A Skeptical Dude's Take: Real Estate

Market Insights for Real Estate Investors and Finance Nerds.

Welcome to A Skeptical Dude’s Take on Real Estate: a frank, hopefully insightful, dive into real estate and financial markets, from one real estate investor to another.

Coming at you live from Nashville, TN.

Today We’re Talkin:

The Weekly 3 - News and Data to Keep you Informed

When will the Fed cut rates? Why not now? Mortgages be too damn High!

Housing Inventory Data Deep Dive.

Tangent - Gas Station Air Compressors are a scam!

The Bottom Line - Good time to Buy?

The Weekly 3: News and Data to Keep You Informed

The Federal Reserve does not care about the election. Fed Chair Jerome Powell gives a speech reiterating their independence. (Stanford)

The Crisis of the American Male, driven by housing supply? (Fortune)

Lower interest rates don’t necessarily improve housing affordability (Dallas Fed)

Today’s Interest Rate: 7.06%

(☝️ .15% from this time last week, 30-yr mortgage)

Bah, we are back to a 7 handle. I was hoping interest rates might start to melt-lower but alas, it was not meant to be.

Interest Rates: The Trend is your Friend

So do we know where are interest rates headed from here? Not exactly.

And anyone that tells you different is one of two things:… lying or stupid. Especially the online Gurus. Just like the stock market, nobody can predict when it will go up or go down. Too many variables. Not even Warren Buffett and Charlie Munger can, or even attempt, to do this. It’s “impossible and stupid.”

But we can analyze trends. The stock market trends up, over the long term, ~8%. And the economy is cyclical. The economic machine, as complex as it is, moves in cycles. So the right question is, where are we in the cycle, and thus, is it more likely for interest rates to be on the up trend or down trend?

So now that we’ve found the right question, what is the answer? Well that’s difficult too.

I’ll take a stab at it.

We are most likely on the down slope. But we aren’t downhill skiing, it's more cross-country. A little up, little flat, little more down, repeat…

Economist Mark Zandi agrees, “[The Fed’s] got everything they need to start cutting rates…It’s just a question of precisely when.”

Why Hasn’t the Fed Cut Rates?

Inflation and unemployment are their primary signals and are telling a very different story. Inflation is not ebbing. PPI, the Fed’s preferred measure of inflation, popped up last month, and PCE, CPI and PPI have been resilient to up in the face of the fastest interest rate increases in history and Quantitative Tightening, where the Fed stops buying corporate and government debt to reduce liquidity in the economy and slow financial markets. Economy resilient, yes, but that also means prices continue to creep up. Moreover, the market has been surprised by higher than expected inflation numbers this year. Year to date, we have seen 6 negative inflation prints, 4 positive, and 2 flat prints. Markets hate surprises. It is also contributing to high bond spreads (and thus higher mortgage rates).

How about employment? This week’s ADP jobs report shows a steady labor market, a little different than last week. Nothing special but steady. US companies added 184,000 jobs across most job categories and wages rose, the most since July.

Without a drop in inflation and a labor market that remains steady, the Fed doesn’t have the signal to cut rates. Why? Their restrictive policy hasn’t worked (yet). So why ease and risk, in all likelihood, a reaccelerating of the asset markets, most likely the stock market, and for sure the real estate market. This could create a bubble or even worse, run away inflation.

You think eggs are expensive now? Well you may live to see a real life golden goose.

The Fed is in a very difficult position. Should they cut rates?

Steve Eisman (ala the Big Short, played by Steve Cornell), is pushing for the Fed to not cut rates, saying it could create a bloated stock market and potential crash. I agree, and as I said last week we could be in an era of the dreaded Stagflation. But rates are killing the housing market, which is at historically low inventories. Lowering rates would bring back some affordability for monthly mortgages for homebuyers.

What’s better, juice the stock market or housing market?

The value of the US stock market is ~$50.8 Trillion. Cutting rates now while the economy is humming and inflation is still strong could create a bubble, leading to a recession.

The value of the US real estate market is ~$52 Trillion (close to the same, fun fact). Keeping rates high could destroy capital intensive activities and businesses. Leading to stagflation and bankruptcies. Bad times for Commercial real estate, small businesses, car buying, and just the average Jane trying to buy a house for the fam. Anything that you need a loan to operate/buy/grow.

