A Skeptical Real Estate Dude

One Dude's Take: Market Insights for Real Estate Investors and Finance Nerds.

Welcome to A Skeptical Real Estate Dude, a real estate investment newsletter, coming at you from Nashville, TN. Every week I bring you a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

The Weekly 3 - News and Data to Keep you Informed

U.S. GDP - Growing Like Micro-Greens ↗️

Home Prices in 2024 - Up 5%+

Local Market Exam - Nashville, TN

The Bottom Line

The Weekly 3: News and Data to Keep You Informed

Federal Reserve Keeps Rates Steady in January. Does not yet see inflation under control and may be “unlikely” for March. (@JasonFurman).

Egypt, Ethiopia, Iran, Saudi Arabia and the UAE have confirmed they are joining the BRICS bloc of countries, strengthening the trading alliance. Current members are: Brazil, Russia, China, India and South Africa. Argentina declined to join despite the invitation. (Reuters).

Mortgage purchase applications fall -11.4%. Small sample and WoW numbers, but something to watch carefully. High rates are still suppressing demand (ResiClub).

Today’s Interest Rate: 6.75%

(👇 .17% from this time last week, 30-yr mortgage)

U.S. Economy Grew Rapidly in 2023

Much of the news coverage this week has focused on the strong U.S. GDP numbers. Rightly so, it was much greener than expected. Let’s dive in.

Year-on-year, the U.S. Economy expanded at 3.1% (2.5% real), significantly above “trend growth” of ~2%. And ended up 3.3% in Q4. Credit where credit is due, the predictions for recession in 2023 were wrong (or pre-mature, which is the same thing). The 400 PhD economists at the Federal Reserve predicted sluggish economic growth, and we ended up growing at 6x their prediction (WSJ). Wowza. What happened, Robert M. Adams? (see my take on risk management at the end of this article).

Perhaps the biggest takeaway is relative growth. The U.S. economy outpaced all other advanced economies last year, and it wasn’t close. You can bet the predictions are going to start rolling in. Already, economists at the IMF are predicting the US to be in pole position in 2024.

Real Estate Investment: a Weak Point in the GDP Numbers

One data point I’d like to pull out of the strong GDP numbers is Residential Fixed Investment, i.e. purchases, remodeling of private real estate and equipment (your HVAC system), broker fees etc…owned by landlords and rented to tenants. It’s been paltry, near flat for the last year, after falling 17.4% in 2022.

High rates crushed U.S. real estate investment and led to a housing recession in 2022-Q1 2023. The GDP numbers for 2023 show the housing market is still in recovery.

The Fed’s monetary policy has (inadvertently) hyper-targeted the real estate market. Not so much on our Amazon carts Consumers, they spendin, they spendin!

Home Prices

Despite restrictive monetary policy, home prices rose 5%+ last year and are continuing up and to the right. In my hometown of Nashville, we are up more than 9% YoY. This, a result of low supply, again despite high interest rates suppressing demand. Great for homeowners, not so great for homebuyers.

What’s in store for home prices in 2024? Industry analysts are getting more and more convinced it’s going to be a banner year. Both Goldman Sachs and Moodys Analytics just revised their home price forecast model up.

Goldman - home prices will be up 5% in 2024, 2.5x+ their previous 1.9%.

Moodys Analytics - home prices will be flat, “sideways” for a while, down -.4%, a large revision up from previously -4.4%. This is one of the mroe conservative calls.

Altos Research - home prices were up 6-7% YoY in January. And should be up 10% YoY in Q2.

Fannie Mae - home prices are expected to rise 3.2% in 2024.

Household Formation Will Drive up ‘Sidelined’ Demand

With the supply of new homes, especially the largest cohort - existing homes -remaining low, pent up demand is likely “pent’ing up” on itself. More and more young adults are coming of age, and are ready to start a family, buy a home, and move out of their parent’s future home office. But even with the homebuilders increasing their output, it’s just not enough. For example, in FY2023 homebuilder Lennar increased its deliveries YoY by 10%, to 73,087 homes, and expects to do so again in 2024.

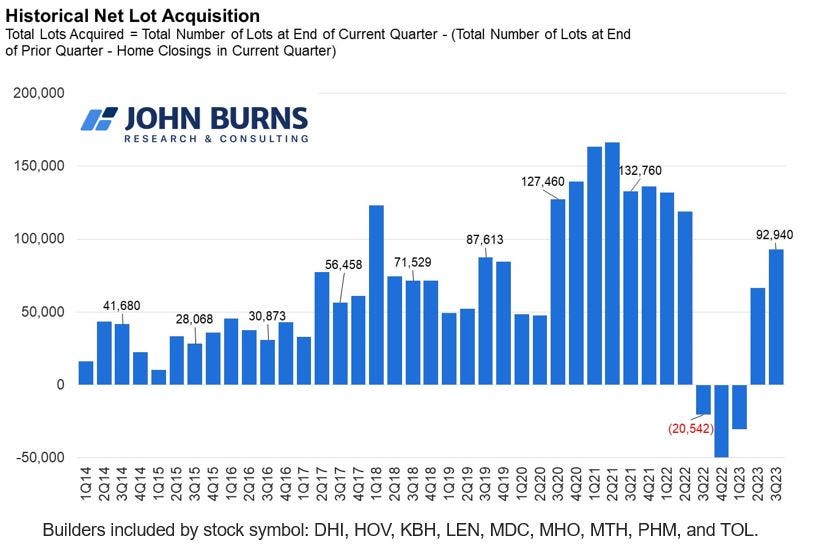

One potential factor is the availability of land for development. “America has a lot of land, local governments have been making it more difficult to obtain development approvals, and also make land expensive to develop.” (John Burns Research)

Thus, home prices in 2024, likely up and to the right.

