Get Your Mindset Fit This Winter

Interest rates have scared off all the HGTV posers, less competition for real estate.

Today’s Read Time: 11 minutes.

Today We’re Talkin:

The Weekly 3 - News, Data and Education

Inflation Update

Interest Rate Update

Feature: To Pay off or Not Pay off a Mortgage: A Lesson on Debt and Risk

My Skeptical Take

The Weekly 3: News, Data and Education to Keep You Informed

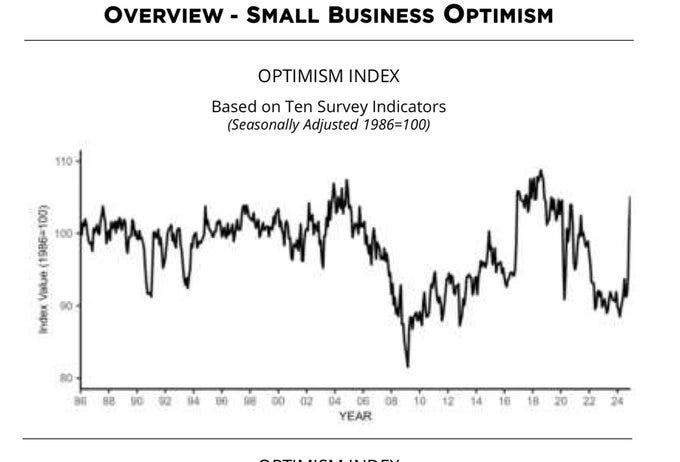

Small business optimism has skyrocketed to a six-year high. Small business owners feel more certain and hopeful about the economic agenda of the new administration. Ex: the percentage of owners expecting higher real sales volumes rose eight points to 22%, the highest reading since January 2020 (NFIB).

What are all those closing costs for? A simple breakdown (@mortgagetruth).

FDA bans Red No. 3, artificial dye used in beverages, candy and other foods. What may be next? (NBC News).

Today’s Interest Rate: 7.25%

(☝️.08%, from this time last week, 30-yr mortgage)

Today we’re talkin’ important news, we get a big update on inflation, interest rate predictions, and I have a story of a family and their 2% mortgage. With a twist.

And make sure to tune in next week, I’m going to tackle insurance. And why it will outpace other services costs in 2025. Keep a lookout.

Ok, let’s get into it.

Important Inflation Update

Hot off the presses, we got inflation numbers for December and they were positive. The Producer Price Index (aka the input costs for businesses that make things and do stuff) was up just .2%, half the .4% expected.

And the closely watched Consumer Price Index also came in below expectations. Excluding volatile food and energy prices, the core CPI annual rate was 3.2%, vs 3.3% expected.

Both were a pleasant surprise after a few weeks of worry of reigniting inflation. Of course, we aren’t out of the woods yet. But this is positive, which is why stocks are up and bond yields are down today.

Price increases were mostly seen in energy, 40% of price increases were from energy, which was up 2.6% for the month, mainly from a 4.4% surge in gasoline. Food and shelter prices also rose, but only 0.3% for the month (BLS).

We will find out more inflation and labor data for December in the coming days. All eyes will be on Personal Consumption (PCE) numbers (the Fed’s preferred inflation measure), to be released on Jan 31st. We will also have a Fed rate cut decision on January 29th. Markets are pricing in a 97.3% chance of NO rate cut.

My Thoughts: I agree with the bond and futures markets, the Fed does not need to cut and they already did their signaling of a monetary posture change from tightening to easing, with 3 rate cuts last year. The 10-year Treasury yield hit a new 14-month high of 4.8% yesterday (although it is down slightly today).

Why?

Markets are still concerned inflation may move higher and the Fed may not cut rates 2x this year, as they said they would. They are also a little spooked about macro-uncertainty and new policy changes. Don’t forget we will have a new President on Monday!

What has all this done for real estate?

The mortgage market is a ghost of its former self, still passing through a prolonged and severe recession. It's one of the worst downturns in real estate sales and mortgage activity in history. Lower activity levels than the Great Financial Crisis.

Refinances are also still in the dustbin. I consider the following index number of 400 to be essentially zero. Only folks who absolutely have to are refinancing, likely folks with hard money, bridge loans or other private financing, such as house flippers who don’t/can’t sell their flip and convert it to a rental. I myself am waiting to refinance more than 4 properties I’ve renovated, which is why I don’t do hard money.

What has this done to real estate industry professionals?

There has been a storm of mortgage broker layoffs, mergers and a culling of the real estate agent herd. Thousands of folks.

Here are just a few examples, all after the Fed started cutting rates (Resiclub and @mortgagetruth).

Zillow starts layoffs (1/10/25)

Redfin to cut 46 jobs at Seattle headquarters (1/9/25)

Ally Financial quits mortgage lending, layoffs (1/8/25)

Central Mortgage Funding halts mortgage lending in state of Connecticut (1/2/25)

EasyKnock shuts down, layoffs (12/7/24)

Fiserv to lay off between 1,000 and 1,500 employees (12/7/24)

Wells Fargo to cut 721 jobs in Oregon (12/5/24)

Opendoor to reduce its workforce by 17%, roughly 300 positions (11/8/24)

Fortress Bank to acquire Compass Mortgage (11/5/24)

Flagstar Bank to cut 1,900 jobs as part of strategic transformation plan (10/17/24)

Check out the full list here.

Silver Lining. High interest rates make it tough. But cream rises to the top. The best real estate professionals will emerge stronger. Case in point, this is one of our busiest times ever and excellent mortgage brokers I know are gaining business from those who have failed.

It’s time to exercise your anterior Mid Cingulate Cortex.

Let’s go!

To Pay off or Not Pay off a Mortgage: A Lesson on Debt

Speaking of mortgages and interest rates, I read an article today that I had to share.

It detailed a lovely family who was being interviewed about their decision to pay off their mortgage early.

Now this is an age-old debate in real estate, mainly with homeowners (or anyone who follows Dave Ramsay’s advice. And while he may be a nice guy, I’m not a fan of much of his zero-debt finance philosophy).

Now, it should be said that paying off a mortgage early is usually not a financial decision, it’s more personal. Some folks prefer to lower their risk by getting rid of the mortgage. Some like keeping their property leveraged. After all, with the same amount of cash, you can own 4 or 5 homes (putting down 20 or 25%) instead of owning it outright. And mortgage debt (aka borrowing to buy real estate) is usually the cheapest debt you can get. Paying the mortgage is usually a top priority, it means keeping your house.

So, should one pay the mortgage off early?

Keep reading with a 7-day free trial

Subscribe to The Skeptical Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.