Are we Close to a Minsky Moment?

Think owning real estate is out of reach? Think again.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Debt, Government and Real Estate.

Is this a Minsky Moment?

Inflation Fears, and a Strong Economy

The BEST Strategy for New Real Estate Investors

My Skeptical Take

The Weekly 3: News, Data and Education to Keep You Informed

Multifamily construction jobs surged from 2021-23 as rent growth led to a construction boom. But it's been flat-ish in recent months as more units complete than start -- meaning it's harder for construction workers wrapping up projects to find the next gig (Parsons).

Housing inventory for sale is close to getting back to 2019 levels. The Housing Market is starting to get back to ‘normal’ (AltosResearch).

The US economy grew at 2.8% in Q3, slightly less than expected; but PCE inflation slowed to .2% MoM - or 2.1% YoY - closing in on the Fed’s target of 2% (CNBC,CNBC).

Today’s Interest Rate: 6.75%

(👇.10, from this time last week, 30-yr mortgage)

Today we’re talking inflation fears, a strong economy, government spending, mortgage rates, a possible Minsky Moment and THE best strategy for a new real estate investor.

Let’s get into it.

Re-Inflation Is the Worry.

Since the Fed started cutting their Fed Funds Rate, mortgage rates have levitated and are now holding relatively range bound near 6.8%.

Why?

The bond market (remember, mortgage rates follow Treasury rates) sees a potential double threat on the horizon:

A resilient US economy significantly slowing the Fed’s expected rate-cutting schedule.

This threat is minor and short-term.

The threat of continued government spending and inflation, or rather, an accelerated re-inflation ala the Stay Puft Marshmallow Man (fun fact, inflation was 4% in 1984 when that Ghostbusters movie came out, down from 9% in 1982. Sound familiar? Coincidence? Scary? Heck no, I ain’t afraid of no ghost!)

This threat is significant and longer term.

The federal government needs to get its house in order. Spending is out of control and threatens a re-inflation.

Let’s look at a few numbers/charts:

The current annual deficit is $257 billion.

Total Debt has pilled up to $36.16 trillion.

Interest on the Debt is UP. Now more than $1.1 trillion PER YEAR.

Perhaps most concerning, our debt as a share of the economy (aka Debt to GDP) continues to increase. Now 120%.

How does this happen? And how does it affect mortgage rates?

When the Federal government spends it must issue treasury bonds to pay for that spending. More bonds in circulation mean a lower price, and thus the interest payment % increases (bond prices and interest percentages are negatively causal).

We spent $10 Trillion in response to COVID, and have continued massive annual deficit spending (as seen above).

This is why we have had high inflation and why we still have high mortgage rates.

There is Hope. I Hope.

I have very positive feelings for the proposed DOGE (Department of Government Efficiency) effort in the coming year, spearheaded by Vivek Ramaswamy and Elon Musk. Their goal is to cut $2 trillion in spending. Which can absolutely be done. Heck, if we just balanced the budget we would eliminate the $1.1 trillion in interest payments + the nearly $1 trillion in deficit spending. Further, a mere 3% reduction in spending per year for 4-10 years, also gets us back to on trend debt levels, lowering our Debt to GDP to historical and manageable levels.

But moving government is like moving the Titanic, with a few oxen. It is possible. And I am hopeful.

If we can’t, we are almost guaranteed to have a recession, ala Mr. Minsky. In my opinion.

Will We Have a Minsky Moment?

A Minsky Moment refers to a point in the economic cycle when the debt accumulated during a speculative bubble and/or prolonged growth begins to devolve into a financial crisis. It is named after economist Hyman Minsky, who proposed a theory of financial instability suggesting that long periods of prosperity can lead to increasing speculation and risk-taking in financial markets. Minsky Moments generally occur after a long period of outsized growth, which ultimately leads to overleveraging once prices stop rising.

Are we currently in a Minsky bubble? We could be. Or we could be a year from now. Let’s look at the telltale signs:

Stability Leads to Instability: During times of economic stability, investors and financial institutions take on more debt, often under the assumption that the good times will continue. This increases leverage in the system.