The Fed may be damned if you do, damned if you don’t….

But What do the “Experts” Think?

You know how I feel about experts… but consensus thinking is helpful to monitor for us Skeptics. Here is what they are saying:

The Mortgage Bankers continues to forecast a higher 6%+ mortgage rate for 2024.

Fannie Mae (and Freddie Mac) recently revised their predictions to higher in 2024 as well: 6.7% in Q2 2024 (previously 6.3%) 6.6% in Q3 2024 (previously 6.1%) 6.4% in Q4 2024 (previously 5.9%).

Wells Fargo: 6.65% in Q2 2024, 6.45% in Q3 2024, 6.15% in Q4 2024. I.e. the Fed and bond markets will remain higher and restrictive.

The Fed is Bad at Predicting % rates

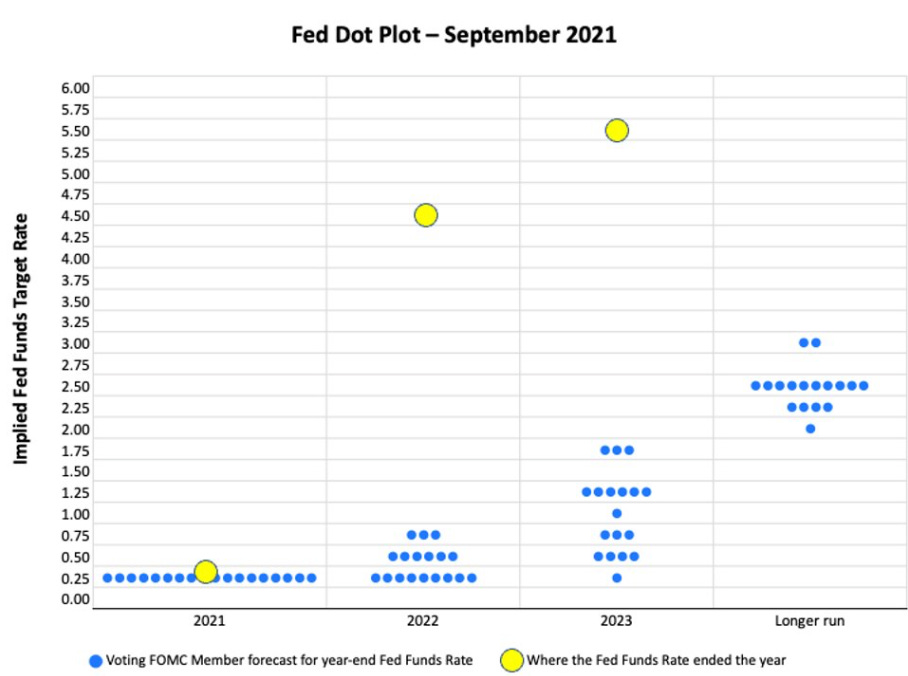

All that being said, the Fed has been just terrible at forecasting to the public what interest rates will be. In Sept 2021, the Fed predicted rates would end 2022 at 0.5% and 2023 at 1%. They were only off by a massive 4% for 2022 and 4.5% in 2023. So take predictions by the “experts” with a crystal-sized grain of salt.

TANGENT Alert! - Gas Station Air Compressors are a Scam

Have you too noticed that your Honda’s tire is a little low and tried to use a gas station air compressor station lately?

If so then you know… they are a legit scam!

I went to 5 last week to fill up my low tire. The result: 3 were completely broken, 1 shut off half way through and then broke, and 1 took my $4 and spit in my face. Want your money back? Well the air compressor station is always owned by a 3rd party, not the gas station. So they say “call this 1-800 number to get a refund,” which also doesn’t work….F%#*

I finally bit the bullet and got a $30 portable air compressor, great for my frequent long road-trips. Can’t recommend higher.

Freedom!

But I digress…

The Good News: Real Estate Market Supply is Picking Up

Back to Real Estate. The good news is inventory of available homes is starting to pick up. This is extremely important on the road to returning to a more normal market.

According to Altos Research/HousingWire : 513,000 single family homes are on the market: 24% YoY, and 102% than two years ago.

The interesting part is that in 2022, mortgage rates and inventory were marching together higher quickly. At the time inventory was growing much faster than it is now. In 2023 supply growth slowed more, but started to catch back up toward the end of the year.

