and homebuyers alike should welcome this trend.

Last week, new listings and active inventory showed mild increases (Lambert) .

And compared to pre-2019, it’s a tale of many states. In my home market of Nashville, we are finally seeing more inventory on the market, even above 2019 levels. Good!

Total inventory is never the whole story. Much of what is for sale, using my home market of Nashville as an example, is not what investors and first-time homebuyers are looking for. Much of total inventory is new, modern, higher-priced, cookie-cutter builds, aka “tall and skinny” townhome style (which are super ugly, in my opinion) and not accessible to most buyers. Existing homeowners are still staying put with their 3% mortgage, keeping value-add inventory still low. We need more 1960s outdated and ugly, we can restore it with a sexy renovation! And for that, we probably just need interest rates to fall, but not much. We saw a large activity spike when rates got below 6.5%.

Still think inventory is “too high?” Think again…

*** Real Estate Coaching ***

Want to own real estate, but don’t know where to start? Call me.

Start by getting some coaching and mentorship. Gain expert advice from someone who actually owns real estate.

No "guru" trying to sell you an expensive course.

No BS. Just frank, honest advice.

Starting at just $100 smackeroos. It will be the best money you've ever spent, if you don’t think so, full refund. You can’t find that guarantee anywhere else in the industry.

Remember your why.

Act now and get 10% off!!! Use my special Skeptical Investor link 👉. Join the Investor-Class!

Want to advertise to the more than 20,000 weekly readers of The Skeptical Investor? You can! Advertise with us; we can help you grow your business. Reach out.

Ok, back to business.

Inventory: The trend is your friend, for now.

…I am highly skeptical of those who decry rising inventory levels. This is a protectionist mindset, and it is a shortsighted, headline-grabbing narrative. Home prices should not continue growing faster and faster, assisted by low supply. This is not healthy, and will be highly detrimental long-term. Remember, more inventory = more deals. Bring on the supply.

Counterpoint: This is the hot part of the home sales season, and new listings should be even higher. “What we want to avoid is an early downtrend and more sellers exiting the market, similar to what we experienced in the second half of 2022, which was not ideal [indicative of an unhealthy housing market], says economist Logan Mohtashami).” I agree.

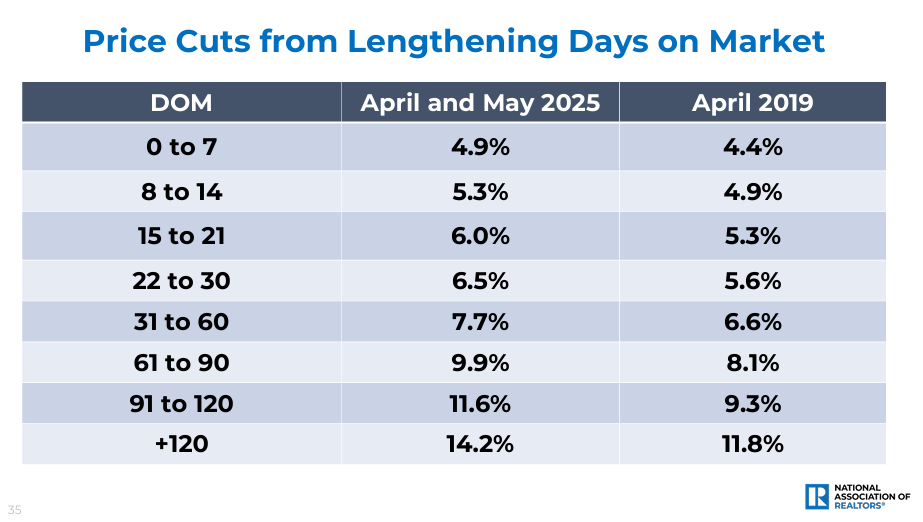

Listing Price-cuts

Ok, cool it everyone. I’ve read the same articles you have. Yes. Home price reductions are up 3% to 39%, over last year’s numbers. But in normal times, roughly one-third of homes see price cuts. This flows when inventory grows and remains high, and ebbs when it shrinks. Inventory has been growing; hence, price cuts have been modestly higher thus far in 2025. All healthy market activity. Housing analysts predict a “modest” home price increase of about 1.77%, signaling a subdued outlook for real home-price growth.