Debt-Driven Speculative Bubbles: As more debt is taken on, asset prices inflate, creating bubbles in markets like real estate or stocks/options or crypto. All are present today. (However, real estate prices are likely a result of supply and there are no signs of excess risk-taking or debt. I’m paying very close attention to the latter two. See below). Stock Price-to-Earnings ratios are at a historic high.

Reversal of Fortunes: Eventually, something triggers a reversal—perhaps an unexpected economic event or simply the realization that assets are overvalued. This leads to a rapid de-leveraging.

Crisis: Investors start selling assets to cover debts, but with everyone selling, prices plummet, leading to a cascade of defaults, margin calls, and financial failures. Folks want to preserve their winnings so they rapidly sell their positions, with little buying. This is the Minsky Moment.

Aftermath: Following the crisis, there's a shift towards safer investments, credit becomes harder to obtain, and a period of economic contraction or recession likely follows until a new cycle begins.

In essence, a Minsky Moment is when the chickens come home to roost; the debt and spending/consumption excesses built up over time become unsustainable, folks get anxious about preserving capital, leading to a sharp economic downturn once the sell-off starts. Now, downturns/recessions/pullbacks are a natural part of the economic cycle. And are normally short-lived. But, if government over spending at this rate continues, a recession will be deeper and prolonged.

Are Home Prices Going Full Minsky Too?

In my strong opinion, no. Home prices are up because of a lack of supply, low activity and high interest rates.

And that doesn’t mean further price appreciation is are stopping, far from it.

In fact, new home price predictions for 2025 just came out, and show a decline let alone a bubble pop in our future.

Why?

Well, homeowners are very secure financially. Here are a few charts illustrating this, credit to @loganmohtashami.

The Robust Homeowner

Homeowner equity is high, really high. And it’s not decreasing, like during our last housing crisis. Heck, it accelerated dramatically during and after the government spending and zero interest rate policy response to COVID.

FYI, this is why real estate is a fantastic inflation hedge.

Prices in 2025 are expected to re-accelerate, absent a return to inflation, interest rates continue to tick down and we don’t have a Minsky Moment.

Here are the Home Price Predictions for 2025:

Apollo - +10.8% - WOW!

AEI Housing Center - +5.5%

Wells Fargo - 4.9%, and 5.2% in 2026.

BofA - +4.7

Goldman Sachs - +4.4

Fannie Mae - +4%

Housing Wire - +3.5%

Morgan Stanley - +3%

Zillow - +2.9%

National Association of Realtors - +2% in 2025 and 2.3% in 2026.

Freddie Mac - .6% - This won’t age well…

Homeowners are in far far better financial shape than they were back in 2009 as a direct result of home price appreciation and policy changes like the Qualified Mortgage. Why? The amount of equity they own in their home has skyrocketed. This has had a tremendous wealth effect.

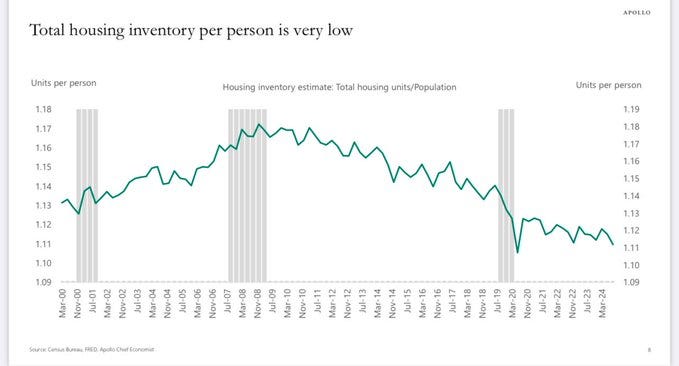

And while there is more inventory on the market, the total inventory vs. population is low. We would likely need this to go up to see a price decrease.