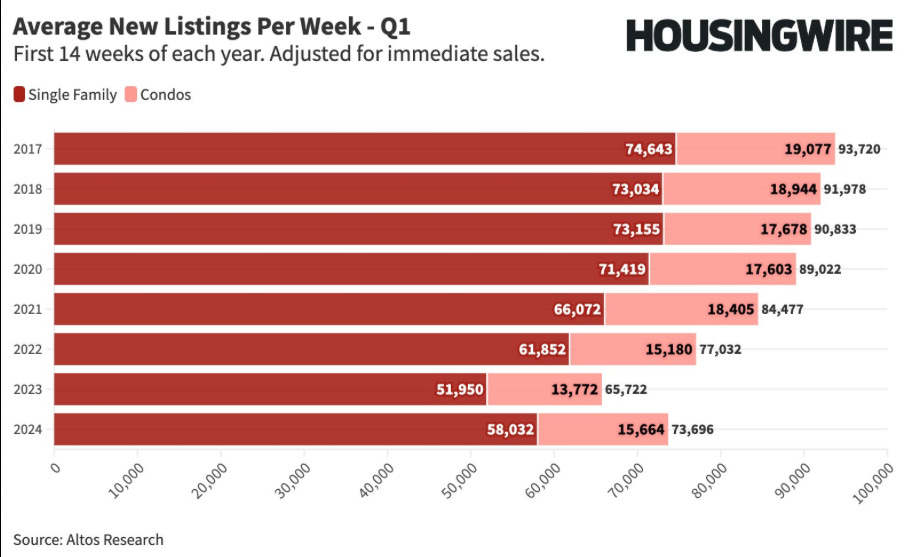

What about 2024? I agree with Los Altos’ analysis. I see supplies continuing an upward trend, albeit slower than one would like (up ~1% last week). There were 60,000 new listings and 17,000 sales, total new sellers are 14% more than in 2023. If we continue this trend, more sellers will mean more sales in 2024. But until the new listings rates gets back to closer to 80,000 per week in March, we’ll be below 2022 levels of housing activity. We currently stand at 8% more sales than 2023 but 15% fewer than this time in 2022.

Putting this in perspective see previous years’ new listings data, since 2017.

The trend is your friend. ☝️

This date is corroborated by housing analyst Lance Lambert. U.S. new listings +14.9% year-over-year U.S. active listings +25.5% year-over-year.

In my home city of Nashville. We are below trend, supply is extremely low and new listings are not growing as we are seeing on average in the US.

Folks are HODLing houses!

And…

The Bottom Line

In short, folks are feeling starting to feel kinda, a little, sorta more comfortable putting their home on the market, at least for these first few weeks in 2024. But not everywhere, like some growth markets like Nashville, where prices are more rapidly appreciating (we were up 9% last year, double the US average). Perhaps people are seeing prices marching higher and rates not moving, so they are worried they may have already “missed out” on buying home altogether?

Stop it. Don’t. That’s monkey brain thinking.

That’s not rigor. It may feel uncomfortable or risky to buy something that seems "expensive. But as I’ve written on in the past, assets (homes, stocks, bonds etc…) appreciate over the long term and, remember, you can’t time the market. Owning an investment property is much much better than keeping your money on the sidelines.

The Skeptics Take: I hear many “experts” talk bout how we need real estate transactions, new listings, inventory/supply etc… to increase in order to quell real estate prices.

But, let’s be real. Home prices, like wages, won’t go down.

They may stagnate but they wont meaningfully deflate. For once, I agree with über-annoying real estate Guru Dave Ramsay:

“If you’re thinking about buying a house… and you’re waiting on real estate prices to come down or interest rates to drop, don’t wait. Buy a house now if you’re ready. The prices aren’t going to come down, and you can always refinance the interest rate.”

So what are you left to do?

Just do it. Jump in. I am.

Most Interesting Tweet(s) of the Week

Breaking, Fed’s Powell sees inflation as too high still but the recent higher inflation numbers as “bumpy” but still overall trending down. I.e. Fed is likely to NOT increase rates more (some were worried) and will keep rates constant/higher for longer. The Fed’s posture is to wait for when to cut.

That’s it for this week. If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! Drop me an email. Andreas.Mueller01@gmail.com. I always like a rigorous discussion.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.