Most sellers (90%+) put their property on the market above comparable sold properties (aka too high). This is becasue 1) they think their property is more valuable than the others for some emotional reason (it’s likley not) and 2) the real estate agent they pick agreed with their high price to get the listing, knowing it wouldn’t likely sell at that price (this is unethical/weak-willed, in my humble opinion).

So, this provides an opening for the savvy, patient buyer. And there is (slightly) more opportunity in today’s market.

I love buying properties that are sitting on the market, ripe for a price reduction. But, where is that sweet spot to pick up a deal? Here is a chart showing the days on market for a given property and the corresponding average price cut, for April / May of this year and 2019.

As you can see, the longer, the better. But in my professional opinion, it’s 60-90 days. That is when to attack. After this time, sellers often take the property off the market and rent or just wait until a later date.

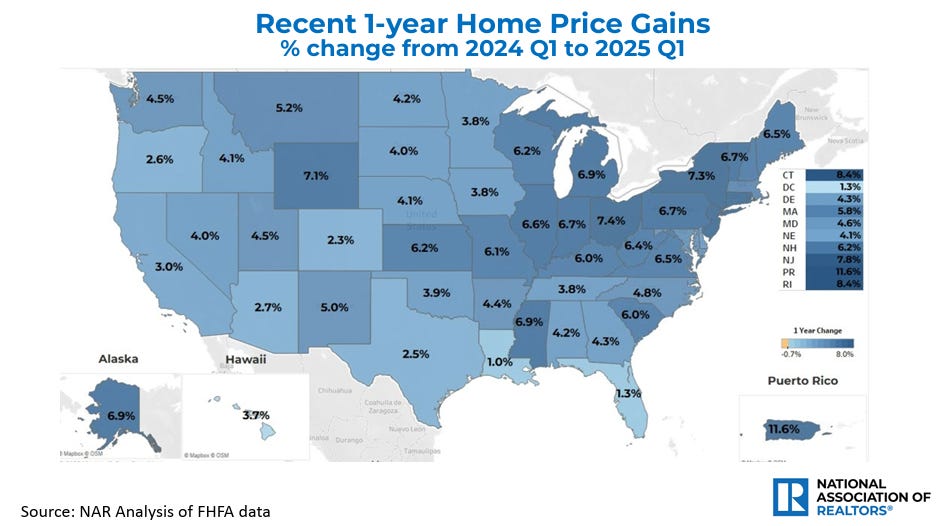

Home Prices are Steady Eddie: w/some markets weaker

Let’s start with last year. Average US price gains 2024-today have been strong to normal.

And for 2025, forecasts for median home price growth vary, with most predictions ~2%+ in 2025 and slightly higher in 2026.

Obviously, this is a much more modest pace from the double-digit insanity of recent years. Chart on👇

Moderation is healthy, like most things in life. Supply is improving to a more balanced market. Slower price growth means less upside from rapid appreciation, true, but it also reduces the risk of overpaying in a habanero-hot market.

My posture: I’m actively looking for value-add opportunities to force appreciation via renovation, stabilize with renters at market rate, and either hold or sell/1031. Repeat.

Mortgage Rates: High yet Stubborn

Uncertainty in US trade policy, combative politics, and, most meaningfully, US spending deficits, are keeping Treasury yields high, and mortgage rates with them. We not only need the Fed to signal more interest rate cuts, but also for these tensions to recede. Remember, mortgage rates track the 10-yr Treasury bond, not the Federal Reserve’s Fed Funds Rate. Traditionally, the spread between the 10-yr Treasury and 30-yr mortgage is around 1.60% and 1.80%. So, even at today’s heighten rates, if our government could just get their shit together, mortgage rates would be 0.83% to 0.63% lower than today’s level. Closing in on 6%.