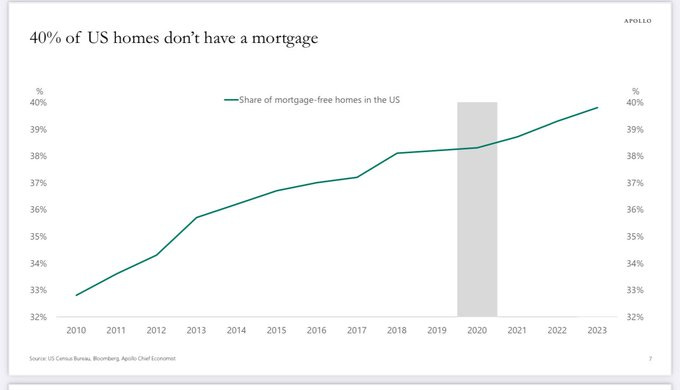

Moreover, many households are insulated from interest rate or inflation shocks. Why? Nearly 40% don’t have a mortgage. This is a historical number.

So what’s the root cause of this price/affordability?

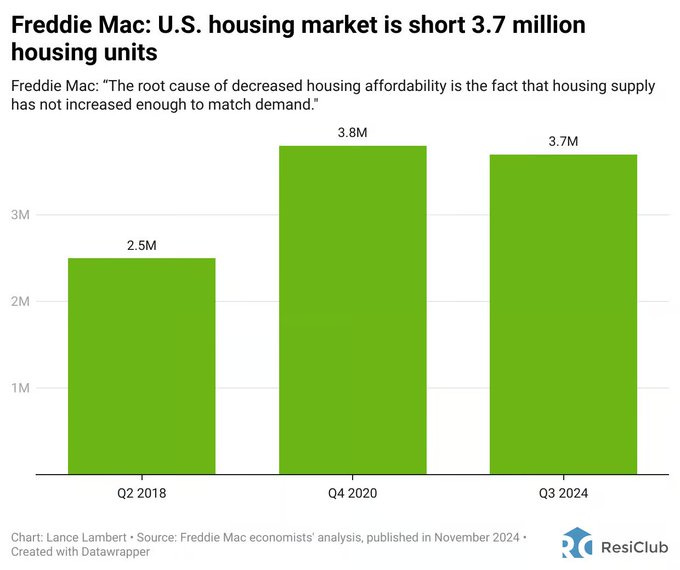

A dearth of housing supply. According to @FreddieMac, we are undersupplied by 3.7 million homes.

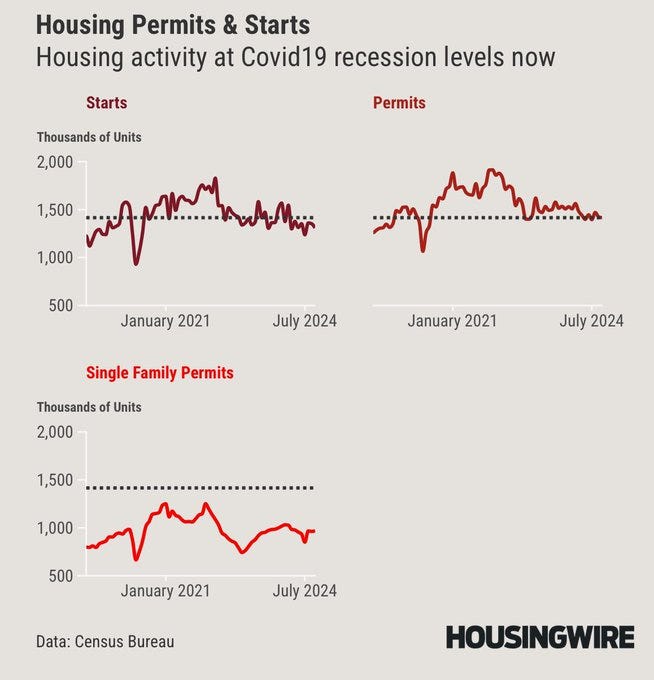

And supply is not going to be fixed in the next few years. New permits for housing development are at recession lows.

So, in summary, home prices should continue to go up. Way up. In my opinion, we will be at 6% next year. And that is the average, housing in growth markets where the population is rising and unemployment is low (like my hometown of Nashville) will realize above-average natural appreciation.

With high interest rates likely for the foreseeable future (say 10-12-ish months), affordability is at an all-time low.

But real estate is still very much possible. Dare I say affordable, if you do it right.

Think Owning Real Estate is Out of Reach for You?

Never fear!

You just have to be strategic and perhaps temper your lifestyle, just a bit.

