A Skeptical Dude's Take on Real Estate

Market Insights for Real Estate Investors and Finance Nerds.

Welcome to A Skeptical Dude’s Take on Real Estate: a frank, hopefully insightful, dive into real estate and financial markets. From one real estate investor to another.

Coming at you live from Nashville, TN.

Fuel for the day: A little Sumatra. Copper Moon makes some good coffee.

Today We’re Talkin:

The Weekly 3 - News, Data and Education.

Real Estate Peaked for the Year?

Interest Rates: Your Margin is My Opportunity.

There is Pain Coming to Real Estate…

The Weekly 3: News, Data and Education to Keep You Informed

Oklahoma City Council approves rezoning to allow building of largest skyscraper in US. (KOCO).

The U.S. Federal Reserve will cut its key interest rate in September and once more this year, according to a majority of forecasters (Reuters).

Book Recommendation: The Book on Rental Property Investing. Real estate rookie? This book is the bedrock.

Today’s Interest Rate: 7.07%

(👇 .21%, from this time last week, 30-yr mortgage)

Real Estate Peaked for the Year?

It’s official. It’s June!

It’s time for sun dresses and shorts! My favorite season. And it also means Real Estate has peaked for the year.

Wait, what?

Well, ostensibly, like a bear emerging from hibernation, March-May is (typically) the height of home buying (and renters moving, although that continues to July, in my experience), as folks emerge from their frigid winter slumber.

Unfortunately, this spring season was not as active as expected.

What’s at play behind the scenes?

Much like the groggy bear, our economy is looking a little sluggish. It grew far slower in Q1 than previously estimated after downward revisions to consumer spending and a mixed bag on inflation numbers, as we talked about last week.

GDP rose a paltry 1.3% January through March, down from the previous measure of 1.6% the Commerce Department reported last month. Of note, GDP was double that (3.4%) at the end of 2023. Removing seasonality, that still is a big dip and a big miss. Notably, last quarter consumers hesitated on purchasing big-ticket items / durable goods, like a new car, at the slowest pace since 2021.

Why do we care?

Many reasons, but for now let’s focus on interest rates. The Federal Reserve is in a highly restrictive policy posture, and is monitoring the economy closely for weakness. If GDP, labor numbers, inflation start to correct in a way they view as weak enough, that will be the Bat Signal to start cutting interest rates (wiki provided for you GenZ folks who have no idea what that is :).

However, I am still of the opinion that the Fed will cut rates in 2024, most likely twice, by .25% each. Inflation is not yet trending down to the Fed’s 2% target, this is true. Labor market is still tight. True too. But these two shall pass.

Housing Market was Slow this Spring

Ok, back to Housing.

The slowdown in the economy may also be attributed to a slower than expected/hoped housing market (or vice versa? Dirty secret: nobody really knows).

This slowdown was illustrated by the National Association of Realtors, which released recent home sales numbers. Contract signings last quarter for home purchases fell by the most in three years and overall activity was the lowest since 2020. Pending home sales also fell 7.7% the largest since Feb. 2021.

Inventory has been creeping higher. True. Unsold inventory of existing homes climbed 9% from one month ago to 1.21 million at the end of April, or the equivalent of 3.5 months' supply at the current monthly sales pace. But, even with more inventory on the market, interest rates are suppressing the capability of potential homebuyers. “Remember that it's not inventory holding sales back; it's demand. We had higher sale levels with less active listings (Mohtashami).”

So home prices must be dropping right?

No.

Supply is too low still. Home prices grew YoY by 5.7% to $407,600 – the tenth consecutive month of year-over-year price gains and the highest price ever for the month of April (NAR).

Opportunity: Higher Interest Rates = Price Reductions

If you are one of the (unfortunately too few) who can stomach a likely temporary higher interest rate, there are deals to be had. Prices are not decreasing, to be clear. But sellers who were hoping to get a few extra bucks, and agents who capitulated, are having to reduce their list price.