Count me frustrated.

Yet, I do think things will settle down. It may take 12 months but rates will get back to ~5.5%.

On the to Fed. When will they resume cutting interest rates?

This chart by NAR is spot on (and I am often critical of their economic work).

In short, inflation is there. Virtually at their 2% target.

So now it’s all about the labor market.

Labor data last week showed hiring strong, and unemployment low (unchanged MoM), beating estimates. New jobless claims were still far under 400,000, which is where I would start to get concerned as a signal of future, economic slowdown or recession (we are at 247,000 today). This is very positive. If jobs stay resilient, and unemployment doesn’t cross 5% or 400,000 initial claims, I think the Fed Cuts.

And if they don’t, the President will act to lower mortgage rates.

How?

I believe he installs a “Shadow Fed Chair” who goes on air everywhere and says that once they get in the seat next year, they plan to aggressively cut rates (credit to economist and housing analyst Logan Mohtashami, who has written about this). This will be a signal to bond investors to buy more long-dated bonds, pushing corresponding mortgage rates down.

So, in summary of the summary:

Real Estate Market will be…normal-ish (NAR).

My Skeptical Take:

Stop waiting and start making shit happen.

Filter out salacious, noisy headlines and focus. The doomer news media and attention-grabbing pundits online are constantly hammering us with apocalyptic predictions. Stories like:

Warren Buffett's Berkshire Hathaway sounds the alarm on the 2025 housing market!

Elon and the President disparaging each other in a public couple’s quarrel.

All Noise!

I, for one, am not feeling those negative vibes, especially in the real estate investment space. I’m focusing on the (above) more pertinent data to my business, and if you are reading this, you are as well. Well done.

When it comes to economics, we have to be much like a combine, and separate the wheat from the chaff.

So, in this market with pessimistic sentiment, high prices, high interest rates, and fewer value-added properties, don’t just stand there.

In other words, stop waiting, start making shit happen.

Here’s a lesson I just had to relearn the hard way, and it’s one I still struggle with to this day: if you’re sitting around waiting for life to hand you the goods - for home prices to fall, for interst rates to come down, for that home-run investment property to appear, for the economy to be flawless, for that perfect girl/guy to come right up to you and ask you out, for democrats- and republicans to get along….

It’s gonna be a long wait.

I’ve been guilty of this myself, especially when it comes to properties and partners. I was waiting for the perfect opportunity to waltz up and smack me in the face.

Spoiler alert: it didn’t. And it won’t for you either.

This hit me like a ton of bricks recently. I realized again I’d been coasting, expecting deals to find me, as if some magic property fairy was gonna drop a discounted multifamily gem in my lap.

Nope. That’s not how it works, not for me, not for you, and not even for the big dogs like Grant Cardone.

Sure, established players with notoriety and celebrity persona might provide great deal flow, but even they are out there hustling, mining the market for nuggets. So if they’re still grinding, what’s my excuse?

The truth is, waiting is a trap. It’s passive, it’s weak, and it’s a recipe for stagnation and is existential. Whether you’re chasing a career move, a partner, or a property, you’ve gotta make it happen. In real estate, that means prospecting like your life depends on it. Get out there, knock on doors, cold-call owners, scour listings, and network with brokers until your voice gives out. Much like relationships, there’s no one perfect property, and there are plenty of fish in the sea. But they ain’t jumping on your hook unless you cast the line, set the hook, and reel ‘em in.

In other words.

Don’t wait to buy real estate. Buy real estate and wait.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

P.S. Want to start owning real estate so you can actually retire? Don’t know where to start? Is a friend or family member in need of a top-performing team of real estate agents? Give us a call! We got you.