Welcome to A Skeptical Dude, a real estate investment newsletter, coming at you from Nashville, TN. Every week we bring you a brief, hopefully insightful, dive into real estate and financial markets, for all you kick ass dudes and dudettes out there.

Today We’re Talkin:

The Weekly 3 - News and Data to Keep you Informed

Interest Rates: the State of Play

Inflation Spotlight: How Auto Insurance Premiums Affect the Housing Market

A Skeptics Take: Money Supply Flashing Red Alert

The Bottom Line

The Weekly 3: News and Data to Keep You Informed

45% of Real Estate Agents who own their Firms Having Trouble Paying Rent on their Offices (Alignable).

US Stock Market Hits Record High. Stocks are continuing their recent advance, with the S&P 500 on track to make its fourth record high in as many days (Barrons).

Tens of Thousands in Layoffs already in 2024. eBay, Blackrock, Twitch, Unity, Wayfair, Unity, CitiGroup…(@GRDecter).

* Bonus * - Shipping through Panama Canal Plunges Back to COVID Low. $270 billion traffic jam (Bloomberg).

Today’s Interest Rate: 6.92%

(☝️ .15% from this time last week, 30-yr mortgage)

Interest Rates: Will Remain Range Bound, until they Aren’t

Following the Federal Reserve’s holiday announcement that their restrictive posture in 2024 will become less restrictive, mortgage interest rates (and Treasury yields) dipped a full 1%. Since then rates have creeped up, likely from lingering inflation / wage growth concerns in the bond market.

Bear in mind, the Fed has NOT yet “pivoted.” Their policies have not yet changed from “restrictive” to “accommodating.” Nor have their policies changed to “less-restrictive.” They have merely begun to look over the horizon, and sometime in 2024 they expect to ease restrictions. They are still in a highly restrictive state. It may not be until 2025 that the Fed considers its policies accommodating.

As the market waits in anticipation for the Fed to act, trying to guess when this may be, rates will likely be volatile, yet range bound. For now, that range seems to be 6.2% - 7% (30yr mortgage). For its part, mortgage buyer Fannie Mae now expects mortgage rates to be 6.4% in Q1 2024 and 6.2% in Q2, down from 7% and 6.8% respectively when it released projections 2 months ago.

Additionally, the spread for mortgage rates above the 10-yr Treasury bond remains historically high and likely will continue to do so until the bond market feels better about inflation (more on the latter, below). Homebuyers have taken some notice. Mortgage applications, while still very low historically, have seen a 3-week positive trend upward and an 8-week trend, seasonally adjusted.

So When will the Fed Cut Rates then?

Last week we talked about when the Fed may start cutting rates. At the time, the bond market was pricing in a 97.4% chance of a rate cut in March - and a mind-bogglingly high 6-8 rate cuts in 2024 (though down from 6-9 a month ago). Every meeting a rate cut, on average, and at over 50% chance. We disagreed, saying it was more likely they would start in June. Since then, the bond traders are now signaling that same sentiment.

We are down to a 43% chance of a cut in March and 82% chance in June.

Will the Fed be ‘forced’ into cutting rates? Only if the economy starts to slide, which Bank of America CEO Brian Moynihan thinks may happen, predicting 4 rate cuts this year and in 2025 to “avoid tipping the economy over.”

Counter point: Economists are touting a strong labor market, which is inflationary and will delay interest rate cuts. Wage growth is outpacing inflation across all wage tiers. It should be noted, strong (but not out of control) wage growth is good for the economy, I’m not hoping for doom and gloom. But, we Skeptics always keep an eye out.

Inflation Spotlight: Auto Insurance

One reason for a hesitant bond market, and thus stubbornly high mortgage to Treasury yield spreads, is inflation expectations. If inflation remains high, even though it has come down from über-high levels, bond yields and mortgage rates will remain elevated. Let’s look at one corner of the inflation front: auto insurance.

Now, we already examined home insurance inflation a few weeks back, and unfortunately, auto insurance premiums are also going wild. For partially the same reasons, like reinsurer costs due to increased disasters - and some new ones.

In short: 2023 saw auto insurance premiums jump 20+%, average premiums are now $2019/yr. The highest levels since the 1970s.

And some industry analysts are projecting premiums to increase another 12.6% in 2024. Hopefully this doesn’t affect my late-night Uber ride? 😬😬😬 (it will).

And watch out on the road folks, in 2023 5.7% of households didn’t have car insurance, up 8% YoY.

Why this Matters for Real Estate

Indirectly this is a signal of overall stubborn inflation; directly, this does matter for the real estate industry. Why? Insurance markets are submarkets of the larger US economy. Higher auto insurance premiums result, assuming no foul play, from underlying costs increasing, such as from higher manufacturing costs, which mean manufacturing costs for other things like building materials are also likely to go up. Same with labor costs. Case in point: auto repair costs (parts & labor) were up almost 20% YoY, and cars are more expensive to replace in today’s market. The average new car costs $48,759. And, don’t blame ‘expensive electric vehicles’ for increased premiums (not that I care either way, but I hear this argument a lot). In 2023 the average electric car became cheaper than the average new gas car. For example: A new Tesla Y (the best selling car in the US and the world) is $3,700 below the average auto price of roughly $48,759 (Bloomberg).