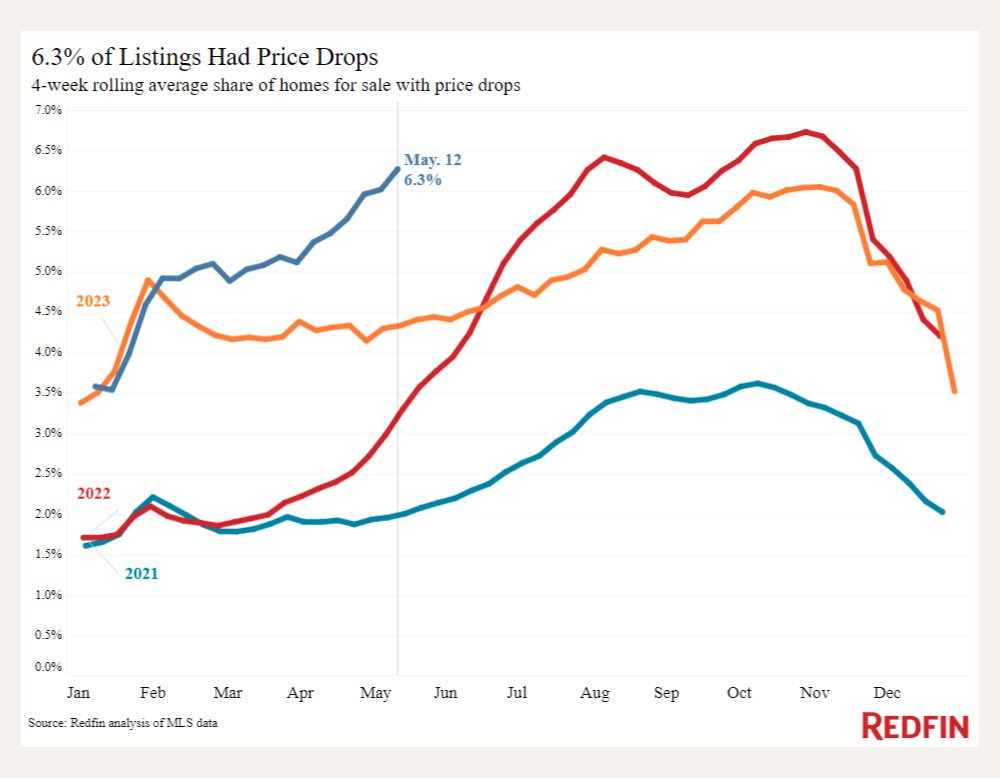

In fact, price reductions from list price are happening at a rate 2x that of 2022, and 3x that of 2021.

And in my hot home market of Nashville, median price reduction is 10% off sticker. Not too shabby. Anecdote: I just picked up a triplex for $425k, reduced from $500k a list price. And no it wasn’t sitting too long, just a few weeks.

There is Pain Coming in Real Estate

The pain is not coming to residential (single family and 1-4 unit homes). Residential real estate is doing just fine, all things considered. We have the 30 year fixed mortgage (more later), and most homeowners who have a mortgage are locked in at under 4%. The pain is coming to commercial (duh), office (duh, see last 2 years), and the new pain is coming to…. Multifamily.

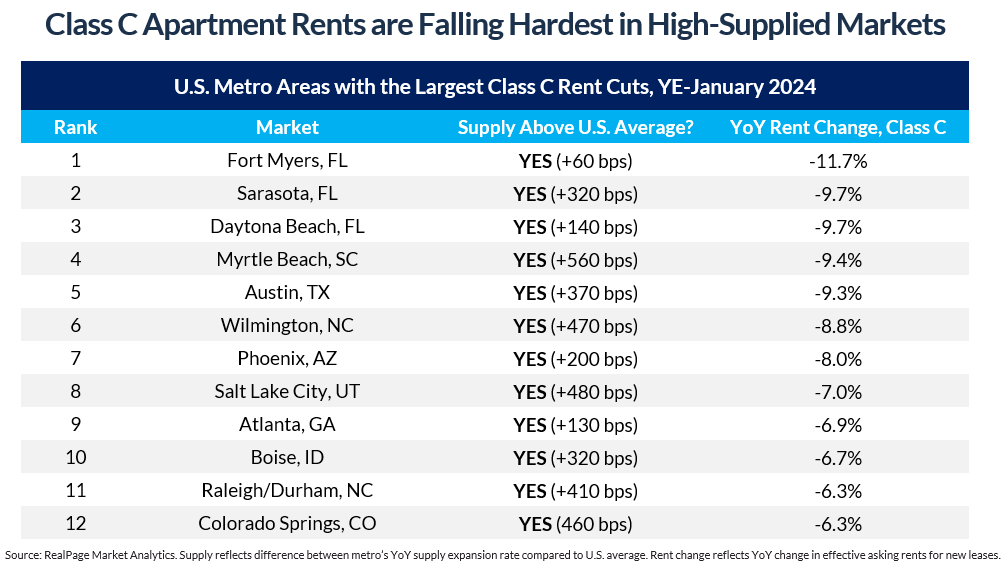

We are in the middle of the country’s largest multifamily construction boom in 40 years. Tons of supply is hitting the market, which will put downward pressure on apartment rents. And 2024 will see even more supply come online. Just look at these markets:

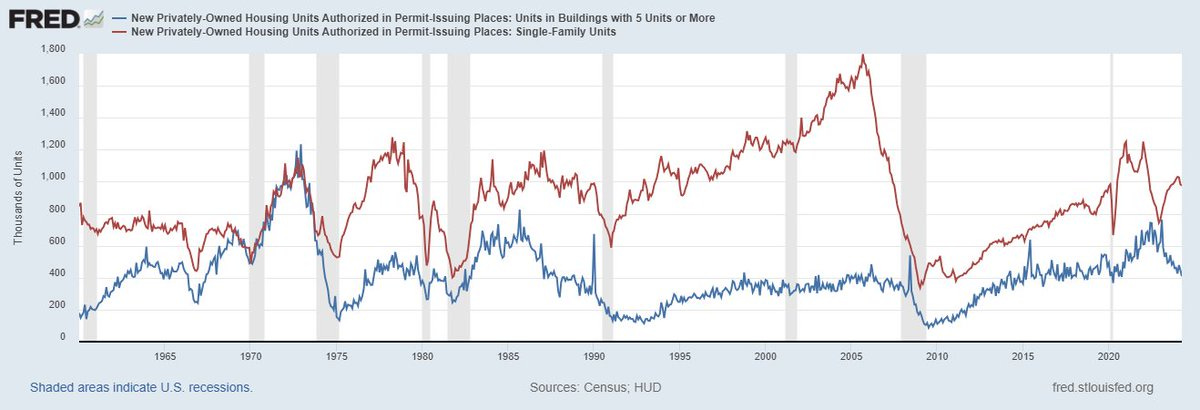

However, the supply cliff is coming. And it’s a BIG CLIFF. Multifamily developments are completing far faster than new starts, and is at the widest levels since 1975. This gap will likely widen further. Rates go down (2020-2021): start building! Rates go up (2022-now): stop starting building!

Thus, the supply glut in apartments and downward rent pressure is temporary.

“Completions are at multi-decade highs while starts continue to rapidly plunge due to several headwinds: high rates, flat-to-falling rents for lease-ups (depending on the market), and construction costs often coming in above replacement value.”

“Simply put: It's very difficult to start new unsubsidized apartment projects right now. Folks on this app often don't realize that developers do not self-fund their own projects. They have to raise equity and debt, and that is very challenging right now for reasons mentioned above.”

“So while supply will continue to exceed demand in 2024, keeping downward pressure on rents, you can see how (assuming the job market stays healthy) demand could exceed supply again by 2025, which would in turn put upward pressure on rents. Cheap debt helped fuel the multifamily construction boom, which in turn tamed rental inflation; and expensive debt is helping tame the multifamily construction boom, which could fuel renewed rent inflation (Jay Parsons).”

I totally agree, couldn’t have written it better myself.

And said another way, permits (aka the early part of the process to build new) for apartment buildings are at 2020 lows. And dropping.

Residential real estate (again, single family and 1-4 unit buildings) are still holding up, in fact, they aren’t high enough. We still do NOT have nearly enough housing.

The U.S. housing market is short at least:

760,000 for-sale housing units

760,000 for-rent housing units

Thus, not enough supply = home prices go up.

But while this is not ideal. It coudln’t be worse. Way worse.

