A Skeptical Dude's Take: Real Estate

Market Insights for Real Estate Investors and Finance Nerds.

Welcome to A Skeptical Dude’s Take on Real Estate, a real estate investment newsletter, coming at you live from Nashville, TN. Every week I write a brief, hopefully insightful, dive into real estate and financial markets, for all you tubular dudes and dudettes out there.

What am I listening to? - Classical, my mix on Spotify. It’s pretty good, if I don’t say so myself.

Where am I? - Home office, but about to walk the pooch. He is giving me the sad pup eye that I can’t resist.

Today We’re Talkin:

The Weekly 3 - News and Data to Keep you Informed

New Inflation Numbers, UP

The President’s New Housing Proposals are Problematic

The Bottom Line

The Weekly 3: News and Data to Keep You Informed

December Jobs report was revised 35% lower: 229,000 jobs added NOT 353,000. (BLS).

Plastic is literally in our blood. And it’s contributing to clogged arteries, bonding with plaque. (MedicalNews).

TikTok may be banned. House passes bill to ban the app by a wide bipartisan margin. (CSPAN).

Today’s Interest Rate: 6.92%

(👇 .05% from this time last week, 30-yr mortgage)

Mortgage interest rates have calmed down a tiny bit, after staying above 7% for most of February, although they remain volatile. Rates for the 30yr stand at 6.92% today, down ~.05% from a week ago. Bond traders are taking a few nibbles of the 10 yr treasuries, but nothing dramatic. For their part the Federal Reserve is starting to think about maybe likely possibly coulda shoulda perhaps cut rates. In testimony in front of Congress this week Fed Chair Powell said it is "Likely appropriate" to cut rates “[sometime] in 2024.”

What is the market thinking? Futures are pointing to 3-4 Fed rate cuts as the likely scenario this year (down from up to 6-9 at the beginning of the year), which just so happens to be right at the target we predicted at the time. 😁 And I’m holding firm. I still think we see 3 cuts in 2024, or a roughly .75% - 1.25% reduction in the Fed Funds rate, starting in June.

Economists are starting to publicly call for the Fed to cut rates, seeing that the Fed is putting at risk the resiliency of the economy. Mark Zandi of Moody's Analytics recently said as much: “The Fed threatens to misjudge the economy’s strength, hold rates too high for too long, and unnecessarily undermine it. Take the job market, which has been critical to the economy’s resilience - hours worked, hiring and quit rates, and temp jobs are all down. All signs of stress.”

Inflation Numbers this Week

The Consumer Price Index measure of inflation increased .4% in February (seasonally adjusted), after rising .3 % in January, or 3.2% YoY (BLS). Shelter and energy were the standouts, contributing over 60% of the monthly increase. Digging deeper, within shelter it was rents that were up the most, .5%.

But here is where it gets a little “weird.” The Fed doesn’t know why their efforts [to slow the economy/inflation] have not worked for housing costs. Speaking to CNBC,Austan Goolsbee, Chicago Fed President, said "That's the things that's really been weird…. We don’t fully understand why it hasn't dropped more."

Really, you don’t know why? (keep reading to end)

And it’s not just shelter, it’s transportation thats heating up NBA Jam style. Particularly car rentals and car insurance. Wow. Now it looks like car rentals are hyper-volatile so I’m going to give that a pass for this month (I’ll keep a Skeptical eye out) but insurance is up there at .9% - down over the last few months - but up 20% YoY. Yuck.

Ok here is some news we really care about y’all. Booze. Did you know the Gov tracks “Whiskey at home” as an economic data point? Looks like booze at home is the loser, up 1.4% MoM, but good news everyone, it’s wine time at Happy Hour. Wine away from home was down .2%. Yay! Finally some good news.

Spoke too soon. Eggs! Dammit eggs, why did you have to screw up the good mojo, and why am I still paying $7 bucks a box? Up 5.8% last month? At least my cheese addiction is looking good. Gotta get me some more laughing cow wedges this month. Don’t judge me.

So what’s all the hullabaloo about? I mean, if you’re like me and don't like to drink, drive, fly, eggs, enjoy reading by flickering candlelight, and prefer living in a tent in your buddy’s backyard (I actually did this in college) then you are good to go. Want a hot tip to save money? When I pick up the tab, I have my friend sign the check. I don’t look at it. Because if you dont look at it it never happened right? Duh, thats just science.

President’s Housing Proposal

Ok enough fun with inflation, some important stuff now!

In his State of the Union speech (don’t worry not getting political here) last week, the President made 2 housing-related proposals:

First, a $10,000 tax credit to middle-class, first-time homebuyers, given over two years. Unclear who “middle class” is but it’s usually defined in the past as sub-$250k income. And I assume they will allow poorer individuals the tax credit too, not just folks who can afford the $5 latte but are living in their parents basement. Just kidding Gen-Z. 😂

Second, a $10,000 tax credit to middle-class families who sell their “starter home” (defined as homes below the area median home price in the county). Catch #1, the prospective buyer has to occupy the home. No idea how the seller is supposed to verify to the IRS that their buyer is living in the home, but hey, if you are in binoculars sales / voyeur aficionado Facebook Group (haha this exists! I thought I was being cleaver), business may be booming next year. 🕵🏽♂️ And if you have a willing buyer but that person is buying it as a second home or as an investment, no $10k for you! Catch #2, many Gen-Z can’t afford the purchase of a home, and need $ from their parents to put up the down payment, 38% to be exact. These young homebuyers may not qualify for this credit or as an owner occupant depending on how the $ from parents / sale is structured. So again….no $10k soup for you Gen Z!