Exogenous side effects can also affect both auto insurance, and….home values! For instance, higher car theft in an area/zip/city can be a factor in depressing home values. In 2023, auto were up ~34% in 2023.

Personal Anecdote: I just exited my last property investment in DC in the fall - a large renovated, yet typical, DC row-house I was renting out. I noticed home prices stagnating in my zip code, deteriorating tenant application quality and more and more anecdotal crime stories from my tenants and neighbors. My skeptical mind was flashing its Spider Senses. Was I crazy to leave a “growth market?” Then I saw this just the other week: “There were 6,829 thefts of motor vehicles last year — [a whopping] 82% increase from the previous year. In the first four days of 2024, 53 cars have already been stolen.” According to D.C. police data.

Holey moley! Everything is intertwined in our economy. Gotta keep your head on a swivel dudes and dudettes.

A Brief Skeptics Take: Money Supply Flashing Red

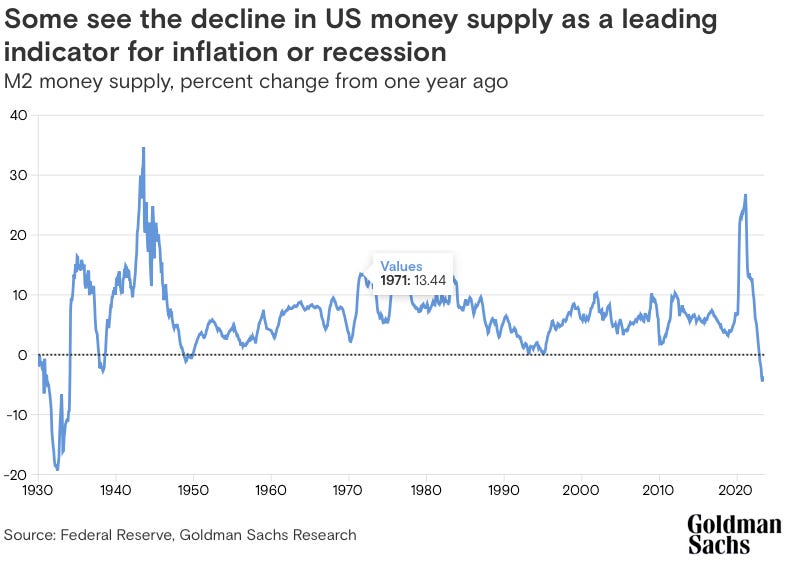

One historically significant indicator of potential recessions, the rate of change in the supply of money whirling around tin the economy, or M2, is officially flashing red (see M2 explanation here). In 2023 M2 declined by 2%, one of the largest annual declines on record. Rapid M2 declines have always signaled a recession is ahead (or happening).

Same is happening in the U.K. M2 plummeting.

Bottom Line

There is reason for optimism on interest rates, as long as the economy holds up, but it will likely be a gradual hike down. Slightly lower mortgage rates will slowly increase demand, accelerating when we get below 6%. Perhaps by Q1 2025. Housing supply main gain over 2023, but will remain lower than demand, propping up home prices.

On Home Prices: As we said last week, the housing market should appreciate more in 2024 than 2023, particularly in growth markets and with rates that likely peaked last year. Zillow, in just the last month, totally reversed its prediction for 2024, forecasting that home prices would appreciate +3.5%, from -.1%. Digging into these numbers, housing analyst Lance Lambert sees the only major national laggareds as the California Bay Area, and much of Lousianna.

Nevertheless, this Skeptical Dude is remaining cautious, a wider mortgage-Treasury bond spread is cyclical and unfortunately usually occurs during periods of economic market stress. I am also watching the M2 numbers like a hawk. An extremely important alert is now flashing in the US and UK, signaling an economic slowdown. Case in point, Goldman Sachs economists recently expressed concern over the labor market, saying, “[there are] three somewhat concerning developments. First, the pace of gross hiring has slowed dramatically .. Second, .. the hiring rate argues for a further drop in job openings in the first half .. Third, .. we find a higher risk of labor market deterioration today than in 2019, with the probability of a 4-5% unemployment rate within twelve months estimated at nearly 20%.” And large financial instututions are shedding employees, nearly 17,000 across Wells Fargo, Bank of America, and Citi (Reuters). Labor markets are the primary data area the Fed is watching to signal if rates need to be cut.

In other words….Stay alert and stay skeptical, all you dudes and dudettes.

Most Interesting Tweet(s) of the Week

Well, despite everything, we could be in this situation….way worse.

That’s it for this week. If you are interested in digging deeper into these ideas or talkin’ real estate investing - which I always love doing - don’t hesitate to reach out. You can email me direct, I try to answer all the emails I get personally. Andreas.Mueller01@gmail.com

Again stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.