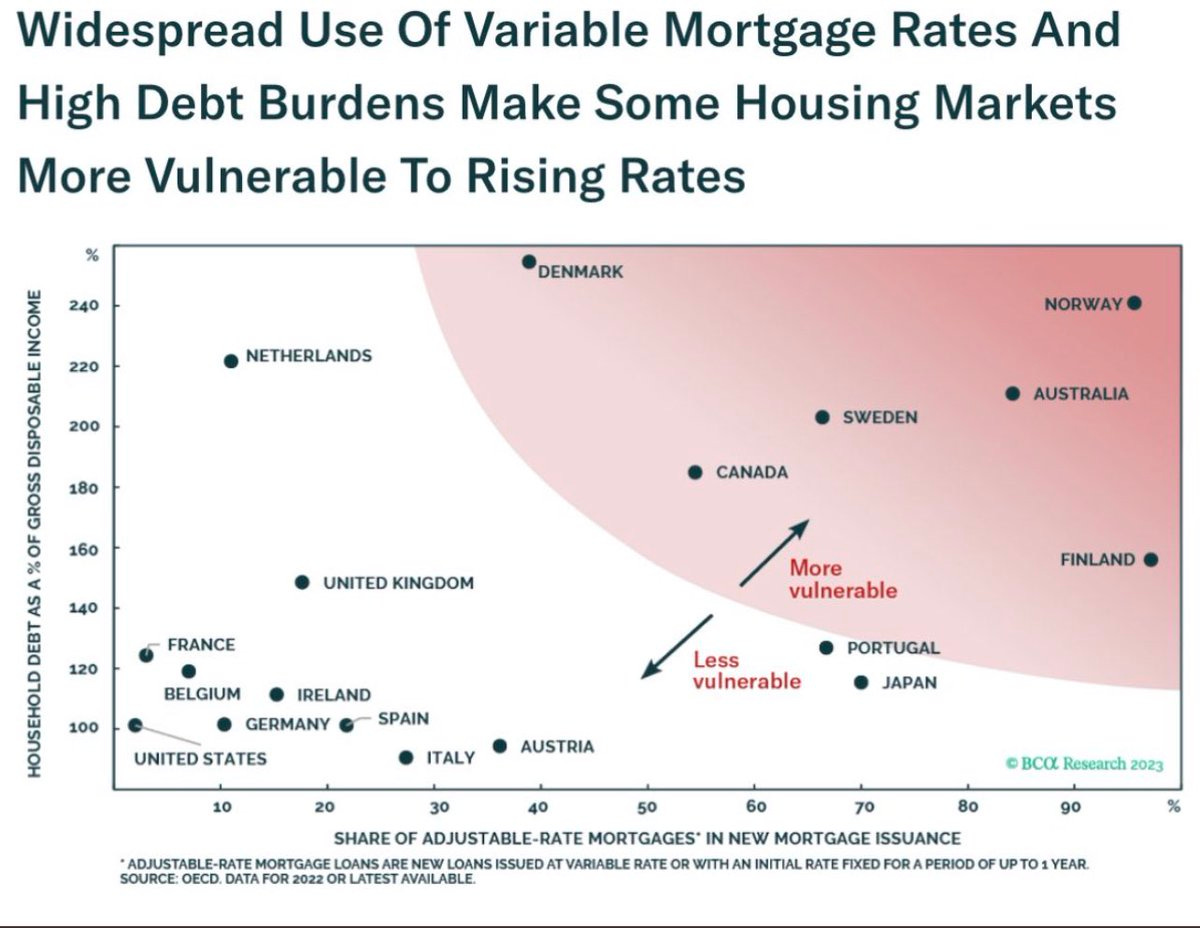

Globally, we are actually in the lower rung of rent and price to income growth. Take a look at Canada! Wow, no wonder they have a strategic Maple Syrup Reserve. Need some of that Liquid gold in case it gets froggish.

Oh, and they also still have a massive % of adjustable rate mortgages in these countries. Not a coincidence.

The US is highly insulated from these issues, relatively of course, because we have the 30-year fixed mortgage and the qualified mortgage law. Kudos to policymakers on this one. For once government is not on a permanent intellectual vacation.

Merica!

The Skeptics Take:

“Your Margin is My Opportunity.” - Jeff Bezos

Higher rates are an opportunity, and can actually be better, for real estate investors. On the buy side you want less competition, and that is exactly what high interest rates do. It separates the investor from the HGTV poser who was buying real estate on margin with a hard money loan that would make the Gambino family pause, and financing the renovations on a credit card to flip it for a quick buck. Yes this was normal a few years ago.

No more.

Higher interest rates can also put pressure on sellers of existing homes, who see their property sit on the market and get nervous. If you make your money when you buy real estate, as the old adage goes, then this type of environment breeds deals. Again, as we say above, price reductions are at a historic high for Spring.

So when I hear on TV, or from the real estate “experts,” that it’s a “seller’s market” because housing supply/Days on market is low… I call BS.

Buyers have the upper hand in negotiations, it’s their market now.

So, I’m declaring this a Buyer’s Market. You heard it here first! (or at least reiterated).

Grab yourself a superstar real estate agent and go get some.

Until next time. Stay curious. Stay skeptical.

Herzliche Grüße,

-Andreas

Please Share this Article!

It takes several hours to write the Skeptical Dude article, and they will always remain free. All I ask is that you share it with 1 friend. If you do, you will get two gifts: free education for one of your friends and good karma for helping to grow the community. You can share it here:

Contact Us

That’s it for this week. If you are interested in talking real estate investing and digging deeper into any of these ideas don’t hesitate to reach out! I always like a rigorous discussion and helping fellow real estate investors.

Looking for a realtor in the Nashville area? Shoot me a note, we work with the best here who specialize in helping investors find great properties.

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.