Prices are not coming down so you have to jump in at some point. The last time home prices had a meaningful annual decrease in the last 40 years was once. 2009-2011. If you are waiting for home prices to dramatically decrease, it’s going to be a long wait.

So, how do you get started?

I’ll tell you.

For Free. No BS, No Gurus selling you a course or a fake friendship.

But, first share this newsletter article to at least 1 friend👇Please. :)

Did you?

You promise?

Ok, now keep reading. :)

House Hacking - The Ultimate Starter Home

The question I most often get is: “Well, what do you think I should do?”

That’s a lazy question…

There are literally 100s of strategies in real estate investing. Short-term rentals, single family homes, small multifamily, medium-term furnished rentals, self storage, commercial 100 unit multifamily, retail, strip malls, notes, etc…

But if you are looking to start, and especially if you are young, have few obligations, or don’t have a ton of cashola in the bank, I’ll give you my suggestion.

I would House Hack, which really is a combination of methods and tax tactics.

I love this strategy. In fact, it may be the best way to start investing in real estate. There are several variations to house hacking, but in essence, house hacking is when you live in the home you are intending to invest in.

Now, normally, living in your home is not an investment. This normally makes your home a liability, not an asset.

Well, that is still true, but only if you do so long-term. Go with me here…

As an individual who intends on living in the home, you can obtain a subsidized loan from the bank, called an FHA loan, the government’s Federal Housing Administration backs this loan, meaning they guarantee the loan for the bank, incentivizing banks to make this type of loan, even if the borrower - you - is considered higher risk. In return, the terms of the loan are very favorable, you can obtain a loan for as little as 3.5% down, and the interest rate is actually lower than the market rate for a 30-year mortgage. There are however additional fees, including mortgage insurance and an upfront FHA fee, which helps fund the program. But, you can buy a house for 3.5%! (a 5% conventional loan is also a great 1b option for those who qualify. Ask your lender).

But that’s not why this is so powerful.

There is no limit to the number of homes you can buy with FHA loans. FHA loans, despite popular belief, are not for first-time homebuyers. In fact, you can buy a new FHA home every year; it just has to be your primary residence, i.e. where you live.

So long term, you can use the FHA loan program to grow a portfolio of properties and only have to put 3.5% down each time. You just need to keep moving into them, hopefully do some improvements while living there and rent out a portion of the home (like the guest bedrooms or basement area), then rent them out fully and move into the next FHA home you buy.

If you can save 3.5% for a $400,000 home, that’s just $14,000 (plus closing costs). Much much less than the $100,000 you would need to save for the traditional 25% down investor loan. Heck, with that same $100,000 you could buy…

…checks notes…

SEVEN $400,000 homes.

This is why house hacking is so powerful. You can do one per year and you can supercharge this by renting out individual rooms during the year you are living there.

But there’s more…

There is also a second option, since you are living in the home.

The Federal Government, in an effort to further incentivize home ownership, allows you to sell the home you live in and pay no tax on the sale.

Zero. With a few small limitations.

Specifically, the IRS rule is, if you live in a home for 2 of the last 5 years, you can sell that home and you are exempted from any capital gains tax on up to $250,000 of the profits ($500,000 if you are married. Who said your spouse never gave you anything :).

So let’s say you bought a place for $500,000. Now you are a little older and have a better job so you have some cash. You can put $100,000 into it (much much less if you so the work yourself, like I had to do when I was young) and it’s now worth $650,000. After 2 years pass, you decide to sell it. Now, remember we are house hacking so we only put 3.5% down to purchase the home, or $17,500, so we borrowed $482,500 to buy the home. Let’s also assume closing costs/fees of $10,000.

So after selling it, you are left with a profit of $650,000 - ~$482,500 - $100,000 - $10,000 =$57,500

Now, normally you would likely pay ~15% capital gains tax on that or $8625, but not today! Remember you are exempt from this tax since you lived in the home for 2 years and the profits were under $250,000 if you are single ($500,000 if married).

So your total return / profit remains $57,500 and your return on investment is $57,500 / (100,000+ 17500) = 49%!

Or expressed as an annual return that’s (49/ 2) = 24.5%!

