A Skeptical Dude's Take on Real Estate

One Dude's Take: Market Insights for Real Estate Investors and Finance Nerds.

Welcome to A Skeptical Real Estate Dude, a real estate investment newsletter, coming at you live from Nashville, TN. Every week I write a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

Today We’re Talkin:

The Weekly 3 - News and Data to Keep you Informed

Main Story: The 2024 Apartment Surge. Does it Matter?

The Bottom Line

The Weekly 3: News and Data to Keep You Informed

Fed May Keep Interest Rates High. More Federal Reserve officials at their meeting last month signaled concern with cutting interest rates too soon and allowing price pressures to grow entrenched. Yet, interest rates are likely at their peaks. (WSJ).

Judge’s decision in Trump real estate trial may have deleterious impact on NYC real estate investments. Large investors believe risk too high now, since decision (@GrantCardone and@Kevinolearytv).

Single-family existing-home sales prices Up. Climbed in 86% of all metro areas in Q4 2023 up from 82% in the previous quarter. The national median single-family existing-home price rose 3.5% from a year ago to $391,700. (@NAR_Research).

Today’s Interest Rate: 7.14%

(☝️ .01% from this time last week, 30-yr mortgage)

Mortgage Rate Update

Mortgage rates are negligibly higher this week, up for the last 2 months, 7.14%. But otherwise not too much news here. SO…let’s sink our teeth into something more meaty: Wild volatility in apartment housing supply.

Apartment Supply Vs Home Supply: a Dickens of a Situation

The supply of total available homes is still too low. Like really low. Like totally low.

But don’t take just my word for it. Last month, Fed Chair Jerome Powell said “there hasn’t been enough housing built and [is the reason for elevated home prices].”

We in the industry saw this after the Great Recession. Housing starts were far below historical averages, creeped up in 2020-21, only to fall again.

And most research analysis agree. We have an overall housing shortage, and it’s in the multi-millions.

Issue Spotlight: Available Land is Still Hard to Come By

Not often talked about, but this really matters. Housing undersupply includes supply of land for development, which you obviously need to build a home. And while the availability of lots for homebuilding has “loosened” we are still undersupplied in most all markets.

According to Honda’s analysis, “Current lot development [supply] is supportive of modest growth in the new home market [in 2024] but doesn’t support blockbuster growth.”

Snapshot in time: Housing Starts Down in January.

How is the undersupply or land and high interest rates affecting future home supply today? In January, new residential housing starts were down sharply, -14% (Census).

Gross.

Apartment Buildings

Now let’s look at apartment unit supply, which I’ve been getting a LOT of incoming questions on.

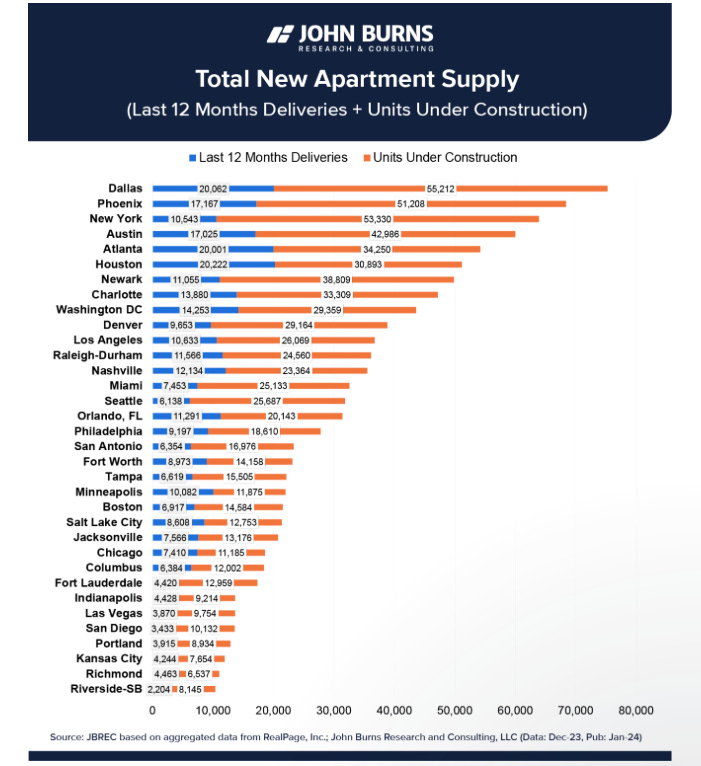

Apartments are a totally different story, they are booming. But will it matter and will it last? New research from John Burns Research and Consulting has the data. Let’s dig in:

It’s a real Dickens of a situation out there.