U.S. Mortgage Interest Rates:

With the economy ostensibly humming along, what does this portend for us in the real estate market? How about interest rates? According to oft-cited economist Mark Zandi, “[The Fed’s] got everything they need to start cutting rates…It’s just a question of precisely when.”

Goldman agrees, in its home price revision, the investment bank also now sees mortgage interest rates falling to 6.3% by the end of 2024.

However, when will we start to see rate cuts? IMO we are still looking at a June timeframe. But, regardless of when the Fed cut rates, it may be just as pertinent to think also about how fast. Even if they start in March, how many and at what % will they make said cuts in 2024? IMO, we are likely to see 3 cuts this year (.25% each). It may be until year-end 2025 when we are back to mortgage rates in the 5’s%, which could keep even more young households on the sidelines until then.

So far, the Fed, IMO, likely does not see a cause for easing monetary policy sooner and/or faster. Inflation and unemployment are remaining within the Fed’s preferred ranges. Core PCE inflation is looking decent, running at 2.1% last month and 2.9% YoY. This week’s jobs report shows a labor market in decent health: jobs openings and hiring rates are near the historical average, although trending down. Layoffs were flat in December at 1%. If there is something to watch, it could be the quits rates, which are falling and are now below 2019 levels, a potential signal of a tightening labor market.

But don’t tell that to the market. Fed Fund futures are now pointing to a 57.8% of a rate cut in March and 94.3% chance in June. Up 10% from last week (CME).

Nashville Market Exam

Let’s take a look at a snapshot of the housing market today, to illustrate how the market is doing, using my home market of Nashville as an example:

Active inventory is low but much higher than last year, up 24% YoY, indicating strong momentum into the 2024 spring season. Total inventory is up 14%.

Home closings are up 20% YoY

Sales Price (median) is up 9% YoY

Homes are sitting longer, average days on market is 31, up 27% YoY. And the average full listing to closed sales cycle for a home is up 42% to 124 days. Anecdotally I am seeing delayed closings due to loan shopping, tight lending standards and more price negotiating.

What’s next for 2024? MoM numbers are signaling positive results, although 1 month a trend does not make. I will keep a sharp eye out and re-exam the next 2 months, which should give a clearer picture. IMO, supply is just too low and there are too many buyers looking for homes. Anecdotally, I have more investors calling me looking for property than ever.

Bottom Line

At the end of 2022, I counted myself solidly in the bearish camp. I thought we were for sure headed for a recession as a result of monetary policy. I was on tilt. We did get a housing market recession in 2022, but that did not continue into 23’.

Of course, we all can be Eddie Bauer quarterbacks Monday after the Superbowl. Predicting where any market will go is hard. Nay, impossible. Don’t try to do it. Instead, have a plan…I absolutely had more hedges in place to manage my risk at the beginning of 2023, but kept it at that. I didn’t fire sale my property or stock market holdings. [What did I do to protect my downside? You’ll have to take some initiative. Shoot me a note, and ask :)]

And speaking of the stock market, well, it’s wild. Like tiger on the plains of Africa chasing a naked guy with a stick, wild. Which is why I prefer real estate. It’s a relatively stable and reliable market with above average growth and tax advantaged gains. The stock market on the other hand? Well…Fun fact, over the last 30 years, 50% of all returns in the stock market came in just 10 days of trading. And if you missed on the best 30 days in the market, well… your returns would be an astonishing 83% lower. Totally insane. Last year was a banner year. The S&P was up 25%. What about 2024? Who knows. In fact, just this week, JP Morgan called the current stock market similar to the DotCom Bubble. It’s been up up up for a while now, due for one of its cyclical avalanches. But again who knows… That’s why I stay aware, I stay optimistic, and of course…

I stay skeptical.

Most Interesting Tweet(s) of the Week

You can now get ultra-fast internet almost anywhere in the world, via “space lasers.”

Property Highlight

Moving in Nashville? Check out this must see budget friendly 2 bed / 1 bath close to Vanderbilt in the rolling trees of Green Hills. A Neighborhood. Close to Whole Foods, Trader Joes, Hillsboro Pike shopping and restaurants. This would be the perfect little cottage for Nashville living. $1900/mo.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can email me direct, I try to answer all the emails I get personally. Andreas.Mueller01@gmail.com

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.