My Thoughts: Two problems.

First, let’s say this proposal “works” as intended. More buyers are incentivized to buy homes. That is the plan, i.e. buyers are persuaded to purchase a home to take advantage of a credit to their taxes a year later (they still need the money up front remember). So demand for homes is higher, what about supply? Well the proposal is mum on that. In fact, proposal #2 will require the home seller to go buy another home to live in (no tax credit for that, since it’s not their “first home.”) So demand up 2x per incentivized buyer. The result? Prices up, it’s just Econ 101. Demand up + supply flat = prices for homes increase, as a direct result of the proposals. Now, it is true that some buyers will realize a $10k lower tax bill, which is a good thing. But the effect will be higher home prices for everyone, especially on those “starter homes.” Further, the price for homes may even increase higher than the $10k credit folks got in the first place (I think it would). Again, if this proposal does what it is intended to do - demand goes up. How much will home prices go up? Depends on the success of the program, the more successful it is the more demand goes up the more prices go up. Interestingly, if the program is ultra-effective, the price of a median home in the US will only have to go up a corresponding 2.5% to completely erase the $10k benefit of this credit (median home price today is $417,700 * .025 = $10,442.50). Lastly, the demand effect may even be more acute today than in a “normal” market because high interest rates have suppressed supply of available homes. Remember, we are currently experiencing an extreme housing shortage, a 50-year low.

Second problem: Putting on my old congressional staffer hat, IMO this won’t get through Congress. Sadly, frustratingly, stupidly….not only will one party not allow the other party a “win” in an election year, these proposals will cost $, and that may actually be preferred. Seeing how partisan the wording is on the White House’s press release/website, maybe the proposal is just as good as a cudgel to beat the other party with, so they can say it’s “their fault you aren’t getting it.” Additionally, the national debt is becoming a thing. Folks are actually starting to care about it as a policy issue this election, making this an even tougher sell in Congress. How bad is the US debt getting? The new growth pace is $1 Trillion every 100 days. 😳 Shocking? Here’s another one, 80% of all US dollars ever were printed in the last 5 years. This is why we have inflation folks. The response to the specter of COVID was $10+ trillion pumped into the economy, more than 10x the amount spent during the Great Recession (2008), and it’s NOT stopping. Just the interest on the debt is more than $1.1 Trillion / yr, more than we spend on our entire defense budget. Not so fun fact, this is a wild “side-effect” of high interest rates, that our young generation will have to shoulder.

Without taking a position on these policy proposals, staying objective and factual, I hope that we can agree that we do NOT need more demand for homes. We need more supply. Nonetheless, people like benefits promised to them especially when it appears they aren’t paying for it (we do) so these types of proposals could slip into a larger bill Congress passes. But I put the odds at 10000 to 1. Want more opinions on these proposals? Further reading here.

Bottom Line

Supply be too damn low!

The Skeptics Take: Government is overactive and it’s the Fed and Congress’ doing. The Fed was a major contributor to both sides of our housing problem. Demand is low because interest rates were jacked up, fast, like really fast (below) in an effort to blunt inflation, which was caused by Congress and the Fed injecting $10+ trillion into the economy in 2020-2022+. Supply is uber-low because few people - unless they have to or die, frankly - want to sell their home with a 2.8% mortgage only to trade it in for a 7% mortgage. Those ultra-low literally never in a lifetime loan % is a result of the Fed dropping the Fed Funds to 0 in 2020 and keeping it low for 2 years, while at the same time buying mortgage backed securities, all while the market was booming. They poured ether on a gasoline fire. I would add that they likely kept rates too low on avg. for the last 15 years as well. Regardless, it’s this yo-yo’ing back and forth of rates that creates a real estate cycle that is extremely difficult for homebuyers and the market to absorb. Especially when it happens rapidly. It will take more than a decade to unwind the current one.

Let’s end with some positive news. Prices for existing homes that are fixer-uppers and ripe for an investor to improve and rent to a needly household have stagnated. In a high interest rate environment, if you can cover the mortgage with the rents, you can get a great deal on a property. Once rates drop, and assuming demand will outpace supply (it will), prices will accelerate. So this begs the answer, YES it IS a good time to buy a home.

In other words, Stay Skeptical but positive y’all. There is always opportunity.

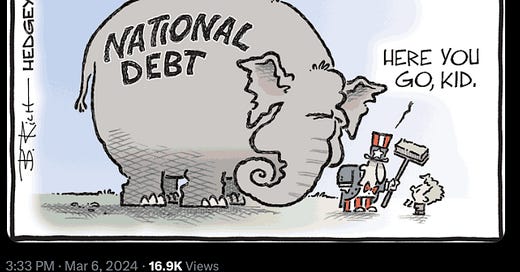

Most Interesting Tweet(s) of the Week

Said another way, the US government is spending $1 Trillion every 100 days. Not sustainable, we can’t get everything we want all the time.

That’s it for this week. If you are interested in digging deeper into any of these ideas or just want to talk real estate investing - which I always love doing - don’t hesitate to reach out. You can email me direct, I try to answer all the emails I get personally. Andreas.Mueller01@gmail.com

Again, stay skeptical, all you dudes and dudettes.

Herzliche Grüße

-Andreas

* The preceding has been my opinion only, the views are my own, and are intended for educational and entertainment purposes only and does not constitute financial advice.