(Drop me a note if my math is off, doing this on the fly! Literally, I’m on a plane now).

You can do this every 2 years.

Almost All of My Homes Have Been House Hacks

When I was young, single and broke making $30k/yr in Washington DC. This is how I started. I bought a home every 2 years, moved in, rented out rooms to buddies, fixed it up (much myself), sold it and reinvested the tax-free earnings.

I didn’t have a catchy alliteration for it at the time, I just knew I needed to save some money so when I took a lovely lady on a date I didn’t have to take her to Crackerbarrel.(No offense CB, I’m more of a Waffle House guy when it comes to terrible diner food. And back then I usually cooked dinner anyway, another superpower strategy to saving money).

But I didn’t stop there. For more than 10 years, far after I “needed” roommates, I continued to rent out the spare rooms in my house, mostly just from Craigslist. Saving on housing costs was a game changer for me, and gave me a stark wealth-building advantage even over folks I knew were making 2 or 3 times my mediocre government salary.

Remember, saving a dollar is far far more valuable than making a dollar because you have to pay taxes on the dollar you make. Fun fact: you will have 50% more money in the bank if you save $1 vs making an additional $1, assuming a 33% tax rate. Go ahead, do the math. I’ll wait.

Eventually, I house hacked enough times to be able to afford the standard 25% downpayment to buy a standalone investment property. I refinanced that too when I could, pulled cash out and bought another investment property. And then another, and another. I also did not stop buying, moving in, renting, improving and selling a new house hack every 2 years.

If you can make the lifestyle sacrifice of moving and living with housemates, this is how anyone can grow a real estate portfolio. No fancy tricks. No gurus. No overleveraging, bridge loans or hard money. This one of the most tax-advantaged, low-risk ways to make money. In real estate, or otherwise. Full stop.

And I would argue, anyone can do it.

My Skeptical Take:

I like to think about the source of the next recession. Which is coming. It will happen.

Probably not today. Maybe not even in 2025. But it will happen, slowly then all at once down the elevator, as they say. The economy is still looking quite strong. I’m extremely bullish on US markets, especially when growth prospects are measured against the other two large global economies: Europe and China. And there is no indication of slowing in the economic data or in corporate earnings or in the labor market here in the US. Life is good, heck 2020 → today saw record returns in real estate and the equity markets (the stock market pullback in 2022 notwithstanding).

The issue in my mind is psychological and human, it is market anxiety after this incredible run. Like when you are up big at the craps table.

Recessions don’t normally happen when we expect them. Economic data doesn’t usually put up a giant Bat Signal to warn us.

In fact, it likely won’t be the proclamation of an economist with their data in tow that alerts us ahead of time. More likely, it will be a General or a President. And it will be a surprise.

By the way, in case you missed it, this just happened! A few days ago the government in Syria fell to rebel forces and its former President fled to Russia.

Global markets reaction? Meh. *Insert shoulder shrug here*.

Things aren’t what they used to be. The US now is the largest producer of fossil fuels, so we dodged a bullet on this potential market moving event.

But if this was 2004, we might have found ourselves embroiled in another Middle East quagmire.

Energy independence is absolutely game-changing (and we need much more)!

But this withstanding, the next recession source will be from a shock to the market, a Grey Swan: something we knew was possible but that we were not anticipating. This will send the market sharply downward toward a Minsky Moment.

Extended prosperity + risk-taking + Market Shock = a Minsky Moment.

Long periods of past success tighten the spring for a future recoil, ostensibly in an effort to preserve profits, especially given the fantastic returns we have enjoyed in both the last two years and since 2020.

But again, things are good. I feel great about our current economy actually.

Which ironically puts me solidly on alert mode.

My skeptical posture and robust real estate portfolio allow me to remain fully invested in the market. I don’t play the try to time the market game. Pikers try to time the market. Winners stay invested (as long as their investment thesis remains intact).

Remaining default Skeptical is how I preserve my thoughts before leaping to prevent jumps before concluding.

At least, I try to.

Until next time. Stay Curious. Stay Skeptical.

Herzliche Grüße,

*** What about you? Did this article motivate you to get started? Drop me a line and tell me. I always love hearing a new investor has decided to get started on the path to Fiscal Freedom! ***