At the start of 2024, new apartment construction sits at historical highs, the most since 1974. Roughly 1 million units are under construction, with about 2/3 of them coming on the market this year. In total, it is expected that the US will have 40% higher new apartment unit supply in 2024 (1.4 million vs average of 980,000, this includes deliveries and under construction, JBREC).

Why is 2024 special for apartment housing construction? Just work backwards. Subtract 3 and 4 years to build something and you get 2020-2021. What was true in 2020 and 2021? ZIRP (zero interest rate policy, for all you young Dudes out there). ie when banks were lending at ultra low interest rates apartment builders jumped on the cheap capital to build that lovely new multifamily apartment building in a town near you.

But not every town.

Dallas, Phoenix, Charlotte, Houston, will boom in 2024.

How will cities do in absorbing this supply influx?

Comparing 2023 apartment supply growth against rent growth we can see that inventory grew at about double normal, and rents still rose .5% on average. Which cities did best?

My home market of Nashville was extremely resilient, for example. It had the 2nd highest supply growth of apartment housing in the nation in 2023 and rent growth slowed only ~1.8%. Charleston, Columbus, Richmond, Denver and many others where strong as well, adding a few % in rent growth, albeit with about half the new supply (JBRE).

However, this “housing boom” will be, dare I say…. transitory. Spookyyy!

The Real Story... It’s Transitory

In 2025, the apartment supply bubble will pop, fall off a cliff, come back to earth, whatever the metaphor you prefer to use…

Permits for development, the last 3 years of inflated material / labor prices and much much higher interest rates has made the environment for apartment construction highly challenging. Add to this the tumult in the regional banking sector - the sector that funds most all commercial real estate lending - and Na also! Apartments are not being started today like they were in 2020-21. It’s hard to make the numbers make sense today for new development.

What will the come down be like?

Nationally, the numbers should be down at least -20%, based on permits. But cities like Seattle, DC and San Antonio will snap back -40%, like an errant tree branch on a hike with your girlfriend when you both aren’t paying attention 😬. Cities Miami and San Diego are pressing forward however, up 40% (although those numbers are likely due also to delay in construction timing).

Bottom Line

As Warrant Buffet is fond of saying, “Only when the tide goes out do you learn who has been swimming naked.” And the 1-2 year spike up and then crater down in apartment supply is certain to add volatility yes, but in the long term, what will it mean?

The Skeptics Take: This news is positive in my view. We can see the cliff coming and a little certainty, is always a positive in my book. Event if it’s “bad” news / especially when it may scare others. If you are in a city expected to receive an influx of supply, you may want to be prepared to weather the 6-12-18 month volatility in your city. Let tenants know today you aren’t raising rents this year, and have them renew their leases today instead of waiting for their lease to come due.

My home market of Nashville (and in Salt Lake, Austin, Jacksonville, Orlando) already had much supply come on the market in 2023 and weathered it well, so perhaps in those cities you have to be less active in managing your portfolio (ostensibly you did this last year). In fact it may be a GREAT time to buy your next rental so you are ready with a nice new place come end of year when overall supply may be in the gutter; and interest rates are likely a little lower.

Apartment vs Residential Landlords. Additionally, and importantly, I’m not buying large apartment buildings so the effect on my and my clients’ portfolios will be muted. Small multifamily and single family real estate supply is still low and under-built. And while, to a degree those assets compete, they offer a different style of living, and thus are relatively insulated from volatility in apartment supply. According to ResiClub analysis, “Multifamily rent growth has softened more than the single-family rental market. And in some regional pockets, multifamily rents are experiencing outright declines.” According to Zillow national multifamily rents rose +2.7% in 2023, while national single-family rents rose +4.6% in calendar year 2023. The disparity between the two should be even more stark in 2024, with the possibility for apartment rents to be negative.

Anecdotally, we saw steady rent growth on average in our portfolio of homes here in Nashville during last year’s apartment boom, in which the data pointed to a -1.8% decrease in apartment rents. And it matters what kind of apartments are coming online. In Nashville, much of the new apartments are considered luxury, which do not compete directly, only indirectly, with my portfolio. Rents for my units / homes are about 1/2 that of a similar sized luxury apartment. Renting modest homes/units is a large part of why my portfolio is resilient in a down market as well.

As I said last week, take some time now to improve / harden your properties to remain robust against any potential downturn. Because you can NEVER predict exactly when it is coming. Don’t try. Just keep improving and building that moat of resilience ….

And as always…Stay skeptical.

Most Interesting Tweet(s) of the Week

A little turbulence and arrive 1 hour early? Am I crazy to be totally into this? Bring back the Concord!

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can email me direct, I try to answer all the emails I get personally. Andreas.Mueller01@gmail.com

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.